REPORT

⚫ 2023 Strategic Priorities Benchmark Study

Key takeaways :

‣ While growing deposits topped the list of priorities for banks, leveraging data was the top priority for credit unions. Growing deposits also ranked as the most difficult priority to achieve.

‣ 79% of financial institutions (FIs) plan to increase their technology spend over the next two years; digital banking, fraud and security, and data analytics are the top three technology investments planned.

⚫ Building Central Bank Digital Currency

Despite the crypto winter, central bank digital currency (CBDC) development and experimentation continues to gain momentum.

⚫ Open Banking Monitor Q1 2023: The old guard is embracing new opportunities

In this preview INNOPAY highlights three key findings that have been observed since the last OBM update.

⓵ Community development is driving differentiation in devex as open banking continues to evolve.

⓶ Payment API's on the rise, while account API's remain stable but significant.

⓷ EU Open Banking is still leading but US Open Banking is catching up.

⚫ APAC Digital Bank Landscape

This report serves as an invaluable guide to digital banks in APAC on current market dynamics from both supply and demand perspectives, offering valuable insights on achieving profitability through optimising client fulfilment across the end-to-end value chain.

👀 NEWS HIGHLIGHT

Enfuce’s award-winning cloud-powered platform, APIs, exceptional technological delivery, and collaborative approach will help Kvika Bank transform Icelandic financial services.

New partnership follows recent tie-up with SEB Embedded, and Enfuce’s brand evolution unveiled at Money20/20 in Amsterdam.

😎 SPONSORED CONTENT

At Klarna Kosma, we want to make accessing open banking solutions as smoooth as possible for our potential partners. So, we’ve brought everything you need to start plugging into the power of open banking together in one place.

Whatever stage your business is at, whether it’s:

🟣 Still exploring the possibilities

🟣 Wanting to play around with our products (for free)

