💬 INTERVIEW

👀 NEWS HIGHLIGHT

Continuing on its mission to democratize access to finance ZELF expands to the United States as a bank of the Metaverse, bringing game loot, NFTs and fiat under one banking roof.

The launch is announced at NFT.NYC, the 4th annual NFT industry event hailed as the Superbowl of NFTs.

👉Read the full article here.

😎 SPONSORED CONTENT

This account means business

320,000 business owners use NorthOne to simplify financial management and get back to what they love.

📊 INFOGRAPHIC

Less than 5% of the world’s 400 neobanks are profitable.

Neobanking has been one of the most talked-about fintech segments of the past decade, a buzzing industry that’s seen an average of 68 new ventures being launched each year since 2017, data from consulting firm Simon-Kucher show.

👉Read the full article here.

📰 ARTICLE

Revolut is axing its free trading for its most premium monthly subscription plan.

Users of its Metal subscription package pay £12.99 per month for a number of benefits including unlimited trading at zero commission but, according to the company, this will end next month. Instead, Metal users will receive an allocation of 10 free trades per month.

👉Read the full article here.

💡INSIGHTS

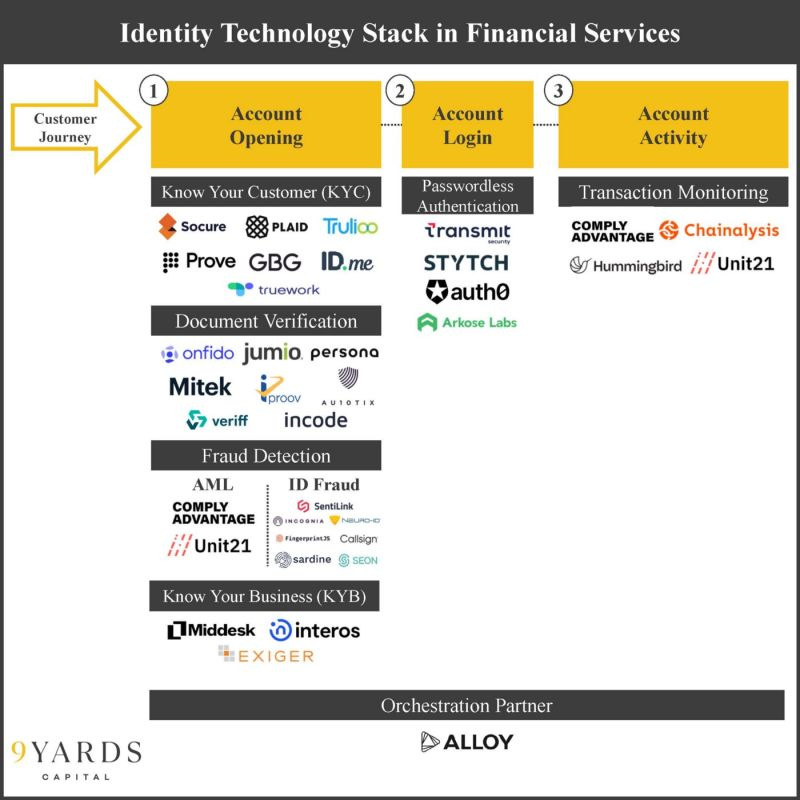

Identity verification companies help financial institutions make real-time decisions to either approve or reject a prospective customer who signs up for an account.

Identity verification processes are not new, though. Since the 1990’s, banks have been required to verify the identity of each prospective account holder in a process called Know your Customer (KYC).

👉Read the full article, with a market overview, by Jelena Hoffart from 9Yards Capital here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️SEON announced a new partnership with Provenir, a global leader in AI-powered risk decisioning software for the fintech industry. Link here.

⭐️ The 10 leading neobanks in the US grew by a little more than 10 million accounts in 2021, from 23.3 million to 33.5 million, according to Cornerstone Advisors. Link here.

⭐️ Stashfin has raised $270 million in a new funding round as the neobanking platform, which currently only serves customers in India, looks to expand to Southeast Asia and other South Asian markets. Link here.

