👀 NEWS HIGHLIGHT

Revolut’s Chief Revenue Officer Alan Chang is leaving the U.K. financial technology startup for a new crypto-currency venture and is seeking to raise roughly $100 million in financing.

Chang is seeking to raise the new funds in exchange for future access to tokens, according to people familiar with the matter, who asked for anonymity because the matter is private.

He has already invested millions of dollars himself, one of the people said.

“After almost 7 years, Alan Chang will be leaving Revolut,” a spokesperson for the firm said. “We wish him every success in his new venture.”

👉 Read the full Bloomberg LP article here.

🔦 Would you like to bring your company/service to the attention of tens of thousands of FinTech enthusiasts?

👉 Sponsor my newsletters and/or podcast episodes!

😎 SPONSORED CONTENT

Contis helps organisations unleash their true potential with award-winning, cloud-based Banking-as-a-Service solutions. With Contis you can put next-generation cards, accounts, and apps in your customer’s hands

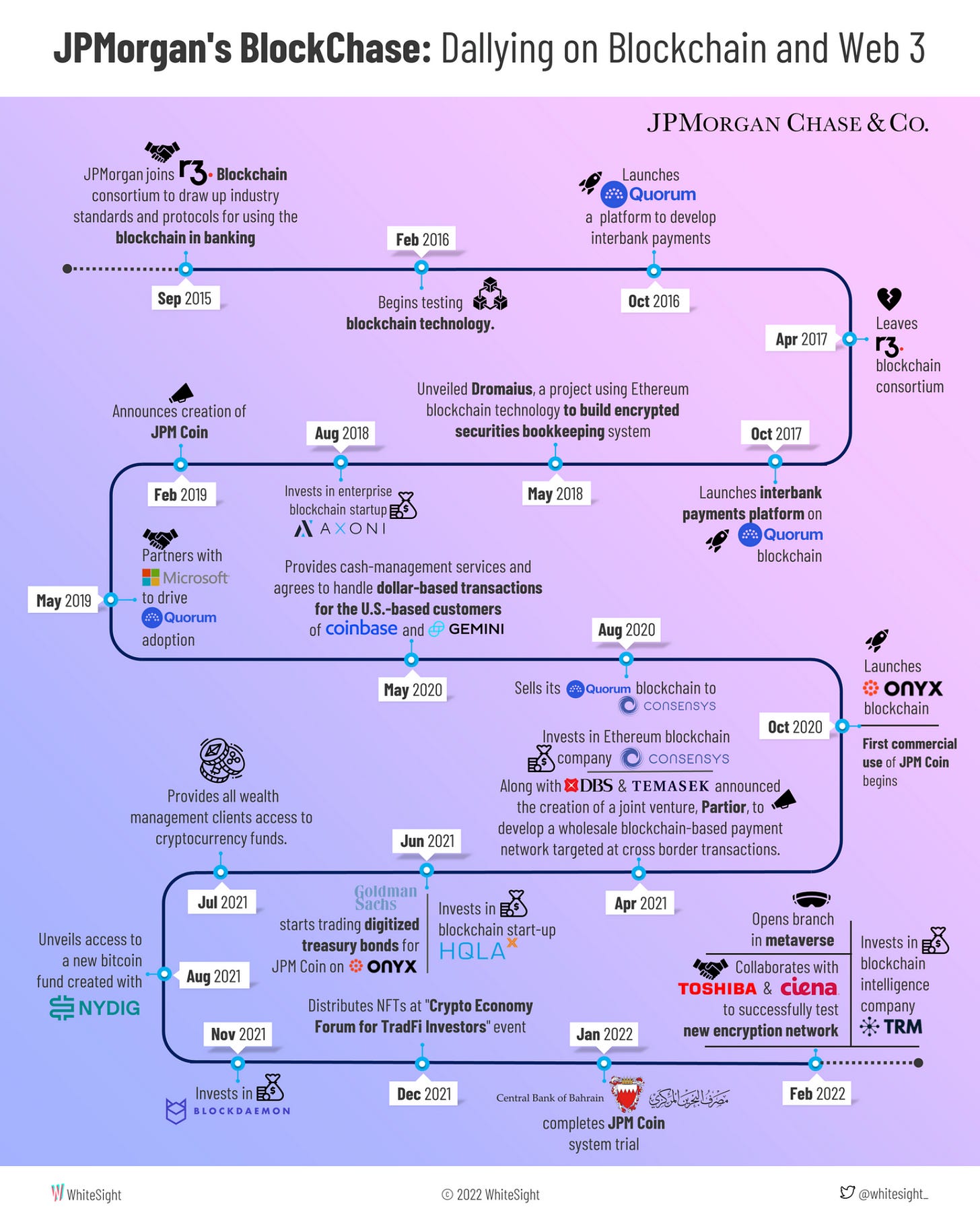

📊 INFOGRAPHIC

👉 JPMorgan’s BlockChase: Dallying On Blockchain And Web 3. Link here.

