Digital Banking | 2022 #5

Weekly news up to Monday, January 31st, 2022

REPORT

The number of global Digital banks has increased by 200% since 2015, and to illustrate the general trends of Digital Bank success, C-Innovation’s report looks specifically at case-studies on Chime and Marcus by Goldman Sachs.

Finn by JP Morgan Chase, Yelo, and Xinja serve as lessons to us on corporate financial faux-pas - during a time where we are (misled) to believe there is a market for everything, these lessons are extremely valuable.

The report provides a comparative analysis of 80 Digital Banks from around the world and investigates their performances in relation to pre-existing Incumbents, the pandemic, and ever-evolving customer demand.

👉 Download the full report here.

👀 NEWS HIGHLIGHT

J.P. Morgan announced that it has entered into an agreement with Viva Wallet Holdings Software Development S.A. (Viva Wallet), a leading European cloud-based payments fintech company, and its existing shareholders to acquire an ownership stake of approximately 49 percent, subject to regulatory approvals. The financial terms of the transaction were not disclosed.

“We are very excited to make a strategic investment in Viva Wallet to support their vision to empower new growth and payments innovation targeted at European small and midsize businesses (SMBs) and middle-market merchant services clients,” said Takis Georgakopoulos, Global Head of J.P. Morgan Payments.

Read the full FF News article here.

😎 SPONSORED CONTENT

Join Sokin for free. Enjoy straightforward, transparent global money transfers at the swipe of a screen and click of a button with no hidden charges or commissions – just unlimited transfers for a fixed monthly fee. Download the Sokin app from the Apple App Store or Google Play Store today.

📊 INFOGRAPHIC

11 out of 28 top European and North American neobanks offer payment acceptance. Payment acceptance is a key product for banks: it meets a key customer near and has a logical fit with digitally-oriented transactional accounts.

Also, customers with payments acceptance exhibit lower attrition and higher deposit balances, and it generates attractive non-interest revenues. Since most neobanks start with transactional products, adding payment acceptance is a logical next step in growing their product catalogs.

👉 Read the full Flagship AP infographic here.

