REPORT

French neobanks may face challenges in staying competitive due to their close association with incumbent banks like Boursorama Banque and Société Générale.

👀 NEWS HIGHLIGHT

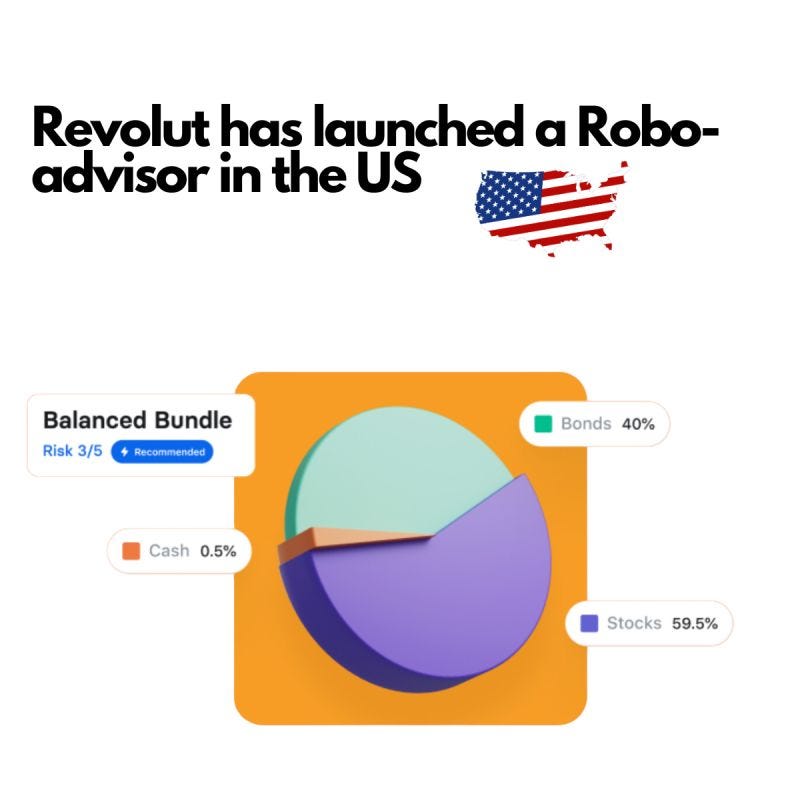

The new feature manages investment portfolios on behalf of customers to remove the friction from investing with lower fees than traditional companies.

Based on responses from customers, the Robo-advisor will provide users the opportunity to invest in one of five diversified portfolios based on their risk tolerance.

😎 SPONSORED CONTENT

At Klarna Kosma, we want to make accessing open banking solutions as smoooth as possible for our potential partners. So, we’ve brought everything you need to start plugging into the power of open banking together in one place.

Whatever stage your business is at, whether it’s:

🟣 Still exploring the possibilities

🟣 Wanting to play around with our products (for free)

🟣 Looking for more support or guidance from our open banking experts

🟣 Fully ready to start developing and testing our API

It’s all here for you 👉

📊 INFOGRAPHIC

In its annual “What’s Going On in Banking?” study, Cornerstone Advisors asked 300 executives at banks and credit unions, mostly in the range of $250 million to $50 billion of assets, about BaaS.

