REPORT

This annual report from Arizent, parent company of American Banker, an information resource for decision makers in financial services, examines the progress and priorities of digitally driven initiatives at financial institutions.

These all-in-one platforms offer a wide range of services to users, from social networking and e-commerce to financial services and ride- hailing. However, designing a successful super app is not an easy task. It requires a deep understanding of user behavior, market demand, and technological capabilities.

👀 NEWS HIGHLIGHT

Now, new N26 customers in France automatically receive a French IBAN from N26’s local branch in France. As an added benefit, these customers with a French IBAN no longer have to tell tax authorities that they have a foreign bank account — that’s less paperwork.

📊 INFOGRAPHIC

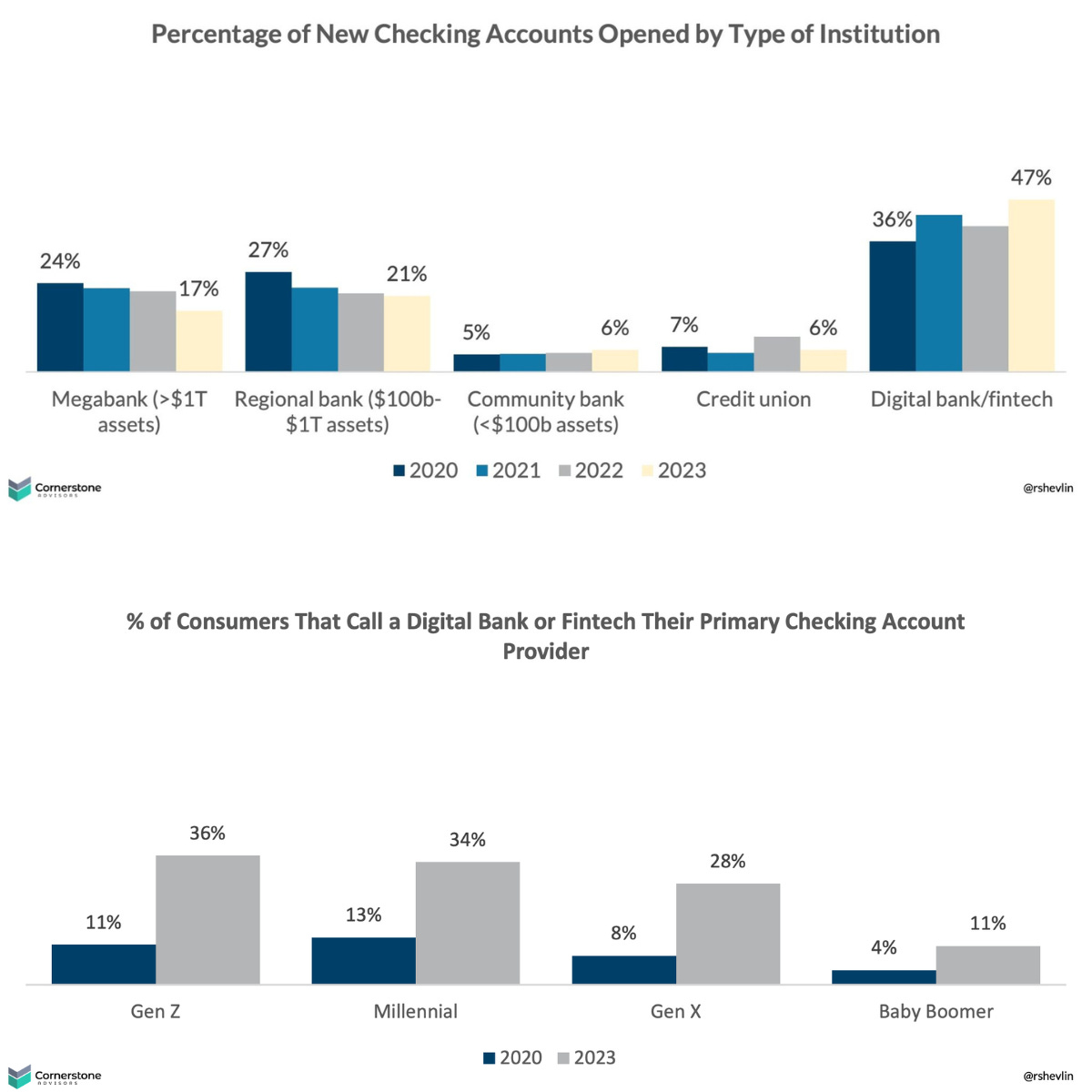

A new study from Cornerstone Advisors, looking at who Americans open checking accounts with, underscores the growth of digital banks and fintechs like Chime, PayPal, and Square—and the decline of megabanks like Bank of America, JPMorgan Chase, and Wells Fargo.

