MVO BLOG

REPORT

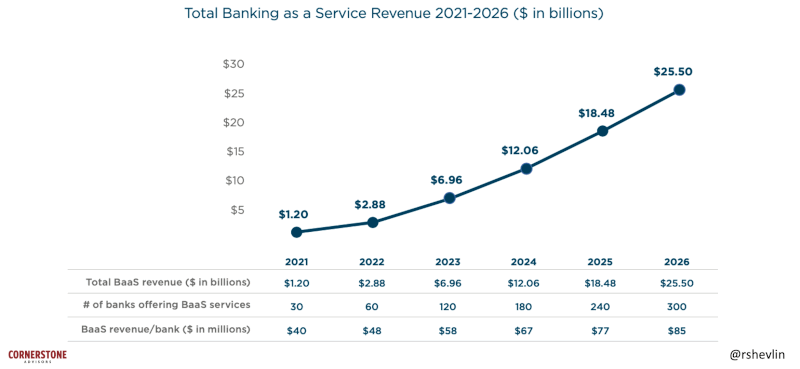

A new report from Cornerstone Advisors, commissioned by Synctera, defines banking as a service and forecasts the future revenue opportunity for banks to realize from this growing trend.

Industry-wide, Cornerstone estimates that the BaaS market could grow to more than $25 billion in annual revenue in 2026.

This would go a long way to replacing the inevitable loss of overdraft fees the banking industry will face over the next five years.

👉 Read the full article by Ron Shevlin here.

👀 NEWS HIGHLIGHT

Financial super app Revolut has launched a new tool for its travel product Stays that lets customers book their stay and pay when they arrive.

Revolut Stays will now let customers in the United Kingdom and the European Economic Area make a reservation with the app and choose to pay when they arrive for their stay with their Revolut card or pay upfront using the app at the time of booking, the release stated.

👉 Read the full PYMNTS article here

😎 SPONSORED CONTENT

Fintech Meetup: Only 4 Days Left to Get a Ticket! Registration closes on Friday. Don’t Miss Out! Get your Fintech Meetup ticket and join thousands of industry peers from 1,000+ companies participating in 30,000+ double opt-in virtual meetings. Here's a sample of who’s already confirmed! Virtual, March 22-24. Get Your Ticket

📊 INFOGRAPHIC

👉 Using Open Banking and Open Finance APIs to Build Green Fintech: Download the full report by Platformable here.

📰 ARTICLE

hi, the crypto exchange upstart and mobile banking platform, has announced a strategic agreement with Contis, a leading Banking-as-a-Service (BaaS) provider in Europe.

Contis, Europe’s most comprehensive banking-as-a-service platform, already partners with some of the world’s largest cryptocurrency and blockchain companies.

With unique technology provided by Contis, hi not only removes the need to liquidate assets before spending and allows for any digital assets in a hi account to be converted automatically to fiat at point-of-sale but will also come with Buy Now, Pay Later (BNPL) functionality that allows members to decide on exactly when their digital assets get converted.

👉 Read the full article here.

💡INSIGHTS

Nu, the holding company that includes Nubank in Brazil, as well as Nu México and Nu Colombia, added 5.8 million customers in the last quarter, reaching a total of 53.9 million customers in Brazil, Mexico, and Colombia – of these, 41.1 million are considered to be monthly active customers.

The largest digital bank in Latin America estimates that more than 55% of its active monthly customers have chosen it as their main account.

According to Guilherme Lago, CFO of Nubank, this is the formula behind the neobank‘s revenue generation potential, and it is working. The combination of engagement – Nubank is a global example of brand building, reaching a 90 NPS – and new products, designed for each market, alongside partnerships, is bringing more loyal customers to Nubank, he told participants of the company’s earnings conference call this Tuesday.

👉 Read the full article by LABS here

🎤 PODCAST

👀 Would you prefer to receive your Digital Banking news daily? 👉 Read all about Digital Banking news here.

Subscribe to our Daily Digital Banking Newsletter and never miss an important update again.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🌎 DIGITAL BANKING HIGHLIGHTS

⭐️ Canza Finance, an emerging markets neobank that is building the world’s largest non-institutional-based financial system, announced the completion of its $3.27M seed round. Link here.

⭐️ Vlad Yatsenko, co-founder and chief technology officer of one of the UK’s most valuable FinTech companies Revolut, has labeled Russia’s leader Vladimir Putin a “brazen liar”. Link here.

⭐️ HooYu, the leading customer onboarding, and KYC technology provider, is partnering with Virgin Money, the full-service digital bank, to implement a new account opening journey for Virgin Money customers. Link here.

⭐️ Found, a startup offering a "full-stack" financial services for self-employed workers, raised $60 million in Series B funding led by Founders Fund. Link here.

