REPORT

⚫ Nubank’s Q1 2023 Financial Results are on 🔥:

The neobank recorded USD 1.6 billion in revenues, an all-time record nearly doubling the company’s performance a year ago.

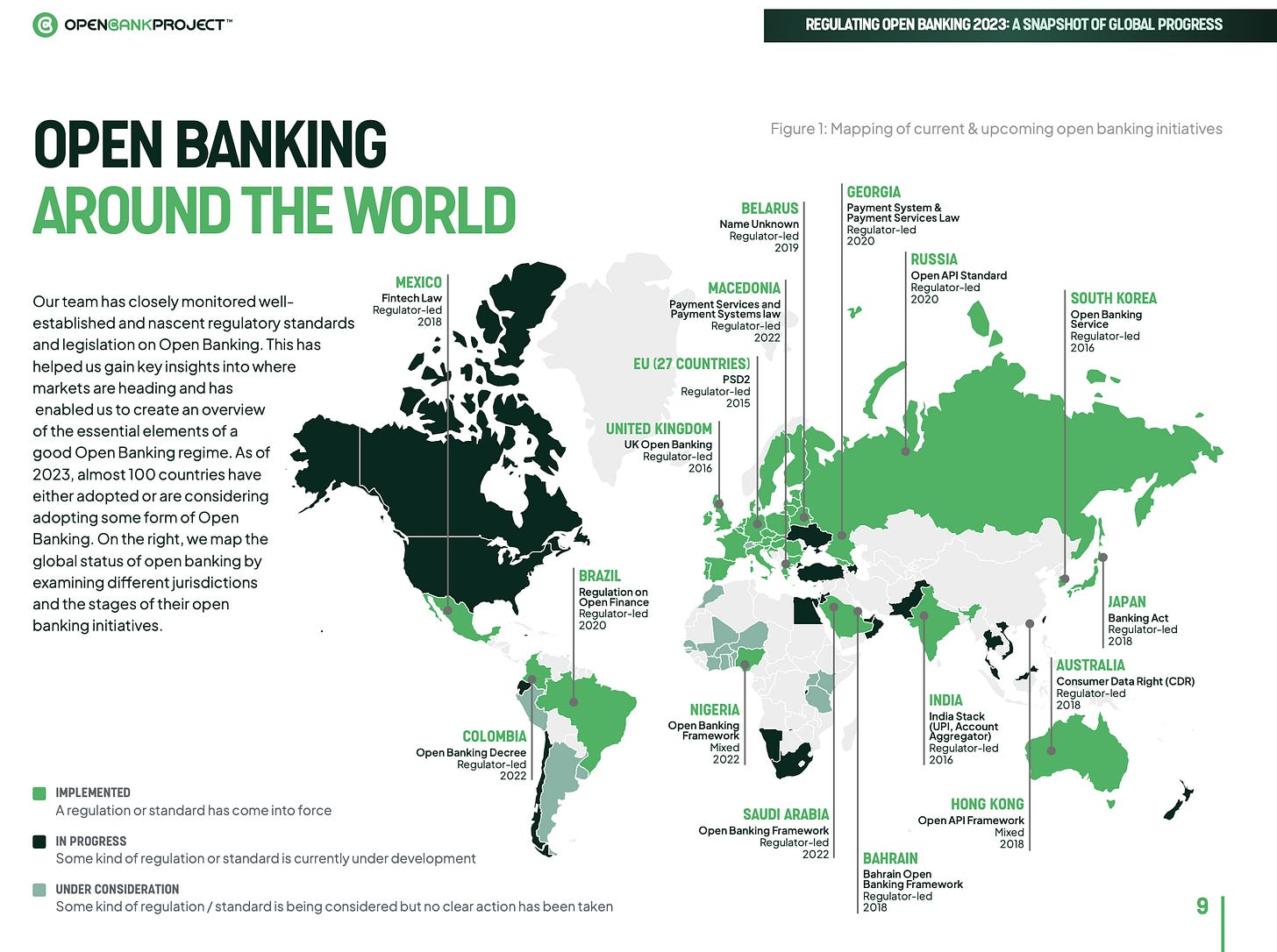

⚫ Regulating Open Banking 2023: A Snapshot of Global Progress

Over the past 5 years, Open Banking has evolved into a common banking practice and has expanded to encompass insurance, savings, and investments under the new term Open Finance.

⚫Check out this interesting #fintechreport: "A Legal Framework for the Digital Euro"

The European Central Bank (ECB) announced the launch of the digital euro project. After an initial investigation phase, they are now addressing key design and distribution issues for the digital currency.

