REPORT

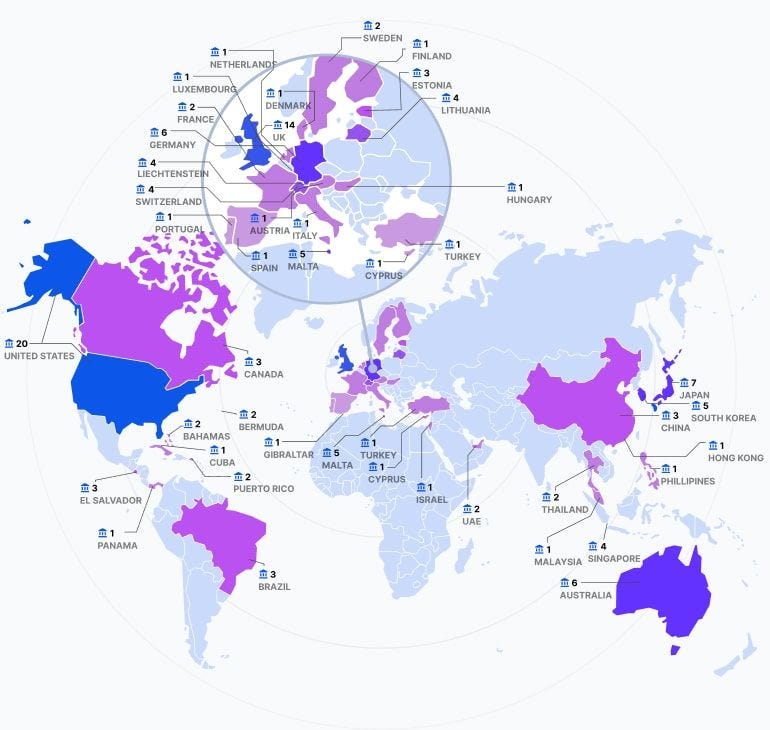

The demise of Silvergate, Signature, and Silicon Valley Bank rapidly followed by the implosion of Credit Suisse sent shockwaves through the financial world. Several contenders are rising up to take the US’s place.

Read the full Crypto Banking Report 2023 by Coincub.

👀 NEWS HIGHLIGHT

Goldman Sachs CEO David Solomon said he isn't worried about Apple's new savings account overshadowing Goldman's own Marcus offerings but that he's watching closely for "cannibalization."

😎 SPONSORED CONTENT

Zotapay is a marketplace for payments, connected to over 1000 payment institutions globally. Our borderless technology enables businesses to accept payments from customers based locally, as well as around the world in regions such as Africa, Latin America, China, South East Asia.

Join Zotapay and unlock your business's full potential.

📰 ARTICLE

RTP technology has been most successful in countries like Brazil, China, and India, where sparse card payment infrastructure fails to satiate a large appetite for electronic payments. However, there are several gaps in the U.S. RTP system.

📰 ARTICLE

After biding its time on digital banking for several years, Thailand is following in its neighbors’ footsteps, setting capitalization requirements and other hurdles that will likely eliminate scrappy upstarts from the application process.

📰 ARTICLE

While many digital banks have gained a significant following among digital-savvy consumers, the truth is that profitability remains elusive for most of them. In fact, only a handful of digital banks have been able to register profitability.

💡 INSIGHTS

In a similar way that calculators and PCs replaced some of the work that bankers were doing manually, AI will replace some of the manual work bankers are doing today. Rich Data Co believes that a ‘human in the loop’ with AI is also the key to delivering reliable lending solutions, especially in the highly regulated financial services industry.

👨💻 BLOG

The launch of FedNow this summer has excited the FinTech world because it introduces government-mandated RTPs. Those will reduce some risks (like insufficient funds fraud), but also introduce new ones (like scams).

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ N26 appointed three new senior executives.

⭐️ ABN Amro teamed with Gimi for the rollout of a financial literacy app for kids.

⭐️ Railsr’s bankruptcy indicates the forthcoming wave of FinTechs coming to market in 2023.

⭐️ Schroders marked Revolut down 46 percent and Atom Bank at 31 percent.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Finastra announced that Plaid is now integrated within Finastra’s Fusion Digital Banking platform.

Lanistar is preparing for launch in the UK. Lanistar has recently invested heavily in building a winning proposition in LATAM and has successfully launched in Brazil with over 20,000 customers on board.

Monzo launched Business Instant Access Savings, which allows business owners to grow their savings while having quick access to their money whenever they need it.

MQube partners with Thought Machine to offer real-time decisions and a smoother journey for mortgage customers.

Revolut connects directly to SEPA financial network, which enables fast, secure, and efficient payments between participating banks for their customers. 36 European countries are part of SEPA, with over 529 million users.

Revolut is on the hunt for a new London headquarters. The company, which has its global base in London’s Canary Wharf, now employs approximately 6,000 employees globally.

EUROPE 🇪🇺

BaFin has been rounding on N26’s internal organization and money-laundering controls since 2018. In 2021 it imposed a €4.25mn fine and decreed that the lender could only accept 50,000 new clients per month.

A unit of Allianz SE put its stake in N26 up for sale at a steep discount, valuing the lender at $3 billion.

USA 🇺🇸

Ripplewood Advisors is considering a bid for the digital banking arm of Orange, as the French telecom carrier’s search for a partner reaches its final stage.

Pidgin announced that U.S. Century Bank partners with Pidgin to bring real-time payments to its growing customer base.

Goldman Sachs announced the launch of a transaction banking business in Japan. The decision was reportedly made in the backdrop of the global economic slowdown, as it hits investment banks, driving some to push for new revenue streams.

Q2 announced Q2 Instant Payments Manager, a new solution designed to help financial institutions manage instant payment workflows from end-to-end with the new Clearing House RTP and Federal Reserve FedNowSM instant payment rails.

Apple Card’s new high-yield Savings account is now available, offering a 4.15 percent APY.

LATAM

Klar aims to reach three million users by the end of the year. It raised $400 million in funding and plans to expand its services to other countries in Latin America.

ASIA

The RippleNet-based MoneyTap app is now supported by three major banks belonging to Yamaguchi Financial Group – Yamaguchi Bank, Momiji Bank, and Kitakyushu Bank.

Techcombank partnered with Personetics to introduce AI-powered money management capabilities.

iFast Corporation’s bank IGB has launched digital personal banking in the UK in six currencies: the British pound, US dollar, Euro, Hong Kong dollar, Singapore dollar, and Renminbi.

AUSTRALIA 🇦🇺

Up partners with The Daily Aus, with the two companies working together to break down the jargon-filled personal finance news sector via a series of video explainers.

MIDDLE EAST

The Bank of Israel is preparing an action plan for the potential issuance of a digital shekel, despite the fact that a decision has not yet been made as to whether the Bank intends on doing so.

Al Maryah Community Bank (MBank) partnered with Dgpays Group to offer a digital wallet integrated with next-level financial solutions across the UAE.

MOVERS AND SHAKERS

BankiFi appointed Lindsay Hodges as their new Director of Product Management and Client Success for the Americas. Hodges’ addition to the team is one of the efforts in the company’s dedication to the North American market.

ClearBank appointed ex-PayPal and WorldPay exec Spiros Theodossiou as its new Chief Product Officer.

BMO Financial Group named Darrel Hackett as its new US CEO, president, and CEO of BMO Harris Bank, as well as of BMO Financial Corporation.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.