REPORT

The forecast from Juniper Research, the market research firm, comes from its latest study regarding the potential of BaaP.

Discover how the telecommunications industry can revolutionise its business model by embracing digital financial services and banking.

According to the World Bank, “one of the most important factors leading to high remittance prices is a lack of transparency in the market.

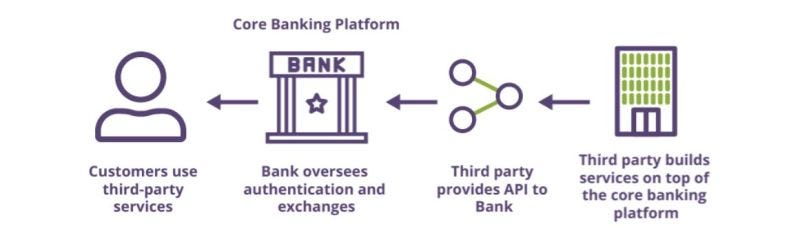

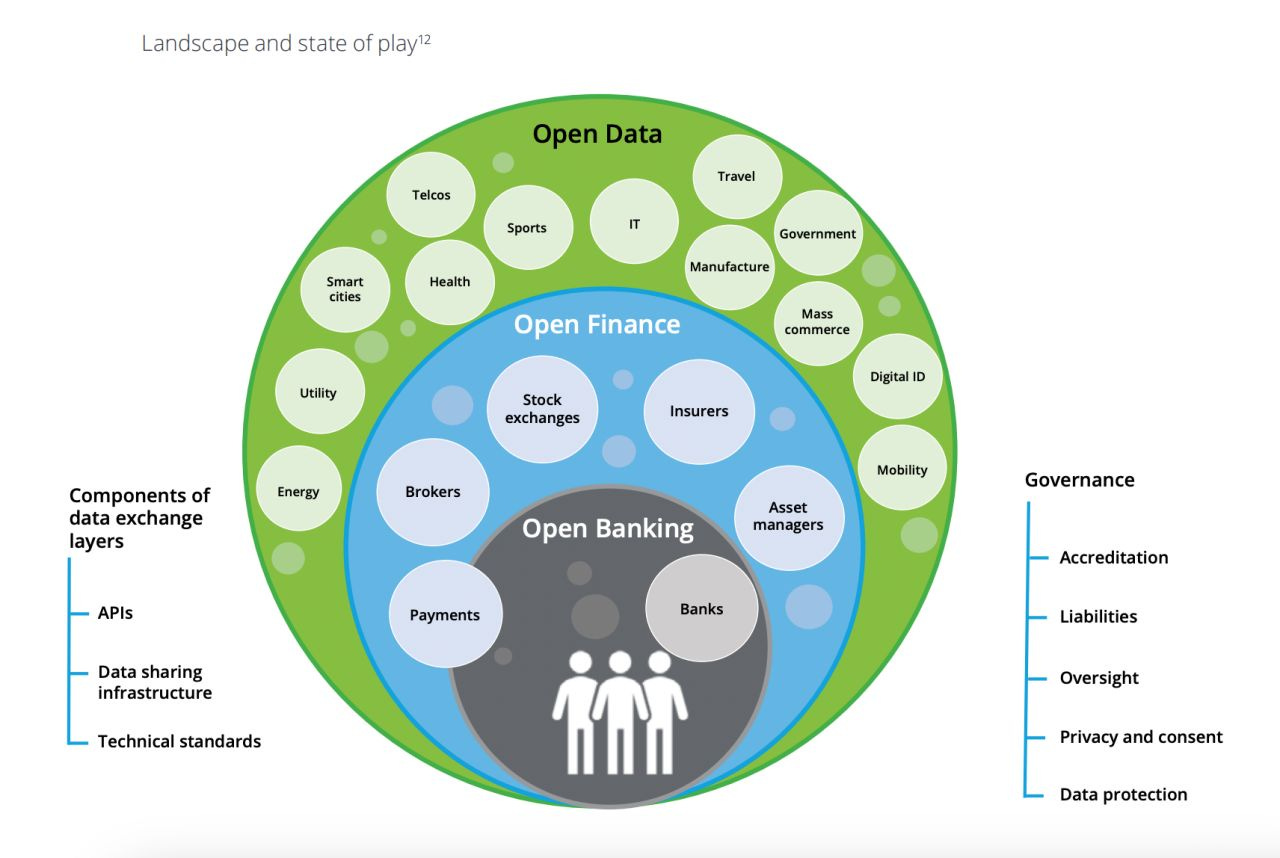

In this report from the IIF and Deloitte we look at the impact of data policies and the importance of broadening the scope from Open Banking to Open Data, not just Open Finance.

When choosing a payment provider, consumers ranked security, trust and transparency as most important, while SMEs added one more factor to the list: the ability to embed a solution into their business software.

👀 NEWS HIGHLIGHT

The digital lender, which is backed by Goldman Sachs, is in talks with an Asian bank about taking its Engine banking-as-a-service platform into a country in Asia, Nick Drewett, chief commercial officer at Starling, told CNBC.

📊 INFOGRAPHIC

