REPORT

⚫ What does the future hold for the BaaS market in Europe and the UK?

The UK🇬🇧 and Germany🇩🇪 have been the traditional breeding grounds for BaaS providers in the region. The two countries are the largest market for BaaS platforms, representing around 60% of the market share in Europe.

Check out "The State of Banking-as-a-Service in the UK & Europe", a WhiteSight #fintechreport commissioned by Toqio 👇

⚫ Of the world’s adult population, 24% is unbanked, with 1.4 billion adults not having access to a bank account.

While the focus is on expanding services, it is also important to provide credit education to these new underbanked customers to ensure they understand the risks of borrowing.

Read and download the full report by Oliver Wyman through the link below👇

👀 NEWS HIGHLIGHT

Monzo reached a milestone of a quarter of a million business customers, with one in 23 businesses in the UK now onboard. Monzo moved into the market three years ago, a year later than arch-rival Starling, which now claims 520,000 small business accounts, representing an 8.9% market share.

📰 ARTICLE

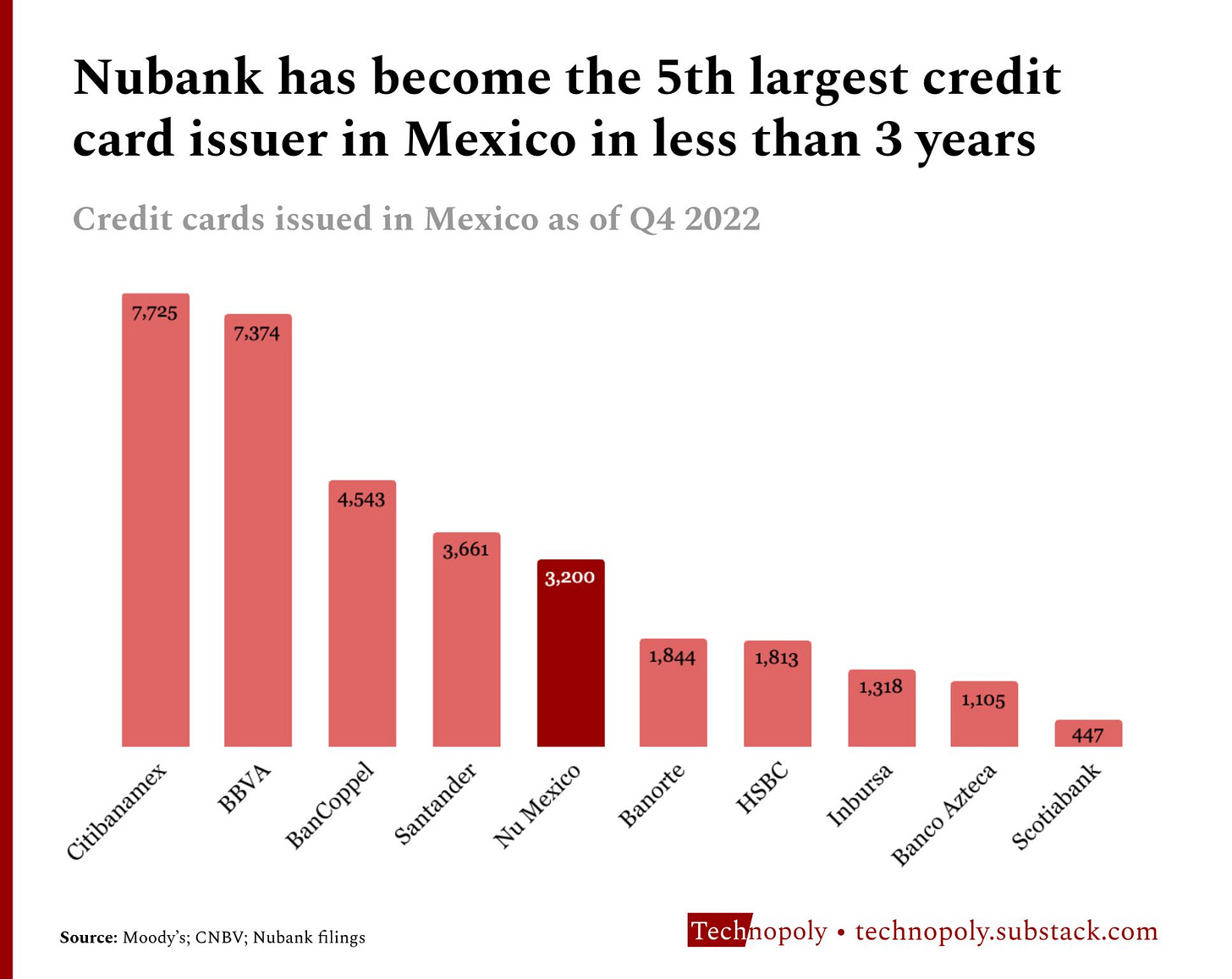

Mexico has been a critical growth geography for Nubank, contributing well over half of its foreign user base. It launched credit cards as its first product in Mexico back in 2022, exploiting the country’s looser regulatory burden to target its low financial inclusion.

How successful has Nubank really been in Mexico? Read all about it in the complete article by Simon Rodrigues through the link below👇

💬 INTERVIEW

Stuart Sopp, Current CEO, joins ‘Fast Money’ to discuss the regional banking crisis and what it means for the FinTech space. According to him, the ‘duration bubble’ is bursting for banks.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ Revolut has made its first foray into Latin America with a live launch in Brazil.

⭐️ Greenwood acquired Kinly in a move that brings together two of the largest Black-owned FinTechs.

⭐️ TD Bank and First Horizon mutually agree to terminate their merger agreement.

⭐️ Fingo partners with Ecobank, and launches neobank on the back of a $4M investment.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

The co-founders of Revolut strongly criticize Britain as a place to run a business, complaining of high taxes, red tape, and a skills shortage and adding that they would never consider a flotation on the London stock exchange.

