REPORT

Check out this Digital Banking in the Middle East #fintechreport

This report by BPC Banking Technologies and Fincog investigates the digital banking market of the Middle East with a particular focus on the countries of the Gulf Cooperation Council (GCC).

👉 Download the full BPC report here.

REPORT

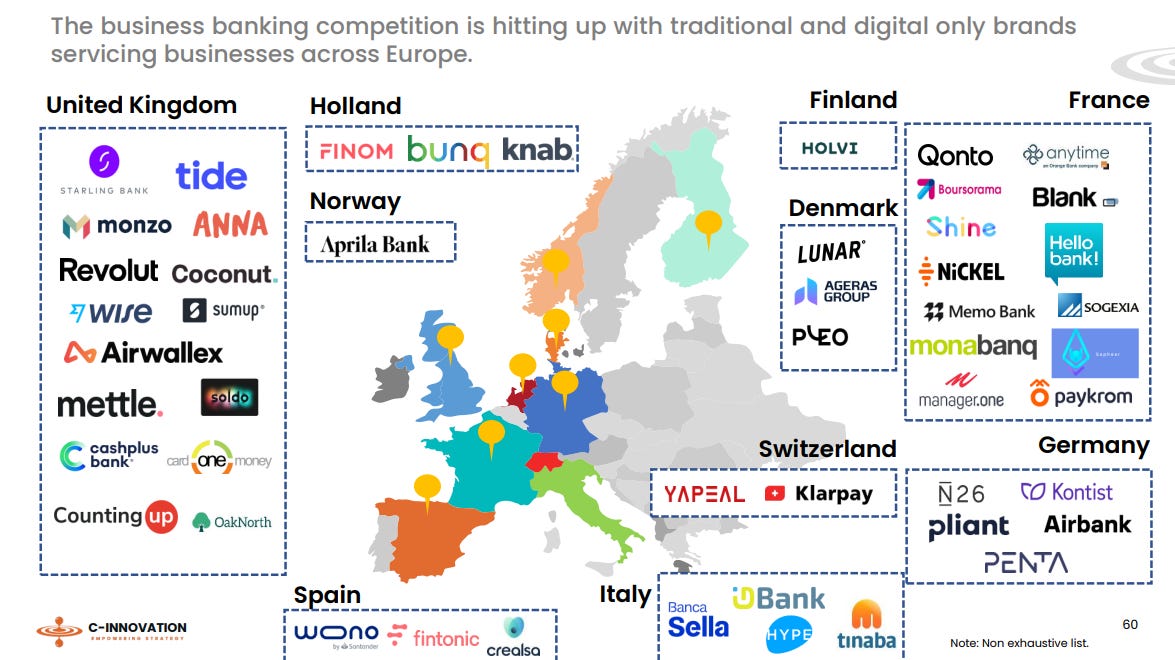

Qonto: The profitability challenge 👇

Qonto, formerly known as Finpal, was launched in France in 2017 with an international focus from day one.

👉 Download the full #fintechreport by C-Innovation here.

😎 SPONSORED CONTENT

How can you utilize open banking to get higher conversions and faster growth? iBilly turned to Klarna Kosma for a powerful API that connects its users to over 15,000 financial institutions. As a result, iBilly's conversion rate soared to 70%, and monthly user rates increased by 28%, leaving valuable time for the company to do what’s important; offer a seamless finance management experience. Read all about it in Klarna Kosma’s latest case study.

