2021: Neobanks are the new affinity-based communities

Pockit, Karat, Panacea, 11Onze, Daylight, First Boulevard, Greenwood

2020 has proven a very difficult financial year because of the pandemic - it affected businesses and individuals hard. This new reality brought new financial needs - one-size-fits-all traditional banking approach doesn’t work anymore.

In 2021, we are seeing new neobanks targeting underserved communities. Geographic lines have been blurred in a truly digital landscape, so neobanks and challengers will focus on affinity-based communities.

Here are few examples of neobanks that focus on these niches:

Pockit: serving the underserved and underbanked.

Pockit is a UK neobank that targets people with poor credit history and those that have been rejected by incumbent banks. They mainly target people living on government benefits, immigrants with no credit history and those with very low credit scores.

Their app features are somewhat similar to other challengers like Monzo and Starling, but what makes them different is their branding approach. Pockit is very transparent with their marketing and content production and they make it very clear which demographic they are targeting. Their motto is “designed for every consumer, no matter their credit history”.

One of their key points is trust, so they want to make sure their target audience trusts them enough to open a bank account with Pockit.

Karat: a bank for content creators

Karat is a neobank focused on content creators. That means influencers and those with their primary source of income from YouTube, Instagram, Twitch and other social media platforms.

After leaving his role as product manager for Instagram Live, co-founder Eric Wei decided to create a bank for a type of business he knew very well. He points out that many of these influencers get turned down by incumbents because they don’t understand how they make their money.

“Traditional banks care a lot about credit scores,” Wei said. “A lot of YouTubers, when they’re blowing up, they don’t have time to think: “Let me make sure my credit score is awesome as well.” ”

For Karat what counts is not their credit score but the influencer’s following. They target content creators with at least 100,000 followers and up. Wei estimated that that’s a potential customer base of 1 million creators.

Panacea Financial: bank for doctors

Launched last November in the US, Panacea Financial will target doctors and resident doctors. They will offer personal loans, refinancing, free checking and savings accounts with no overdraft charges.

Panacea plans to expand their product offering with mortgages, working lines of credit and loans that help doctors open clinics and buy equipment. Their plan is to offer financial support through the life cycle of a physician — from graduation through residency to establishing a permanent practice.

Panacea has simplified the loan process as loans do not rely on credit scores. The applicant can be approved in 24 hours, no co-signer is required with proof of a medical degree and employment.

11Onze: Catalonia’s first non-Spanish-linked banks

11Onze is seeking a banking licence from a European Union country but not from Spain, because the start-up wants to maintain its independence from the country.

The main goal is to make 11Onze the country’s “central private bank” and Catalonia is an autonomous region of Spain.

In a recent interview, Jordi Roset, one of the bank’s co-founders explained that there are countries with fewer inhabitants than Catalonia, which have safe national banks and are rich states like Finland, Australia, or Denmark and Catalans “need a bank that does not work for the establishment and the Spanish Deep State”.

11Onze plans to offer loans, current accounts, payments, and a marketplace for goods and services. As well as treasury and accounting solutions for both small and medium-sized enterprises (SMEs) and families.

Daylight: bank for LGBTQ+

Last year, Daylight launched in the US and is the first and only digital banking platform specifically designed for and by the LGBT+ community.

They are fully digital banking with an app that offers tools to help the LGBT+ community expand their financial skills and plan for their future.

One of Daylight's big USP is to offer networks of financial coaches specialized in LGBT+ money management and life events, such as expanding one's family and gender-affirming surgery.

First Boulevard and Greenwood: Bank for Black Americans

First Boulevard, an “unapologetically Black” digital neobank, is launching early this year in the US and promises to eradicate the wealth gap for Black America through comprehensive financial education.

“Black America as a whole has been blocked from learning how money works. We want to connect our members to wealth-building assets such as micro investments like money market accounts, high-yield savings and cryptocurrency — things that Black America has largely been blocked from”, explained co-founder and CEO Donald Hawkins.

The bank has just raised USD $5 million in seed funding from Barclays, Anthemis and a group of high profile angel investors.

To follow its promise First Boulevard will offer a variety of features including Cash Back for Buying Black™ program that helps members earn up to 15% cash back when they spend money at Black-owned businesses.

In October 2020, neobank Greenwood made the headlines in the US as the first digital bank for Black and Latinx people and business owners.

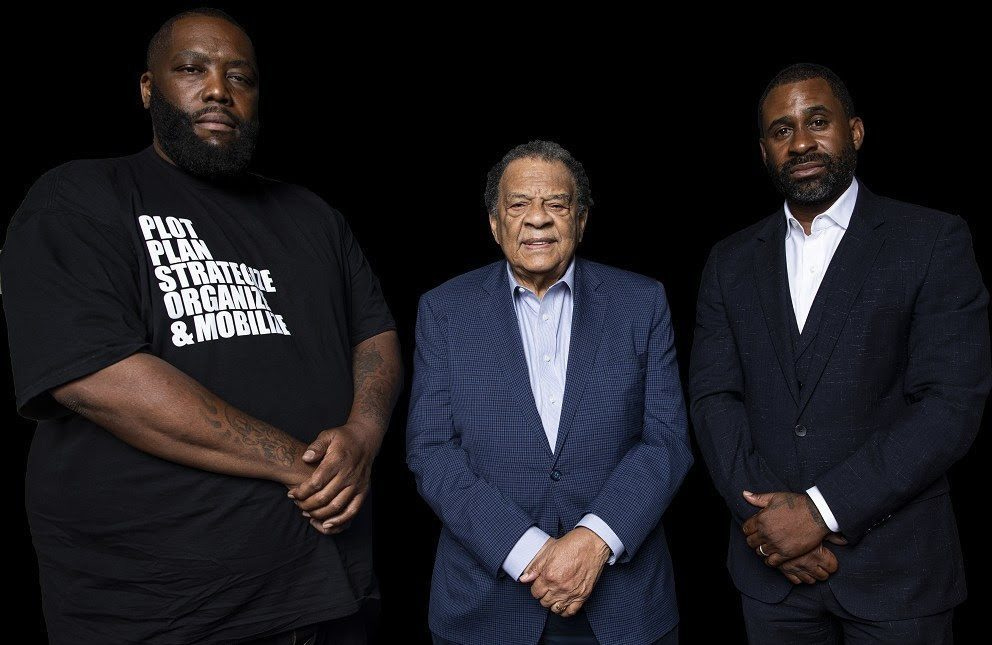

Headed by Bounce TV founder Ryan Glover and his close friend, rapper-activist Michael “ Killer Mike'' Render as co-founders, Greenwood raised USD $3 million in seed funding from private investors.

Last week Greenwood followed up with a USD $40 million Series A, only a few months after its launch.

With these very successful first funding rounds, Greenwood proved that the traditional banking system left the Black African community totally underserved.

The main motto of Greenwood is to give back to the community: for every customer sign-up Greenwood will provide five free meals to a family in need; and every month it will provide a $10,000 grant to a Black or Latinx small business owner that is a Greenwood customer.

Another feature is customers will have the option to round up their spending transactions to the next dollar and donate the difference to Black American funds and organizations.

Conclusion

Now with the Black Lives Matter movement and consumers pushing for better gender equality, they will grow and get real adoption. I see potential for these underserved segments, but only the bank(s) that is truly providing people with the best-tailored products is going to win this race. 2021 is going to be a game-changer for these neobanks.

A bank for the disabled is HUGELY needed!!