REPORT

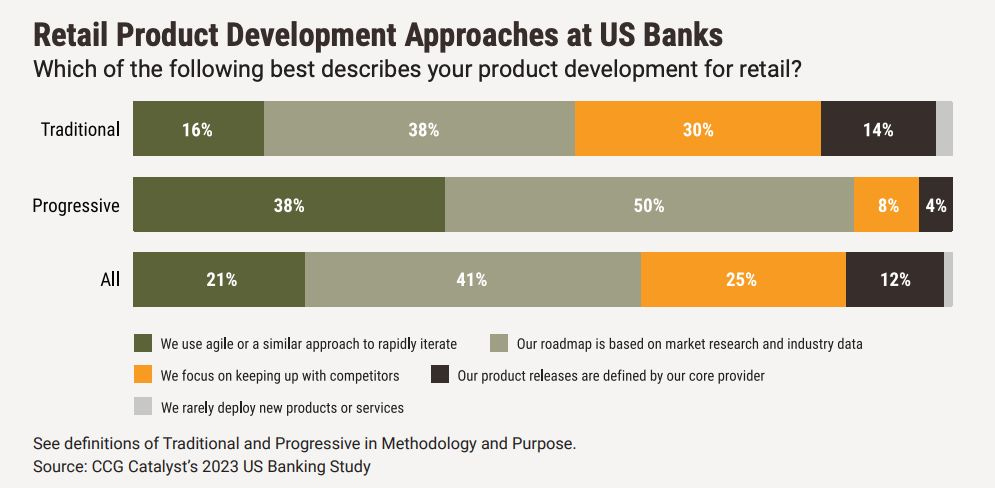

This third edition of The Banking Battleground presents the findings of CCG Catalyst’s 2023 US Banking Study and explores how the industry is thinking about what comes next.

In 2022, European banks saw increased profitability in anticipation of higher interest rates in 2023. However, challenges remain compared to pre-2008 levels.

C-Innovation research shows that digital banks have identified lending as a crucial source of income, expanding their lending activities compared to pre-pandemic times.

👀 NEWS HIGHLIGHT

Revolut said it was launching a streamlined version of its app in Sri Lanka, Chile, Ecuador, Azerbaijan and Oman, allowing customers to transfer money to over 50 countries using more than 30 currencies.

The company said there would be no fee for customers transferring to other Revolut customers, while transfers to non-Revolut accounts would incur a 1% fee, with a $1 minimum, in the five new countries.

😎 SPONSORED CONTENT

📰 ARTICLE

Lenders can now more easily embed Plaid Link into their user journey so that they can start using cash flow data in underwriting. With cash flow underwriting becoming the industry standard, our goal is to make it as easy as possible for lenders to access real-time cash flow data through Plaid.

FDIC accidentally released the list of SVB’s biggest depositors and it includes a few big and interesting VC and FinTech names.

A document from the Federal Deposit Insurance Corp., which the agency said it mistakenly released unredacted in response to a Bloomberg News Freedom of Information Act request, provides one of the most detailed glimpses yet into the bank’s big customers.

👨💻 BLOG

BaaS offerings are on the rise and the term is widely used. However, there are essential differences between licenses and resulting capabilities.

💡INSIGHTS

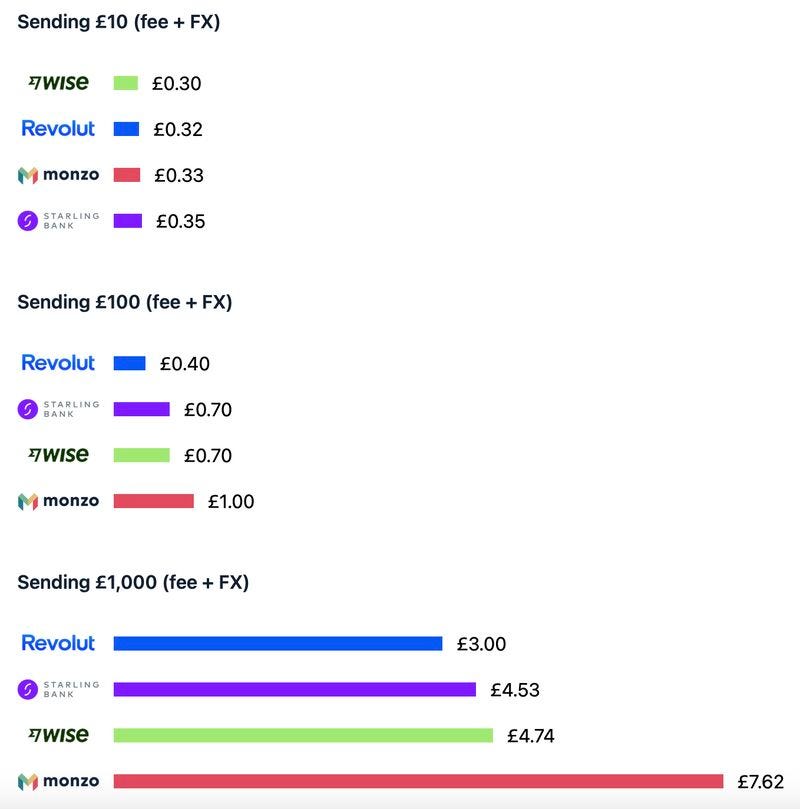

Millions of people in the UK already use at least one of the challenger banks. If your current account already offers similarly-priced transfers, what's the incentive to switch?