📰 ARTICLE

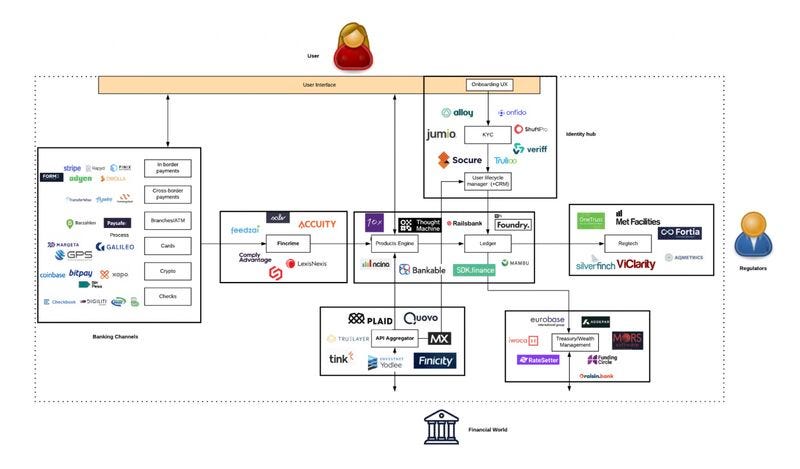

The major building blocks for creating a digital bank.

Boden has undoubtedly blazed a trail in British banking. The Swansea native remains the only woman to have launched a bank in the UK and has led Starling to become the first of the upstart fintech lenders to reach profitability.

👨💻 BLOG

Australian cryptocurrency exchanges are running out of options to let local customers convert their crypto into dollars, as new measures brought in by a wholesale banking provider under the guise of stopping scammers could also prevent exchanges from providing essential services.

💡INSIGHTS

The “worrying weight of compliance” is taking its toll on banks. Almost two thirds (60%) say they are concerned about committing an anti-money laundering (AML) breach according to a SmartSearch survey.

Notably, the 8 deals listed below all occurred within a 5-month period:

Only 18% of those quizzed were familiar with the concept of open banking, although the percentage among 18- to 34-year-olds rises to 35%. Similarly, only 11% of respondents had heard of screen scraping.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ Goldman is looking for a way out of its partnership with Apple.

⭐️ Maza raises $8m to expand credit access to US immigrants.

⭐️ Santander invests in trade finance network Komgo.

⭐️ Mbank collaborates with Khalifa Fund to launch its corporate banking platform.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

NatWest is offering 24 months of free business banking to UK businesses switching their main business banking account to NatWest.

Qover partners with Monzo to bring seamless insurance experience. Through this collaboration, users gain access to a range of features that include automated insurance certificate generation and real-time reporting.

EUROPE 🇪🇺

The popular website builder Jimdo from Germany has launched a banking product powered by Solaris.

Orange enters exclusive talks with BNP Paribas to exit retail banking.

UBS Group AG is planning to cut more than half of Credit Suisse Group AG’s 45,000-strong workforce starting next month as a result of the bank’s emergency takeover.

ZEN.COM is partnering with Aion Bank and Vodeno. This collaboration with top-tier Banking-as-a-Service (BaaS) providers enables us to offer enhanced local banking services to their Polish customers.

CaixaBank launches FXWallets service for international payments. The new offering allows customers to open an account immediately with no opening or maintenance costs and enables international payments in more than 50 currency pairs.

USA 🇺🇸

Sendwave launches bank account for migrants. Sendwave is offering select customers a FDIC-insured bank account with an accompanying debit card.

LATAM

Mexican Banco Azteca has launched 100% digital accounts, enabling customers to open an account online within 10 minutes without physical branch visits.

Nubank announced that customers who take out a personal loan in the company’s app now have a financial protection alternative to combat unexpected events and keep their installments up to date.

Nubank’s PJ account reaches over 3 million customers.

AUSTRALIA 🇦🇺

Zeller is revolutionising the Australian business banking sector – introducing new, non-bank alternatives to Australia’s outdated bank offerings, to better address the evolving needs of business owners.

Wise will offer its special class of banking licence to local fintechs in Australia and other non-banks to allow them to create business deposits and payments services banks.

OCEANIA

Revolut wants to upend banking in New Zealand by offering free deposit accounts and cheaper money transfers and foreign exchange.

AFRICA

SoLo Funds, a community lending platform that has grown to over one million users in the U.S., is expanding to Nigeria, its first international market.

MOVERS AND SHAKERS

LHV Bank appoints Rachelle Frewer as new CFO. Frewer will take over from Gary Sher as CFO of the company, which obtained its banking licence last month.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.