Good morning FinTech Fanatic!

I'm happy to present to you my latest newsletter Connecting the dots in RegTech newsletter in collaboration with my neighbors in Amsterdam: Fourthline

In this weekly newsletter, we'll be your intrepid guides, leading you through the winding paths of compliance, risk management, and all things regulatory.

With news updates and podcast episodes we'll bring you the latest trends, emerging technologies, regulatory updates, and inspiring success stories from the pioneers who are reshaping the industry.

So sign up for this great newsletter to make sure you'll stay up to date on all things RegTech!

And now on to other FinTech industry news I listed for you today:

REPORT

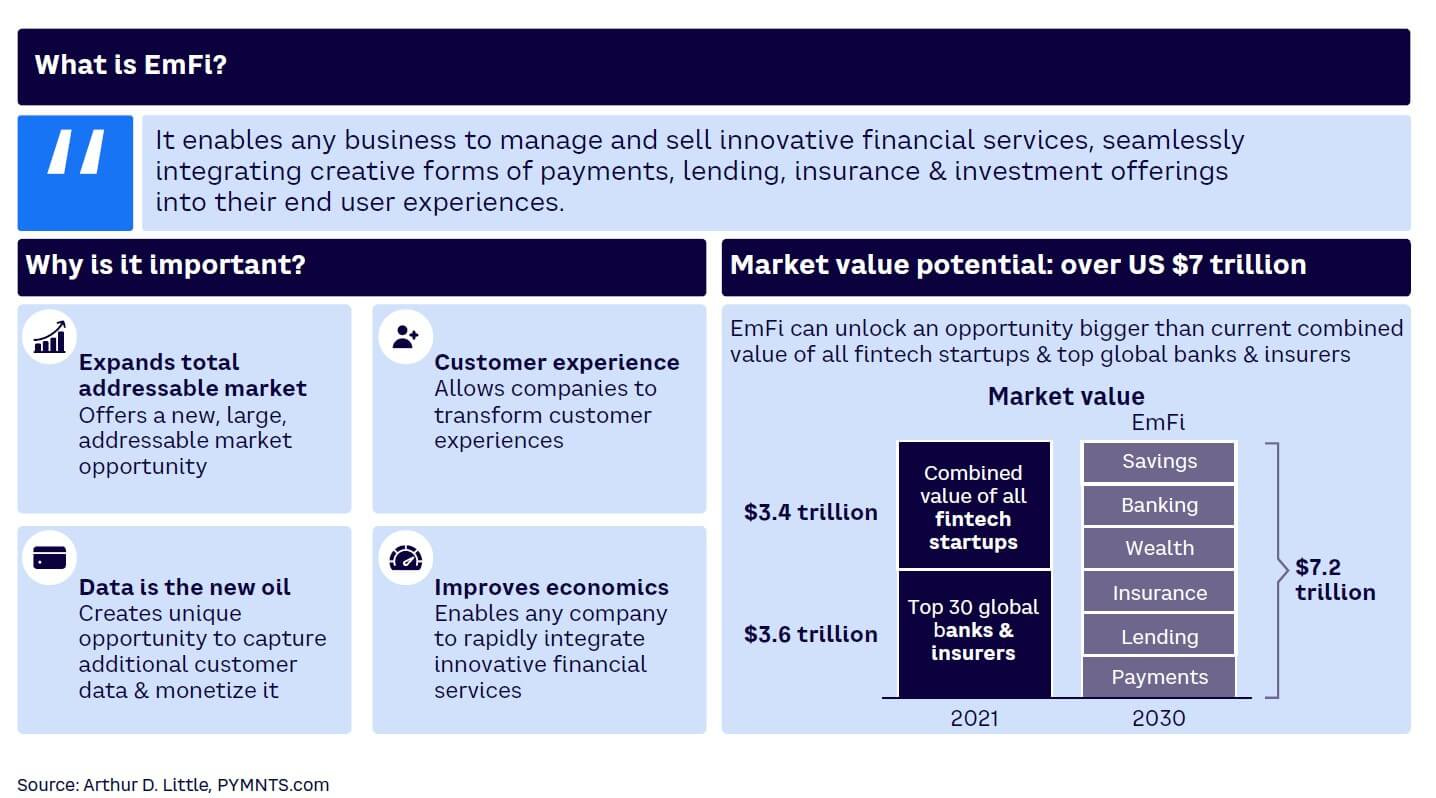

Embedded finance (EmFi) arguably has been the most hyped financial technology topic of the past two years. Its rise has forced traditional finance to take a back seat to make way for a more integrated and seamless customer experience.