The bank lost a net 7,635 switchers during the first three months of 2023.

📰 ARTICLE

Debanking - the process of denying or removing financial services to people owing to their political views - has morphed into a political issue in recent weeks.

This came about after the former Brexit party leader Nigel Farage made a subject access request to private bank Coutts, which is owned by NatWest, after his account was set to be closed by the bank.

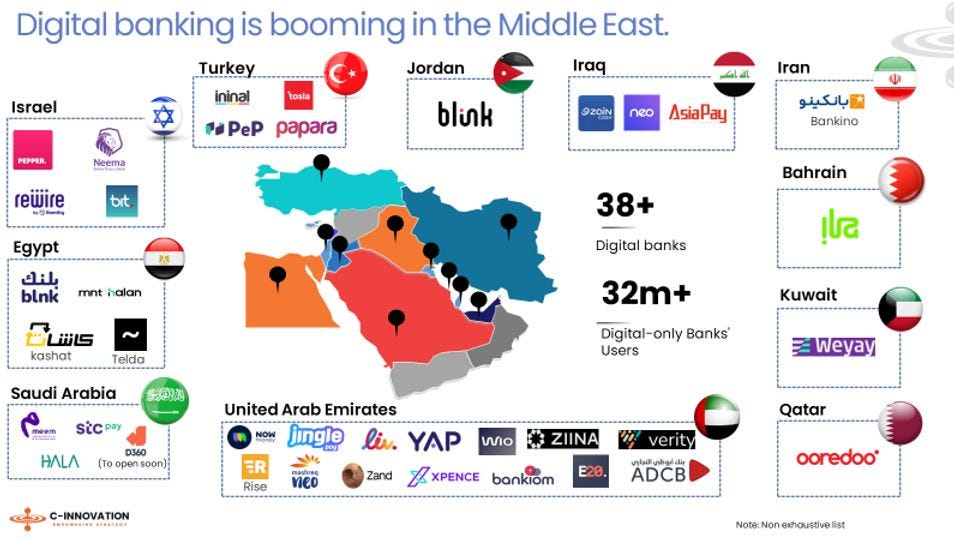

Independent startups and corporate-backed entities have pursued different trajectories in their efforts to carve a niche in the digital banking landscape.

Independent brands have been characterized by their rapid expansion strategies, leveraging simple payment products and streamlined licensing processes.

👨💻 BLOG

This blog offers a glimpse into the initial insights discovered in our forthcoming report, which will delve deeper into the digital banking ecosystem of the Middle East.

Though the company has made substantial progress — lowering its quarterly losses from a peak of $88 million in Q4’21 to about $27.5 million last quarter, Varo’s progress on its “path to profitability” appears to have stalled.