📰 ARTICLE

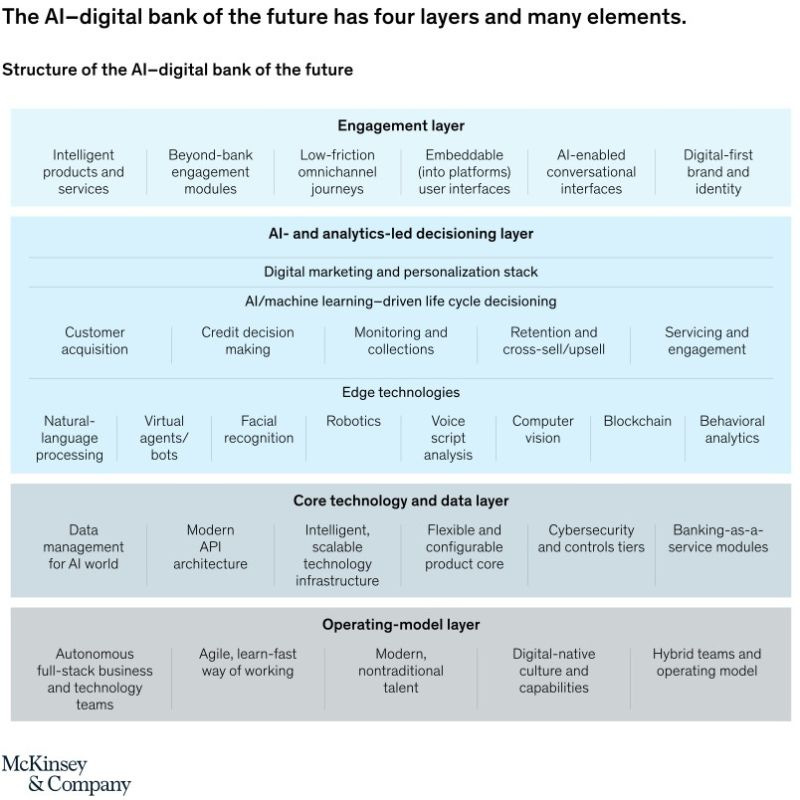

Licensed neobanks are disrupting the global financial services industry on the back of strong trends, but their long-term success hinges on their ability to create an artificial-intelligence-powered banking model that is customer centric, operationally efficient, and profitable at scale.

👨💻 BLOG

One of the most interesting features of the Revolut Business API is that of "Draft Payments": Bulk Payments via API that requires approval. It seems to me an fascinating concept and rarely seen in the market, very useful for payroll, paying suppliers, expense management, among other applications. Check out this example of how this functionality could be implemented from a Google Sheets by Juan Segundo Ferrari.

What happened? We were told that embedded finance was a panacea, capable of turbocharging bank margins at the same time as boosting revenues and customer loyalty for their brand partners.

Many challenger banks have seen an influx in customers in recent months as clients abandon high street lenders because of their low savings rates.

