REPORT

Few developments within financial services have happened with such breathtaking speed as the evolution of neobanks.

According to their analysis, there are now roughly 400 Neobanks around the world serving close to one billion clients.

👉Download the full report here.

👀 NEWS HIGHLIGHT

Revolut has launched new fee-free USD transfers to the UK.

Companies in the UK can use US bank details to accept payment from US customers with no fees via Revolut Business.

👉Read the full article here.

😎 SPONSORED CONTENT

At MoneyLion we believe you should get more from your money. Our mission is to rewire the American banking system so that we can positively change the financial path for every hard-working American. Our products offer no hidden fees, and few barriers to entry. Accessibility is what we’re all about. There are no credit checks for cash advances and no hard credit checks for our loan products. Everyone is welcome.

📊 INFOGRAPHIC

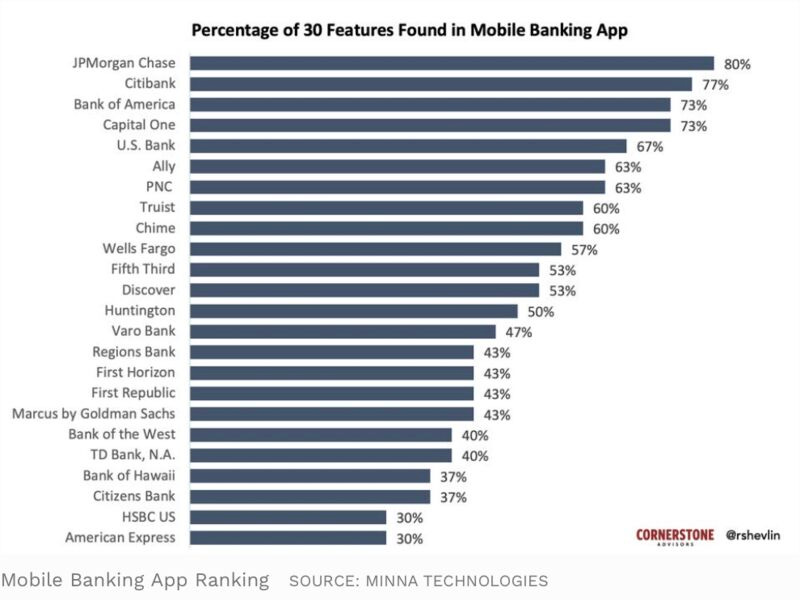

In a recent study of US consumers, Cornerstone Advisors found that Americans now consider the quality of digital banking tools to be a more important factor in their decision of who to bank with than branch locations, the quality of the branch experience, or even what interest rate a bank pays on deposits and savings.

👉Read the full article here.

📰 ARTICLE

How two Africans overcame bias to build a startup worth billions.

A pair of twentysomethings from Uganda and Ghana thought there was a fortune to be made bringing transnational financial services to Africa’s 1.2 billion people. With 5 million users, San Francisco-based Chipper Cash is just getting started.

👉Read this full amazing story by Jeff Kauflin here.

💬 INTERVIEW

JPMorgan wants to bring trillions of dollars of tokenized assets to DeFi.

Speaking to CoinDesk at Consensus 2022 in Austin, Texas, Tyrone Lobban, head of Onyx Digital Assets at JPMorgan, described in detail the bank’s institutional-grade DeFi plans and highlighted how much value in tokenized assets is waiting in the wings.

👉Read the full article here.

💡INSIGHTS

Commercial banks have a critical role in financing the transition to a low carbon, sustainable and equitable future.

Through their lending, investment, and other financial services, commercial banks play an indispensable role in mobilizing and allocating financial resources to the private sector.

👉Read the full article here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ Revolut has entered into a strategic partnership with Tink to offer its European customers seamless payment solutions powered by open banking technology. Link here.

⭐️ClearBank opens the door to virtual GBP accounts for Ziglu customers. Link here.

