REPORT

⚫ German Mobile Banking App Review by Optima Consultancy

The summary is based on an ongoing research study comprising:

* Data from 26 German mobile banking apps including challengers, incumbents, direct banks, and credit providers.

* Apps published on both iOS and Android operating systems.

* Analysis of 114 features across 11 categories.

⚫ The State of Consumer Banking & Payments Report: H1 2023 by Morning Consult

KEY TAKEAWAYS:

Financial well-being remains lower than in 2021: Inflation and interest rate hikes have impacted the financial well-being of all households, regardless of income.

Bank failures shine a light on trust

Digital wallet dominance continues

👀 NEWS HIGHLIGHT

Marqeta Inc has abruptly pulled the plug on its Australian business as it scrambles to tame operating losses across its global business.

😎 SPONSORED CONTENT

It's time to stop making incremental fixes to your financial products. Unlock new opportunities and stay ahead of the game by going digital—enhance customer experience, tap into the global market, and revolutionize your financial products. Don't know where to start? Look for an experienced guide to help you:

🚀 Make product-related decisions your customers will love

🔗 Avoid integrating with incompatible or not suitable third-party solutions

💰 Optimize your spending and drive faster profitability

🌐 Leverage the flexibility and scalability of an external partner

Discover how we can help you navigate the digital landscape and unlock the full potential of your business. Learn more at our website.

📊 INFOGRAPHIC

India Neobanking Sector Poised for 50.5% Annual Growth Through 2025

💬 INTERVIEW

Making Australia’s startup scene Awesome!

Dexter Cousins chats to Dom Pym, the co-founder of Up and a FinTech investor.

💡INSIGHTS

⚫ Revolut has crossed an astonishing milestone: 30 million retail customers

Revolut has added over five million new users globally.

Revolut's customer base now makes more than 400 million transactions a month.

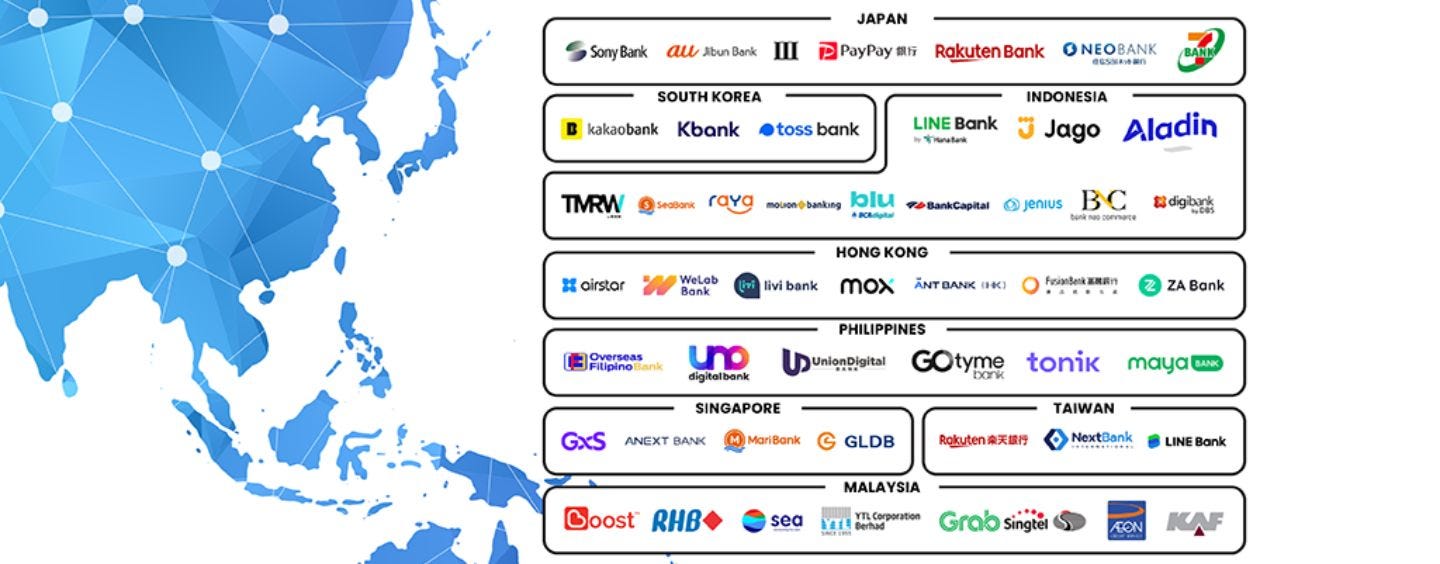

⚫ Digital-first banks in Asia are set to challenge established commercial banks

⚫ Monzo Bank and Starling Bank's 2023 annual reports are out!

