REPORT

⚫ Nubank's Quest for sustainable growth amidst high inflation, interest rates, and credit card defaults:

This deep-dive by C-Innovation provides a comprehensive analysis of Nubank's remarkable journey.

It explores how Nubank rapidly onboarded customers with credit cards and integrated other financial products into the app.

⚫ ECB publishes a progress report on the digital euro and a study on possible features of a digital wallet.

Key Takeaways:

👉Digital euro is potentially available initially to euro area residents, merchants, and governments.

👉Digital euro could be made available via existing banking apps and Eurosystem apps.

👉Offline and person-to-person payments across the euro area are seen as highly valued.

👀 NEWS HIGHLIGHT

N26: Neobank lays off additional more than 70 employees.

Around four percent of the entire workforce of over 1,700 people are affected by layoffs. They are to receive “comprehensive severance packages”. The fintech wants to be in the black by 2024.

📊 INFOGRAPHIC

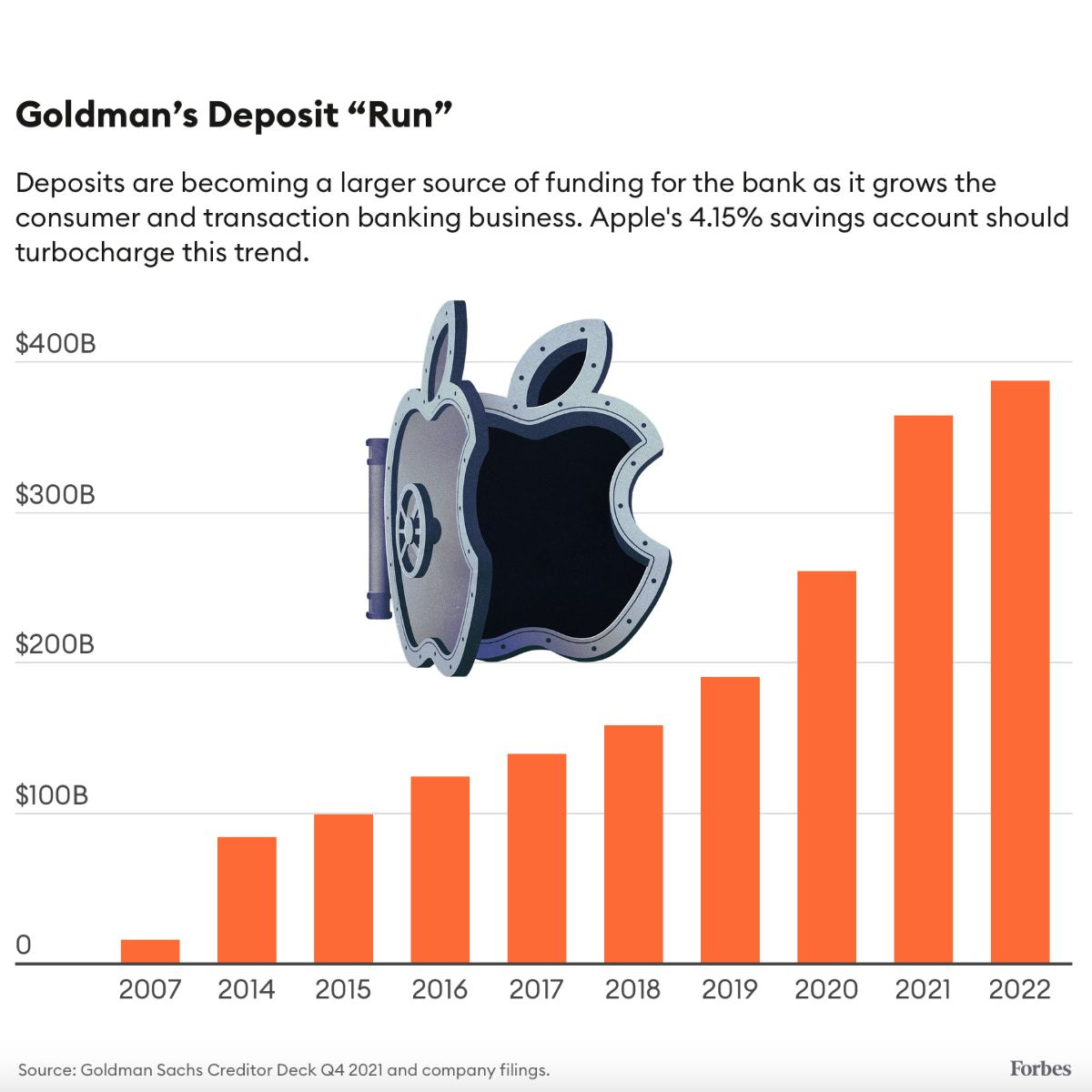

⚫Why Apple’s partnership with Goldman is the future of banking:

Last week Apple effectively dropped the mic on the nation's banking industry.

While the average bank is paying less than half a percent on savings accounts, the $2.6 trillion technology company announced it would be offering 4.15% annual returns to savers – no minimums, no lockups and FDIC-insured.

The new product rollout comes at a time when regional banks are scrambling in the wake of the Silicon Valley Bank crisis to maintain their deposit bases, and cash-starved fintech startups are likewise struggling.

Check the full story here

📰 ARTICLE

⚫Europe’s banks temper ambitions to challenge big US payments groups

A European banking alliance set up to take on the US-dominated payments market has tempered its ambitions and plans to roll out a pilot scheme later this year after agreeing to acquire two FinTech companies.

The European Payments Initiative was originally launched by more than 30 banks and credit card processors to compete with Visa and Mastercard. Still, it has instead settled for a more modest start.

The EPI has agreed to buy Dutch payment company Currence Ideal and Luxembourg-based Payconiq International.

⚫Why is Revolut opting for a “liquidity facility” from a mystery lender?

Revolut has had a busy start to 2023. It’s shipped a number of new products, brought in a new behavioral team to improve its corporate culture, finally published its long overdue accounts, and even reported its first profits (for 2021). Moreover, it even is on the hunt for a new London HQ too.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ JPMorgan Chase will acquire all $93.5bn of First Republic's deposits and most of its assets as US regulators close the California lender.

