REPORT

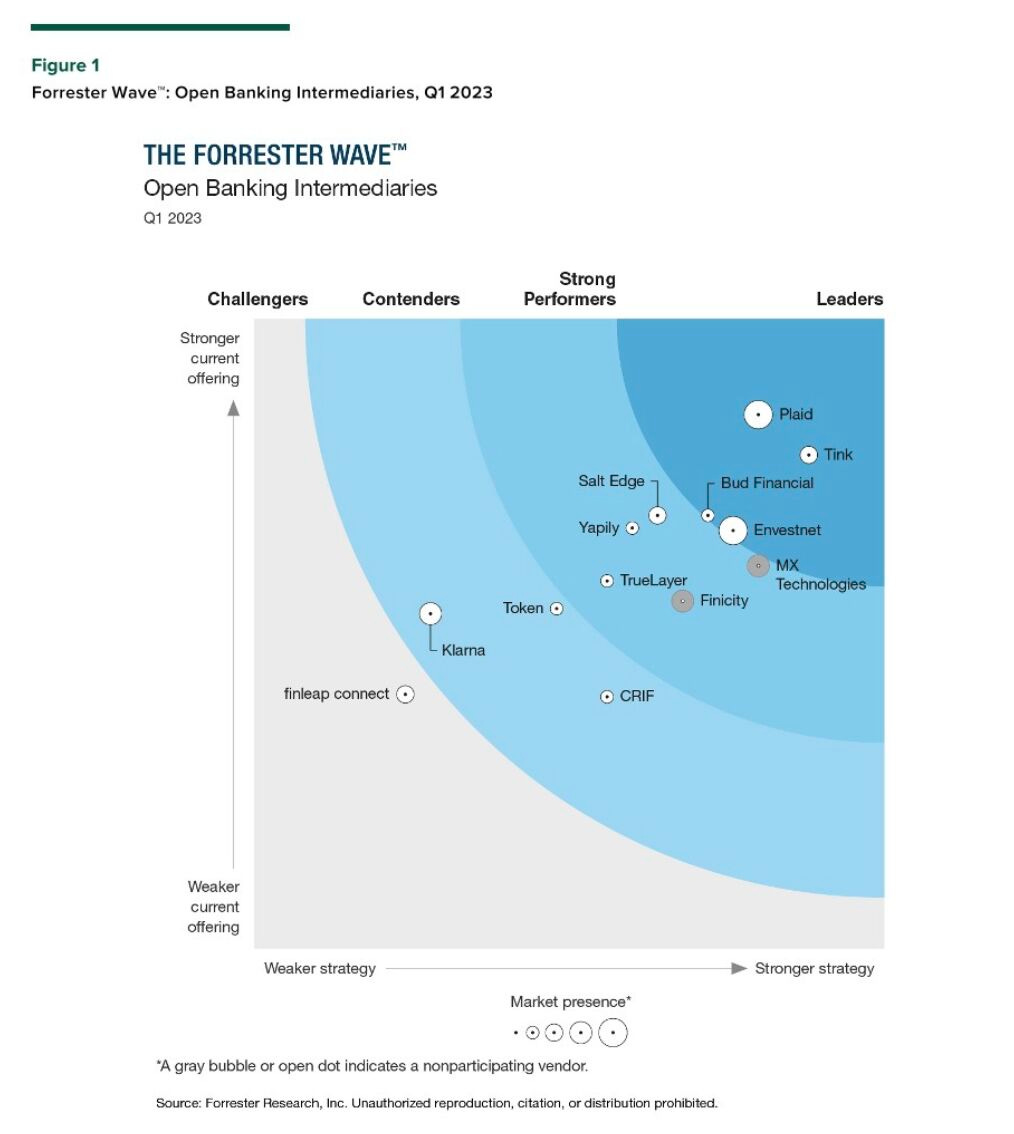

As part of The Forrester Wave™ evaluation of open banking intermediary providers, Forrester identified, analyzed, and scored the 13 most significant ones. Download the full report to read all about the providers that matter most.