📰 ARTICLE

Goldman Sachs Group Inc. said it plans to close its operations in Russia, the first major Wall Street bank to leave in response to the nation’s invasion of Ukraine.

“Goldman Sachs is winding down its business in Russia in compliance with regulatory and licensing requirements,” the company said Thursday in an emailed statement.

The Wall Street powerhouse has maintained a presence in Russia in recent years, but the country doesn’t amount to a meaningful portion of its global banking business.

👉 Read the full article here

👨💻 BLOG

💬 INTERVIEW

“Every part of the world needs Monzo” according to its CEO, who has underscored Monzo's global ambitions and hit out at incumbent banks accusing them of being analog businesses with digital storefronts.

TS Anil also said that Monzo was adding over 100,000 new users each month without paid marketing, and that Monzo’s buy now, pay later offering was launched with an eye on future regulation of the buy now, pay later market.

👉 Read the full Altfi article written by John Reynolds here.

💡INSIGHTS

Stock markets have been in turmoil since the start of 2022. With the rise of geopolitical tensions, popular indices such as the S&P500 and Nasdaq have lost over 10 percent of their value.

Cryptocurrencies aren’t fairing any better either. Bitcoin has fallen 11 percent in the last month, and 17 percent for Ethereum.

For those new to investing, it’s an ideal time to learn about safe havens — assets that remain unaffected, or even gain value, during times of market volatility. Precious metals such as gold and silver are prime example.

👉 Read the full Vulcanpost article written by Ishan Singh here.

🎤 PODCAST

This week, PCN CEO Rogier sat down with Niels van Daatselaar, Co-founder & CEO of TreasurUp, to discuss how banks have struggled to keep up with online commercial banking and how TreasurUp’s white-label offerings to banks fill the gap.

He is currently the CEO of TreasurUp which won an innovation campaign at Rabobank in 2016.

👉 Listen to the full Team PCN podcast here.

🎤 PODCAST

Check out Kapronasia’s latest podcast episode with Volt Bank CEO, Steve Weston.

Volt is taking action to put customer’s interests at the center of what we want do, and show that banking can be done in a better way for cutomers, not just making statements of intent.

👉 Listen here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 DIGITAL BANKING HIGHLIGHTS

⭐️ Unbanked is building a neobank “built on blockchain.” The company seeks to provide digital banking that is better, faster, and, of course, cheaper for consumers and businesses. Link here.

⭐️ MoneyLion yesterday announced financial results for the fourth quarter and full-year ended December 31, 2021. Link here.

⭐️ Will Ferrell-backed Danish neobank Lunar has launched a new payment offering for its 15,000 business customers, saying it will “empower” entrepreneurs. Link here.

⭐️ PayPal said Saturday it was suspending its services in Russia, adding to the number of firms retreating from the country in response to its invasion of Ukraine. Link here.

⭐️ American Express says it is suspending its operations in Russia and Belarus, becoming the latest credit card giant to respond with measures denouncing Russian President Vladimir Putin’s decision to invade Ukraine. Link here.

UK 🇬🇧

A £14 billion class-action lawsuit against Mastercard interchange fees has moved a step closer to trial with an additional £2.7 billion added to the claim following the latest judgment by the UK's Competition Appeal Tribunal. Link here.

Payment technology provider, Tribe Payments, announced it has been selected for digital banking and card issuing services by business banking platform Fyorin. Link here.

UK consumer lender Lendable has secured £210m in equity funding from Ontario Teachers’ Pension Plan Board, funding that it says gives the lender a £3.5bn valuation. Link here.

Satago, the cash management platform that provides automated credit control, risk management, and invoice finance to SMEs and accountants, announced that it has partnered with Lloyds Bank to transform access to short-term finance for its business customers across the UK. Link here.

Leading specialised payments platform, Paysafe, announces the appointment of J.P. Morgan as its core banking provider.Link here.

EUROPE 🇪🇺

Several Russian banks said they would soon start issuing cards using the Chinese UnionPay card operator's system coupled with Russia's own Mir network, after Visa and MasterCard said they were suspending operations in Russia. Link here.

Launched on the 25th February, Revolut enabled millions of its customers worldwide to instantly donate to the Red Cross Ukraine Appeal, targeted at supporting victims of the war in Ukraine. Link here.

