👀 NEWS HIGHLIGHT

Latin American neobank Nubank has announced the launch of its proprietary online payments solution.

With NuPay, the digital banking giant allows customers to complete their e-commerce purchases with a few clicks within the firm’s app.

The firm’s new solution allows for payment with account balances or interest-free installments through the Nubank app.

According to Nubank’s product vice president Livia Chanes, NuPay aims to simplify the online shopping experience in Brazil.

👉 Read the full article here.

🔦 Would you like to bring your company/service to the attention of tens of thousands of FinTech enthusiasts?

👉 Sponsor my newsletters and/or podcast episodes!

😎 SPONSORED CONTENT

Burgopak delivers award-winning innovative packaging solutions for some of the world's leading Banks and Fintechs. Creating a positive user experience with beautiful design drives customer engagement, elevating your brand and increasing card activation.

👉 Discover why packaging is crucial in digital banking here

📰 ARTICLE

Nikolay Storonsky, the founder of cash-transfer app Revolut, approached a senior Bank of England official in a rare move last week amid his company's drive to become a bank.

Storonsky, 37, is understood to have attended an event led by Sam Woods, deputy governor of the Bank, and City Minister John Glen, who dialled in virtually.

Revolut has yet to receive a UK banking licence – partly owing to a backlog of applications at the Bank – despite applying for one early last year.

👉 Read the full This is Money article here.

