Digital Banking | 2023 #2

Weekly news up to Monday, 9th of January 2023

REPORT

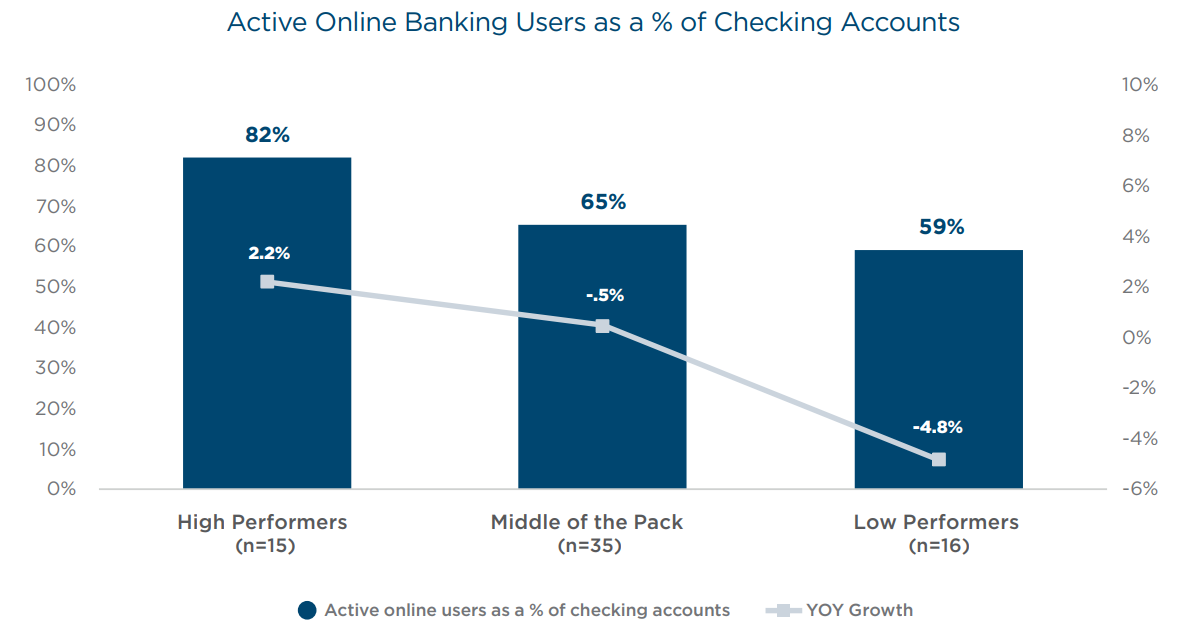

High-performing institutions have, on average, 82% of their checking account holders actively using their online banking platforms. That’s 17% higher than the middle-of-the-pack institutions and 23% higher than the low performers.

👉 Read this Cornerstone FinTech report by Ron Shevlin and Elizabeth Gujral here

REPORT

Banking-as-a-Service: How it Can Catalyze Financial Inclusion.

👉 Check the whole CGAP report by Gcinisizwe Mdluli, Ivo Jeník, and Peter Zetterli here

