Check out the latest 🇦🇺 Australian Open Banking Ecosystem Map👇

REPORT

In “Payments gets personal—strategies to say relevant,” Accenture reports on a survey of 16,000 payments customers across 13 different countries, they revealed how the return of meaningful interest rates is interacting with ongoing digital disruption in payments to reshape the expectations of customers. 👇

REPORT

Visa sees remittance shift to app-based digital payment methods.

Remittances are not only a lifeline for millions of migrant workers and their families, they are also vitally important for the prosperity of many developing economies around the world. As the amount of global remittance inflows continues to reach new records1, 53% of surveyed consumers are turning to digital apps to send and receive funds around the world.

👀 NEWS HIGHLIGHT

Enfuce teamed up with UK neobanking start-up Science Card to launch a ground-breaking payments card, which forms part of a new infrastructure for funding scientific research, designed to create the future earlier rather than later.

SVB news

First Citizens Bancshares Inc., one of the nation’s largest regional banks, is buying big pieces of Silicon Valley Bank more than two weeks after the lender’s collapse sent tremors through the banking system.

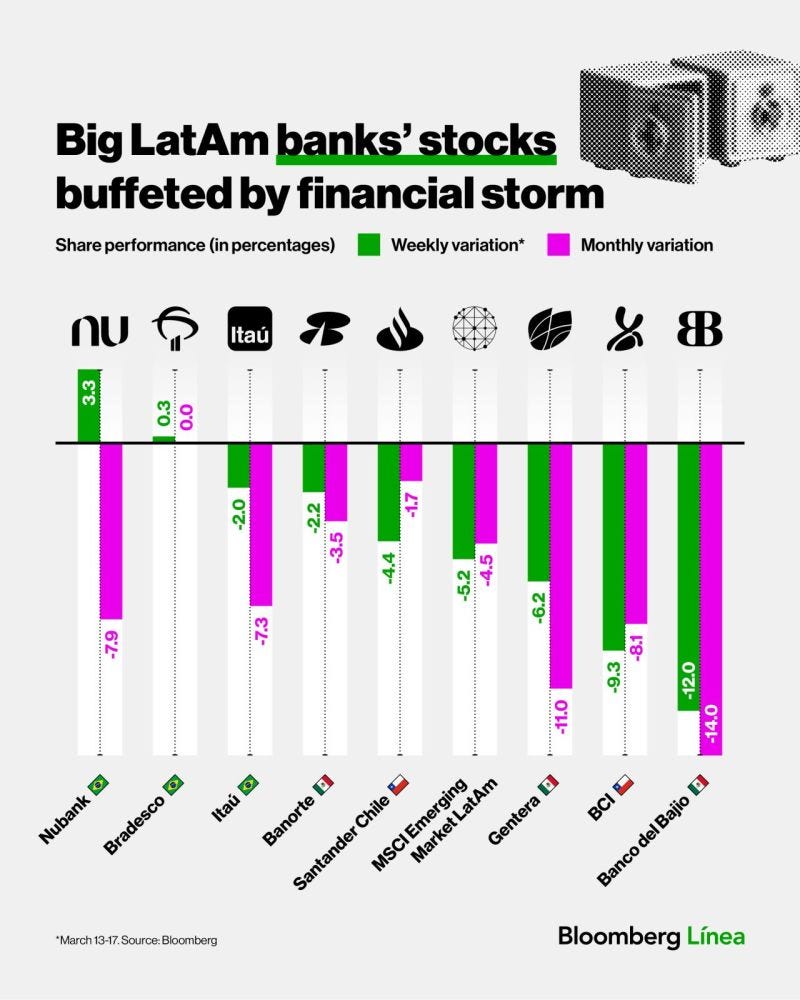

The financial shock caused by the failure of Silicon Valley Bank and then by the collapse of Credit Suisse takes a toll on Latin American banks (as their stocks show)👇

📰 ARTICLE

🚨 Block shares plunge 19% after short seller Hindenburg says Jack Dorsey’s company facilitates fraud.