📰 ARTICLE

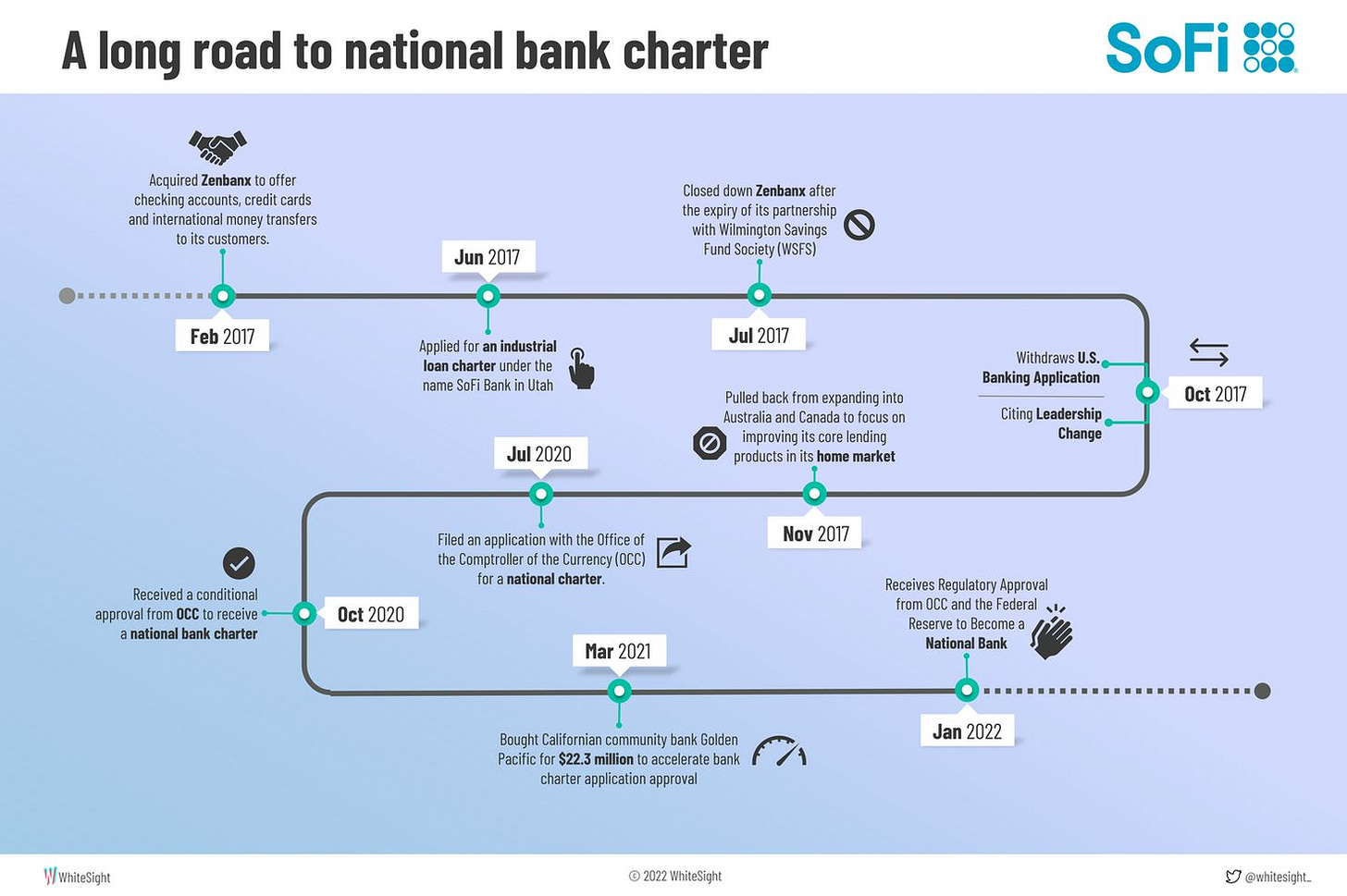

SoFi has become the latest American FinTech to acquire a banking charter in this race of banking licenses, as the national regulators accepted its applications to become a Bank Holding Company and form SoFi Bank.

Through this post, WhiteSight is taking a look at some of the key events that shaped its path towards becoming a national bank.

👉 Read the full article by Sanjeev Kumar and Risav Chakraborty here

👨💻 BLOG

Robinhood is bleeding. Jamie Dimon is spending. JPMorgan Chase has billions to spend catching up with fintech startups. What about just doing a deal instead?

👉 Read the full Protocol newsletter by Benjamin Pimentel here.

💬 INTERVIEW

Moneyfarm CEO and co-founder Giovanni Daprà spoke to AltFi following the announcement of a multifaceted tie-up with investment house M&G.

The deal sees M&G lead a £44.1m investment round in Moneyfarm, acquire a minority stake in Moneyfarm, and use Moneyfarm's digital expertise to launch its own digital investment service.

👉 Read the full Altfi article here.

💡INSIGHTS

The digital disruption of Islamic finance will be one of the key trends of the fintech sector in 2022. The industry is rising, empowering a new generation who are beginning to embrace the benefits on offer from smart fintech applications.

One of the challenges the Islamic finance sector is facing is a lack of market awareness and knowledge surrounding the basic principles of Sharia-backed products and services. This is an issue commonly raised in non-Muslim jurisdictions, and the UK is no exception.

👉 Read the full Financial Reporter article here.

👀 Would you prefer to receive your Digital Banking news daily? 👉 Read all about Digital Banking news here.

Subscribe to our Daily Digital Banking Newsletter and never miss an important update again.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 DIGITAL BANKING HIGHLIGHTS

⭐️ Revolut has announced that U.S. customers can transfer money to Mexican bank accounts. Link here.

⭐️ Solarisbank and Contis have completed their previously disclosed partnership, bringing their combined revenue to €100 million. Link here.

⭐️ Mastercard Inc beat quarterly profit expectations on Thursday as domestic spending through its cards rose and cross-border volumes grew following an uptick in international travel. Link here.

⭐️ Marqeta launches in Singapore, the Philippines, and Thailand. Link here.

