REPORT

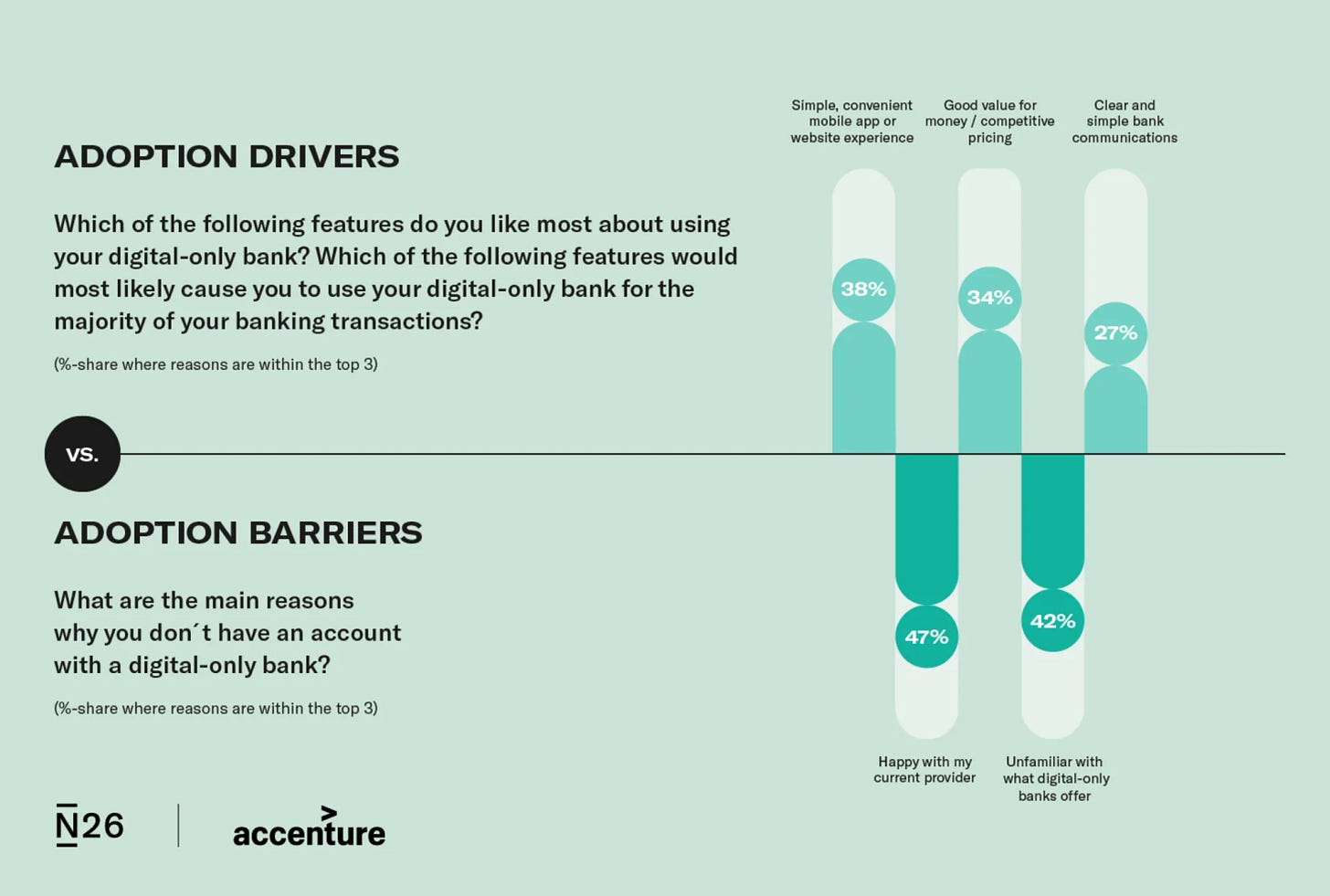

N26 teamed up with Accenture to gain a better understanding of consumers’ attitudes towards digital banking. Their analysis is based on their 2020 Global Banking Consumer Study, which surveyed 47,000+ customers of digital-only and/or traditional banks in 28 markets.

👉 Read the full report here.

👀 NEWS HIGHLIGHT

JPMorgan Chase & Co.'s COO fired a warning shot at fintech stars like Stripe, Square, and PayPal: Wall Street was asleep at the wheel, but now it's time to 'really compete with them'.

Fintechs have long been a thorn in the side of big banks, but JPMorgan Chase Co-President and COO Daniel Pinto says the time has come to put up or shut up.

👉 Read the full article here.

500+ Organizations have already signed up for Fintech Meetup (online, March 22-24), the world’s largest fintech meetings-only event!

