REPORT

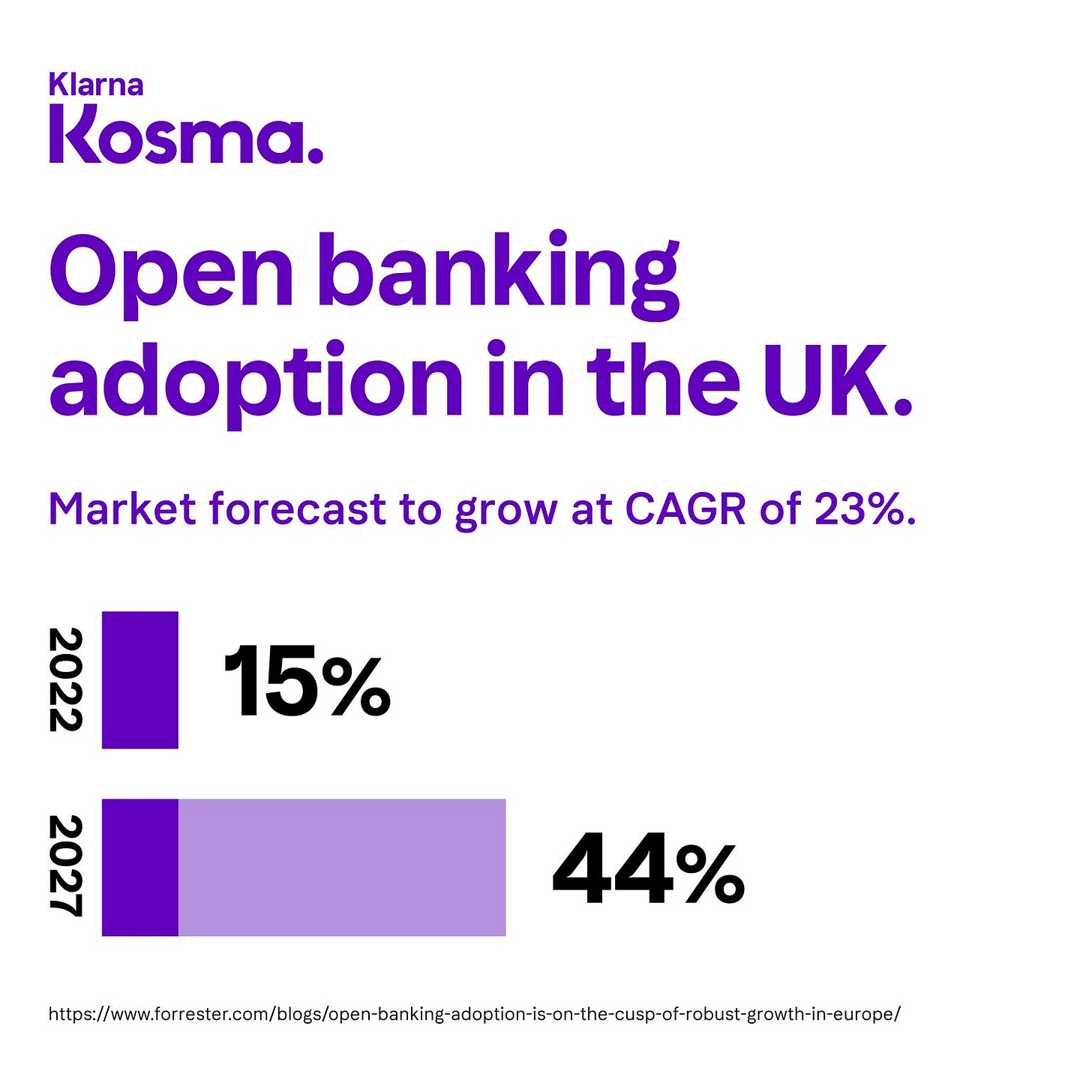

Forrester predicts an overall doubling in the adoption of open banking services across EU countries from 2022 to 2027. Some other key takeaways include:

The adoption rate of open banking is directly in line with the ones from Mobile Payment and Mobile Banking.

Growth of open banking will slow slightly between 2022 and 2024, before booming again in the years 2024 to 2027.

Consumer interest in open banking services is at a peak.

Read the full report through the link below👇

👀 NEWS HIGHLIGHT

Mastercard introduced Cross-Border Services Express, a tool that enables financial institutions to set up international payments for their customers seamlessly. The service delivers that entirely in a digital-first experience.

📰 ARTICLE

With around 250 digital banks across the globe, 20% of them are within the APAC region. This is a positive number as it reflects the fact that this sector is expected to forge the future of FinTech and reimagine the possibilities for financial services.

📰 ARTICLE

Just 1 in 10 (12 %) of UK banking customers use an app-only bank as their main bank, according to a recent Accenture survey. According to the survey of 2400 UK adults in February 2023, nearly 1 in 3 (32%) still prefer to do all their banking in person.

💡INSIGHTS

While most digital banks struggle to make money, South Korea’s are largely profitable. One of the main reasons is that they have large tech companies with strong digital capabilities as strategic shareholders.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ SVB’s Chief Risk Officer Kim Olson and at least one other executive are leaving the firm.

⭐️ Deutsche Bank is preparing to shut down its IT operations in Russia.

⭐️ Clearstream created a new bank Clearstream Fund Centre S.A. in Luxembourg.

⭐️ Saxo Bank incorporates the TRUSTDOCK service into its products to offer ID verification for customers in Japan.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Tide called for UK businesses to kickstart a global carbon removal movement by taking full advantage of underutilized marketplaces to deliver Net Zero.

The Bank of England opened recruitment for staff to oversee the development of its proposed central bank digital currency.

Revolut launched a new version of its app which includes joint accounts. Customers will be allowed to create an extra account within the app to be jointly owned by two people.

EUROPE 🇪🇺

Intergiro partnered with Incharge to launch a new banking app designed to make financial services easier and more accessible for students in Europe.

Societe Generale partners up with Lemonway to offer payment services for large European corporates entering the B2B marketplace arena.

USA 🇺🇸

Bankjoy integrates with Fiserv Portico. Through this integration, credit unions using Fiserv will have greater flexibility to deploy Bankjoy’s world-class digital banking tools for their members.

Fiserv ushers 20 banks into Federal Reserve’s real-time payments network, FedNowSM, which is expected to launch in July 2023.

Monzo Bank joins forces with Plaid. Its customers in the US will now be able to connect their accounts to more than 8000 FinTech apps through Plaid’s network.

LATAM

Nubank is now testing ‘NuConsignado’. The much-anticipated product is a type of loan settled directly and automatically from the payroll.

ASIA

HCLTech and Temenos deepen their partnership to accelerate digital transformation in the banking industry.

The Payment & Clearing Association of China warns that technology like OpenAI’s ChatGPT could pose risks such as cross-border data leaks.

SeaBank Indonesia posts a strong annual profit of 59.5 billion rupiah (US$4 million) in FY2022, compared with a loss of 315.3 billion rupiah (US$21.1 million) in the previous year.

AUSTRALIA 🇦🇺

Australian Banking Association launched a new campaign to raise awareness of a series of scam scenarios and provide customers with tools to beat the scammers.

MIDDLE EAST

Purpl announced a partnership with Remitly to enable remittances to Lebanon with a better user experience and at a lower cost than traditional brick-and-mortar money transfer companies.

The Saudi Central Bank’s investment into enhancing its payment infrastructure is paying off as it has exceeded the 60% retail e-payment target set by the Financial Sector Development Program.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.