REPORT

Dive right into this special report from LendIt and Amount on the risks and opportunities of embracing a digital strategy – and what leading financial institutions must do next.

Findings showed that for most FIs that partner with fintechs, fraud, and risk are top concerns in digital banking, and nearly half integrate new consumer credit products like BNPL.

Two hundred enterprises contributed to the white paper; respondents were individuals from the c-suite, product, or risk management at banks with under $50 billion to $300 billion under management.

👉Read the full Lendit Fintech News article here.

👀 NEWS HIGHLIGHT

LatAm's Nubank beats revenue estimates on strong client additions.

The neobank reached nearly 60 million customers in Brazil, Mexico, and Colombia.

“This is the strongest quarter in Nu’s history. We reached nearly 60 million customers and a record-high activity rate of 78%,” Chief Executive Officer David Véléz said. The majority of clients (57.3 million) are in Brazil.

👉Read the full LABS article here.

💡Also, Nubank turns cell phones into POS terminals for corporate clients. The so-called NuTap allows corporate customers to collect payments using only their cell phones as a POS terminal. Link here.

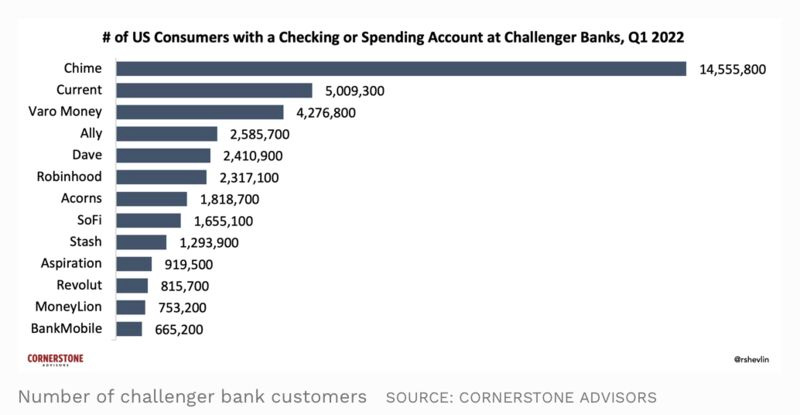

📊 INFOGRAPHIC

2022 Online Bank Ranking: Chime at the top, Current coming on strong.

👉Read the full article by Ron Shevlin here

💳 MVO - CARD COLLECTION

CaixaBank has launched a Visa card with Braille reading and writing code embedded for visually impaired customers.

👉 Read more here.

📰 ARTICLE

Four strategic lessons from digital-only banks and neobanks.

Research by J.D. Power points to consumer preferences relating to fees, rates, and services that banks and credit unions must address.

👉Read the full article here.

💬 INTERVIEW

With 18m personal users, 500k business users and operations in more than 200 countries, Revolut could very confidently class itself as a ‘super app’.

Revolut CEO Nik Storonsky: “Our mission is to unlock a borderless economy.”

👉Read the full Altfi article here.

💡INSIGHTS

The future of finance is open, and the rise of Banking-as-a-Service (BaaS) means this future is closer than ever.

👉Read the full article here.

🎤 PODCAST

UKTN Podcast: Banked: CEO on open banking and disrupting payments:

“We’ve got a very big ambition,” Brad Goodall tells UKTN Podcast host Mark McDonagh.

👉Link to the full episode here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ Visa CEO is confident remote work would have kneecapped his career. Link here.

⭐️ Mastercard launched a program that allows retailers to offer biometric payment methods, like facial recognition and fingerprint scanning. Link here.

⭐️ Plaid officially expands into identity and income verification and fraud prevention. Link here.

⭐️ The number of neobanks has grown tremendously in the last two years, but only a few of them are profitable. Link here.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Thought Machine has doubled its valuation to $2.7bn. Link here.

Recognise Bank seals £8.7 million capital raise. Link here.

Tide has announced a partnership with Sage. Link here.

MarketFinance raises £100 million debt financing to fund UK SMEs. Link here.

9Spokes and Virgin Money unveiled a ‘financial dashboard’ for Virgin’s SME business customers. Link here.

Railsbank has announced strategic moves to support growth and build expertise in the sports industry. Link here.

Revolut's planned native crypto token will aim to reward customers for their loyalty. Link here.

EUROPE 🇪🇺

Mastercard partners with Dreams on sustainable banking. Link here.

USA 🇺🇸

Jack Dorsey defended the Afterpay deal saying value will ultimately be created by building connections between groups in the economy. Link here.

Unit, a banking-as-a-service startup, has closed on a $100 million Series C round of funding led by Insight Partners. Link here.

Greenlight launched credit cards for parents. Link here.

Climate First Bank officially launches its digital solar lending platform. Link here.

Quontic Bank opens metaverse outpost. Link here.

Stretch wants to bank individuals with a conviction history. Link here.

Nomad raised $32 million. With the round, the company is valued at $200 million. Link here.

iOS 15.5 brings a new Apple Cash update that lets you send and request money directly in your Wallet. Link here.

LATAM

Neon triples revenue in its quest to become the biggest bank for Brazil’s working class. Link here.

ASIA

Planto has partnered with Cogo to develop software for the city’s banks that encourages consumers and small businesses to cut their greenhouse gas emissions. Link here.

Affin Bank partners MYTHEO to offer Robo-advisory for the mass affluent. Link here.

Neobank Fi launches a new feature ‘Connected Accounts’; to allow users to sync multiple bank accounts. Link here.

GrabFin brand will be progressively rolled out in other Southeast Asian markets in the coming months. Link here.

AUSTRALIA 🇦🇺

Commonwealth bank has begun pilot tests of Kit, a new money app and digital information tool for kids. Link here.

Westpac is looking to UK-based technology provider 10x Banking to provide the core technology. Link here.

Smart bank 86 400 will now be known as ubank, following its merger with Australia’s first digital bank. Link here.

Acacia Money unveils home loan compare and swap feature. Link here.

AFRICA

VodaPay super app has attracted 2.2 million downloads and 1.6 million registered users in the eight months since its launch. Link here.

Sokin expands payments partnership with Mastercard across the Middle East and Africa. Link here.

MOVERS AND SHAKERS

Atom Bank has appointed Andy Sturrock from BP as its new chief technology officer. Link here.

Rebecca Owen has been promoted to commerce director and Louise Halliwell has been promoted to savings director in Bank North. Link here.

Ronelle Arbib has become the Recognise Bank’s first COO and Mo Fadaei has been promoted to Director, Banking Platforms and Partnerships. Link here.

Solarisbank appoints Ingmar Krusch as CIO and Dennis Winter as CTO. Link here.