REPORT

ACI’s 2023 Prime Time for Real-Time report reveals that global real-time transaction volumes are rising to record highs. Download the full report through the link below👇

REPORT

“Innovation is important in banking because it drives growth, allows organizations to stay competitive, and helps solve complex problems in an ever-changing world.” - Innovation in Retail Banking Report’s author Jim Marous

Download the full report by Qorus and Infosys Finacle through the link below👇

👀 NEWS HIGHLIGHT

Tandem Bank acquired the recently-launched app Loop Money. Loop is a social network aimed at helping its customers to lend and borrow money with each other, and using open banking to enable seamless payments.

📰 ARTICLE

Many neobanks have to come up with a plan to accelerate their path to profitability. According to the insightful series by Dmitriy Wolkenstein, CEO at TIMVERO, regardless of who your customer is, you have to address several key questions.

📰 ARTICLE

Last week ended with an explosive article published by NY Magazine; “The Meltdown of a Gay Bank”. The article homed in on Daylight, an LGBQT+ focused neobank.

👨💻 BLOG

Open banking is perfectly placed to benefit from the rapid advances in AI. ChatGPT will soon be helping to power a new generation of customer service chatbots, while AI models will get even better at predicting customer behavior.

💡INSIGHTS

Open Banking and Open Finance are making their way around the globe, with many countries looking at how financial data can be shared and managed via open APIs. Follow the journey with us through Konsentus’ Open Banking world map.