Tot, an Italian start-up that provides digital banking tools for self-employed professionals and micro-businesses with up to ten employees, has launched. Link here.

Nordic neobank Lunar raises $77M at a $2B valuation, launches crypto trading platform and B2B payments. Link here.

Bitpanda Payments has been authorized to conduct payment activities as an Electronic Money Institution (EMI) in Austria. Link here.

USA 🇺🇸

Stilt, the leading provider of financial services for immigrants, announced it has raised $14 million in Series A funding led by Link Ventures. Link here.

Marqeta, the modern card issuing platform, announced that Citi Commercial Cards has selected its tokenization-as-a-service capabilities to facilitate the provisioning of cards into mobile wallets. Link here.

Zeta Suite, a banking tech unicorn and provider of next-gen credit card processing to banks and fintechs, and Mastercard announced a 5-year global partnership. Link here.

CANADA

Pillar, a new fintech offering business accounts designed to support small and medium-sized enterprises (SMEs), is gearing up for launch in Canada. Link here.

ASIA

Indonesia-based Bank Jago earned 86 billion rupiah (around US$6 million) net profit after tax in 2021. It’s the first positive year for the digital bank after it recorded annual losses for the past six years – well before the new management, backed by regional super app Gojek, took over in 2019. Link here.

The central bank Friday barred SoftBank-backed Paytm Payments Bank from adding new customers due to likely gaps in its technology systems, potentially denting its small finance bank aspirations and further roiling investors skeptical of the fintech's ability to boost earnings after an expensive initial share sale. Link here.

Ayoconnect, Southeast Asia's largest open finance platform, and Bank Rakyat Indonesia (BRI), Indonesia’s largest bank by total assets, have signed a memorandum of understanding (MOU) to leverage Ayoconnect’s open finance technology in BRI’s digital banking solutions with the intention to generate greater financial inclusivity and economic growth in the world’s fourth-largest country by population. Link here.

Mox Bank Limited is offering all Mox Credit customers a smarter way to clear their credit card bills with ‘Instant Clear’ Credit Card Balance Transfer Plan. Link here.

Bharti Airtel has struck a deal with India’s Axis bank to roll out a range of financial services products to its 340 million customers. Link here.

AUSTRALIA 🇦🇺

The Open Banking fintech Bud has announced its Australian launch after receiving accreditation from the Australian Competition and Consumer Commission to provide Open Banking services. Link here.

MIDDLE EAST

Credit Libanais has partnered with VISA, the world leader in digital payments, and Codebase Technologies to develop a frictionless, omni-channel onboarding experience for customers looking to acquire virtual prepaid cards. Link here.

AFRICA

Nigerian digital bank Yep! raises $1.5M pre-seed for its ‘financial super app’ play. Agency banking is big business in Nigeria and sub-Saharan Africa. It involves agents or merchants, who act as human ATMs, offering financial services such as transfers, savings, and payouts to the underbanked and unbanked that rarely visit bank branches. Link here.

Digital-only bank, TymeBank has partnered with National HealthCare Group to introduce TymeHealth, billed as one of the most affordable medical insurance solutions available to local consumers. Link here.

MOVERS AND SHAKERS

ThetaRay, a leading provider of AI-powered transaction monitoring technology to protect banks and fintechs against financial crimes, announced that it is strengthening global revenue operations with the appointment of Peter Reynolds as the company's Chief Revenue Officer (CRO). Link here.

Allica Bank – the fintech challenger bank that seeks to empower Britain’s small and medium-sized businesses – has announced the promotion of Ravneet Shah as Chief Technical Officer (CTO). Link here.

Neobank Monzo is expanding its board with the addition of non-executive director Lizzie Runham, the VP of HR for international at social media giant Meta (formerly Facebook). Link here.

Fintech scale-up Pleo, which offers simplified spend management and smart company cards, boosts its executive team with the induction of Mette Hindborg Gade, functioning as the company’s Chief People Officer. Link here.

Fiserv, Inc., a leading global provider of payments and financial services technology, announced that its Board of Directors elected Frank Bisignano, President, and Chief Executive Officer, and a current director of Fiserv, as Chairman of the Board. Link here.

OPPORTUNITIES

BNP Paribas has set itself a target to have 1,000 more women working in IT professions by the end of 2024, through both internal and external recruitment. The French lender describes the 'program for the feminisation of IT' as one of its strategic strategic priorities. Link here.

An appeal has been launched to encourage businesses in the FinTech sector to donate and raise much-needed funds for those affected by the crisis in Ukraine. Fintechs For Ukraine aims to encourage tech firms to raise as much money as possible to help support victims of the crisis, with donations going directly to Save the Children’s Ukraine Appeal. Link here.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.

-