REPORT

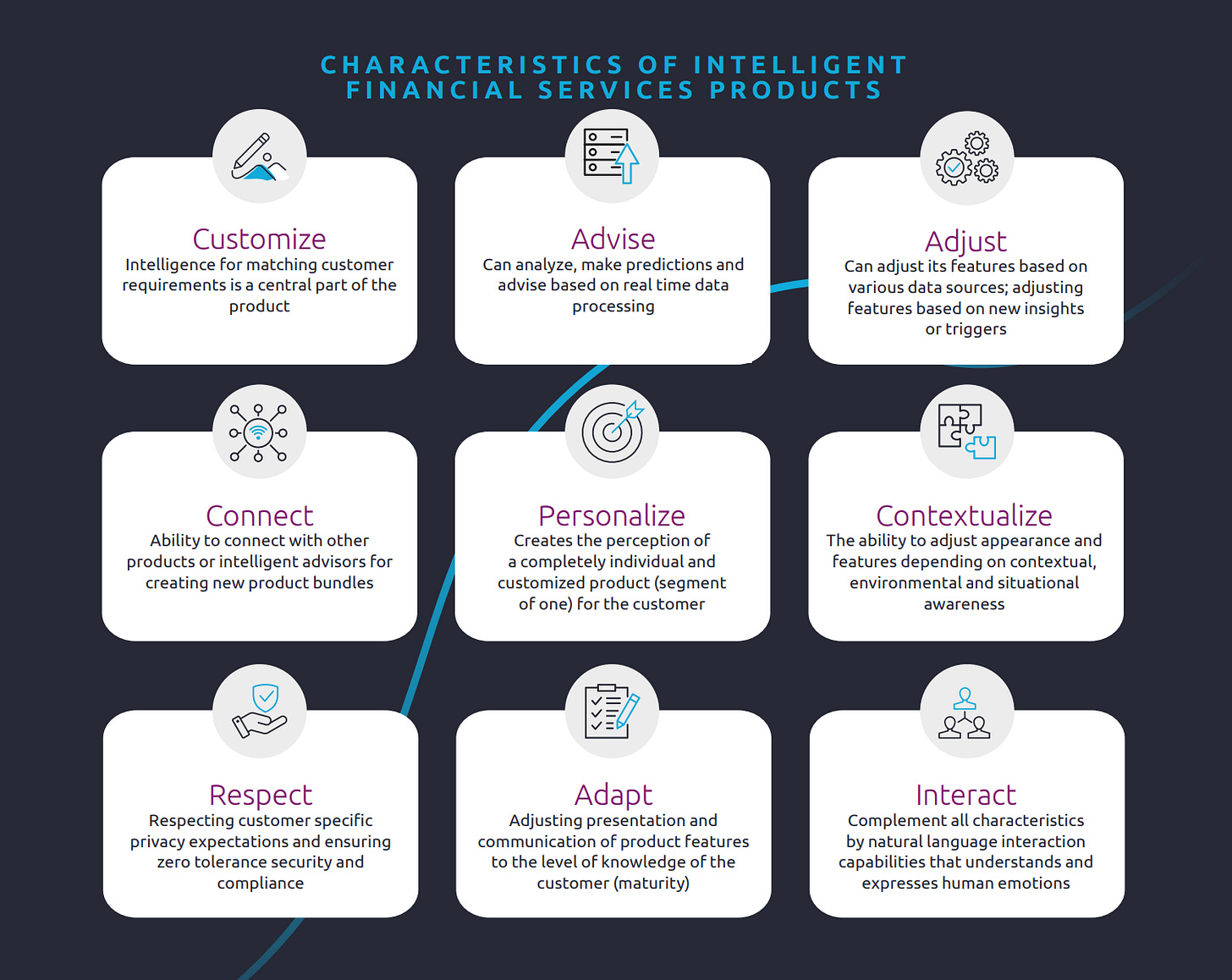

"From Traditional Banking to Invisible Finance"

The times are changing in the Financial Services industry. We can already see the first signs of an upcoming impact that will be orders of magnitude bigger than anything before.

👉 Read the full report by Michael Zwiefler and Alexandra Rockermeier here

👀 NEWS HIGHLIGHT

Revolut was fined €70,000 for failing to submit audited annual financial statements to the Bank of Lithuania. The Central Bank of Lithuania said that Revolut also failed to follow rules regarding the handling of customer complaints.

👉 Read the whole Silicon republic article by Vish Gain here

📰 ARTICLE

Brazil’s Nubank has its sights set on disrupting Latin America’s financial services. Since its founding in 2013, the challenger bank has grown its user base rapidly.

👉 Read the full article by CB Insights here

👨💻 BLOG

A fascinating trend has happened in FinTech in recent years, where non-financial companies are delivering financial services. Historically, cards were issued by your bank. Today, cards are now delivered to you by neobanks such as Cash App, Chime, or Varo.

👉 Read the full article by Jonathan Ching here

💡INSIGHTS

Do you know about the three types of open banking APIs? Each has its own purposes and attributes.

👉 Check this insight by Klarna Kosma here

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ The top tech trends poised to reshape industries in 2023. Link here

⭐️ Twig is further expanding into mainland Europe with the acquisition of Vybe. Link here

⭐️ Axis Bank partnered with OPEN to launch a fully digital current business account proposition. Link here

⭐️ Yes Bank partnered with banking-as-a-service startup Falcon to improve the banking experience of its customers. Link here

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Zopa Bank hit £3bn of deposits, according to an update from the company. Link here

Starling Bank expects to quadruple profits this year, it picked up 520,000 small business accounts in the SME market, representing an 8.9% market share. Link here

EUROPE 🇪🇺

Denmark's transition away from cash has seen the country record its first-ever year in which it experienced zero bank robberies. Link here

Trade Republic´s investors will now receive 2 percent interest on their cash balances, without having to pay or subscribe. Link here

ASIA

HDFC Bank is partnering with Microsoft in the next phase of its digital transformation journey and unlocking business value by transforming the application portfolio. Link here

Yes Bank turned to technology firm Microsoft to transform the mobile banking experience of its customers. Link here

Jupiter reportedly snared INR 25 crore in debt from Alteria Capital. Link here

Next Commercial Bank went live on Temenos core banking platform, opening to customers in 2022. Link here

MIDDLE EAST

Flat6Labs and Wio Bank signed a Memorandum of Understanding to streamline SME-centric banking services. Link here

MOVERS AND SHAKERS

Backbase announced the appointment of Mark Appel as Chief Marketing Officer. Link here

Stephen Grainger is becoming the new Swift Chief Executive for the Americas & UK Region. Link here

The Clearing House appointed David Watson as its new president and CEO beginning Feb. 1. Link here

Moonstone Bank chief legal officer Joseph Vincent left the financial firm, after being with the bank for just eight months. Link here

Foong Chee Mun announced that he will be stepping down as the Chief Technology Officer of MoneyLion. Link here

The head of Goldman Sachs Group Inc's direct-to-consumer unit, Swati Bhatia, is stepping down from the role. Link here

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.