⭐️ Spire has announced a strategic partnership with Mastercard, a technology leader in the global payments industry. Link here.

⭐️Raisin Bank AG is expanding its business to include payments. To this end, the Banking-as-a-Service (BaaS) provider is acquiring the payment services division of Bankhaus August Lenz & Co. AG. Link here.

⭐️Digital bank Kroo has just won its full UK banking licence ahead of plans to launch personal current accounts "in the coming months". The startup secured £26m in its Series B funding round at the start of the month which it said went a long way toward supporting the new current accounts. Link here.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Frost has launched to the general public after initially opening its app to its first wave of users. Now, everyone in the UK can download the app and sign up for Frost. Link here.

Starling Bank has reached a milestone of three million current accounts. The challenger bank has added 1m users in the past 18 months.m Link here.

Revolut has picked Ireland as the first market to launch its buy now, pay later product that will see it go head to head with the likes of Klarna and other FinTechs in the rapidly growing area of lending. Link here. Revolut Business has reportedly launched a new cashback offer for US customers. Link here.

Monument has increased the headline rates it pays on its 2-year and 5-year fixed savings accounts. Link here.

EUROPE 🇪🇺

Northmill, which has the vision to improve financial life, launches Apple Pay to all its card users. Link here.

USA 🇺🇸

MoneyGram has partnered the Stellar Development Foundation with to initiate the roll out of its crypto-to-cash service that is now available in key remittance markets, including Kenya, the U.S., Canada, and the Philippines for the first wave of users. Link here.

Hatch Bank announced that it has signed an agreement with FedFis to provide proprietary data and unique market insights to help better understand evolving customer behaviors and industry trends. Link here.

Mode Eleven Bancorp has chosen Finzly’s payment hub technology to power its Banking-as-a-Service (BaaS) offering. Link here.

Flagstar Bank has suffered a data breach that has hit over 1.5 million customers. Link here.

VersaBank has announced a definitive agreement to acquire Minnesota-based Stearns Bank Holdingford for an estimated $13.5 million (CA$17.4 million). Link here.

LATAM

A month after recording its “strongest quarter” in history, Brazilian neobank Nubank has shared plans for consolidation in Latin America. Link here.

ASIA

National Bank of Kazakhstan is announcing the launch of operation of an upgraded Instant Payment System’s platform (hereinafter, the IPS) designed for instant interbank transfers and payments in 24/7 mode. Link here.

BigPay announced the launch of its Cash Pickup services in Indonesia and the Philippines, as an added feature to its existing remittance feature. Link here.

AUSTRALIA 🇦🇺

Parpera has seen a surge in the growth of its member base, 80% MoM to 500 businesses, within 3 months of its business debit card launch. Link here.

Chippit, a new digital banking app, has launched in Australia in a closed beta, access for which is currently waitlisted. Link here.

MIDDLE EAST

QNB has announced its launch of Open Banking platform for a wider audience including the Bank’s customers, partners and emerging fintechs in Qatar. Link here.

Arab Tunisian Bank a mid-sized universal bank serving retail, SME and corporate customers, has gone live with Temenos’ core banking system. Link here.

AFRICA

After extending credit to thousands of customers over mobile phones since 2015, Ghana-based fintech Fido is now in search of additional growth avenues for its expansion across Africa. Link here.

MOVERS AND SHAKERS

Griffin has appointed Adam Moulson as interim CEO while current CEO and co-founder David Jarvis is on parental leave. Link here.

Sardine announced Simon Taylor as its new Head of Content & Strategy. Link here.

Mambu has appointed Werner Knoblich as Chief Revenue Officer (CRO), Fernando Zandona as Chief Technology Officer (CTO), Tripp Faix as Chief Financial Officer (CFO) and Sabrina Dar as Chief of Staff to the CEO. Link here.

Recognise appoints Sahil Thapa as chief technology officer. Link here.

Santander has tapped Héctor Blas Grisi Checa to take the reins of the Spanish banking multinational in 2023. Link here.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.