⭐️ Starling Bank CEO Anne Boden says crypto is very dangerous. Link here.

⭐️ Railsbank is now Railsr as it rebrands for an embedded finance future. Link here. Also, Railsr has launched a new Rewards-as-a-Service product that enables brands to build their own branded rewards programs. Link here.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

LHV UK secures €35m as part of the UK banking licence application process. Link here.

Zopa is ushering in the era of BNPL 2.0, with its new service. Link here.

Allica Bank has announced the go-live of its new core banking system supplied by Mambu, while Spanish neobank Plazo has signed for Mambu’s tech to support its lending business. Link here.

Cashplus is introducing a Digital Health Check for its SME customers, powered by Mastercard. Link here.

Lloyds Bank is partnering with Sage and Satago to offer instant financing to Sage customers based on the value of unpiad invoices. Link here.

Modulr announced it has launched its real-time Euro payments service, based on the real-time pan European SEPA Instant scheme. Link here.

NatWest eyes digital wealth acquisitions amid sector slowdown. Link here.

Metro Bank is being sued by US software company Arkeyo over allegations that it leaked the company's coin-counting technology to a rival firm. Link here.

EUROPE 🇪🇺

Backbase raised €120 million in growth equity funding from Motive Partners. Link here.

Januar has chosen Tuum as the core banking platform to power its pan-Europe goals. Link here.

Juni is announcing $206 million in funding — a $100 million Series B and a further $106 million in debt. Link here.

N26 partnered with Ukraine-Hilfe Berlin e.V. to allow its customers to donate directly from the N26 app and support those affected by the war and humanitarian crisis in Ukraine. Link here.

Fluid Finance has launched its mobile app, which it dubs as a “financial super-app”. Link here.

USA 🇺🇸

Apple has introduced Apple Pay Later, a new feature backed into the company's payment platform that will allow users to split purchases into separate payments. Link here. Apple-owned subsidiary to manage Apple Pay Later credit checks and loans without a bank partner. Link here.

Marieta announced that Western Union will support their next-generation real-time, multi-currency digital wallet and digital banking platform in Europe. Link here.

Mobiquity launched a global digital Islamic banking minimal viable product (MVP) for the Muslim community. Link here.

Ivella is the latest fintech focused on couples banking, with a twist. Link here.

LATAM

Revolut is preparing to crank up its new Brazilian operation in November, just before the FIFA World Cup gets underway, and has as part of its offering an international account for fans traveling to watch the national team in Qatar. Link here.

Ualá’s acquisition of rival Wilobank, is the final hurdle to a deal that grants the Argentine “unicorn” greater scope in its quest to expand its financial services in Latin America. Link here.

Nu Mexico has over 2.1 million cardholders and is growing at a much faster pace than Nubank did in Brazil almost a decade ago. Link here.

Klar has raised $70 million in equity funding at a valuation of $500 million. Link here.

Financial inclusion goes at full throttle in Peru with BN’s first digital bank account. Link here.

ASIA

Salary Hero wants to provide lower-income Thai workers with more financial flexibility. Link here.

Akulaku wants to increase its Bank Neo stake to around 40 percent from the current 25.2 percent. Link here.

MIDDLE EAST

NymCard closing $22.5m in funding to remove the friction for Fintechs launching payment products across MENA. Link here.

AFRICA

Carbon released Carbon Zero: BNPL web app which helps customers spread the cost of purchases into interest-free installments, in-store or online. Link here.

MOVERS AND SHAKERS

Starling Bank has set its sights on buying a lending platform and is also hiring in Dublin ahead of an anticipated move into Europe, CEO Anne Boden has revealed at Money 20/20 Europe. Link here.

Tuum has announced that it has appointed Sergei Anikin as CEO. Link here.

OPPORTUNITIES

Contis has revealed plans to increase its headcount by more than 33% over the next six months, with the Yorkshire-headquartered firm intending to recruit 123 additional roles across the UK, Lithuania, and India. Link here.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.