👀 NEWS HIGHLIGHT

Credit Kudos, a UK open banking startup that helps lenders make better decisions, has been acquired by US tech giant Apple.

The deal closed earlier this week, according to three people close to the deal.

One source said it valued the startup at about $150 million, a significant uplift in valuation.

👉 Read the full FF News | Fintech Finance article here.

🔦 Would you like to bring your company/service to the attention of tens of thousands of FinTech enthusiasts?

👉 Sponsor my newsletters and/or podcast episodes!

😎 SPONSORED CONTENT

How to open a UK entity, in association with Mishcon de Reya

Setting up an entity in the UK can be challenging, we know, because we've done it. That's why we've worked with international law firm, Mishcon de Reya, to create this practical guide to growing your business into the UK.

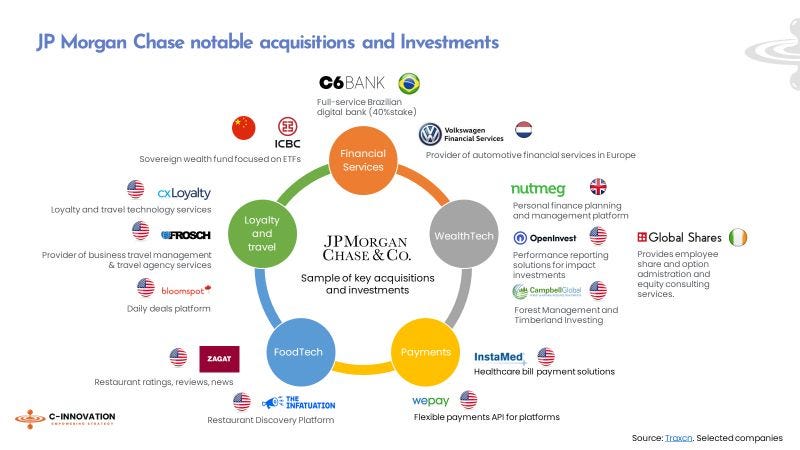

📊 INFOGRAPHIC

JPMorgan Chase & Co. Notable Acquisitions and Investments:

👉 Read the full C-Innovation article by Isabel Richardson here.

📰 ARTICLE

Magnus Larsson, CEO and Founder of MAJORITY, the leading digital bank and community membership for immigrants living in the United States, spoke with Efma’s Boris Plantier about his bank’s offering that is tailored to the unique needs of the migrant community.

The demographics of neobank users are often surprising; it is not only young people who are signing up, but also older age brackets. What is the standard profile of your target customer? What has been key to your customer acquisition success?

👉 Read the full article here.

👨💻 BLOG

Who runs Europe’s top neobanks? Not women…

Even in 2022, it’s still a man’s world at Europe’s biggest legacy banks — only around a quarter of top management is women.

But what’s the picture at the neobanks that claim to be disrupting the stuffy finance industry?

According to Sifted analysis, women are just as lacking in the key decision-making roles at Europe’s top challenger banks. That’s despite the fact that many market themselves as providing financial services for the underserved — including women.

👉 Read the full article by Amy O'Brien and Steph Bailey here.

💬 INTERVIEW

After securing £175m in funding earlier this week, ClearBank CEO Charles McManus sat down with AltFi to discuss the company’s European expansion.

In a round led by Apax Digital, the UK’s next-generation clearing and embedding bank will use the investment to expand across Europe and beyond.

The firm, which launched in 2017, serves more than 200 financial institutions and fintechs including Tide, Coinbase, Chip and Oaknorth Bank.

McManus explained how ClearBank enables companies to act as if they have a banking licence.

👉 Read more here.

💡INSIGHTS

“Embedded commerce” started with things like PayPal and has evolved with products like Stripe, many years later. But “embedded finance” is appearing as a new wave in fintech, with the likes of Contis, Solaris, Swan, and Stripe Treasury (not yet live in the EU).

Intergiro has been a stealth-mode, privately funded, bootstrapped startup for the last five years, but is now emerging as part of this embedded banking movement, calling itself “a financial cloud” on which almost any kind of company can offer banking services. Link here.

🎤 PODCAST

What Happens When Every Brand is a Bank?

Eric Sager, COO of Plaid and Ben Brown, cross-industry financial services lead at Accenture sat down with Jim Marous, host of The Financial Brand to discuss competitive trends, the impact of embedded finance on traditional financials services, and the opportunities in the marketplace.

Embedded finance enables businesses to seamlessly integrate financial services into their business models, providing banking, credit, payments, or other services — efficiently and at the consumer’s point of need.