🟣 Looking for more support or guidance from our open banking experts

🟣 Fully ready to start developing and testing our API

It’s all here for you 👉

📊 INFOGRAPHIC

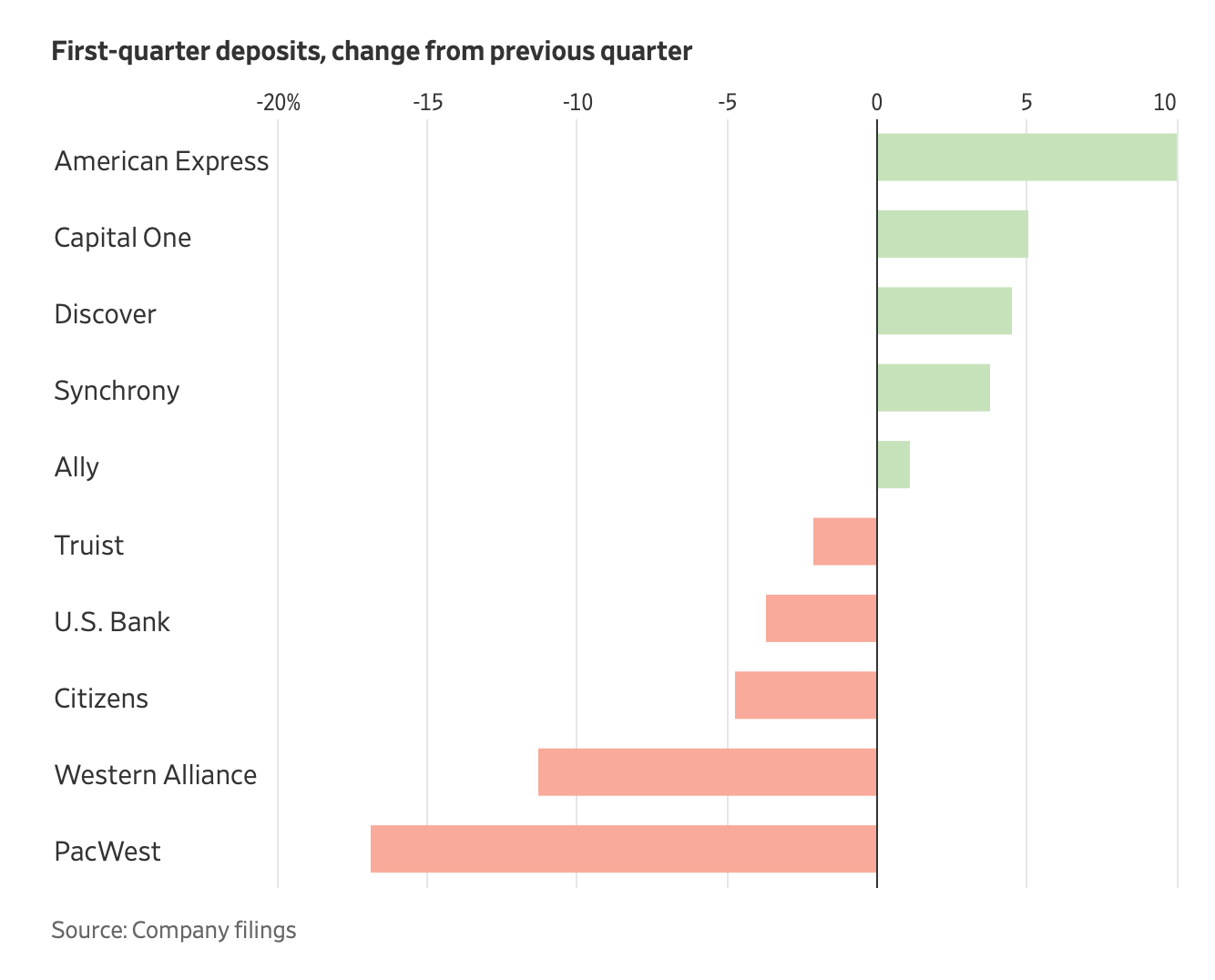

Online banks are winning the deposit war.

📰 ARTICLE

Challenger banks hunt for acquisitions as rising interest rates reveal opportunities.

Nigel Terrington, chief executive of Paragon Bank, told City A.M. that they “continue to look for opportunities” having made four acquisitions in seven years.

👨💻 BLOG

BaaS can be offered by companies like Solaris, Finastra and Marqeta, whilst curators of the financial ecosystem are few and far between. Either way, it’s all about building what I call the Lego Bank.

💡INSIGHTS

How cross-border payment flows have changed over time.

FXC Intelligence data shows remittances grew from around $420bn in 2010 to a projected $1.1tn in 2025.

🎤 PODCAST

In this podcast, Ali Niknam, the founder and CEO of bunq, spills the beans on the challenger bank’s plans for the year while also airing his views on current fintech news stories.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ bunq's 2022 Annual Report is out, and the numbers are on fire.

⭐️ Revolut chair Martin Gilbert holds talks with PRA as licence impasse drags on.

⭐️ Mambu's CEO and co-founder Eugene Danilkis has resigned with immediate effect for "personal reasons".

⭐️ Digital Banking Maturity 2022. Closing the Gap to Fully Digital User Experience in Banking.

⭐️ Experian rolls out 'Mule Score' to help banks identify suspicious accounts.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Starling Bank enables abuse victims to 'hide' malicious payment references. Also Starling Bank introduces virtual cards for joint current accounts.

HSBC plans to expand Silicon Valley Bank globally.

Allica Bank and ClearBank team up to boost banking for UK SMEs. Allica Bank reports £2 billion in its savings accounts after strong start to 2023.

Griffin raises $13.5m Series A for its licensed banking software.

Finastra integrates with S&P Global Market Intelligence for corporate and syndicated lending.

EUROPE 🇪🇺

Mastercard launches new open banking innovation in Europe to accelerate financial inclusion.

Lunar opens up infrastructure to enable instant payments in the Nordics.

USA 🇺🇸

Robinhood customers shift to high-yield deposits amid banking turmoil.

Payment apps like PayPal and Venmo might be convenient, but they’re not banks — and a federal financial services watchdog is worried that too many consumers are treating them as such.

Jifiti announced that they have signed an agreement to launch an embedded lending solution with FIS.

Binance moved billions through two U.S. banks, regulators say.

A new crypto banking system arises under the shadow of a regulatory crackdown.

Apple previews new features coming to Apple services this fall.

FIS has acquired banking-as-a-service startup Bond.

LATAM

C6 plans to open its first "Carbon Offices", not traditional bank branches but spaces designed for comfort and security.

Nubank pulls first mass layoffs, branded as 'restructuring'. Nubank's “little boxes” onboard 1 million users in Mexico.

Mexico Fintech battle heats up as Ualá rolls out new account.

ASIA

JPMorgan to work with Indian banks on blockchain-based USD settlement platform.

StanChart embarks on layoffs across Singapore, London and Hong Kong hubs.

Toss Bank, Kakao Pay to launch car installment payment comparison service.

AUSTRALIA 🇦🇺

NZ fintech Aera unveils savings account to help Kiwis grow their deposits faster.

Australia’s Federal government says it will stop using cheques by 2028 and wind down the whole system by no later than 2030.

CBA has limited transfers to high-risk crypto exchanges as US-led crackdown spreads.

MIDDLE EAST

Dubai Islamic Bank launches DIB ‘alt’, ultimate digital banking experience for its customers.

One Zero is to introduce a generative AI chatbot.

Bank Albilad initiates open banking services.

AFRICA

Awacash acquires microfinance banking license from CBN.

TymeBank is now signing up over 300 000 customers a month in SA and Philippines.

MOVERS AND SHAKERS

LHV Bank announces the resignation of Gary Sher.

Marc Cadieux has been appointed President of Silicon Valley Bank Commercial.

Anne Boden, the founder of Starling Bank stepped down as chief executive following a row with investors over a more than £1 billion (€1.17 billion) fall in the valuation of the digital lender.