REPORT

N26 prides itself on being the first fully digital bank that kick-started the Neo-bank trend now worth USD$47 billion globally.

👉Download the full C-Innovation report “N26 Racing for Differentiation” here

👀 NEWS HIGHLIGHT

Atom Bank is considering a SPAC merger on the New York Stock Exchange at a valuation of $700 million.

The Durham-based digital lender has now raised more than £115m in the last 12 months and is currently valued at £435 million.

👉Read the full Finextra article here.

📰 ARTICLE

Neobank users are more likely to feel disgruntled by poor customer service than those who have accounts with full-service traditional online banks.

Startups may be able to get away with sparse staffing and email-only responses early on, when customer needs are simpler.

👉Read the full article here.

💬 INTERVIEW

The number of neobanks has grown tremendously in the last two years, but only a few of them are profitable, according to a new report from Simon-Kucher & Partners, a global consultancy which had looked in detail at the profitability of neobanks around the world.

“Neobanks have seen super high-speed growth, but at the same time we expect that less than 5% are profitable,” said Christoph Stegmeier, a senior partner.

👉Read the full article here.

💡INSIGHTS

📊 INFOGRAPHIC

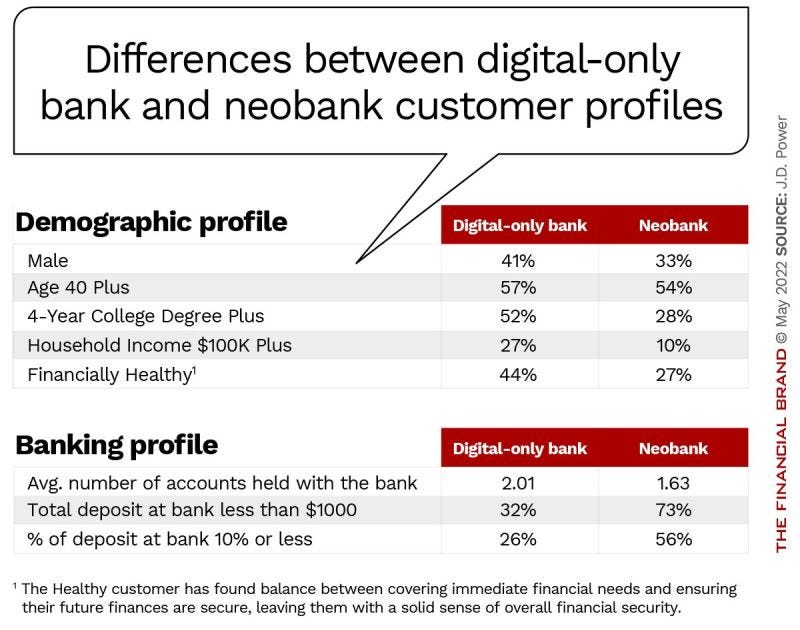

In its 2022 U.S. Direct Banking Satisfaction Study and new companion research on neobank satisfaction, the research firm found that neobank customers are more likely to be women, have less education, and have lower income than customers of digital-only banks.

👉Read the full “Four Strategic Lessons from Digital-Only Banks and Fintech Leaders” article by The Financial Brand here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️JP Morgan shared a first look at the early success of its multi-million dollar bet on launching a challenger bank in the UK. Link here.

⭐️ Swift and CapGemini work on CBDC gateway to existing payment networks. Link here.

⭐️ Global Top 100 Digital-only Banks Ranking - No easy path to profitability. Link here.

⭐️ This 2016 pitch deck helped neobank N26 raise its Series B. Link here.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Revolut is looking to hire an Investor Relations team, a move that could mark the starting gun on its long-awaited stock market listing. Link here. Also, Revolut Business aims for larger SMEs and corporates with ‘spend management’ launch. Link here.

Starling's Anne Boden chairs taskforce to boost female entrepreneurs. Link here.

Former Tory minister Theodore Agnew has launched a public attack on Starling Bank, dragging the online lender into the Covid loans scandal by claiming it did not run adequate checks on borrowers before handing out taxpayer-backed loans. Link here.

Barclays Bank is adding to a wave of branch closures across the UK, announcing plans to shut an additional 27 sites this year. Link here.

EUROPE 🇪🇺

CaixaBank has launched a Visa card with Braille reading and writing code embedded for visually impaired customers. Link here.

UBS is launching a purely digital product line, UBS key4, for clients who want to carry out all of their banking transactions from their smartphones. Link here.

Qonto announced today the launch of its new solution for invoicing. Link here.

Brand New Day has opted for Sentinels, Europe’s leading intelligent transaction monitoring and client risk management platform, to scale its anti-money laundering controls. Link here.

USA 🇺🇸

Elon Musk hints at super app and payment ambitions for Twitter. Link here.

Synapse announced the launch of Global Cash, a secure cash management account product. Link here.

M1, The Finance Super App™ announced it has selected Thought Machine, the cloud-native banking technology company, to power and grow its platform. Link here.

CANADA

Mambu and Brim Financial announced a strategic partnership to deliver a modern, more powerful digital banking, deposit, lending, and cards platform across Canada and the U.S. Link here.

ASIA

Mega Bank has chosen Avaloq’s core banking platform. Link here.

AUSTRALIA 🇦🇺

National Australia Bank is inviting customers to pre-register for the forthcoming launch of a new BNPL offering. Link here.

The Australian Payments Network has issued new guidelines around the use of QR codes as a payment method. Link here.

Australian watchdog sues Mastercard for allegedly misusing card payment market power. Link here.

MIDDLE EAST

YAP selects Euronet Pakistan as their technology partner to operate as an EMI in Pakistan. Link here.

MOVERS AND SHAKERS

Tyme Group has appointed co-founder Coen Jonker as new CEO of digital-only bank TymeBank, while current CEO Tauriq Keraan will be group executive: growth projects for Tyme Group. Link here.

KAF Investment Bank announced that it has appointed Rafiza Ghazali as the CEO of its Islamic digital bank. Link here.

Tandem Bank has appointed Georgina Whalley to the newly-created role of chief impact and marketing officer. Link here.

Payoneer appointed John Caplan co-Chief Executive Officer and Director alongside current CEO Scott Galit, effective immediately. Link here.

Digital challenger bank Cashplus has appointed Tatiana Lipiyaynen as its new chief customer and marketing officer. Link here.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.