We all know Peter Ramsey for his famous UX case studies and the time has come to put Wise under the microscope.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ Backbase acquires digital wealth platform Nucoro.

⭐️ Citi TTS taps Pismo to strengthen demand deposit account solutions.

⭐️ Banked has signed a new partnership with incentive programmes provider Tillo to develop its customer retention strategy in place.

⭐️ Nubank launches a program that allows customers to present themselves with an insurance policy.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Bankable has acquired of Arex Markets, giving the combined company the ability to embed credit and working capital into the payment flows of established neobanks, multinational brands and fintech platforms.

Wise launches instant access savings account paying 4.12%. Wise Interest allows UK personal and business customers to use their cash balances, including pounds, US dollars and euros.

EUROPE 🇪🇺

Qover announced a second partnership with Revolut to provide embedded insurance for its new trip and event cancellation cover.

Compass acquired 100% of HeidiPay Switzerland AG from parent company HeidiPay. The acquisition will enable Compass to become a consumer credit operator in the Swiss market through HeidiPay Switzerland’s distribution licence.

Froda has partnered with Lunar and Visa to launch its card-based embedded lending solution for small businesses in Denmark.

Deutsche Bank has become the latest investment bank to announce its push into the crypto custody market.

Backbase partners with Entrust to enable Apple Pay and Google Pay for Financial Institutions.

The Bank of Lithuania revoked the licence of the electronic money institution UAB PAYRNET for serious, systematic and multiple violations of legal acts.

Bank of Italy, the Associazione Bancaria Italiana (ABI) has brought together a group of banks in a pilot program for a central bank digital currency (CBDC).

CaixaBank has partnered with Iberpay to introduce the SEPA Request-to-Pay (SRTP) service in Europe.

Novobanco has partnered Feedzai to help enhance its customer experience, improve its digital journey and provide fraud protection.

Vivid Money, a German rival to Revolut, has shelved plans to launch in the Irish market.

USA 🇺🇸

SVB Financial Group entered into an agreement to sell its investment banking business, SVB Securities, to a group led by Jeff Leerink, SVB Securities’ CEO and founder, and backed by funds managed by hedge fund firm The Baupost Group.

nCino Inc is exploring its options, including a potential sale, after attracting takeover interest from private equity firms.

JP Morgan’s Chase ups savings account rate to 3.8% after Bank of England ‘super-hike’.

JPMorgan starts euro blockchain payments for corporates. Blockchain projects have yet to yield large benefits for banks.

LATAM

Nubank completes all mandatory steps for the payment initiator status. Nubank can now perform the initiation of Pix payment transactions within the framework of Open Finance Brasil.

Segura Bank has selected Temenos to power its upcoming cloud-based digital bank offering targeting “mid to high earners in Latin America”.

CARIBBEAN

Finastra and ADVANTAQ partner for streamlined compliance onboarding for banks in the Caribbean.

ASIA

Hong Kong Monetary Authority (HKMA) is applying pressure on HSBC, Standard Chartered, and the Bank of China to consider accepting crypto exchanges as clients.

MUFG is partnering with JR East to allow customers to consult with their financial advisors from a booth in “Ekinaka” (literally, “inside the station”) as another move to eliminate restrictions imposed by the conventional format of branches.

SVB customers in Asia still stuck with outstanding loans. These customers had their deposits seized by the Federal Deposit Insurance Corp. (FDIC) and still have outstanding loans with First Citizens Bank.

TransBnk has made a significant stride in its growth journey by successfully amassing $1m in seed funding.

SCBX announced its readiness to apply for a license to establish a virtual bank with South Korean digital bank KakaoBank.

Citibank, DBS, OCBC and Swiss Life were penalised a combined S$3.8 million by the Monetary Authority of Singapore for breaches of AML/CFT requirements.

The Bangko Sentral ng Pilipinas (BSP) intends to introduce further incentives to promote sustainable and green financing in the Philippines.

JPMorgan Chase & Co will be establishing its commercial bank in Singapore as part of its global expansion plans.

Tonik posts 38% rise in customer deposits but losses widen to $33.4m in 2022.

AUSTRALIA 🇦🇺

Nine25 set the benchmark for the rest of the Australian banking and financial services industry to follow by announcing the launch of the fastest transaction account opening in just 30 seconds.

MIDDLE EAST

Okoora has introduced an integrated AI-powered platform, known as Automatic Business Currency (ABCM) to augment currency operations and provide global coverage.

MOVERS AND SHAKERS

JPMorgan Chase has named veteran executive Teresa Heitsenrether chief data and analytics officer.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.