REPORT

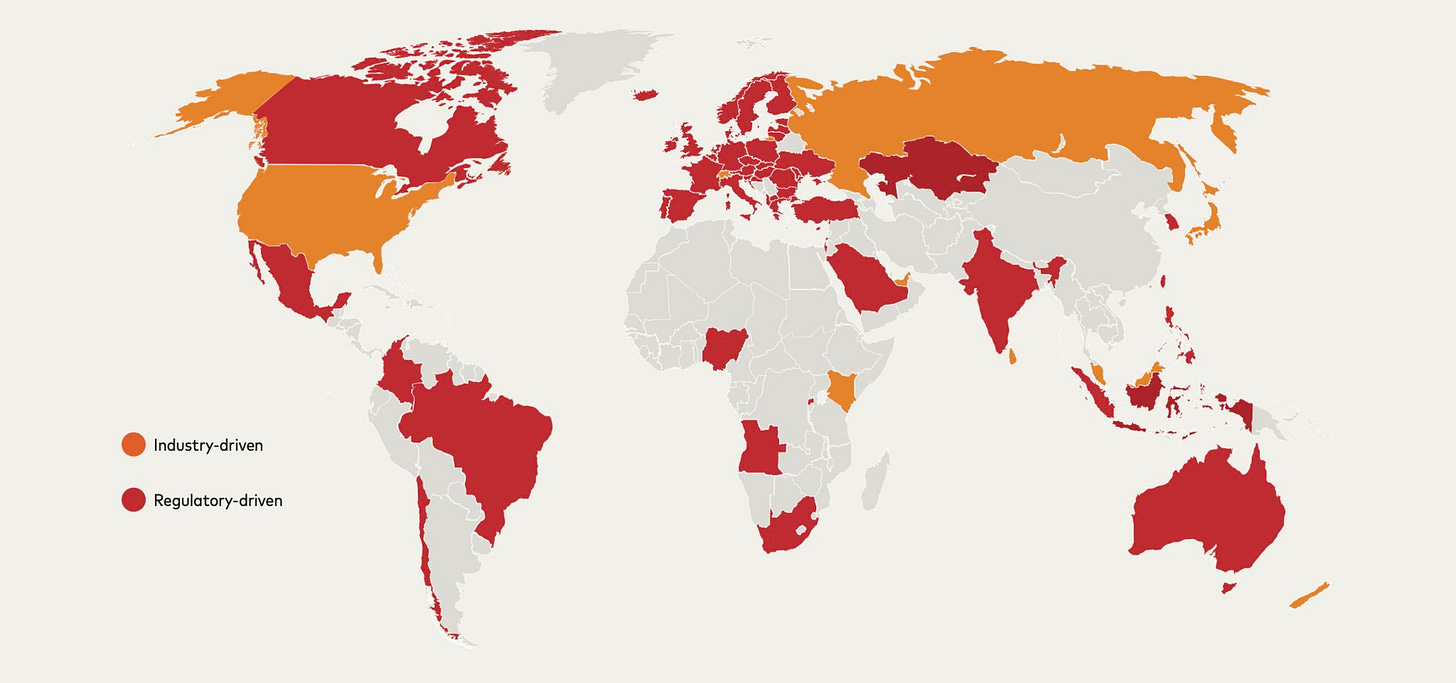

Understanding the different global approaches to open banking is essential. Some countries rely on regulation, some let the market lead, others pursue a hybrid approach.

👉 Download the full Mastercard Finicity, a Mastercard Company report, with more stats and figures here.

👀 NEWS HIGHLIGHT

Krea and Klarna said that their partnership has helped small and medium-sized enterprises (SMEs) in that country receive larger loan offers at lower interest rates.

The release says the partnership has helped businesses receive on average 15% larger loan offers, at a 4% lower interest rate.“Using Klarna Kosma SMEs can quickly and securely provide transaction-level data directly from their business bank account to the Krea platform,” the release said.

👉 Read the full Pymnts article here.

😎 SPONSORED CONTENT

2022 is set to be a pivotal year in the adoption and regulation of cryptocurrencies. So as regulators, policymakers, and the media pay more attention to the financial crime risks associated with crypto, what can compliance teams do to ensure their AML programs are best-in-class? Our new guide addresses this question. Download your free copy today.