👀 NEWS HIGHLIGHT

Swan, the emerging leader in embedded finance, has open-sourced its no-code banking interfaces and reduced the time to market of new pilots by 75%.

Swan is dedicated to opening up opportunities for any type of business to embed financial features into its offering, like accounts, cards, and payments.

📊 INFOGRAPHIC

Majority of APAC consumers prefers remittance services to be offered in a super app.

71% of APAC senders and receivers said they were irritated with the repetitive and time-consuming paperwork associated with cross-border money transfers.

📰 ARTICLE

Whilst all components of the anti-money laundering process are critical to adhere to the AML laws imposed by countries, KYC and the Customer Identity Verification process are slightly more important.

KYC/IDV is where key data points about individuals are captured (name, address, ID number), and any relevant documents and usually government-issued physical IDs are uploaded.

👉I highly recommend reading the complete deep dive article by Jas Shah on this very important subject in FinTech and Banking.

👨💻 BLOG

Ualá and Nubank's journey to super app status amidst economic challenges in LATAM.

💡INSIGHTS

OakNorth: A blueprint for profitable growth in digital banking

While many challengers and neobanks struggle to turn a profit, OakNorth Bank has cracked the profitability code early on.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️Revolut is locked in a fight with top shareholder SoftBank and UK government requests meeting as neobank awaits licence decision.

⭐️ Nubank reached over half a million customers in Mexico within a week of launching their saving service, "Cuenta Nu". Mexico could become more relevant for Nubank than Brazil, and investing in artificial intelligence is a "great priority", according to David Vélez, the bank’s CEO.

⭐️ Fintech Talents Festival, known as the UK's biggest fintech event, will return for its 5th edition on November 13-14, at The Brewery in London.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Since Revolut’s CFO resigned last week, Sifted's identified two more senior leaders who have left the neobank.

LHV Bank announces the extension of its maximum loan size to £5 million, enabling further support for UK SMEs aiming to grow.

Standard Chartered Bank has partnered with merchant acquirer Worldpay from FIS to expand the market coverage of its Straight2Bank Pay solution.

Starling Bank launched a tool that splits inbound payments and automatically determines the optimum acounts for storing funds.

Wise CFO Matthew Briers to stand down in wake of bike accident.

Bud Financial teams with Google to provide insights from transaction data.

Allica Bank offers 5% cash savings fixed rate bond.

ING and Quantexa have announced a strategic partnership.

Bank lending to rise by £29bn as Britain dodges recession.

EUROPE 🇪🇺

Synctera is expanding its partnership with Mastercard by integrating Mastercard’s open banking platform (provided by Mastercard’s wholly owned subsidiary, Finicity).

N26 introduced a new savings account in Spain, offering a competitive interest rate of 2.26% TAE without any conditions or fees.

After losing two C-suite leaders earlier this year, N26 is cutting 71 jobs.

Moss | Spend smarter selected Deutsche Bank to handle payment transactions for its customers in the EU.

National Bank of Georgia streamlines Open Banking Services.

USA 🇺🇸

America First Credit Union selects FirstClose to offer instant home equity.

MoneyLion to add ChatGPT-powered search to its marketplace.

Sagicor Bank Barbados has gone live on US-based fintech Mbanq’s Banking-as-a-Service (BaaS) platform.

Plaid made a relatively quiet announcemen that will have a big impact on open banking in the U.S.

FRSH offers banking products and services to help returning citizens — those who have been released from jails and prisons.

JPMorgan Chase CEO Jamie Dimon said it's not likely that his bank would acquire another struggling lender after its government-brokered acquisition of First Republic.

You can now earn 5% on your savings with neobank Step, says CEO CJ MacDonald on his socials.

Meridian Bank taps Corserv to launch business credit card programme.

LATAM

Nubank turns $141m profit in Q1 as Brazilian market share nears 50%.

Nu México reaches 500,000 debit card users and Ualá doubles down on offering for businesses.

ASIA

Revolut launches seven new currency accounts for Singapore customers.

Whampoa Group is to set up a digital bank in Bahrain offering traditional banking services as well as round-the-clock payments.

AUSTRALIA 🇦🇺

Revolut Business is officially live in Australia.

DigitalX and fund manager TAF Capital were involved in the trade of eAUD to USDC stable coin, with blockchain fintech Canvas central to the test FX transactions.

MIDDLE EAST

UAE Emirates NBD Bank partnered with PWC and digital asset custodian and settlement provider FireBlocks to launch its Digital Asset Lab. PWC Middle East and Fireblocks will be founding council members.

MOVERS AND SHAKERS

Tuum announced the appointment of Myles Bertrand as Chief Executive Officer.