Digital Banking | 2022 #12

Weekly news up to Monday, March 21st, 2022

REPORT

Jake Anderson conducted a recent consumer research study on neobanking surveying over 5000+ consumers worldwide.

👉 Check out the full results here.

👀 NEWS HIGHLIGHT

ClearBank has closed a big round of funding, money it will be used to take its services beyond its home market and move into newer areas such as cryptocurrency exchanges.

The company has raised £175 million ($230 million at today’s conversion rates), from a single investor, the PE firm Apax Partners.

👉 Read the following article here.

🔦 Would you like to bring your company/service to the attention of tens of thousands of FinTech enthusiasts?

👉 Sponsor my newsletters and/or podcast episodes!

😎 SPONSORED CONTENT

At MoneyLion we believe you should get more from your money. Our mission is to rewire the American banking system so that we can positively change the financial path for every hard-working American.

📊 INFOGRAPHIC

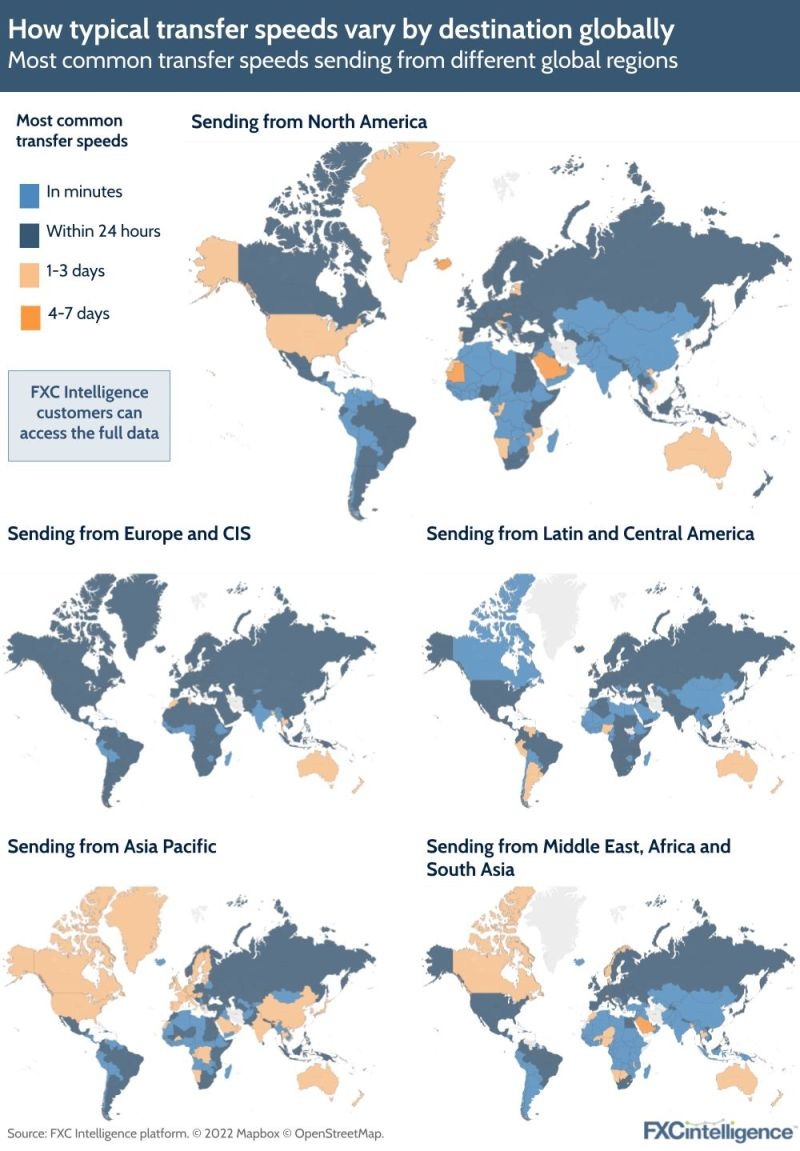

Advances in payment technologies have raised expectations of money transfer speeds, but how long do transfers typically take between different parts of the world?

Global payments speeds vary considerably around the world. Sending from Europe is typically the fastest, from Asiapacific the slowest.

Read the full FXC Intelligence article by James Mckee here.

💬 INTERVIEW

According to Anne Boden, CEO at Starling Bank:

It is “very, very unlikely” that all major banks will have high-street branches in the future.

Boden also said that the challenger bank is considering opening up an office in Leeds or Manchester.

👉 Read the full AltFi article here.

💡INSIGHTS

HSBC and The Sandbox announced a new partnership that will open up a host of opportunities for virtual communities across the world to engage with global financial services providers and sports communities in The Sandbox metaverse.

The groundbreaking partnership between The Sandbox and HSBC will see the global financial services provider acquire a plot of LAND, virtual real estate in The Sandbox metaverse, which will be developed to engage and connect with sports, esports and gaming enthusiasts.

👉 Read the full article here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 DIGITAL BANKING HIGHLIGHTS

⭐️ PayPal is expanding its services to allow its users to send money to Ukrainians. Link here.

⭐️ Digital challenger bank Starling Bank has grown its market share in the SME banking space to 7.5% in just four years. Link here.

⭐️ Global retail bank Santander has been forced to pay customers hundreds of pounds in compensation after making it almost impossible to access online banking without a smartphone. Link here.