💡INSIGHTS

Recent news reveals that Starling Bank has achieved an unprecedented second year of profitability, solidifying its position as a game-changer in the banking industry. But that's not all!

C-Innovation dives deeper into the fascinating highlights presented in another great report.

Let's take a closer look at the profitable digital banks: Despite the immense challenges faced by digital banks in 2023, there are a few standout success stories.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ Revolut launches Express Elixir in Poland.

⭐️ Alex Weber is stepping down to rest and reflect after 10 years at N26.

⭐️ Papara becomes latest unicorn following acquisition of Spain’s Rebellion.

⭐️ Silicon Valley Bank gets back to lending.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Monzo hits 7.5 million customers, annual losses remain stable. Monzo has recorded an annual loss in the twelve months to March but also says it is now operating at a profitable level on a monthly basis.

The Chancellor of the Exchequer, Jeremy Hunt has been denied an account with online bank Monzo, it’s been claimed, amid a row about anti-money laundering rules.

Lloyds Banking Group has hailed the success of its inhouse Innovation Sandbox as a key measure in improving its ability to collaborate with fintechs.

Tandem has secured a £20 million capital raise from Quilam Capital after turning in its first full year of underlying profit last month.

NatWest concludes that banks, fintechs and regulators need to work together to resolve key economic obstacles that are holding back wider adoption of open banking in the UK.

Mastercard is tapping into its AI capabilities to help a host of UK banks predict and prevent real-time payment scams.

Revolut launches a savvier way to shop where customers earn cashback from their favorite retailers.

Tandem Bank on the hunt for London home. The neobank’s London-based staff are currently working from a “ringfenced private” WeWork space in London while it hunts for a permanent London base.

The Bank of England has enlisted payments platform Nuggets to work on a privacy and identity layer for any future digital pound.

EUROPE 🇪🇺

BBVA announced the launch of a unit to further strengthen the bank’s financial crime prevention structure.

Revolut, has expanded its services in Germany with personal loans. Now, existing customers can apply for loans between €1,000 and €50,000 through the Revolut app with just a few clicks.

USA 🇺🇸

Revolut is moving to delist Solana (SOL), Polygon (MATIC), and Cardano (ADA) in the United States after the three tokens were listed as securities by the Securities and Exchange Commission last month.

Revolut’s US payment flaws allowed thieves to steal $20mn. The problem stemmed from differences between European and US payment systems, which meant that when certain transactions were declined Revolut would erroneously refund accounts.

The Federal Reserve Bank of New York says that proof-of-concept run with a host of banks has demonstrated the feasibility of a regulated digital asset settlement platform supported by shared ledger technology.

Synch Payments will not launch until at least next year after being told it needs approval under EU rules.

LATAM

Z1 has been authorized by the Central Bank of Brasil to operate as a payment institution (IP) which allows for managing prepaid payment accounts.

BanCoppel taps Temenos for core banking overhaul. BanCoppel aims to scale its operations and offer an integrated ecosystem of “easy and accessible” banking services.

ASIA

Tonik Bank is growing fast but losing more money. Tonik’s financials for 2022 recently appeared in several media reports, and by the looks of things, the three-year-old digibank is doing reasonably well in terms of customer acquisition.

TOKI and Noble will work with Progmat, a project launched by Mitsubishi UFJ Trust and Banking, to bring Japanese stablecoins to Cosmos.

Kakao Pay launches ATM service in Japan, Vietnam and Laos. The service allows users to withdraw the national currency of each of the three countries with just a mobile phone that has the KakaoTalk or Kakao Pay app installed.

AFRICA

Xhuma has arrived in South Africa. This fintech will simplify financial management, provide greater control over money, and offer a wide range of features – such as digital savings pockets and automated transactions.

MOVERS AND SHAKERS

N26 promotes Andrea Isola to VP of European Markets and Business Operations. Isola will be responsible for the bank’s growth across its core European markets, leading a team that includes the General Managers in the region.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.