👨💻 BLOG

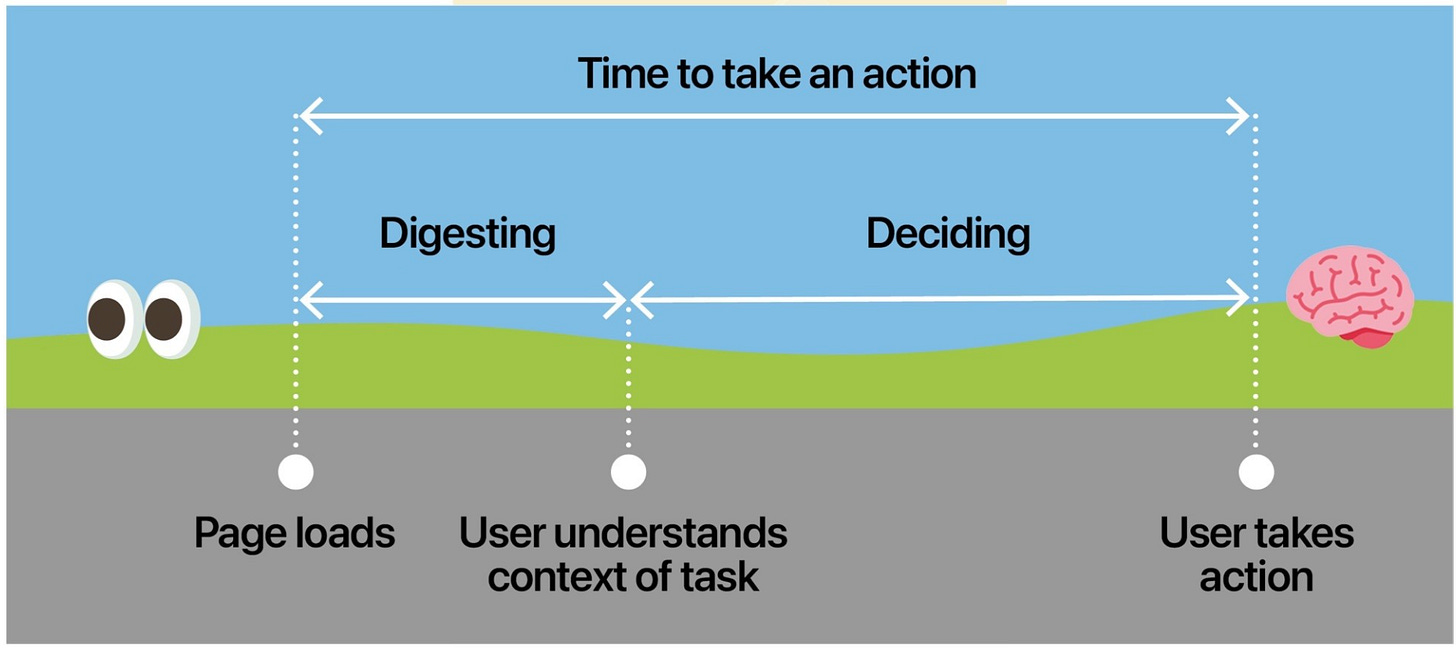

Revolut, whom Peter Ramsey criticized for complicating their UX with too many features, are at it again. But is it different this time?

Here's a new Built for Mars UX case study on Revolut Junior—their banking companion app for children.

👉 Check the full case study here

💬 INTERVIEW

N26's Chief Growth Officer, Alexander Weber, describes the customer experience that sets the German neobank apart from its competitors, and how their ambitious plans for the next decade center around wealth management.

👉 Read the full Efma article/interview here.

💡INSIGHTS

“We knew intuitively which direction we should go in but it was very hard to put [decentralized finance] into words” in 2015, said Stuart Sopp, CEO and co-founder of Current.

Seven years ago, the founders of Current envisioned a challenger bank that would balance blockchain-based services with traditional banking. This was well before the term “decentralized finance” existed and when cryptocurrency was in its infancy.

“We thought, maybe money doesn’t need to be held in banks,” said Stuart Sopp, Current's CEO and one of its co-founders.

Sopp started thinking about this when Trevor Marshall, an intern at Morgan Stanley when Sopp was the investment bank’s head of foreign exchange, showed him the bitcoin white paper in 2011.

👉 Read the full American Banker article here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 DIGITAL BANKING HIGHLIGHTS

⭐️ The Bank of Italy has imposed a ban on the recutiment of new customers by digital bank N26 following an on-site inspection which uncovered lax money laundering controls. Link here.

⭐️ Fiserv, Inc. , a leading global provider of payments and financial services technology solutions, announced the completion of its acquisition of Finxact. Link here.

⭐️ Payments giant Adyen is moving into providing banking services, the company said Thursday. Link here.

⭐️ Challenger Bank Recognise, reaches £100 Million in lending. Link here.

⭐️ Russia's biggest bank, Sberbank, which has been cut out of the global financial markets — and now it's launched a cryptocurrency. Link here.

UK 🇬🇧

UK-based neobank, OakNorth, has revealed a 73 per cent increase in pre-tax profits in its 2021 Annual Report, published this week, bringing numbers up to £134.5m. Link here.

Allica Bank says it’s set to hit £1bn in committed lending offers this year, double what it previous expected, helped by investment in its tech offering. Link here.

PensionBee pensions are now available to sole traders, in addition to the owners of limited companies, through the Starling Business Marketplaces. Link here.

Financial management app Snoop is now entering the employee benefits market with its money management tool in a bid to bank B2B clients. Link here.

EUROPE 🇪🇺

Vivid Money, a Berlin-based challenger bank whose backers include Japanese conglomerate SoftBank, has withdrawn its application to secure an e-money licence from the Central Bank of Ireland. Link here.

German fintech start-up SaveStrike, founded by Jan Wedemeyer, Konrad Krappen and Anton Engelhardt in February 2022, is developing a new mobile banking app designed to help millennials invest in capital markets. Link here.

Revolut Bank is officially live in nearly 30 countries after launching in Ireland. Link here.

Starling Bank, a digital challenger bank headquartered in London, has said the brand is to launch in “Ireland and beyond”. The mention of the launch came in an Irish job advert posted last week, suggesting the bank is getting closer to offering its services here. Link here.

Whoa! The Dutch sent €4.2 billion in Tikkie transactions this year. Tikkie’s parent bank, ABN AMRO Bank N.V., has revealed that more than 100 million Tikkies were sent in 2021 — which makes up for an €800 million increase to 2020’s record number. Link here.

