Digital Banking | 2022 #16

Weekly news up to Monday, April 18th, 2022

MVO BLOG

REPORT

Forbes publishes its fourth annual World’s Best Banks, in conjunction with market research firm Statista.

Instead of looking at balance sheets and profit and loss statements, as Forbes does for its annual list America’s Best Banks, Statista surveyed more than 45,000 customers in 14 languages around the globe for their opinions on their current and former banking relationships.

Banks were rated on general satisfaction as well as key metrics such as trust, fees, digital services, and financial advice.

The best banks in 27 different countries are highlighted below👇

👉 Read the full article, with the full list, here.

🔦 Would you like to bring your company/service to the attention of tens of thousands of FinTech enthusiasts?

👉 Sponsor my newsletters and/or podcast episodes!

📊 INFOGRAPHIC

With their latest blog, WhiteSight puts on the hat of the digital banking definitions police and tries to set the record straight on the types of digital banks out there and what makes them different.

👉 Read the full article by Afshan Dadan here.

💳 MVO - CARD COLLECTION

Revolut has teamed up with pop star Liam Payne to launch a limited edition card.

The Sunset Card- co-designed between Payne and Revolut- follows other similar-type Revolut limited edition cards collaborations which include one with Anthony Joshua.

The card is labeled with the former One Direction star’s signature and the card’s design is based on the cover of his debut album LP1, released in 2019.

👉 Read the full article here.

📰 ARTICLE

How Greenwood Became the Most Hyped Startup in Black America

Founders Paul Judge and Ryan Glover knew little about banking, but 700,000 believers joined their exclusive waitlist. So can their fintech company actually repair centuries of racist banking?

👉 Read the full Bloomberg article Brett Pulley and Jordyn Holman here.

👨💻 BLOG

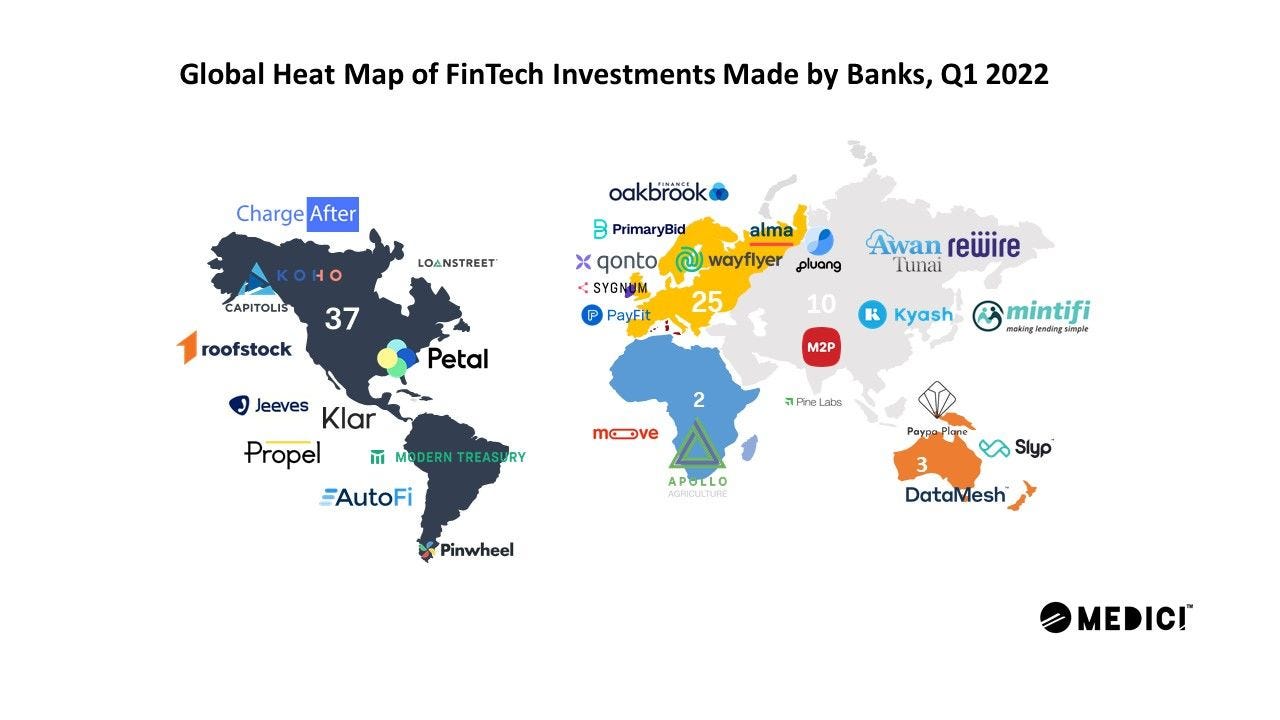

In the 21st century, FinTech is leveraging advanced technologies to disrupt banking and financial services and offer customized solutions to users.