Here is a quick overview by Matt Village. Let’s start with Starling’s headlines:

Revenue rose from £216m to £453m (up 109%)

Profit jumped from £32m to £195m (up 509%)

Next to Monzo’s headlines:

Revenue rose from £154m to £355m (up 131%)

Losses decreased slightly from £119m to £116m (down 2%)

⚫ Banks as facilitators of everyday life

Banking is experiencing a technological revolution. This evolution has led to new business models, such as open banking, embedded finance, platforms, ecosystems, and beyond banking.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ Jaja Finance selected Bud to become its open banking and data intelligence partner.

⭐️ Cross River Bank enters a consent order with FDIC.

⭐️ FinTech associations from Latam propose joint standards for Open Finance.

⭐️ Nubank became the second-largest bank in Brazil by market capitalization.

⭐️ Tandem Bank has hit a full year of operating profit for the first time in company history after transitioning into a ‘green bank’.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Tandem Bank boosts interest on fixed savings to a market-leading 5.25%.

Revolut amasses customers in Ireland with more than 5,000 Irish businesses joining.

EUROPE 🇪🇺

CEO of bunq reveals a possible new funding round and a profitability landmark.

Tuum and Fourthline partner to offer European financial institutions a secure and agile core banking solution.

Pleo launches auto top-up functionality powered by JPMorgan payments.

Mia-FinTech announced its partnership with Mambu.

BNP Paribas and NatWest are going live with Dynamic Credit from CobaltFX to simplify the allocation of credit for FX transactions between banks.

CaixaBank has co-developed a prototype for a personal payments wallet using the digital euro. The bank has also launched a solution aimed at businesses that allows them to accept card payments using an Android device.

HSBC is reportedly set to rename the U.K. arm of Silicon Valley Bank.

USA 🇺🇸

Cross River Bank partners with paymints.io for real estate transaction platforms.

Dave Inc. members earned more than $1 million through its new Side Hustle feature.

The Managing Director of Visa is cool on banks’ bid to battle Revolut.

JPMorgan Chase has laid off about 500 people, most of them working in technology and operations groups.

CANADA

A wave of upstarts has attempted to take on Canada’s banking oligopoly over the past decade, but these days the challengers are putting the emphasis on collaboration over direct competition.

LATAM

CNBV approved Ualá’s purchase of ABC Capital, allowing the company to move forward with a merger that finalizes its path to a banking license.

Tenpo is days away from receiving a license to offer credit cards in Chile.

Nubank released a new feature called Extra Limits, which allows bank users to perform transactions via Pix in the credit method. Additionally, Nubank and Uber have joined forces to integrate NuPay into Uber's platform.

Nubank sees substantial growth opportunities in boosting its lending business in Brazil. It will invest up to a further 700 billion pesos ($159 million) in its Colombian operations by 2025.

ASIA

UNO Digital Bank partnered with 1Sari Financing Corporation to support the growth of sari-sari store owners and micro-enterprises.

Trust Bank aims to be Singapore’s fourth-largest retail bank by 2024.

Binance CEO says the firm is unlikely to buy up any banking institutions, despite a growing worry of crypto companies being debanked.

Axiata Group is set to launch its digital bank by the end of this year.

AUSTRALIA 🇦🇺

The RBA held an invitation-only conference in Sydney for participants in the Australian Central Bank Digital Currency pilot project.

Up launches recycled plastic debit card with Seabin in sustainability push.

MIDDLE EAST

Dubai Islamic Bank launches a DIB ‘alt’ feature.

The Islamic digital bank led by KAF Investment Bank aims to launch its operations by the year-end or early next year.

D360 Bank partners with Thunes allowing its clients to instantly and securely transfer funds to their beneficiaries.

Starting June 1, 2023, instant money transfers will be operational in Morocco.

AFRICA

Branch International leverages AI technology to minimize credit risk.

MOVERS AND SHAKERS

N26 announced the appointment of international regulatory compliance and governance expert Déborah Carlson-Burkart to its Group Supervisory Board.