👉 Listen to the full podcast episode here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 DIGITAL BANKING HIGHLIGHTS

⭐️ Tomo, a ‘PayPal for the mortgage industry’ fintech startup, lands $40M at a $640M valuation. Link here.

⭐️ Chetwood Financial acquires core banking provider Yobota. Link here.

⭐️ Tintra has secured a subscription for a further $2 million just days after it announced plans to create the world’s first built-for-purpose Web 3.0 banking platform. Link here.

⭐️ Wise has introduced Auto Conversions for users who regularly convert between currencies. Link here.

UK 🇬🇧

BOMADU (Bank of Mum and Dad United) is readying to launch in the UK to help young, first-time buyers. The UK’s first neobank designed to help out young, first-time buyers is readying to launch. Link here.

Payhawk has partnered with Curve to launch a guide to how fintechs can work with the existing financial system, and how disruptive startups can partner with banks. Link here.

Claro Money offers the UK’s first digital financial coaching app which aims to simplify personal finances, with a focus on those under the age of 45. Link here.

Andaria Financial Services is now live in the UK and EU with its digital business current account offering. The company says its account provides access to 100+ currencies and real-time foreign exchange, allowing banks to avoid banks’ high exchange mark-ups. Link here.

Bucking the trend towards low interest rate offerings by other banks, digital bank Monument has launched new 12-month, 2-year, and 5-year savings products that offer rates of 1.8, 2.05 and 2.4 per cent respectively. Link here.

EUROPE 🇪🇺

Solarisbank, Europe’s leading Banking-as-a-Service platform, announced a partnership with Berlin-based neobroker fina to bring its white-label securities brokerage solution to the market. Link here.

German investing and deposit marketplace Raisin DS is adding a new asset class to its lineup in the form of private equity. Through a partnership with fintech Moonfare—itself aimed at democratizing access to private equity investments—Raisin is adding private equity investments to its investment platform (known as WeltSparen in Germany). Link here.

Temenos, the banking software company, announced that Rakuten Europe Bank – part of the Rakuten group, a unique ecosystem of 70+ businesses and over 1.6 billion members worldwide – has signed with Temenos to deliver banking services including Rakuten Pay on the Temenos Banking Cloud. Link here.

The neobank Northmill, the highest-ranked bank on Trustpilot in Sweden with a rating of 4.8 out of 5, continues to focus on customer experience by introducing WeMeet. Customers can book a personal video meeting with a customer service representative and get help with their personal finances. Link here.

Revolut employees in Ukraine are being “evacuated” and taken to “safe shelters" while other fintech workers take up offers of working visas and other relocation support measures offered by their employers. Link here.

USA 🇺🇸

Flyp Financial, creators of the mobile banking app “Flyp,” officially announced the availability of their app in both Google Play and App Store. The app, which offers a series of banking features including a gamified rewards program, is now live and available to download for the public. Link here.

Cross River, a US provider of core infrastructure and embedded financial technology to fintech companies, has teamed up with blockchain data platform Chainalysis to expand its crypto services. Link here.

Less than seven months after closing on a $57 million Series B, fast-growing fintech Jeeves has raised $180 million in a Series C round that values the company at $2.1 billion. Link here.

Gemini, which was recently valued at over $7bn following a $400m funding round, joins the likes of Meta, Google and Stripe which have also been approved to use electronic money in Ireland. Link here.

AUSTRALIA 🇦🇺

ANZ has become the first bank in Australia to execute a stablecoin transaction through a public permissionless blockchain platform. Link here.

MIDDLE EAST

Bank Leumi one of the largest banks in Israel, has become the first in this country to offer cryptocurrency operations after an agreement with the American crypto company Paxos. Link here.

AFRICA

Africa’s global bank, United Bank for Africa (UBA) Plc, and leading Pan-African Payments Company Cellulant have announced a partnership that will extend payment services for merchants and consumers across 19 key African countries in which UBA operates. Link here.

MOVERS AND SHAKERS

UK-based fintech Monese has hired product and tech veteran Alistair Bennett as its new chief product officer (CPO). Bennett brings more than 20 years’ worth of experience to the role, having worked across product, technology platform, and digital transformation at Barclays, Lloyds Bank, and RBS Group. Link here.

Canada finally has its open banking lead. PwC Canada digital banking director Abraham Tachjian has been chosen to kickstart open banking efforts in the country. Link here.

OPPORTUNITIES

Toqio, the leading European Fintech SaaS (Software-as-a-service) company has announced its official launch in Spain. With offices in London, Madrid, and Nairobi, Toqio is now focusing on the Spanish market where it will increase its number of clients, operations and double its workforce. Link here.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.

Fantastic coverage guys, I have just subscribed