REPORT

Which neobanks have raised the most capital?

👉 Check out the full report by SEON Fraud Fighters here.

👀 NEWS HIGHLIGHT

Chase reaches 1 million UK customers at 1 year anniversary.

Chase now holds over £10 billion* in customer deposits in the U.K., and has processed approximately 92 million card and payment transactions since launch.

The firm also closed on its acquisition of Nutmeg, the U.K.- based digital wealth management platform which will form part of extended investments offer for Chase customers.

👉 Read the full Finextra article here.

😎 SPONSORED CONTENT

Burgopak delivers award-winning innovative packaging solutions for some of the world's leading Banks and Fintechs. Creating a positive user experience with beautiful design drives customer engagement, elevating your brand and increasing card activation.

Discover why packaging is crucial in digital banking here

📰 ARTICLE

Revolut head of crypto: 'Washing machines consume more energy than bitcoin'.

Did Revolut suggest Tesseract Energy is building a blockchain energy company to sustainably power bitcoin?

👉 Read the full Altfi article by Stephan Roth here.

💡INSIGHTS

Institutional crypto custody: How banks are housing digital assets.

👉 Read the full Cointelegraph article, in collaboration with WhiteSight here.

🧐 ANALYSIS

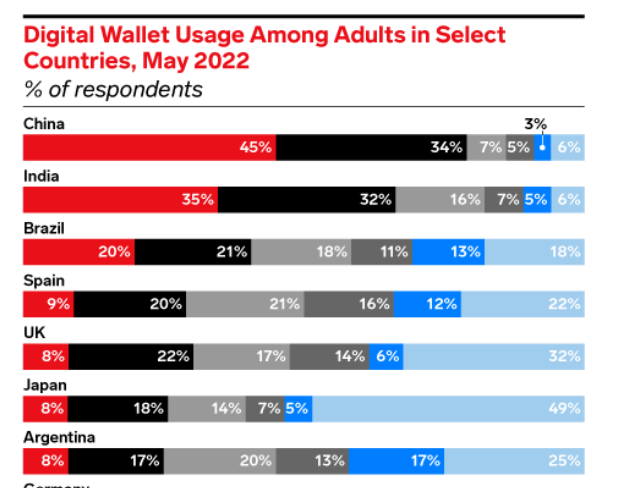

The top countries for digital wallet use.

👉 Read the full Insider Intelligence article here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ Brazil's central bank said it would set a 0.7% limit for interchange fees for prepaid cards, which are offered by fintech in free digital accounts, in a setback for the booming sector in Latin America's largest economy. Link here.

⭐️ Vivid launches business banking for freelancers. Link here.

⭐️ Revolut won registration from the United Kingdom's Financial Conduct Authority (FCA) to offer crypto services in the U.K. following a lengthy wait. Link here.

⭐️ Habito and Atom Bank withdraw their mortgages. Link here.

⭐️ Bank North: SME neobank goes bust after failing to raise Series B. Link here.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Mastercard and Visa face UK corporate card interchange class action suit. Link here.

New digital bank Bond to launch soon in the UK. Link here.

Bankkit launched in the UK, offering foreign exchange and overseas bill payment functionality and an integrated current account. Link here.

Railsr partners with DND Finance to launch new credit card. Link here.

Tide introduces higher-priced Tide Pro plan with unlimited transfers. Link here.

Allica Bank has announced it has become profitable. Link here.

Mumsnet teams up with Chetwood to launch financial products in 2023. Link here.

Losses reduced at Tandem Bank as switch to "green digital bank" bears fruit. Link here.

EUROPE 🇪🇺

Swift builds proof-of-concept for blockchain interoperability. Link here.

myTU closes €5 million seed round. Link here.

ZEN.COM and Neosurf expand their cooperation with Neosurf vouchers being another way to top up ZEN account. Link here.

Solaris becomes new partner for ADAC credit card. Link here.

Paytend taps Tribe for issuing and acquiring services. Link here.

USA 🇺🇸

Onuu launched its mobile app across the US, available on the Apple store, with the Android rollout scheduled for October. Link here.

Nexo gets U.S. bank charter after buying stake in regulated bank. Link here.

Goldman Sachs recorded several global deals that have contributed to making its investments bag full. Link here.

Dexy gears up for launch in the US. Link here.

ASIA

WeLab eyes a ‘pan-Asia franchise’ as digital banking footprint grows. Link here.

The Bangko Sentral ng Pilipinas approved the second set of guidelines for digital banks following the release of the digital bank framework in December 2020. Link here.

Grab to launch digibank in Malaysia, Indonesia in 2023. Link here.

Revolut introduces an in-app educational feature for its Singapore users. Link here.

Shelf is gearing up for launch in India. Link here.

Synapse to expand to India and Latin America. Link here.

AUSTRALIA 🇦🇺

Avenue Bank partners with nCino to reimagine SME Business Banking. Link here.

Reserve Bank of Australia outlines its CBDC development in latest whitepaper. Link here.

MOVERS AND SHAKERS

Fiinu appointed John Willcock as a new chief product officer (CPO) and Charles Resnick as chief financial officer (CFO) as the firm gears up for the launch of its plug-in overdraft solution. Link here.

Tandem Bank CEO Susie Aliker announced her intention to step down in the coming months. Tandem’s board announced a succession plan that will see Deputy CEO Alex Mollart become chief executive designate, subject to regulatory approval. Link here.

Uplinq Financial Technologies announced the addition of Daniel Moore to its advisory board, where he will help guide Uplinq’s strategic direction. Link here.

If you are a fintech startup and have over 100 questions send me an email. Maybe I can answer a few.