📊 INFOGRAPHIC

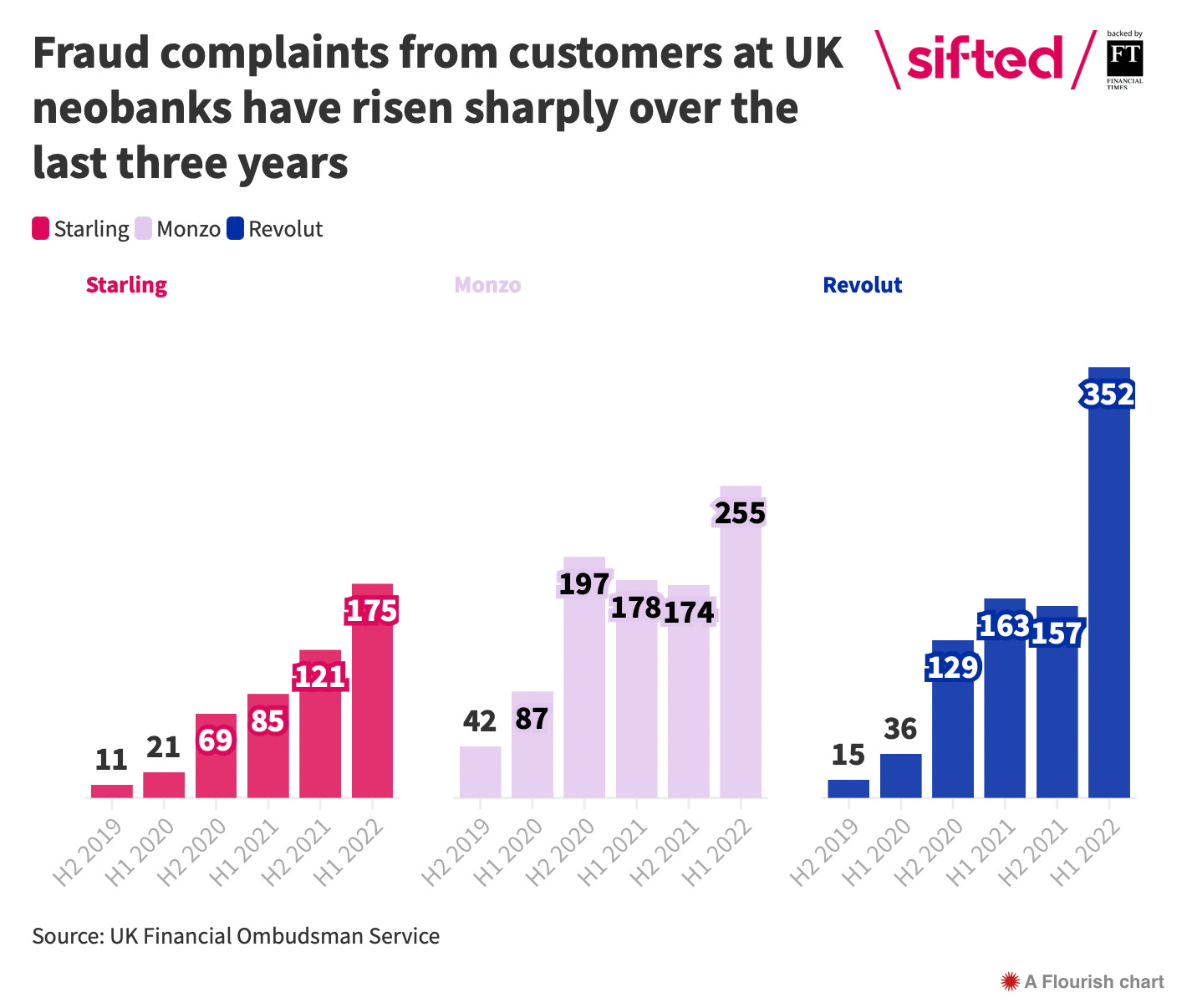

Scammers ‘targeting neobank customers’ in the UK as fraud rates soar.

Fraud complaints from customers of three of the UK’s biggest neobanks are at a three-year high, according to official UK data seen by Sifted.

The UK’s Financial Ombudsman Service (FOS), an independent body established by the British parliament, deals with complaints against financial businesses.

👉 Read the full sifted article here.

📰 ARTICLE

In letters addressed to the CEO of SoFi and banking regulators, four Democrats on the Senate Banking Committee voiced their concern over SoFi’s use of crypto assets given the recent FTX meltdown.

In a letter to the Federal Reserve’s vice chair for supervision and the acting heads of the Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency, Sens.

👉 Read the full Banking Dive article here.