Amsterdam-based bunq, an independent neobank that helps users save time, money, and the environment, announced on Thursday that it has entered a new partnership with Brussels-based Mobilexpense, a professional company focused on travel and expense management. Link here.

Klarna has stealthily created a dedicated unit devoted to open banking, including doubling its bank connectivity in the past year from 6,000 to 15,000 banks making us the largest bank aggregator in the world. Link here. On that note, Wilko Klaassen, the company’s VP Business Development, reveals how Klarna’s disruptive DNA can help partners shake up the Open Banking market with new data applications here.

Arion Bank, one of Iceland’s leading universal banking groups, has chosen the Banfico OB Directory Plus to support its Open Banking and PSD2 access-to-account compliance process. Link here.

USA 🇺🇸

A new US banking app called Swell, which combines checking, credit and more into one integrated account, is set to launch in June. Link here.

The Financial Technology Association (FTA) has added MoneyLion to its roster of members. MoneyLion is a mobile banking app or neobank that provides services in partnership with MetaBank. Link here.

Mana Interactive Inc. introduced a payments and rewards platform for people who love to play video games that will include a Mana deposit account and Mana Visa Debit Card’s neobanking solution that rewards gaming activities and purchases. Link here.

Finicity, a Mastercard Company, and Fiserv, Inc., both leaders in open banking technology, are advancing the future of open finance through secure data sharing. Link here.

In a big few months for Oxbury Bank, the company has closed its third funding round at £31m, and acquired its strategic IT partner Naqoda. Link here.

Cross River Bank raised $620 million in funding at a valuation north of $3 billion. Link here.

Neo, the treasury management, payments and FX fintech, has cleared $3 billion through its multi-currency accounts, saving clients an estimated $15 million in banking fees, as appetite grows for an alternative to the traditional corporate banking model. Link here.

LATAM

Revolut has hired Glauber Mota as its new Brazil CEO for its ongoing push into Latin America, part of its ambitions to a leading global financial ‘super app’. Link here.

ASIA

THE co-founder of e-commerce platform Lazada and its former chief marketing officer Charles Debonneuil has been appointed to be the Asia-Pacific general manager of Revolut. Link here.

Waafi Bank, a start-up bank in Labuan, Malaysia, has gone live with a suite of banking technology products from Oracle FS. Link here.

AUSTRALIA 🇦🇺

Melbourne-based fintech start-up Yondr Money is looking to raise up to $1.5 million via crowdfunding platform Birchal to fund its expansion as a challenger to mainstream banks. Link here.

The company formerly known as Xinja Bank that now trades as “TechStacked” has suffered a major blow to its effort of becoming an investment platform provider after the resignation of chief executive, Anna Burton. Link here.

MIDDLE EAST

United Arab Emirates’ Mashreq Bank has launched Neopay, a unified merchant acquiring and consumer paytech business. Link here.

MOVERS AND SHAKERS

Revolut has beefed up its US firepower with the appointment of two executives. The neobank has appointed Yuval Rechter, an expert at driving growth through social media and commerce, as its US general manager. It has also appointed Danil Ovechkin, who has previously headed up marketing for HelloFresh, the meal kit delivery firm, as US head of growth. Link here.

Leading digital bank Tandem announces the appointment of Ben Mitchell as Director of Savings with immediate effect. Link here.

UK-based financial superapp Revolut has hired BTG Pactual's Glauber Mota to lead its move into the Brazilian market. Link here.

According to the latest study from Provenir, a global leader in AI-powered risk decisioning software for the fintech industry, fraud prevention is the biggest driver for investments in AI-enabled risk decisioning this year.

OPPORTUNITIES

The survey, which canvassed the views of 100 decision-makers from fintechs and financial services firms across Europe, found that other major drivers for investments in AI-enabled risk decisioning include automating decisions across the credit lifecycle (68%), competitive pricing (65%) and cost savings and operational efficiency (61%).

👉 Read the full Finextra article here.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.