⭐️ Mercury, a well-funded, three-year-old startup that offers a host of banking services to startups, is rolling out a new offering for its customers: venture debt. Link here.

UK 🇬🇧

NatWest launched its own free Carbon Tracker app as a pilot aimed at the manufacturing and transportation sectors. Link here.

Mastercard has partnered HSBC to launch a product in the UK that allows businesses to use their commercial card program to make payments to any supplier, regardless of whether the supplier accepts card payments. Link here.

Caxton, the leading UK fintech payments provider, announced a major partnership with Banking-as-a-Service provider OpenPayd to offer customers a simplified payments experience. Link here.

EUROPE 🇪🇺

An Post, the state-owned provider of postal services in Ireland, is looking for a banking platform service provider and has published an e-tender on the Office of Government Procurement website. Link here.

Trust is the foundation on which banks build their business. But at Yapeal trust has been put to the test. Two articles that appeared recently on Inside Paradeplatz, an online financial news site, suggest that the neobank is on the decline. Link here.

Aazzur has signed a sales partnership with European Banking-as-a-Service (BaaS) leader Treezor to enable both companies to expand their customer base and strengthen their BaaS offering. Link here.

Consumer lending platform provider, Oakbrook Finance, has raised £142m of new capital with global financial services firm J.P. Morgan and alternative investment advisory firm Atalaya Capital Management. Link here.

JPMorgan Chase & Co said on Tuesday it would buy Global Shares, an Irish fintech firm whose software helps businesses manage employee stock plans. Link here.

In its march towards educating the Catalan community about money matters and financial ecosystems, Barcelona-based fintech 11Onze has launched its “11Onze School” program. Institut Cendrassos de Figueres in Girona is the first school to have received a training session. Link here.

Revolut is making it easier for refugees escaping Ukraine to open Revolut accounts and waiving some FX transfer fees- a move that has been given the thumbs up by the Ukrainian deputy prime minister. Link here.

USA 🇺🇸

Green Dot announced that it’s partnering with Plaid to offer open banking data sharing to customers of its in-house neobank, GO2bank. Link here.

CANADA

Canadian tech leaders are calling upon Canada’s federal government to appoint an open banking lead and start implementing the other recommendations made by the Advisory Committee on Open Banking in last year’s long-awaited report. Link here.

LATAM

Nubank said that new central bank rules for digital banks will bring lower capital requirements than originally expected next year and in 2024, with the announcement lifting its shares. In a securities filing, the Warren Buffet-backed star of Latin America's fintechs said the change does not have a significant impact on its "business model or our ability to grow." Link here.

ASIA

Kyash, a Tokyo-based mobile financial app, has raised $41.2 million (4.9 billion JPY) in Series D funding. According to a report by Nikkei, this marks Block’s first investment in an Asia-based company. Link here.

For most challenger banks, the identity of the underlying institution that holds deposits is buried in the fine print. For East West Bank and BayaniPay, the relationship is front and center. BayaniPay, a digital remittance service that connects the U.S. and the Philippines, debuted in California in November 2021 with no-fee remittances. Link here.

Grab Financial Group (GFG) Malaysia and SEDANIA As Salam Capital Sdn Bhd (SASC) are partnering to offer Grab Cash Financing-i, a shariah-compliant financing product, to eligible Grab drivers and delivery partners. Link here.

Maybank has launched its new Maybank Personal Digital Financing which provides instantaneous approval and subsequently disbursement within 10 seconds. Link here.

Risk management platform Sentinels has been selected by Spanish neobank Rebellion Pay to enhance its anti-money laundering (AML) and risk profiling capabilities. Link here.

The YONO app is serving as an online marketplace, and offers several services. "I think we have moved much ahead of the transactions, in terms of the payment transactions. We are leveraging this platform for many more things." Link here.

AUSTRALIA 🇦🇺

Parpera, a money management platform for sole traders, freelancers, and startup founders, has launched Australia's first embedded finance business experience using a debit card linked directly to deposit accounts, in partnership with Railspay (the Australian arm of Railsbank) and Volt Bank. Link here.

MIDDLE EAST

Finastra announced its collaboration with Union of Arab Banks to help banks across the Arab League member states offer enhanced digital services to their customers. Link here.

AFRICA

Discovery Ltd, Africa’s second-biggest insurer by market value, is expanding its footprint into five countries on the continent as it adapts to meet the needs of pan-African companies. Link here.

African neobank 4G Capital has raised $18.5 million in a Series C funding round. Link here.

Fonbnk, the company making it easy for users across emerging markets to participate in the web3 economy, announced the closing of a $3.5 million seed round. Link here.

Pivo entered the market with Pivo Capital, a credit-focused financial services platform for supply chain small and medium businesses (SMEs), because of the co-founders’ track record in the supply chain industry, especially the logistics aspect. Link here.

MOVERS AND SHAKERS

PPS, an Edenred company, and the UK and Europe’s market-leading payments provider, announces the appointment of Andrea Keller as Managing Director. Link here.

Bitstamp, the world’s longest-running cryptocurrency exchange, has appointed James Greenwood as the company’s Chief Technology Officer (CTO). Link here.

Jason Oakley, co-founder, and CEO of Recognise, a UK-based challenger bank for SMEs, has stepped down. Link here.

Michigan-based banking tech provider Bankjoy has hired André Jones as vice president of operations. Link here.

Alex Kriete, co-head of digital assets at Citi, announced his resignation from the banking giant after 11 years at the firm on Thursday via LinkedIn. Link here.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.