📰 ARTICLE

As Neo-banks like Revolut and N26 make news headlines with multi-billion-dollar valuations, the world of digital banking seems very lucrative.

👉 Read the full C-innovation article by Isabel Richardson here.

💬 INTERVIEW

Cash App is looking more and more like a major, multi-featured, traditional bank these days than the mobile peer-to-peer payments system it started as nearly 10 years ago.

For Block co-founder and chairman Jack Dorsey said: “Over time, we want to work towards being primary because everything that you need in your financial life you can find within Cash App Card. So that’s the goal, that's what we're focused on, and I think we have the best strategy to get there.”

👉 Read the full PYMNTS article here.

💡INSIGHTS

Sia Partners released a study on the present state of mobile banking in 🇭🇰Hong Kong and 🇸🇬Singapore.

👉 Read the full article here.

💳 Card Collection

Revolut has brought back its Poppy cards after raising £100,000 to support the Royal British Legion's Poppy Appeal.

👉 Read the full British Legion article here.

🎤 PODCAST

The Big Tech Show with Adrian Weckler is Ireland's newest tech podcast. Every week we analyze the big issues, interview the most interesting people and review the best gadgets.

👉 Listen to the full The Big Tech Show podcast episode here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ Money Fellows raised $31 million in what it describes as the first close of its Series B investment. Link here.

⭐️ Solaris is aiming to triple its revenue to €300mn in the next two years despite job cuts, struggling clients, and a recent rebuke from its regulator. Link here.

⭐️ Form3 secured a €23 million venture debt facility to explore acquisitions, launch into new markets and support new product growth. Link here.

⭐️ Chqbook launches digital current accounts for small business owners. Link here.

⭐️ Revolut launched “Revolut Chat” - an instant messaging feature in their banking app. Link here. Revolut chat function will integrate NFT profile pics. Link here.

⭐️Binance considers bank acquisition for equity upside. Link here.

⭐️ What is a Bank? Alex Johnson is looking for an answer to this question. Link here.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Finastra unveils the Digital Banking Insights app. Link here.

Staff at Monzo have told management they plan to form a union and ask the company to formally recognize it. Link here.

Bank of Ireland has begun rolling out bio-sourced debit and credit cards across its entire cards portfolio. Link here.

Standard Chartered launches Payouts-as-a-Service tech. Link here.

Tandem is launching a new consumer-focused hub to help promote its mission of greener living. Link here.

Santander is set to block real-time payments to crypto exchanges next year. Link here.

EUROPE 🇪🇺

Bricknode is enabling core banking platform Tuum to add investments to its platform, as part of a new partnership. Link here.

USA 🇺🇸

JPMorgan Chase wants to disrupt the rent check with its payments platform for landlords and tenants. Link here.

UnionBank goes live on Metaco Harmonize to launch cryptocurrency services. Link here.

Walmart-backed fintech has been making changes to an online bank it acquired. Link here.

Dave Inc. announced that it officially surpassed $5 billion in total advances and overdraft advances to its members with its ExtraCash service. Link here.

Dave's CEO Jason Wilk aims for steady profitability by 2024, by concentrating harder on building usage, rather than just adding new customers. Link here.

LATAM

PagBank: The biggest bank you’ve never heard of in Brazil. Link here.

ASIA

GoTyme entrusts Daon with ID verification. Link here.

UnionDigital Bank announced its partnership with Thought Machine and deployed its core banking engine Vault Core. Link here.

ANEXT Bank launches new initiative to drive financial inclusion for SMEs. Link here.

airasia Super App completes its ASEAN expansion plans for 2022 with its official launch in Indonesia, focusing on Bali as a key international tourist market. Link here.

UnionDigital Bank acquired 1.73-M customers, reached US$ 70-M in loan book size. Link here.

A SEA of Transformation: Southeast Asia’s Digital Banking Landscape. Link here.

AUSTRALIA 🇦🇺

Volt announced its hotly anticipated expansion into Australia has been tabled for the first quarter of 2023. Link here.

Novatti to launch International Bank of Australia. Link here.

AFRICA

TymeBank gets the green light to buy Retail Capital. Link here.

MOVERS AND SHAKERS

Swift announces the appointment of Max Mamondez as Chief Financial Officer. Link here.

N26 announced the appointment of its new group Supervisory Board as it continues to evolve its governance structures in preparation for the next stages of development. Link here.