Short seller Hindenburg Research announced Thursday that the payment company was its latest short position, alleging that Block allowed criminal activity to operate with lax controls and “highly” inflates Cash App’s transacting user base, a key metric of performance.

💡INSIGHTS

Let´s superpower one of the world’s most popular budgeting apps for young people with open banking!

With more than 3 million users worldwide, Buddy is the fastest-growing budgeting app on the App Store. Partnering with Kosma allowed Buddy users can safely connect their bank accounts - checking account balances in real-time, monitoring their spending, and setting up payment reminders, all from the app.

💡INSIGHTS

Is Revolut really worth $33bn right now? Banking stocks are in freefall and Stripe’s valuation is down by half. So does Revolut’s $33bn price tag stack up anymore?

It has 28m global retail customers — far more than competitors Monzo (7m) and Starling (3.5m), which are focused on the UK. Unlike them, however, it doesn’t have a banking license — and yet its valuation still dwarfs theirs.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ JPMorgan Chase is acquiring a data analytics provider for startup investors called Aumni.

⭐️ Revolut is to enter the Irish car insurance market, as it continues to expand its business here.

⭐️ Alex.Bank began its newest capital raise, with the target of raising $20 million.

⭐️ Raisin raised €60 million in a series E funding round, from existing and new investors.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Recognise Bank secured a £25m cash raise from its largest investor, PV27, company was fully licensed at the end of 2021 and raised over £95m in investment so far.

Standard Chartered Bank announced the global launch of the working capital and lending capability on its Straight2Bank platform.

Plend selected GoCardless, a global leader in direct bank payments, to provide Variable Recurring Payments through GoCardless’ Instant Bank Pay feature.

Former Penta founder Jessica Holzbach resurfaced with Pile, a timely new treasury package for high-growth startups and venture funds.

Cable and Griffin partner to integrate robust automated financial crime assurance into Griffin’s BaaS platform.

USA 🇺🇸

Fiserv combines the technology stack with Central Payments' API marketplace, enabling FinTech, enterprise businesses, and payment facilitators to bring financial products and services to market with greater speed and growth potential.

Vemanti Group teamed up with banking technology provider Finastra to build a Southeast Asian neobank, the digital lender will cater to SMEs, with the initial focus on the Vietnamese market.

ASIA

Rakuten Group plans an initial public offering of its banking arm, in a probable $807 million listing that would test demand for the e-commerce giant's online lender.

Bursa Malaysia announced the deployment of its Centralised Sustainability Platform which will be piloted by Maybank and the UMW Corporation.

Nomura Real Estate Holdings and East Japan Railway have joined a growing list of Japanese companies entering the banking business to expand their base of loyal customers.

Trust Bank now onboarded over 500,000 customers just seven months after its official launch in September 2022.

MIDDLE EAST

Purpl announced its successful go-live on Mambu’s cloud-native banking platform and will provide Lebanese citizens at home and abroad with seamless ways of transacting.

Sygnum announces the opening of its Middle East hub in the Abu Dhabi Global Market international financial centre to provide a portfolio of Swiss-regulated crypto banking services.

Qashio partnered with Alinma Bank to launch its operations in the Kingdom. This is the first time that a KSA bank has joined hands with a fintech company to provide solutions to its corporate banking customers.

The Central Bank of UAE jointly held a signing ceremony with G42 Cloud and R3 to mark the implementation of the CBUAE Central Bank Digital Currency Strategy.

MOVERS AND SHAKERS

TNEX‘s CEO Bryan Carroll will be stepping down from his position and will stay on as a board member.

Synapse announced the formation of a new Policy & Regulatory Advisory Board and the appointment of Daniel Gorfine, as Chair.

HugoBank appointed of Atyab Tahir as Chief Executive Officer, subject to the State Bank of Pakistan's fit and proper assessment.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.