REPORT

⚫ The State of Consumer Banking & Payments Report: H1 2023

Key takeaways :

‣ Financial well-being remains lower than in 2021: Inflation and interest rate hikes have impacted the financial well-being of all households, regardless of income.

‣ Bank failures shine a light on trust: Consumers have faith in the industry even after the collapse of three regional banks.

‣ Digital wallet dominance continues: Bank branch and ATM visits are becoming a thing of the past.

⚫ How to choose your Core Banking Platform?

Due to the liberalization of the traditional banking market and the explosive growth of Fintechs, since 2015, Core Banking Platform solutions have begun to increase.

👀 NEWS HIGHLIGHT

Westpac has launched a range of pre-paid cards that will enable enhanced accessibility to blind or visually impaired customers.

Prepaid credit and debit cards will be available to those who struggle with their eyesight as Westpac has featured different design elements to the cards so customers can distinguish their payment cards better.

😎 SPONSORED CONTENT

The Fraud Fighters Manual is now available for digital download 🎉

In six exciting chapters across 168 pages, authors from top companies like Brex, Mercury, and Lithic share the best practices of fraud prevention—offering practical strategies and real-world examples to empower fellow professionals in the fight against fraud 💪

📊 INFOGRAPHIC

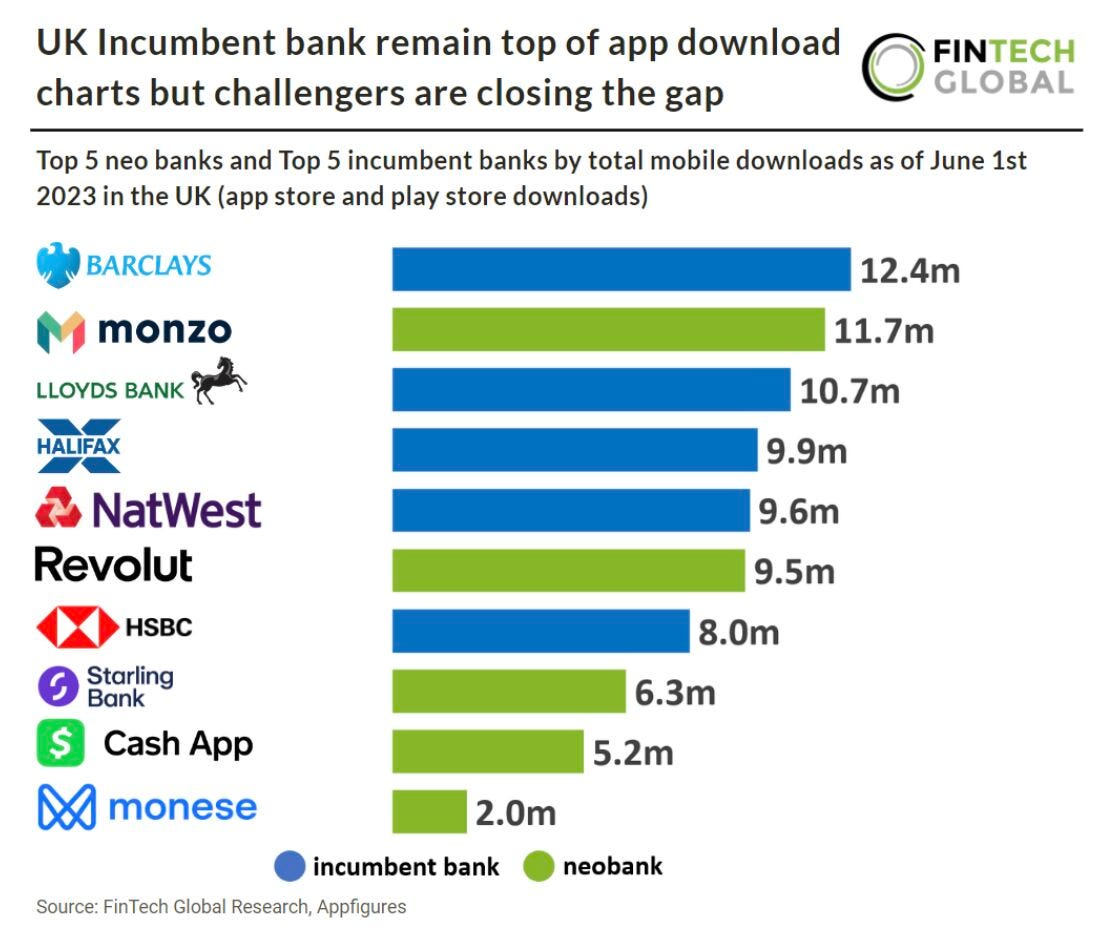

UK Incumbent bank remain to of app download charts but challengers are closing the gap.

