REPORT

N26 market entry followed a mixed strategy.

It focused on rapidly onboarding customers with a simple prepaid card product, whilst applying for a full European Banking Licence, which has leveraged to consolidate in the region, servicing to over 20 EEA countries.

👉 Check N26 report by C-Innovation here

👀 NEWS HIGHLIGHT

Community banks and credit unions might drop out of partnerships with instant-payment apps like Zelle if required to reimburse customers who fall victim to scams.

👉 Read The Wall Street Jurnal article by Imani Moise here

😎 SPONSORED CONTENT

Fintech Meetup is Q1’s BIG new event! Find new leads and partners. Meet everyone you need to meet in 30,000+ double opt-in meetings. Hear from 250+ speakers. See 200+ sponsors & Exhibitors and network with 3,000+ other senior level fintechers. At the Aria, Las Vegas March 19-22. Get ticket!

📊 INFOGRAPHIC

The UK has the highest contactless limit in Europe.

The UK’s contactless limit is now £100, after rising from the £45 limit on October 15th, enabling consumers to make larger purchases without the need for a chip and PIN.

👉Check this Contactless Limits Around the World infographic by suits me here

👨💻 BLOG

The introduction of open banking in Europe in 2018 kickstarted a digital revolution in how consumers interact with banking services.

While the sensitivity of financial information means traditional banking services require siloed security systems that customers traditionally access through bank-owned branches, websites and apps, open banking has opened the door to a new era of multibanking.

👉Read The five ways multibanking is changing banking blog by Klarna Kosma here

👨💻 BLOG

The aforementioned issues with respect to challenger bank business models (high CAC, reliance on interchange fees) are compounded by the fact that they tend to have a limited product offering.

👉 Read the Four Embedded Finance Strategies for Incumbents blog by Ben Robinson here

📰 ARTICLE

Amid a worsening economic climate and inflationary pressures, digital banking startup Current dropped its subscription fees this year — a cost it said it can absorb by building its own payment processing infrastructure and eliminating the need for a third-party payment processor.

👉Read how Current pivoted to free in this Banking Dive article by Suman Bhattacharyya here

🧐 ANALYSIS

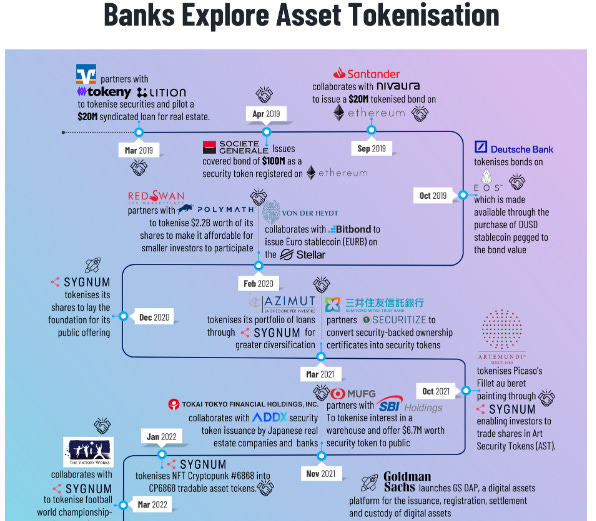

The blockchain and crypto industries have been weathering the difficult ‘crypto winter’, with decreased activity and market value presenting barriers for companies when it comes to continuing operations.

👉 Read WhiteSight article by Sanjeev Kumar and Animesh Kaushik here

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ JP Morgan signed a deal to buy a 48.5 percent stake in Athens-based payments fintech Viva Wallet for more than $800 million. Link here

⭐️ Capco's latest Asia Pacific Retail Banking Survey Report 2022. Link here

⭐️ Westpac abandoned plans to buy Tyro Payments. Link here

⭐️ A consortium of top US, European and UK banks have backed a $24 million Series B round in operational risk network Acin. Link here

⭐️ New York State-regulated banks will need to get prior approval from regulators ahead of any virtual currency-related activities. Link here

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Teneo became the first firm to utilize the new Confirmation of Payee functionality embedded within NatWest's account-to-account payments platform Payit. Link here

Paysafe Group’s cash arm started a new partnership with ING Germany. Link here

Starling Bank launched its first saving product, a one-year fixed-term deposit account offering a 3.25 percent rate. Link here

Wise launches a new product that will enable users to hold money in government-backed assets. Link here

EUROPE 🇪🇺

Western Union launched its Digital Banking app in Romania, which offers both digital banking and international money transfers, all in one place. Link here

Rabobank hails blockchain pilot for euro commercial paper transactions. Link here

Bpifrance is using Thought Machine’s cloud-native core banking platform, Vault Core. Link here

LATAM

Neon acquired Brazilian FinTech Leve Capital. Link here

Nubank also laying off several employees. Link here

MIDDLE EAST

NOW Money and ThetaRay announced a collaboration to implement ThetaRay’s cloud-based AML solution to monitor cross-border payments on the FinTech’s payments platform. Link here

Blue released its latest technology that allows users to trade US-listed stocks via Bluepay. Link here

MOVERS AND SHAKERS

Griffin announced two new executive hires: Sameer Dubey as Chief Product Officer and Fergus Speight as General Counsel. Link here

Carsten Höltkemeyer, who took office as CEO designate of Solaris earlier this year will officially take the office of CEO from Dr. Roland Folz on 1 May 2023. Link here