📰 ARTICLE

What is correspondent banking? How does it work in the real world, and what is it used for?

Think of money laundering and you might imagine colorful and complex schemes — sacks of cash smuggled across borders, or convoluted loan arrangements routed through Byzantine corporate structures on obscure Caribbean islands.

👉 Read the full article on this topic by Will Neal and Khadija Sharif here.

👨💻 BLOG

Under a third of millennials own a credit card.

Instead, according to recent research, Millennials prefer more sustainable financing options, such as interest-free BNPL, which helps consumers stay on top of their payments with structured payment plans.

👉 Read the full Klarna Kosma blog article here.

💬 INTERVIEW

Q&A with Griffin: “We’ve built a purpose-built bank just for fintechs”.

At the FinTech Talents Festival in London, FinTech Futures sat down for a chat with Adam Moulson, chief commercial officer at Griffin.

👉 Read the full interview with Adam Moulson, chief commercial officer at Griffin here.

💡INSIGHTS

In its seven years of existence, Revolut swiftly made its way from a multi-currency payments startup in the UK to a digital bank scaleup in Europe, and now marching towards becoming a global financial super-app.

👉 Read the full story in this great article by Risav Chakraborty and Anjali Singh here.

🎤 PODCAST

Paul Taylor, CEO and Founder of Thought Machine, talks about his background, why he founded the business, and the journey Thought Machine has been on 👇

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ Less than three months after its public debut, the “anti-woke” banking startup GloriFi is canceling itself. Link here.

⭐️ Atom bank agreed on terms with BBVA, Toscafund and Infinity Investment Partners to add a further £30m in equity to its balance sheet. Link here.

⭐️Banking has officially entered the metaverse as a new business strategy. Link here.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Starling Bank cuts customers off from crypto-related payments. Link here.

Atom bank re-introduces suite of Prime and Near Prime mortgage products. Link here.

Revolut is seeing a surge in older customers using its service, attracted by its savings rates. This age group has nearly doubled the amount of cash savings it holds using Revolut, up 87 percent. Link here.

ClearBank broke into profit in October on a monthly basis as its 2022 revenues to date reached £45.4m. Link here.

Railsr launched Insights, a dashboard to empower brands to track, manage and enhance the end-to-end experiences of their customers. Link here.

Griffin launches its sandbox to break down barriers for startups and FinTech developers. Link here.

BVNK secured a UK Electronic Money Institution license through the acquisition of SPS. Link here.

EUROPE 🇪🇺

SWISS4.0 has been granted a fintech license by the Swiss Financial Market Supervisory Authority to operate as a financial institution. Link here.

USA 🇺🇸

Lumin Digital announces partnership with Vantage Credit Union. Link here.

Dave has enough cash to survive the current downturn for fintech firms and reach profitability a year from now, according to CEO Jason Wilk. Link here.

CANADA

RBC roll out Swift Go, enabling businesses to send cross-border near real-time low-value cross-border payments. Link here.

LATAM

Nubank broadens product portfolio in Mexico: launches waitlist for digital account and debit card. Link here.

ASIA

UOB EVOL cardholders can now offset 100% of their electricity carbon footprint. Link here.

Galgal Money raised USD 1 million from angel investors. Link here.

ZA Bank and Wise announced a partnership to offer low-cost and quick international money transfers to Hongkongers. Link here.

AWS powered Trust Bank to onboard more than 300,000 users in two months. Link here.

MIDDLE EAST

The Saudi Central Bank announces the licensing of a new payment financial technology company, namely: Tweeq International financial Company to provide E-wallet services. Link here.

CredoPay ties up with Oman's largest business conglomerate The Zubair Corporation to start operations in Middle East. Link here.

MOVERS AND SHAKERS

The Bank of London poached Phil Knight from 10x Banking as group CTO and chief information security officer. Link here.

David McCarthy has been appointed as Tandem’s Chief Financial Officer (CFO) becoming a member of both the bank’s Board and executive committee. Wahid Ali is joining Tandem as Chief Risk Officer (CRO) from specialist lender Masthaven. Link here.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.