Kemi Badenoch, the Business Secretary, is seeking an emergency meeting with Revolut over fears the £26bn company may abandon the UK amid frustration with high taxes and red tape.

Paymentology announced a strategic partnership with Nomo Bank, the world’s first fully digital Sharia–compliant cross-border bank. Nomo, part of the Bank of London and The Middle East, is backed by Boubyan Bank.

Coconut is set to be sold to rival GoSimpleTax after its latest funding round was scuppered by changes to the UK’s upcoming Making Tax Digital scheme.

EUROPE 🇪🇺

LHV Bank announces it has been authorized as a credit institution by the Prudential Regulation Authority, becoming the first institution to receive a banking license without restrictions in 2023.

Owners Bank announced its technology stack of partners that are working together to make banking as seamless as possible for small businesses.

Green-Got is bringing climate-conscious banking to Europe. The neo-bank has raised €5 million – part venture capital and part crowdfunding.

USA 🇺🇸

The Federal Deposit Insurance Corp. issued a cease-and-desist order against Cross River Bank due to its lending practices. A spokesperson for the bank expects the FDIC action won’t impact its growth.

LATAM

Nubank reached the milestone of 80 million customers. According to the company, this growth was driven by a number of factors, including the expansion of its product portfolio, the introduction of new features such as Pix and credit lines, and others.

C6 Bank launched a current account for Brazilians living abroad, offering accessible and convenient banking services.

ASIA

Boost is considering raising up to US$100 million in a new funding round. The funds raised would be used to expand the company’s digital banking operations.

The Bank of Thailand will postpone the release of the Virtual Bank Licensing Regulations to the end of this year. The bank has identified various questions and concerns about the details of the licensing regulations, which may significantly affect the decisions made.

Bank Alfalah collaborates with SendSpend to launch a state-of-the-art, international remittance service.

GXS Bank, backed by Grab, trails Trust in adoption as deposit cap hampers growth.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.