It’s the easiest way to meet Fintechs like Alviere, BitPay, BlockFi, Certa, MANTL, Nymbus, Signal Intent & Zero Hash (to name just a few!), Investors like Bain Capital, Commerce Ventures & Tribeca Ventures, Banks like Bank of America, Citi, J.P. Morgan & Wells Fargo, Neobanks like Dave, Revolut & Varo Bank, Credit Unions representing 13 million members and many, many others!

Get Your Ticket and start planning for 2022!

📊 INFOGRAPHIC

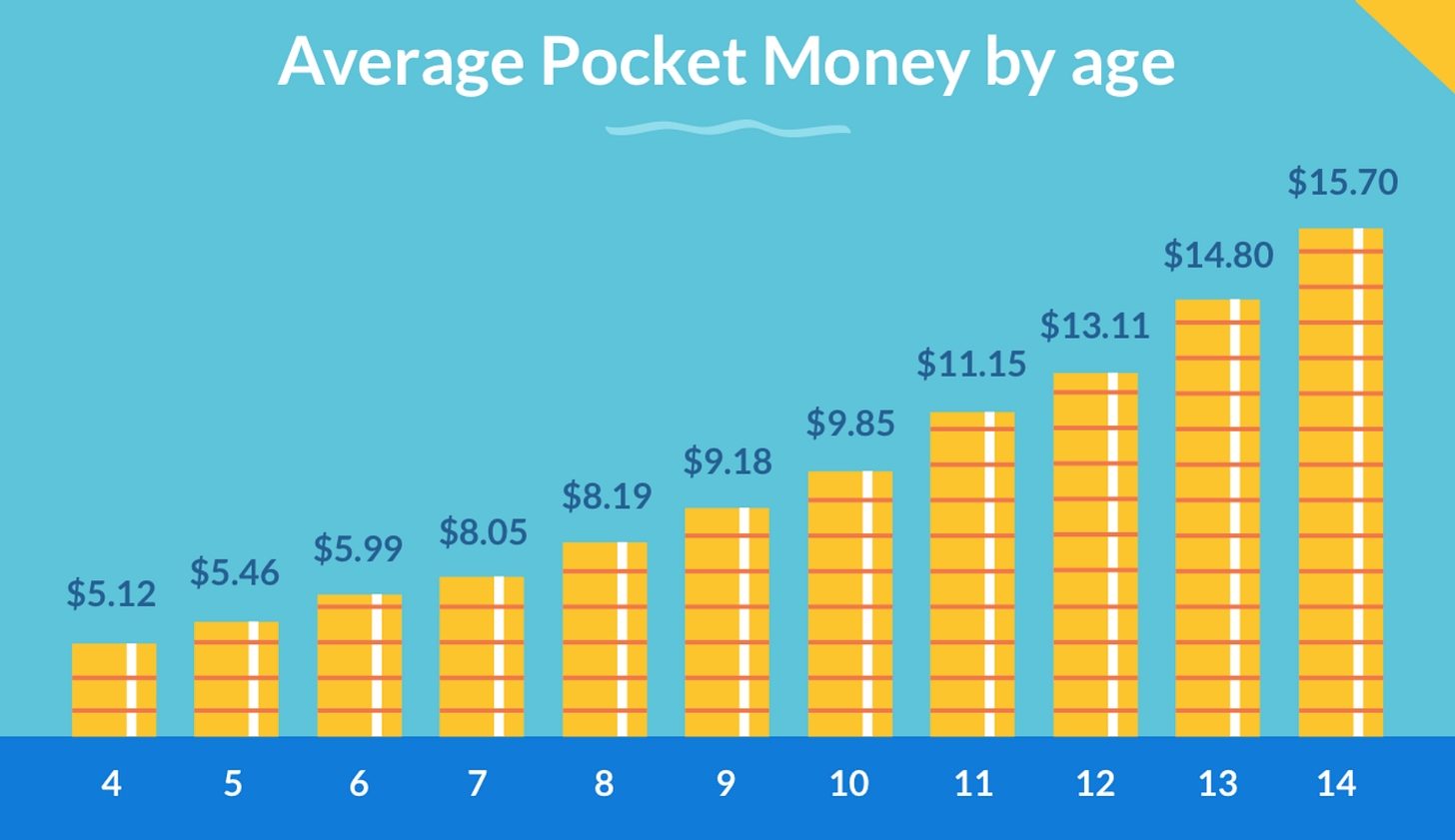

The Allowance Report by RoosterMoney is a snapshot of the pocket money habits of kids aged 4-14 across the US.

👉 You can find it all here.