💬 INTERVIEW

Revout Lite is a streamlined version of the Revolut app which can be used to send and receive money, enabling customers in Armenia to make fast, free and secure money transfers, domestically and internationally.

💡INSIGHTS

MoneyLion recorded a net loss before other expense and income taxes of $1.7 million for the second quarter of 2023 versus a net loss before other income and income taxes of $26.9 million in the second quarter of 2022, and a net loss of $27.7 million for the second quarter of 2023 versus a net loss of $23.1 million in the second quarter of 2022.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ Tinkoff Bank application disappeared from Google Play.

⭐️ Tandem Bank boots interest rates to 5%.

⭐️ New suit says Wells Fargo opened more unauthorized bank accounts.

⭐️ Recognize Bank launches two new savings accounts offering up to 6.1%.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Barclays says tech companies should be liable for scams on their platforms. The call for action comes as Barclays data reveal that four in every five scams it encounters originate on tech platforms, including social media and online marketplaces.

Nigel Farage can bank with us, boss of London fintech Pockit says as it unveils $10 million raise.

UK government moves towards offering open banking payments for public services.

EUROPE 🇪🇺

N26 gives customers in France local IBAN numbers. The German bank hopes money transfers will become easier but it will change how customers declare their accounts on tax returns.

ABN AMRO introduces a new version of SurePay’s IBAN-Name Check API. The API performs an instant check on the correctness of your customer and supplier data (name and IBAN) based on real-time data from Dutch bank accounts.

Tink has announced the expansion of its existing partnership with An Post.

Bank of Russia set to begin digital ruble pilot. The Bank of Russia has revealed that it has enlisted 13 banks for the pilot testing of a digital ruble involving real-world transactions.

USA 🇺🇸

Greenlight Financial Technology launched the Greenlight Family Cash Mastercard to help those same customers build their credit before they reach adulthood.

Wells Fargo and BNP Paribas are among the latest banks to be hit with multi-million dollar penalties by US regulators over employee use of unofficial communication tools like WhatsApp and iMessage.

Dave narrowed its net loss in the second quarter, and CEO Jason Wilk says it can become profitable next year as planned by continually refining its core product, $500 cash advances underwritten by artificial intelligence.

Revolut to boost crypto team by 20% despite US exit. Digital lender eyes growth in other jurisdictions after pulling back from the US crypto market.

SoFi Bank has revealed in its quarterly earnings report that it holds $170 million worth of crypto, made up of Bitcoin, Ethereum, Litecoin, Solana, Ethereum Classic, and Dogecoin.

LATAM

albo has announced its acquisition of delt.ai for US$20 million. With this acquisition, albo has strengthened its position in Mexico’s financial services sector, becoming the only neobank to offer debit and credit products for both consumers and SMBs.

Thought Machine expands into Latin America and welcomes Cordada as latest client. Cordada will use Thought Machine's cloud-native core banking platform, Vault Core, to develop highly personalized financial products for SME lenders and fintechs across Latin America.

Klar has entered the Mexican savings market, ready to compete with Nu and Ualá, promising up to a 14% annual interest rate.

ASIA

Kakao Bank posts strong Q2 results. Kakao Bank is one of the few digital lenders that has reached profitability and stayed there, as it showed with its solid second-quarter earnings.

AUSTRALIA 🇦🇺

ANZ is investing in a new security capability designed to detect mule accounts being used to receive funds from scam victims and other criminal activities.

Bendigo and Adelaide Bank have banned high-risk payments to digital asset exchanges for its 2.3 million customers to combat fraud.

MOVERS AND SHAKERS

Sanjiv Somani, the JP Morgan exec overseeing the bank’s fintech challenger business Chase in the UK, has stepped down.

OPPORTUNITIES

The Bank of England is on a recruitment drive for UK researchers and academics to join a newly-created CBDC Academic Advisory Group (AAG).

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.