The EmFi market size and its many components, including payments, lending, savings, insurance, and investments, is estimated to reach US $7.2 trillion by 2026.

👀 NEWS HIGHLIGHT

Monzo Bank Ltd is exploring a potential combination with Lunar Group A/S as it looks for ways to expand in Europe.

📰 ARTICLE

Visualized: The 100 Largest U.S. Banks by Consolidated Assets 🏦

The largest 100 banks in the U.S. hold a combined $18.8 trillion in consolidated assets, but recent collapses of medium-sized banks like Silicon Valley Bank and First Republic have caused worries throughout the banking world.

This visual using data from the Federal Reserve ranks the country’s 100 largest banks by the size of their consolidated assets.

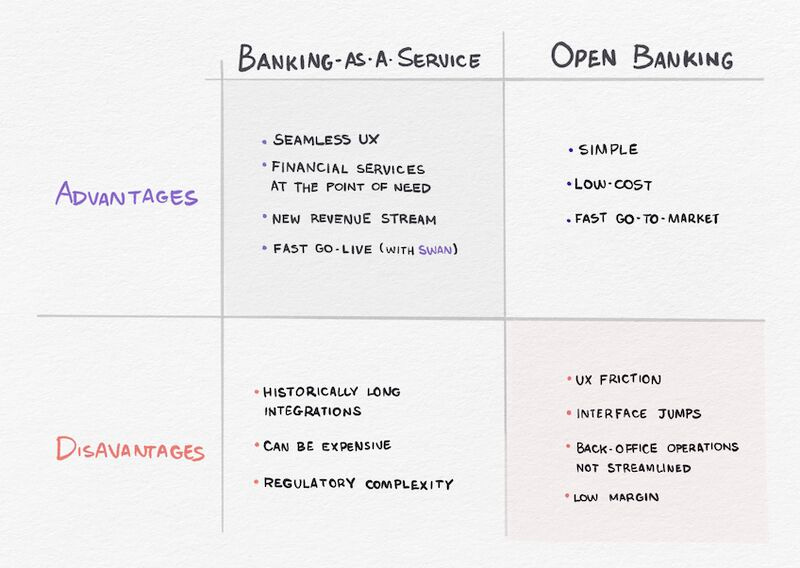

I highly recommend reading this great short piece article by Max Cutler from Swan to learn all you need to know on this topic.

💡INSIGHTS

They explore the company's strategic approaches to leadership stability, cost efficiency, and revenue diversification, which have been instrumental in supporting Monzo's growth amidst market challenges.

No major bank has collapsed since First Republic Bank at the beginning of May. But that doesn’t mean fears about banks have gone away.

As lenders begin reporting their second-quarter performance, attention will turn to how their earnings are holding up in the aftermath of the failures.