⭐️ The U.S. Federal Deposit Insurance Corporation is preparing to place First Republic under receivership imminently.

⭐️ Revolut launches its POS solution in Spain and plans to integrate it into Bizum.

⭐️ Vacuumlabs announced the launch of several new propositions to complement Thought Machine’s cloud-native core banking technology, Vault Core.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Wise is now offering its US-based business and personal customers the opportunity to opt-in to receive 3.92% APY on their USD balances.

Revolut opens the crypto customers' access to an external tax reporting service at discounted prices and takes another step forward toward its mission to build the first super app for all things money.

EUROPE 🇪🇺

Fellow Bank is Alisa Bank as of 21 April 2023. The new name better reflects the company’s vision to offer the smoothest everyday banking services.

Mastercard and egabi FSI partnered to expand financial institutions and non-traditional partners’ access to new embedded finance and digital lending products across Eastern Europe, Middle East and Africa.

BankID is launching a digital ID card, the card will verify users in the same way as a physical alternative. It will include the holder's photo, name, personal identity number and age and will have a QR code.

Temenos has been preparing for the digital currency future, integrating with two DLT-based CBDC technology stacks.

USA 🇺🇸

Jack Henry & Associates was selected by First Community Bank, Sunrise Bank, and Today’s Bank for its retail and business banking core infrastructure.

Greenwood announced the launch of its General Access platform – expanding Greenwood’s spending, saving, and financial services to all after successfully enrolling all interested waitlist users.

ASIA

Hong Kong’s biggest virtual bank is pushing into transfers of crypto and fiat currencies to provide account services for the city’s burgeoning digital asset sector. ZA Bank will offer token-to-fiat currency conversions over licensed exchanges.

The Cambodian Ministry of Economy and Finance (MEF) and Advanced Bank of Asia entered into a Memorandum of Understanding to advance digital economy and fintech initiatives in the country.

MOVERS AND SHAKERS

Barclays appointed Kirsty Everett as its new chief compliance officer and a member of the group executive committee, subject to regulatory approval.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.