💡INSIGHTS

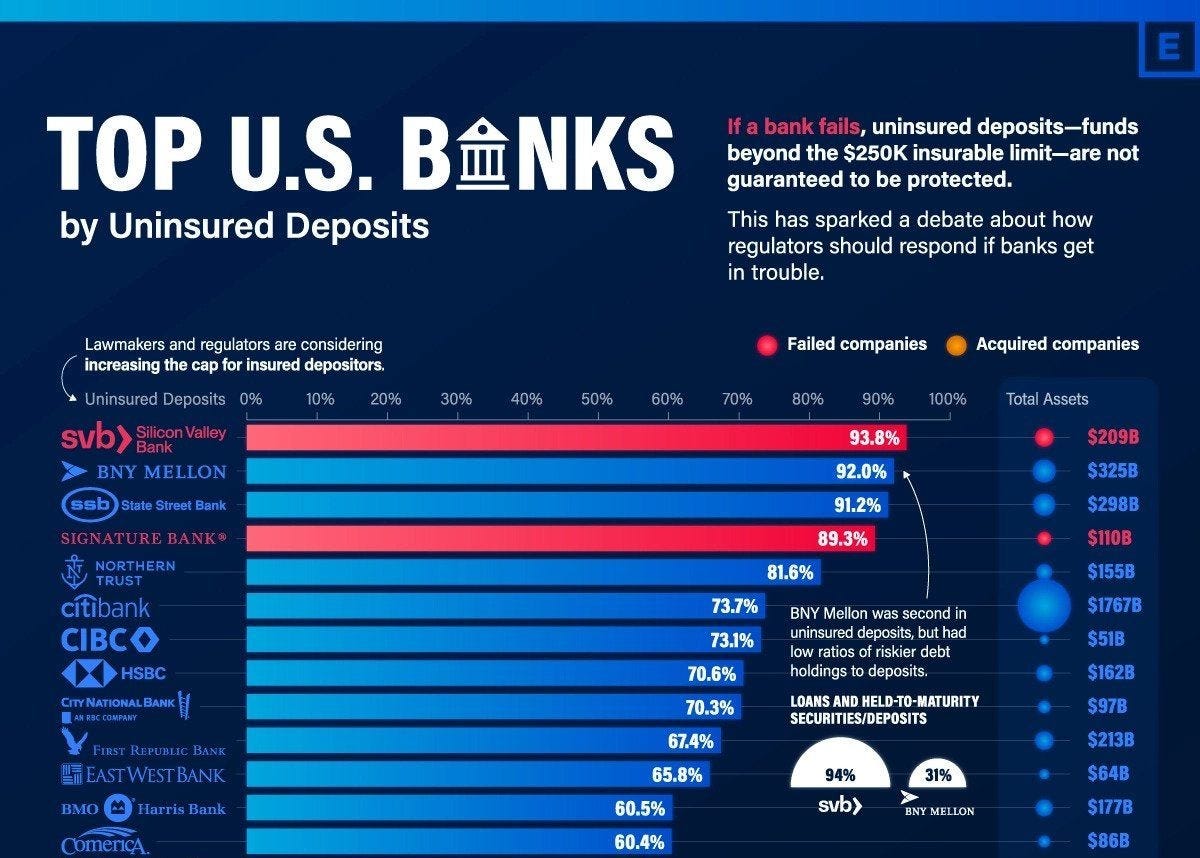

In the wake of the SVB fallout, Visual Capitalist looks at the 30 U.S. banks with the highest percentage of uninsured deposits, using data from S&P Global.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ bunq officially applied for a US banking license.

⭐️ Current’s ex-Head of Talent Isabelle Mitura sued the $2.2 billion company, alleging racial and sex-based discrimination.

⭐️ Google plans to restrict apps that offer loans to individuals from accessing sensitive user data such as photos, videos, and contacts.

⭐️ Postfinance will offer customers access to major cryptocurrencies and related services, using the banking platform developed by Sygnum.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

ClearBank slashed its 2022 losses by 65%. Its net income reached a record of more than £58 million, helping the embedded banking provider to further narrow its losses.

Revolut's attempts to bridge the gender pay gap at its business are going into reverse, with the mean differential between women and men increasing from 23% to 25%.

Revolut launches ‘Crypto Collections’ for multi-token investing. Clients will be able to buy an entire collection and spread their investment evenly among their tokens.

After the accuracy of Revolut's accounts drew scrutiny from regulators, the firm's plan to secure a U.K. banking licence is facing delays.

Molo Finance launched ‘Rapid Remortgage’ to help investors get an offer on their buy-to-let mortgage in just 24 hours.

EUROPE 🇪🇺

APAS handed the Wirecard’s previous auditor EY a €500,000 fine and banned it from taking on new audits for companies of public interest for two years.

Orange Bank will migrate to Mambu’s cloud banking platform at its head office in France, based on its previously successful launch on Mambu in Spain.

Lunar bank is to offload its P2P business to SaveLend Group. The firm moved into the P2P market in 2021 after the takeover of Lendify in an all-stock transaction worth €100 million.

Backbase will hold its Backbase Tour for the first time in Africa. The event will be held in Johannesburg on May 16 with international and regional innovation leaders.

BNP Paribas Cash Management extends its partnership with Worldline to reduce fraud in SEPA Direct Debit transactions.

AMLYZE and Skaleet partner to bolster financial crime prevention among financial institutions to the new level.

Anapaya partnered with Finastra to provide Swiss banks with access to the Secure Swiss Finance Network.

USA 🇺🇸

Liberty Bank launched on Alkami’s cloud-based digital banking platform. The move will enable Liberty Bank to leverage data and provide enhanced channels.

ASIA

MUFG Bank is set to invest INR 19.1 billion (approximately US$ 232 million) in DMI Finance which focuses on consumer digital lending.

Oracle launches a new suite of Cloud services for banks, which will, among others, provide them with highly scalable corporate demand deposit account processing.

Alliance Bank Malaysia introduced its virtual credit card in partnership with Visa, CTOS Digital, RinggitPlus’ owner Jirnexu, YTL Communications, and TNG Digital.

Banks, the central bank and police in Singapore are working together to develop standards for vetting potential customers from crypto and digital assets sectors.

AFRICA

Nigeria’s Federal Competition and Consumer Protection Commission released a list of all the loan apps licensed to operate in the country.

MOVERS AND SHAKERS

Philippe Morel will take over as CEO of Railsr weeks after parts of it were sold through a pre-pack administration.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.