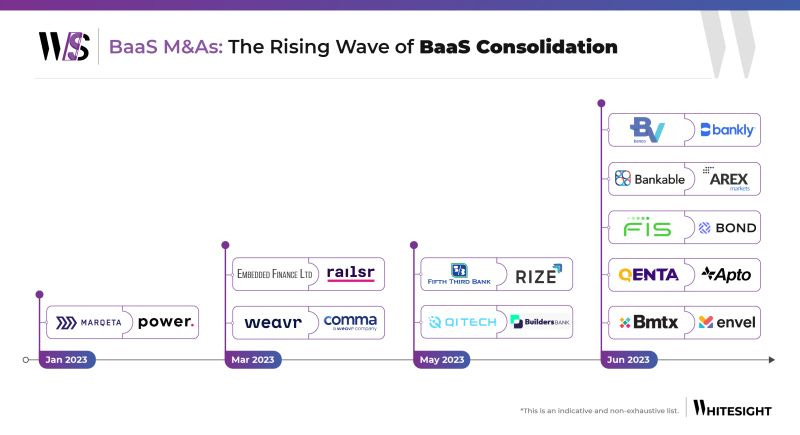

The demand for agile and expandable infrastructures is at an all-time high in the fintech sector. And with technology evolving at warp speed, financial institutions are being pushed to think on their feet and embrace change.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ OakNorth reached £900m of business lending in H1 2023.

⭐️ Solaris secures €38 million capital raise.

⭐️ FCA chief warns banks of AI risks and Big Tech threat.

⭐️Swift pilots instant payments across currency zones.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Revolut deals with the fallout of both a system flaw and cybersecurity data breach.

Revolut has moved a step closer to its goal of becoming a super-app by adding a new marketplace for booking tours and attractions yesterday.

The City minister told Revolut chiefs that he could not influence its stalled bid for a UK banking licence at a rare meeting with Britain’s most valuable fintech company.

While details on the Revolut 20 million USD robbery are still coming out in dribs and drabs, one clear thing is that the robbers exposed a loophole in the system.

N26's Eduardo Prota reportedly told that they are not leaving the Brazilian market. He said that N26 is concentrating on making the account the main account for their customers.

EUROPE 🇪🇺

CaixaBank is launching a new feature in its online banking to enable shared bill payments using Bizum.

Bitstamp and Qi Digital to help banks integrate crypto currency payments.

The Bank of London is investing €200m into setting up a new base in Luxembourg having formally applied for its EU banking licence.

Payhawk has received an EMI licence and opened an office in Lithuania, increasing its global presence to eight offices.

Raisin is on track to reach a major milestone of over €50bn in assets under management (AUM) by the end of the year.

USA 🇺🇸

The Consumer Financial Protection Bureau (CFPB) ordered Bank of America to pay more than $100 million to customers for systematically double-dipping on fees imposed on customers with insufficient funds in their accounts.

Goldman Sachs reportedly completed a $1 billion loan sale to the investment firm Varde as part of its plans to exit from its Marcus consumer loan business.

Jenius Bank launches US digital consumer banking business.

LATAM

Nubank has signed an agreement with Fireblocks, a global digital asset platform that offers a service for offering blockchain products and managing crypto transactions.

Revolut extends crypto investment services to brazilian customers.

ASIA

UnionBank injects PHP 900 million capital into UnionDigital Bank. The digital bank said that the latest additional infusion will help drive the digital bank’s expansion, particularly in digital loans which will soon be launched in the UD app.

Citi announced that it will pilot its new platform in the second half of 2023 across Singapore, India, Hong Kong, and the U.K.

Hokkoku Bank has released new payment terminals that are capable of QR code payment and support Wi-Fi as well LTE connections, making it possible to accept payments inside and outside the store.

AUSTRALIA 🇦🇺

NAB completes transfer of 86 400 customers to Ubank technology platform.

NAB’s scam alerts prompt customers to stop $270 million in payments.

Australia Post will close the domestic operations of its POLi Payments business at the end of September.

National Australia Bank will block payments to high-risk cryptocurrency exchanges, which is understood to include Binance.

MIDDLE EAST

Emirates NBD has launched an enhanced and upgraded version of its WhatsApp banking service, providing customers with a convenient, secure and reliable digital banking experience like never before.

Emirates NBD revamps digital bank Liv with new value proposition targeting Gen Now.

AFRICA

The internationalization of BKN301 continues with the opening a new office and landing in Egypt.

The Central Bank of Egypt issues new rules for licensing digital banks.

MOVERS AND SHAKERS

Australia appoints Michele Bullock as the first female head of its central bank, the Reserve Bank of Australia, amid public backlash over rising interest rates.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.