📰 ARTICLE

High customer costs a drawback for Hong Kong’s digital banks profitability.

This has created an opportunity for digital banks to step in and offer highly personalized and digital experiences.

💡INSIGHTS

⚫ Banks partner with fintechs to boost their payments offerings.

Banks continue to partner with fintechs this year, with the aim of expanding their payment offerings in an increasingly competitive space. Here are the key partnerships in Q2 by FXC Intelligence👇

⚫ European banks are putting "AI" in 30% of their job ads.

But while banks are racing to hire and invest in artificial intelligence, the EU yesterday voted to pass its AI Act which could limit the technology.

The AI Act is the first piece in a series of complex legislation designed to improve transparency around AI development, but which could also slow its use in Europe.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ Colombian central bank partners Ripple for blockchain pilot.

⭐️ Citizens announced that it is working with Wisetack in a partnership that will initially focus on BNPL loans for consumers fixing up their homes, repairing vehicles and getting medical services in a tightening economy.

⭐️ HSBC has decided to shutter its wealth and personal banking business in New Zealand.

⭐️ Ministers will not intervene to rescue Revolut’s faltering application for a UK banking licence.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Revolut is launching its new “ultimate” membership card, Ultra, that will replace Metal as its top-tier plan.

Revolut is continuing its ‘super app’ roll out with a new push into e-commerce and advertising as it opens up new ways for brands to advertise in its app.

Molten Ventures has written down its stake in Revolut by 40% in the latest blow for the British FinTech company.

Tide has committed to helping launch 200,000 women-led businesses by 2027. The commitment builds on its aim to help 100,000 women-led businesses get started by the end of 2023.

BIS and Bank of England complete CBDC project.

Allica Bank doubles deposits to £2bn as rising rates boost savings.

HSBC rebrands, expands its SVB UK buy as HSBC innovation banking.

"Banks are becoming museums of technology," says the former Barclays boss, highlighting the rapid transformation occurring within the financial industry.

Zopa launches new Smart ISA savings product.

EUROPE 🇪🇺

illimity Bank secures €50 million via EIF to help finance Italian SMEs.

Keytrade Bank has announced its partnership with Infosys Finacle Suite for the modernisation of its core banking system.

Sberbank aims to pioneer digital currency trading in Russia.

The German branch of Silicon Valley Bank is looking for a buyer, German financial news outlet Finance Forward and business magazine Capital reported.

Keytrade Bank has chosen Infosys' Finacle suite for a comprehensive core banking overhaul.

USA 🇺🇸

ONE, a fintech owned by Walmart, is offering users a 5% annual percentage yield on savings accounts of up to $100,000.

The Bank of New York Mellon Corporation (BNY Melon) has partnered with MoCaFi, helping the underserved access bank services.

United States Bank taps Bankjoy for online and mobile.

LATAM

Nubank launches new loan modality with direct treasury as collateral. The user will be able to make the contract through the digital bank app with the promise of facing less bureaucracy and with greater speed.

Banco Afirme announced the start of operations of the digital bank Billú, for which it allocated an investment of over 300 million pesos (17 million dollars).

Habitto, has officially gone live, marking a significant milestone in the country's banking sector.

ASIA

Fino Payments Bank has partnered with Hubble to introduce what it calls “India’s first” spending account.

The day-to-day operations of the Singapore entities of UBS and Credit Suisse will not be interrupted by the completion of the takeover, according to a statement from the Monetary Authority of Singapore (MAS).

Mox Obtains licence to become the first Hong Kong virtual bank to launch Hong Kong and U.S. equity trading services.

Al Rajhi Bank Malaysia partners with Neelofa’s muslim lifestyle app TheNoor.

MIDDLE EAST

Jordan Ahli Bank proudly announces the launch of Qawn, Jordan's first-of-its-kind social payment app, revolutionizing the way users send and receive money through built-in chat capabilities.

MOVERS AND SHAKERS

Zopa is beefing up its management team and has hired Peter Donlon as its CTO, as the company looks to fuel growth and prepare its business for an eventual public listing.

N26’s Chief Growth Officer, Alexander Weber, will be leaving his role at the end of June.

Goldman Sachs fintech executive Stephanie Cohen to take leave of absence.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.