UK 🇬🇧

With an ambition to attract £2 billion in deposits over the next year, Zopa Bank has launched a 'hybrid' savings account, enabling customers to combine easy access and fixed-rate accounts from a single dashboard. Link here.

After $5 million USD of investment, Novus, the impact banking app, has officially launched to the UK public. With Novus, every time a user taps their card, real-time ‘impact’ points are donated to various environmental and social causes such as funding meals and cleaning the ocean. Link here.

There could soon be a new bank in town, as LHV UK announced it has submitted its banking licence application with the Bank of England. Erki Kilu, the CEO of LHV UK, said it had taken the organisation “exactly a year” to prepare all the materials needed to submit its application. Link here.

EUROPE 🇪🇺

The berlin-based platform for embedded finance Monite has raised $5 million. The round was led by Point72 Ventures with participation from Klarna founder Victor Jacobsson, Mollie founder Adriaan Mol, PayPal senior executive Phil Valka, Plaid executive Jason Pate, fintech investor, and Money2020 founder Jonathan Weiner, and Ex-Deutsche Bank Board Member and Oxygen investor Ralph Müller. Link here.

Bnext, the Spanish fintech created in 2017 to be the alternative to traditional banking, uses the blockchain technology of their investor Algorand, one of the few decentralized platforms exclusively focused on the exchange of capital worldwide, to develop financial products as well as reduce execution times and costs. Link here.

USA 🇺🇸

SoFi users may now take a look at the new savings and checking account with an APY of up to 1%, the company announced on Thursday. In addition, there are no overdrafts, maintenance, or transaction fees associated with this account. Link here.

Bank of America added more than 2 million active digital clients last year, a single-year record, with its total number of verified digital users reaching more than 54 million. The bank’s clients logged in to its digital platforms a record 10.5 billion times in 2021, a year-over-year increase of 15%. Link here.

LATAM

Plurall says it is applying technology, data science, and a “hyper-focus on customers to deliver mission-critical financial services” to entrepreneurs and SMEs left out by digital-first banking and financial services. Link here.

ASIA

Fi, the Bengaluru-based neo-bank aka online banking platform announced that it has just crossed one million accounts, within just 8 months of it becoming available to users. About thrice this number (1 million) have signed up on the app showing interest to use it. Link here.

India’s Niyo Solutions Inc. has raised $100 million in a new financing round as the consumer-facing neobank platform looks to add lending and insurance to its offerings and make deeper inroads in the world’s second-largest internet market. Link here.

AUSTRALIA 🇦🇺

Revolut, which rolled out its Australian services in August 2020, has now enhanced its offerings to Aussie clients by launching stock trading services, the fintech company announced on Wednesday. The new service will allow Revolut’s Australian clients to buy and sell company stocks listed on two American exchanges, the New York Stock Exchange (NYSE) and NASDAQ. Link here.

MIDDLE EAST

Bank Jago wants to bolster the country's Sharia banking segment, with assets only accounting for 6.5% of the total banking industry’s assets. Link here.

FLOOSS, a digital digital-first program, which provides financial services across the Kingdom of Bahrain has been launched following Mastercard‘s partnership with Payment International Enterprise. Link here.

Mashreq, one of the leading financial institutions in the United Arab Emirates, has taken a stake in NymCard, the only Banking-as-a-Service provider in the Middle East, to help grow the booming fintech ecosystem in the UAE and support the next generation of innovators. Link here.

Israel-based ThetaRay plans to roll out AI-driven solutions to help Mashreqbank PSC, Dubai’s third-biggest lender, detect financial fraud during cross-border payment transfers. Link here.

AFRICA

Discovery released interim financial results for the six months to December 2021 this week, with group chief executive and founder Adrian Gore saying that the shared-value insurance model ensured Discovery’s resilience during a tough period. Link here.

MOVERS AND SHAKERS

Varo Bank, N.A., the first all-digital nationally chartered bank in the US, announced the appointment of Corey Carlisle to Head of Public Policy. Link here.

After five years at Tide, the SME banking provider’s UK CEO Laurence Krieger announced his departure yesterday. Krieger has been Tide’s UK CEO since January 2021, and joined Tide from Revolut in 2017 as chief operating officer. In a post on LinkedIn, Krieger said that he was “extremely grateful” to the team at Tide, but that he had decided to move on. Link here.

Solarisbank's first Chief Growth Officer will focus on international expansion as the banking-as-a-service platform increases its reach across Europe. Hot on the heels of Solarisbank’s recent news that their joint-entity agreement with the UK’s Contis was approved, the Banking-as-a-Service platform presented their newest hire, Chief Growth Officer Chloé Mayenobe. Link here.

OPPORTUNITIES

Monzo is hiring for what it has dubbed an “exciting new investment and wealth business”, leading some to warn advisers not to underestimate the potential new entrant. The challenger bank, which has grown to around 5mn retail customers over more than 10 years, last week put a job advert out for a general manager of investments. Link here.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.