📰 ARTICLE

“As a transgender woman, I live daily with the financial costs of gender-affirming care, which often isn’t covered by workplace health care—if you’re lucky enough to have it,” says Daylight CTO; Billie Simmons.

👉 Read the full article written by Laura Miller from Wired here.

💡INSIGHTS

A few overlapping factors have led to the rapid development of fintechs in Latin America, including low banking penetration, high interest rates, favourable regulation and, the latest global development no one can ignore, Covid-19.

👉 Read the full article written by Elles Houweling from Verdict here.

🎤 PODCAST

The podcast recommendation of the week belongs to Sifted’s 3rd Podcast episode: "The neobank battle over millennial millionaires’ wallets"

👉 Listen here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 DIGITAL BANKING HIGHLIGHTS

⭐️ Feeling nostalgic? Read Nubank’s seed deck here. Also, check out “How to Build a Neobank: the Nubank Story” here.

⭐️ Ron Shevlin’s “2021’s Winners And Losers In Fintech And Banking” list. Link here.

⭐️ Raisin Bank AG is teaming up with ComplyAdvantage to scale its anti-money laundering (AML) program. Link here.

⭐️ A new challenger billing itself as “the first neobank for women of colour” is preparing to launch in 2022 and is currently open for sign-ups. Link here.

⭐️ Capital One’s decision to eliminate the fees will cost it about $150 million in revenue per year. Link here.

UK

Koto Card Ltd is rebranding to The Credit Thing and radically changing its product. Link here.

Monument is gearing up for its next funding round. It also launched is first tranche of savings products and app with “hundreds” on its waiting list. Link here.

Novus has successfully achieved 100% of its £900,000 crowdfunding target. Link here.

Monzo Bank’s valuation has surged to $4.5bn, an increase of more than 200 per cent since the start of the year, as thousands of new customers helped double revenues. Link here.

Bank North has concluded a £50m senior financing facility with London-based global asset manager Insight Investment. Link here.

Zopa is to wind down the retail investing business to concentrate exclusively on its new banking operation. Link here.

EUROPE

Pleo has picked up a large tranche of funding to help it double down on its business at a time of strong growth. Link here.

Mambu raised €235 million in an EQT Growth-led Series E funding round, the largest financing round to date for a banking software platform. Link here.

bunq will become the first European digital bank to start offering mortgages. Link here.

Talenthouse, Vodeno, and Aion Bank, announced that they have joined forces to launch embedded banking services for creatives in Europe. Link here.

USA

Nerve Collabs now offers total transparency to all group members via a shared checking account. Link here.

MAJORITY raised $27 million in its Series A funding round led by Valar Ventures. Link here.

CANADA

Equitable Bank is expanding its EQB Evolution Suite® prime mortgage solutions to Quebec. Link here.

LATAM

Credijusto bought Banco Finterra, their CEO shares his experience. Link here.

Nu Holdings Ltd. raised $2.6 billion in a U.S. initial public offering priced at the top of a marketed range it had earlier lowered. Link here.

ASIA

Alif Bank accomplished the first stage of its partnership with Visa to roll out a suite of financial products. Link here.

Wise has enabled B2B transfers to China in Chinese yuan (CNY) from 8 currencies, with plans to later expand this to other currencies supported by Wise. Link here.

Tinkoff Group remains committed to its planned expansion into the Philippines by pursuing a commercial banking license in the country. Link here.

Tonik Digital Bank Inc. secured over P5 billion or around $100 million in consumer deposits only about eight months after its launch in the Philippines. Link here.

Dinero signed pact with discount broker 5paisa. Link here.

AUSTRALIA

Westpac agreed terms to acquire money management app MoneyBrilliant from AMP Limited and management shareholders. Link here.

Judo Bank decision to run an entire bank in the cloud has proven prescient after it successfully integrated a major new customer relationship management (CRM) platform in a matter of months. Link here.

MIDDLE EAST

stc pay’s 7.4 million loyal users are now able to understand their financial lives on a much deeper level than they have in the past with this new partnership with financial wellness experts Moven. Link here.

AFRICA

DISCOVERY Bank aims to break even with up to 700 000 clients in 2024. Link here.

Kwara raised Ksh. 451.8 million ($4 million) in a seed round. Link here.

MOVERS AND SHAKERS

Edfundo has appointed three key specialists to its advisory board. Link here.

Wise has named David Wells, the former CFO of Netflix, as the chairman of its board of directors. Link here.

Greenlight Financial Technology, Inc. announced several key executive hires to further accelerate the company's rapid growth as it surpasses $100M in ARR with more than 4.5 million parents and kids. Link here.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.