REPORT

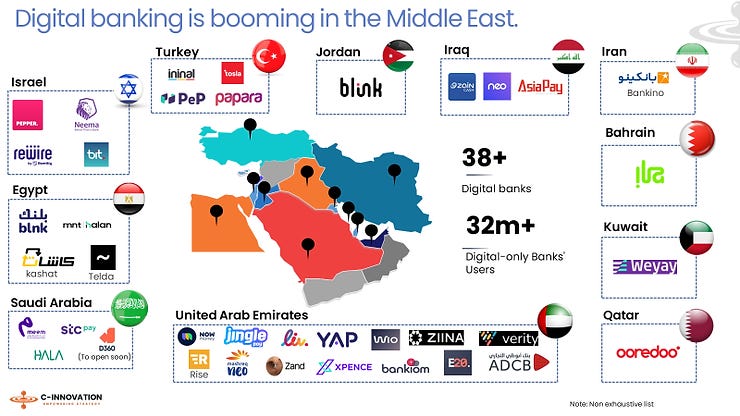

We are thrilled to announce the upcoming release of our highly anticipated regional report on the Digital Banking landscape in the Middle East. Building on the resounding success of our previous report, "From Disruption to Profit: The Rise of Digital Banking in Europe's Profitability," we are now turning our focus towards the burgeoning and dynamic markets of the Middle East.

👀 NEWS HIGHLIGHT

Flutterwave announced the enhancement of its $end Mobile product, now Send App by Flutterwave, to facilitate faster, easier, and more affordable money transfers from people in the diaspora to their families, friends, and loved ones in Africa.

📰 ARTICLE

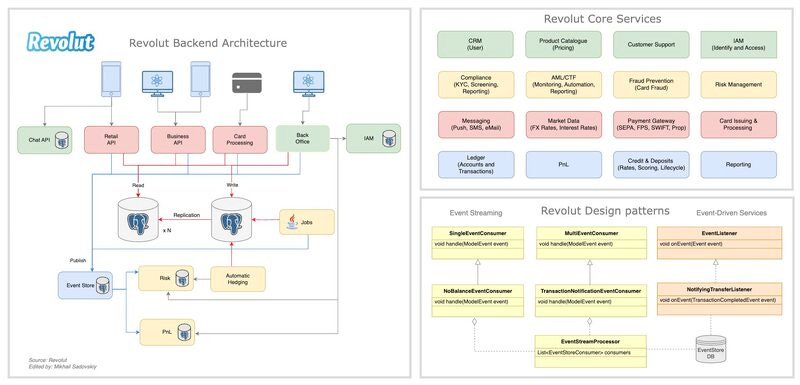

🏦Architecture of a Neobank: Revolut

Revolut is the largest neobank in the UK and Europe with more than 30 million retail customers for 2023.

Revolut successfully built an event-driven microservices architecture that lots of companies are struggling to implement.

This architecture was the result of trial and error; it went through a transformation from a monolith and matured in the way it is presented in the diagram below👇

There is nothing better than pursuing innovation with efficiency, especially when security is at stake, and the partnership between Mambu and Fourthline is aiming to achieve exactly this. As these two companies join forces, the promise is that customer experiences will rapidly change, shifting towards seamlessness and ease because two of the best players on the market are the ones holding the reins.

💡INSIGHTS

BirAPI Open Banking Turkiye Monitor - July 2023 - by BirAPI 👇

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ Proposed PSD3 And Payment Services Regulation (PSR).

⭐️ Judo Bank impacted by HWL Ebsworth cyber attack.

⭐️ Toss Bank in advanced talks to close $154M funding at a valuation of $2.1B.

⭐️ Bunq CEO, Ali Niknam: US regulators ‘tough but fair’ amid license wait.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Revolut reports spikes in money transfers around international cultural celebrations.

Monzo Bank refused to give Jeremy Hunt, the chancellor, an account described the Conservatives as “evil” and celebrated Tory election losses.

USA 🇺🇸

Dave announced a 4.00% annual percentage yield (APY) on both Dave Spending and Goals accounts for members in search of high-yield savings opportunities on all of their accounts.

Apple announced that Apple Card’s high-yield Savings account offered by Goldman Sachs has reached over $10 billion in deposits from users since launching in April.

HSBC has come together with Tradeshift to launch a jointly-owned business focused on the development of embedded finance solutions and financial services apps.

WaterStone Bank has partnered with nCino to upgrade its technology and migrate its lending activities to its cloud banking platform.

Mitsubishi UFJ Financial Group Inc. will buy a stake in U.S. Bancorp for $936 million, deepening an alliance after selling its regional banking business to the US lender last year.

Revolut has announced the suspension of its cryptocurrency services in the United States.

LATAM

Revolut has expanded its operations in Brazil and is poised to enhance its services into a financial superapp. Glauber Mota, CEO in Brazil, revealed that Revolut secured a Direct Credit Society license from the Central Bank of Brazil.

ASIA

Siam Commercial Bank (SCB) and the Bank of Thailand (BOT) have developed an app as part of a retail Central Bank Digital Currency (CBDC) pilot project.

10x Banking announced its APAC expansion plans fueled by its study revealing that a third of banks in key markets across the globe are losing large numbers of their customer base to rivals due to slow transformation.

Revolut, has launched Instant Card Transfers in Singapore, providing secure, low-cost, and convenient remittances.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.

Hi Marcel,

Interesting read! What do you put the digital banking expansion in Asia down to?