THIS WEEK’S DIGITAL BANKING FUNDING NEWS

Moves provider of a banking app exclusively for gig workers raised $5M in Seed funding. Link here.

Kroo successfully raised £26 million. This round of funding has had incredible results with over 60% of investors reinvesting, showcasing their belief in the Kroo vision. Link here.

Nik Storonsky is on the hunt for someone to lead his next endeavor, an artificial intelligence-powered venture fund. Link here.

💡And much more in our #DoneDeal Weekly Newsletter. Link here

REPORT

The fourth edition of the Optima Consultancy German report, in partnership with Visa, shows that whilst FinTechs flaunt feature-rich banking apps, some traditional providers have stepped it up by adding a host of new features to their apps.

👉Download the full “Mobile Banking App Review Germany 2022” report here.

REPORT

Amount’s national research study of Buy Now Pay Later power users disproves the stereotypical credit-averse and credit-light consumer descriptions.

👉Download the full report here.

👀 NEWS HIGHLIGHT

Revolut, the global neobanking juggernaut and one of Europe’s most valuable fintech companies has long been known for its early bet on crypto.

Its most recently rumored iteration of this appetite for all things blockchain-based is the launch of its own native token focused on loyalty dubbed ‘Revcoin’.

👉Read the full altfi article here.

😎 SPONSORED CONTENT

Burgopak delivers award-winning innovative packaging solutions for some of the world's leading Banks and Fintechs. Creating a positive user experience with beautiful design drives customer engagement, elevating your brand and increasing card activation.

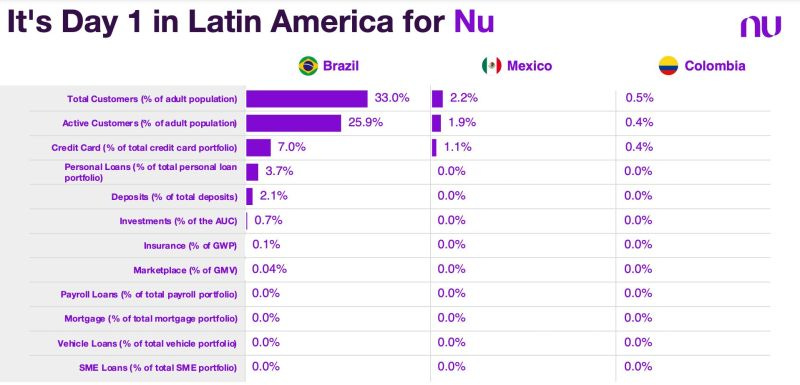

📊 INFOGRAPHIC

Impressive numbers from Nubank 🚀

👉Link to the full post here.

📰 ARTICLE

N26 uses Stripe for seamless account top-ups.

N26 is not an ordinary bank. There are no tellers, no bank branches. You never have to wait in line. Instead, in eight minutes on the N26 mobile app, you can open an account with a full range of functionality: checking, savings, transfers, and direct debits.

👉Read the full article here.

👨💻 BLOG

How Osterus became the workforce Benchmark of digital banking.

Neobanks are becoming increasingly popular, they are leaving their own mark in the financial world and it looks like they are here to stay. What’s more, the global neobanking market size is expected to reach US$ 2,048.53 billion by 2030.

👉Read the full article by Julian Herzog here.

💬 INTERVIEW

Mastercard CEO, Michael Miebach, said that he does not expect SWIFT, one of the most widely used cross-border payments services, to exist after five years.

👉Read the full CNBC article here.

💡INSIGHTS

2021 was a year of great progress for Open Banking across the EU and UK.

The regions witnessed strong growth both in the volume of API calls and the number of third-party providers (TPPs).

👉Read the full article here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ European regulators are pushing for new laws that would give them the power to revoke licences for firms in serious breaches of anti-money laundering rules. Link here.

⭐️ Haven Life and Kinly are announcing a new partnership to make term life insurance more accessible to Black Americans. Link here.

⭐️ Yolt announces a collaboration with October, Europe’s leading SME lending platform. Link here.

⭐️ Over half of UAE population uses digital wallets. Link here.

⭐️JPMorgan Chase is amping up its investments in payment processors, and according to the global bank’s head of innovation and corporate development, everyone else in the financial services industry should follow suit. Link here.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Tranch, the B2B buy now, pay later provider that emerged from stealth just last week, has signed its first major technology partnership. Link here.

BSO revealed new research uncovering a “resilience paradox” suggesting that financial institutions have come to tolerate poor cloud connectivity experiences. Link here.

EUROPE 🇪🇺

Copper.co announced that it has been approved for membership of the Swiss Financial Services Standard Association (‘VQF’) through Copper’s Swiss entity in Zug. Link here.

Nuri is the latest to feel the chill winds of change in fintech markets, announcing plans to lay off 20% of its workforce in a drive to reach profitability. Link here.

In Switzerland, banks and financial institutions have been slow in embracing the open banking movement, a delay that can partly be explained by institutions’ conservative corporate culture as well as an overarching fear of losing customers to third parties. Link here.

N26 wants to triple its client number in Belgium. Link here.

USA 🇺🇸

Spriggy has extended its latest funding round, raising an extra $10 million in capital to enable it to invest in more financial products for families, without having to focus on raising funds again for years. Link here.

Varo Bank could run out of funds by year-end, filing shows. The bank reported $263 million in equity and a burn rate of $84 million in 2022’s first quarter. Link here.

Dave launches cash back rewards to all Dave spending members. Link here.

Banking giant Capital One enters B2B software industry with launch of new business. Link here.

👉 And much more on our US FinTech Weekly Newsletter. Link here.

CANADA

Manzil has raised $2.44 million CAD ($1.91 million USD) in seed funding and made its first acquisition, purchasing fellow Toronto-based firm Muslim Will for an undisclosed amount. Link here.

LATAM

On the eve of migrating to Nasdaq, Neobank Inter hits 20 million clients in Brazil. Link here.

ASIA

India's effort to break Amazon Inc and Walmart Inc's dominance of its e-commerce sector, by establishing its own open network, has begun lining up banks and other key players needed to move it forward. Link here.

Kiya.ai launches Indian banking metaverse. Link here.

Green Link Digital Bank has opened its shops. The bank said it is targeting commercial banking for micro-small-medium enterprises (MSMEs) with supply-chain financing and technology services. Link here.

Grab is targeting the public launch of its Singapore digital bank in the second half of 2022. Link here.

Ant Group has «soft launched» its Singapore digital bank, dubbed ANEXT Bank. Link here.

GCash announced that it had surpassed PHP 500 billion in Gross Transaction Value in March 2022. Link here.

AFRICA

Vesti is planning an expansion into a host of new countries this year after securing backing from Techstars. Link here.

MOVERS AND SHAKERS

PagoNxt has appointed Kush Saxena as CEO of PagoNxt Merchant Solutions, a newly created role in the company. Link here.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.