UK 🇬🇧

Atom bank is partnering with Sesame to provide increased accessibility for those applying for mortgages through Sesame’s brokers. Link here.

CMA takes Monzo to task over breach of Retail Banking Market Investigation Order. Link here.

Penfold, the digital pensions platform, has announced they have been added to Starling Bank’s Personal Marketplace, allowing customers to set up a Penfold pension through the Starling app in a matter of minutes. Link here.

A total of 782,223 people switched their UK bank accounts in 2021, the Current Account Switching Service (CASS) says, compared to just over 1 million in 2019. Link here.

Fintech Farm, a newly launched fintech startup based in the U.K. that creates digital banks in emerging markets, confirmed to TechCrunch that it has raised $7.4 million in seed funding. Link here.

EUROPE 🇪🇺

UniCredit will continue to study potential mergers and acquisitions after deciding against a Russian deal due to geopolitical risks but won’t stray from plans to return billions in capital to shareholders, Chief Executive Andrea Orcel said. Link here.

Surecomp announced that Rabobank, the second-largest Dutch bank, is fully operational with its integrated back and front-office digital trade finance solutions DOKA-NG and allNETT. Link here.

Veriff is now valued at $1.5 billion. The new financing will be used for growing the workforce, R&D, sales, and marketing. Veriff claims its video approach makes online IDV “more accurate” than physical face-to-face authentication and prevents fraud more often. Link here.

German fintech N26’s chief operating officer is stepping down, the latest in a series of high-profile departures in the past two years. It also leaves the company with no full-time woman at the C-suite level. Link here.

After opening its Amsterdam office only in November, payments-as-a-service provider Modulr has now secured the Electronic Money Institution (EMI) licence it needs to expand its services across Europe. Link here.

Spanish banking giant Santander has announced the launch of a new buy now, pay later (BNPL) platform called Zinia. Link here.

Estonian fintech startup Tuum announced a €15m Series A funding round as it looks to strengthen its European presence, while also investing in product innovation and preparing for expansion beyond Europe. Link here.

Hamburg-based fully licensed bank Varengold Bank AG and the Berlin-based fintech Banxware announce a new strategic partnership. Together they will allow platforms to launch tailor-made embedded loan products in a few weeks without any technical or regulatory effort. Link here.

USA 🇺🇸

Vesta’s technology aims to provide a customizable platform for mortgage origination, supporting approval, underwriting, and the closing and funding of home loans. Link here.

A financial technology start-up that Walmart created and backed said Wednesday it is acquiring two more companies as it aims to build an all-in-one app where consumers can manage their money. Link here.

Vesti Technologies Inc announced it raised five hundred thousand dollars ($500,000) as part of a pre-seed funding round to improve its product platform, increase its users base and solidify its market penetration into the African market. Link here.

Temenos, the banking software company, announced the availability of Infinity Digital for Salesforce that brings together the worlds of CRM, assisted channels, and digital channels onto a single platform, available here on Salesforce AppExchange – the world’s leading enterprise cloud marketplace. Link here.

LATAM

Mozper, the startup that helps parents in Latin America educate their children to make smart and responsible financial decisions, launches in Brazil, together with Visa. Link here.

MIDDLE EAST

Dubai's ICICB Group preps Brazilian digital bank. The group has a long track record of generating revolutionary new businesses and propositions with rigorous discipline and pace, spanning the entire scope of possibilities, from initial strategy to technical development. Link here.

ASIA

Al Rajhi Bank Malaysia (ARBM) has selected Thought Machine to power its upcoming next-generation digital bank. Link here.

AFRICA

The microfinance company Barko intends to enter South Africa’s retail banking market with a new digital bank built on Temenos Transact and powered by the Temenos Banking Cloud. Link here.

MOVERS AND SHAKERS

Marqeta welcomes Sunaina Lobo, Chief Human Resources Officer. Suni formerly led People teams at Navis, Cisco, SVB, and ANZ Bank and brings a wealth of human resources experience to Marqeta. She will lead our People and Culture function globally to support our growth and company culture. Link here.

OPPORTUNITIES

Monzo is to launch an investment and wealth business and is recruiting for an executive to head up the unit. Link here.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.