REPORT

The future of banking looks increasingly different, with new business models emerging on the back of digitalization, interconnectivity, and the availability and use of rich data.

Explore the journey of Starling Bank, a digital disruptor in the UK banking industry. With over 3.6 million customers, Starling aims to transition from a challenger fintech to a credible “grownup” bank.

👀 NEWS HIGHLIGHT

It's official. Revolut, Europe's most valuable startup, has launched in Brazil. Which means that, after years of absolute dominance, Nubank now faces serious competition.

FinTech Insights compared Revolut to Nubank and to the Latin American banking market more broadly.

📊 INFOGRAPHIC

👨 💻BLOG

This blog covers the role of traditional AI in the banking sector and acknowledges its improvements while pointing out limitations in generating innovative content.

Boden’s decision followed a clash with investors over fund manager Jupiter’s decision in February to sell its holding in the bank at a price that cut Starling’s valuation from £2.5bn to between £1bn and £1.5bn, according to people familiar with the situation. Read the complete insightful blog post by Chris Skinner.

💬 INTERVIEW

NatWest’s Howard Davies: “The rise of neobanks, fintechs and AI challenges traditional banking.”

Mr Davies discussed the bank runs in the US, his views on the state of banking in the rest of the world, and the competition banks face in the digital world.

💡INSIGHTS

FICO's report shows that Gen X, Millennial and Gen Z groups want "consumer-centric" personalized services offered by fintechs. Traditional megabanks need to develop more personalized digital offerings that create more engaging experiences.

The study in collaboration with research firm Dynata delves into the relationship different age groups have with banks and money in the country.

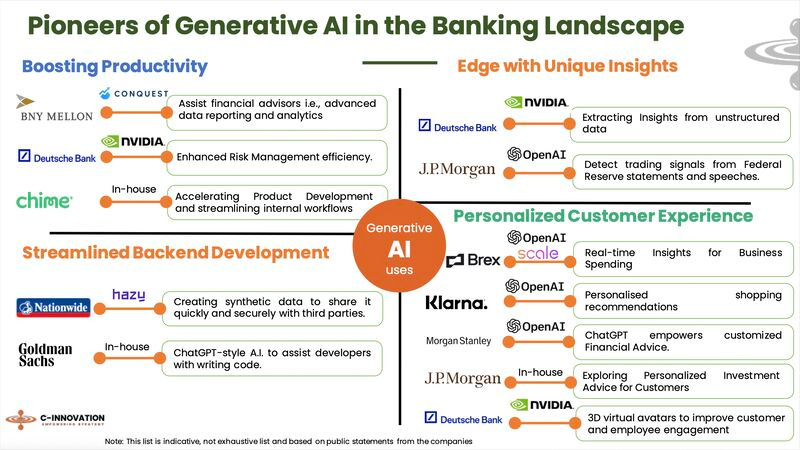

Boston Consulting Group (BCG)’s Fintech Control Tower has just released its highly anticipated GenAI in Banking Report.

The report sheds light on the incredible opportunities in this transformative field.

🧐 ANALYSIS

The banking industry has been experiencing a seismic shift towards digitization over the past several years, bringing the banking experience and operating model closer to that of other industries and consumer expectations than ever before.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ Credit Suisse handed biggest fine in Prudential Regulation Authority’s history.

⭐️ Bunq has raised $111M at a flat $1.8B valuation to break into the US

⭐️ Nubank reaches 80 million customers in Brazil.

⭐️ NatWest CEO Alison Rose to step down.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

UK banks are closing more than 1,000 accounts every day. Nigel Farage calls for royal commission as data shows big jump in customers being ‘debanked’

Metro Bank transforms mortgage platform as it prepares to enter two new markets. The upgraded platform will greatly improve the mortgage application process and user experience for intermediaries and their teams.

Revolut partners with AIG to launch car insurance in Ireland to offer the chance to buy Revolut car insurance to 3,000 customers from today and then roll out the product to all customers in the coming months, it said.

Monzo dragged into the “debanking” row after closing account of Gina Miller’s political party. The bank subsequently explained that it doesn’t allow political parties to open Monzo Business accounts.

Recognise Bank rolls out two new business savings accounts. The 7 Day and 35 Day Notice accounts provide better interest rates than their Easy Access counterparts.