Traditional banks, however, find it difficult to upgrade legacy platforms due to slow tech adoption and regulatory and capital investment challenges.

As a result, they are making strategic investments in FinTechs and forming bank-FinTech partnerships to delight their customers with innovative products.

👉 Read the full MEDICI Global article here.

💬 INTERVIEW

Ibrahim Lukman, Founder & CEO of Halal, describes how he is expanding the frontiers of financial inclusion in Nigeria and Africa with a no-interest rate policy.

👉 Read the full Efma Q&A here.

💡INSIGHTS

More Britons have borrowed through buy now, pay later services since the start of 2021 than have taken out traditional debts such as bank loans or mortgages, according to new research.

Ten per cent of adults had used BNPL, while 6 per cent had taken out a mortgage, 3 per cent had taken a bank loan and 2 per cent had used an authorised, interest-charging overdraft, according to research by loan provider Creditspring.

Despite their rising popularity, around a third of adults were unaware that BNPL schemes were a form of borrowing.

👉 Read the full This is Money article here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 DIGITAL BANKING HIGHLIGHTS

⭐️ Monzo co-founder and GB Bank Chairman Paul Rippon, has led an angel investing round of £275,000 for new fintech OnLadder. Link here.

⭐️ Cross River’s one-stop-shop technology opens up the first personal loans for U.S. Revolut consumers, with more offerings slated to launch in the coming months. Link here.

⭐️ Welcome Tech, which wants to build a ‘super app’ for immigrants, raises $30M. Link here.

⭐️ Volt bank is now a member of Blockchain Australia, furthering the goal of the adoption of blockchain technology. Link here.

UK 🇬🇧

Leatherback, a UK startup for international remittance payments for migrant workers and multi-currency businesses, has raised $10 million in a pre-seed round led by pan-African funding agency ZedCrest capital. Link here.

Finastra announced a Banking as a Service (BaaS) collaboration with Microsoft to bring new lending options to thousands of Small and Medium Enterprises (SMEs) – a sector severely underserved when it comes to accessing finance. Link here.

EUROPE 🇪🇺

Dutch banking giant ABN AMRO Bank has signed a multi-year subscription extension with Temenos to support customer growth and business expansion on the Temenos Banking Cloud. Link here.

USA 🇺🇸

Dwolla, a fintech company powering innovation with sophisticated account-to-account payment solutions, announced the release of Virtual Account Numbers (VANs), a highly anticipated feature to unlock the connection between banks and fintechs. Link here.

Step, the all-in-one financial solution for the next generation, announced a waitlist and unveiled plans for its new crypto and stock investment product, becoming the first financial app that will allow both teens under 18 and young adults to buy, sell, hold and receive crypto. Link here.

While Daniel Sathyanesan was running his own business — a service-based design agency — he quickly realized that banking options for a digital solopreneur were less than ideal. Link here.

LATAM

Brazil‘s Nubank, Latin America’s most valuable fintech, is fueling its expansion in Mexico and Colombia with the investment of a $650 million line of credit. Link here.

ASIA

Tencent has rolled out a wallet that enables users to make transactions using China's central bank-backed digital currency. Link here.

Over the past decade, Southeast Asia has undergone a significant technological transformation, a shift that’s been enabled by the region’s highly adaptable digital consumers. Consumers have leapfrogged to mobile devices, skipping personal computers altogether. Link here.

BigPay, a Capital A venture company, and digital bank aspirant, announced that it has rolled out DuitNow offerings for its users nationwide. Link here.

AUSTRALIA 🇦🇺

Douugh Ltd, the banking ‘super app’ on a mission to help customers budget, save and invest their money to live financially healthier lives, is pleased to announce a partnership with Pinwheel to facilitate automatic direct deposit switching for its US customers. Link here.

AFRICA

Neobanks have been transforming the financial landscape in many parts of the world, not least in major countries in Africa. In recent times, emerging markets such as Africa have been rapidly evolving in digital-first financial services, including digital banking and payments, despite limited economic resources. Link here.

MOVERS AND SHAKERS

Brazilian digital bank Neon has appointed Twitter and Google veteran Koji Pereira chief design officer. Link here.

The Bank of London, a new challenger clearing bank, has hired Tom Wood as its first deputy CEO for the UK. Link here.

Plaid has appointed Ripsy Bandourian as its first head of Europe after a period of significant growth for the company across the continent. Link here.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.