Current Account Switch Service reveals 1.2 million switches in past 12 months. Between April and June 2023, the Current Account Switch Service saw a 76% increase in the number of switches on the same period last year.

EUROPE 🇪🇺

Banco Santander, BBVA and CaixaBank team up to tackle fraud with FrauDfense. The trio have created FrauDfense, a new joint venture that will enable the exchange of all relevant and useful sources between the three banks to form one joint response to the issue.

Verestro unveils Banking-as-a-Service platform. This product empowers global banks to offer BaaS solutions to customers and partners.

LHV Group's unaudited financial results for Q2 and 6 months of 2023 are out. Q2 was characterised by active business for LHV, as well as increasing client activity.

USA 🇺🇸

FDIC scolds banks for manipulating deposit data. Last Monday, the Federal Deposit Insurance Corp. sent a warning to U.S. banks not to take liberties with their deposit numbers.

Treasury Prime and Academy Bank form BaaS partnership. This partnership addresses the increasing demand for flexible and scalable solutions that effectively meet the evolving needs of businesses and customers.

Revolut offers accounts to non-US citizens without Social Security Numbers in the US. While these non-US citizen accounts won’t have access to certain Revolut features, the initiative is a significant step forward in promoting financial inclusion.

Citi acquires Deutsche Bank’s Mexico license. The deal will help Citi separate its institutional and private business in Mexico from its consumer, small-business and middle-market operations ahead of a planned IPO for Banamex in 2025.

Grasshopper Bank partners with Cable for cutting-edge automated financial crime effectiveness testing and oversight across the bank’s clients and BaaS platform.

Cross River to support Plaid real-time payments. Instant Payouts via Plaid Transfer, powered by Cross River, is a game-changing technology that benefits businesses. The bank also closed second quarter with over $66MM in Lender Finance loans. The Company’s growing CRE business saw 100 percent growth in number of Lender Finance loans originated.

SVB Financial seeks up to $12.6 Million in executive bonuses. Executives are affiliated with credit investment arm, filing says.

LATAM

Nubank integrates available limits on a single screen to facilitate customers’ financial journey. In the section called “My Limits”, customers can manage all their available credit lines in one place.

Nubank announced a partnership with Hopper to deliver a full range of booking options such as flights, hotels, and car rentals through the bank’s mobile app. The neobank also teamed up with Casas Bahia to offer a new in-app shopping experience with exclusive discounts and benefits without leaving Nu's app.

ASIA

Habitto hits 12,000 downloads in first month. The bank launched its app on June 13 2023. Since then, the app has already seen over 12,000 downloads and over ¥130 million in new deposits.

Kuwait International Bank rolls out corporate online banking platform heralding a new phase of financial empowerment and security for its corporate customer.

10x Banking plans Apac expansion. The firm plans to accelerate the company’s growth in APAC fuelled by a landmark study revealing that a third of banks in key markets across the globe are losing large numbers of their customer base to rivals due to slow transformation.

NetGuardians wins contract at Bank al Etihad. The bank will strengthen its fraud prevention capability, further mitigating the risk of fraudulent activity across all payment channels.

How Thailand’s state-owned ‘social bank’ is tackling inequality with open source. Government Savings Bank aims to be a ‘social bank’ that supports the underbanked and lower income communities across the country.

AUSTRALIA 🇦🇺

Alex Bank plots second, late 2023 capital raising. The bank is set to go cap in hand to investors for a second multi-million dollar capital raising in under a year.

Westpac, CBA dip into money markets using digital Aussie dollar. The deal is a world-first between mainstream regulated banks using a “central bank digital currency”, or CBDC, and market securities.

AFRICA

TymeBank clients get money back after outage causes technical glitch. TymeBank has found the cause of the problem and will work on improving how they resolve the issue should it occur again.

OPay aims to stake USD 60 M on bold neobank play in Egypt. The African technology provider has announced its intention to apply for a license to establish a digital bank in Egypt with a capital of USD 60 M.

MOVERS AND SHAKERS

N26 appoints permanent replacement for chief risk officer. Carina Kozole will take over the C-suite role from interim CRO Jan Stechele later this year, who will continue as managing director.

Coutts CEO resigns over Nigel Farage row. CEO Peter Flavel has stepped down from the private bank with immediate effect over the “mishandling” of Nigel Farage’s bank account closure.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.