👀 NEWS HIGHLIGHT

This collaboration means enhanced onboarding journeys, smoother compliance processes, and exceptional customer experiences for financial institutions of all sizes.

📰 ARTICLE

US banking regulators have raised risk and compliance concerns over Goldman Sachs’ partnerships with financial technology companies.

A division of the bank’s transaction banking business (TxB) has stopped signing on riskier fintech clients following the warning by the Federal Reserve earlier this year.

Current CEO Stuart Sopp says the fintech has opened 4.5 million savings accounts for mostly low-income customers since it launched in 2015. Now Current is moving beyond deposits, both to help customers build up their credit scores and to realize a goal of achieving profitability by the first quarter of 2025. It has launched a secured credit card called 'Build' and more loan products are in the works.

💡INSIGHTS

Canadians’ reliance on their smartphones continues to increase. Interac data reveals a 53% jump in the use of Interac mobile payments in stores and a 17% surge in its use for e-commerce purchases between August 2022 and July 2023.

Over 1 billion of these mobile transactions have taken place within a 12-month period for the first time ever.

Open banking, the ground-breaking financial technology, has reached a significant milestone, surpassing 11.4 million payments in July 2023. This achievement reflects a 9.3% increase in total payments compared with the previous month, highlighting the growing adoption of open banking services.

By the end of August, the tool had reportedly “reached 8.6 million active customers, more than double the 3.5 million recorded in January.” During the same period, the solution “achieved the milestone of R$ 14.6 billion in assets under custody.”

🎤 PODCAST

Miguel Armaza interviews Pedro Conrade, CEO/Co-Founder of Neon, one of the largest digital banks in Brazil and Latin America, serving almost 20 million clients.

🧐 ANALYSIS

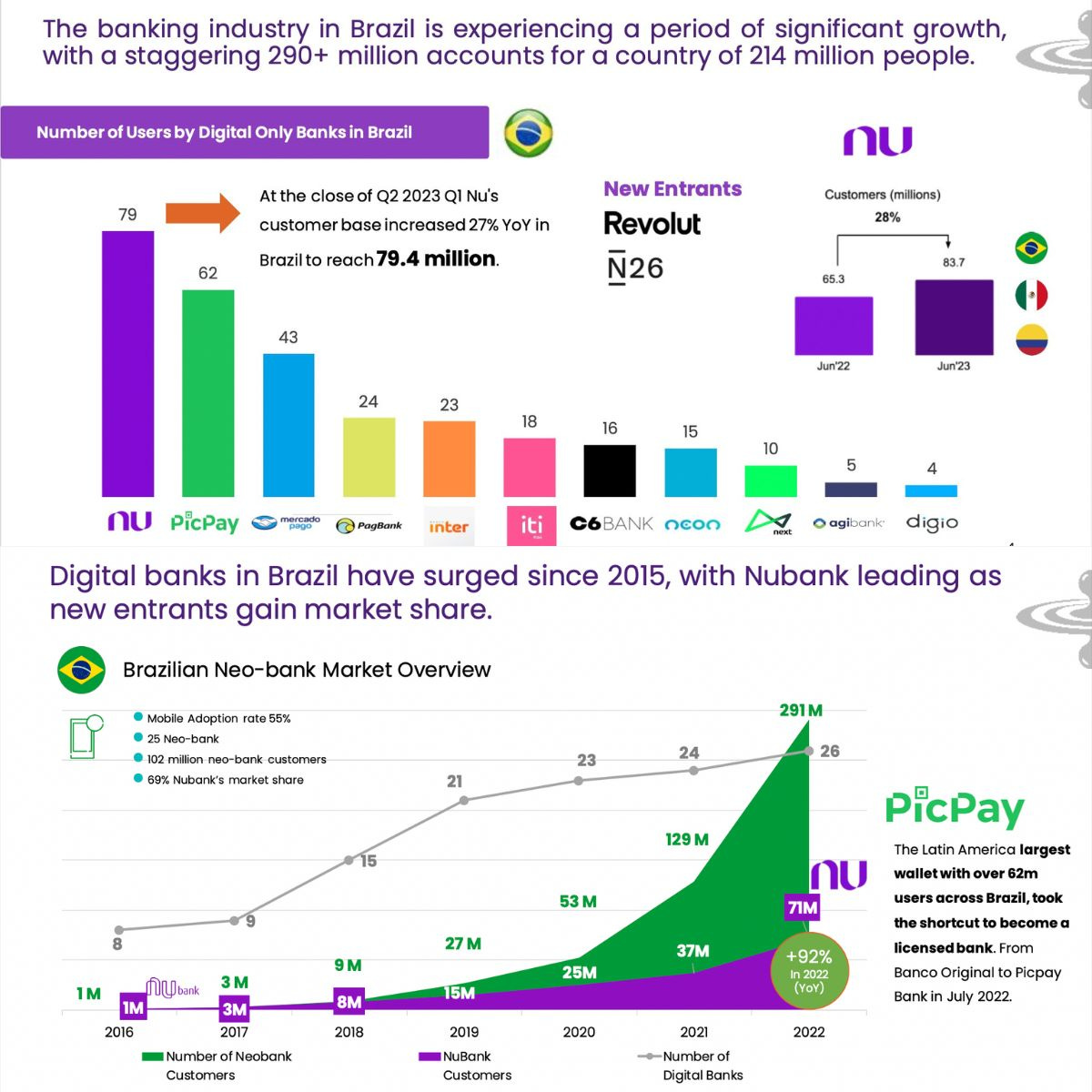

Over the past decade, digital banking has surged in Brazil🇧🇷, a country with 290 million digital accounts for its 214 million people.

The landscape has been shaped by Brazil's booming economy, flourishing e-commerce sector, and regulatory changes from the Central Bank, such as allowing FinTechs to offer credits and introducing open banking and the Instant Payment System (PIX).

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ Revolut establishes new lending arm in Australia.

⭐️ N26 CPO Gilles BianRosa steps down, becomes supervisory board member.

⭐️ JPMorgan increases stake in Brazilian digital bank C6 to 46%.

⭐️ Up is set to launch 'Up High', a new tier of banking for a monthly fee, offering more services.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

LHV Bank has teamed up with Raisin UK to move into the personal savings market.

EUROPE 🇪🇺

ING Bank is facing a lawsuit involving millions of euros from Efri. Efri argues that Payvision, a subsidiary of ING, was seriously negligent in vetting its clients, thereby facilitating a large-scale scam that targeted individual investors.

Ivy is announcing some funding in its bid to make that a reality. The company has raised $20M to take open-banking payments internationally.

Deutsche Bank is reportedly engaged in early stage talks with digital investment and broker platform Scalable Capital over a potential investment or partnership deal.

USA 🇺🇸

VSoft Corporation has partnered with Pidgin to bolster its ability to take real-time payments, and improve its efficiency.

US Bank and Elavon have launched a new point-of-sale (POS) solution to help small business owners avoid making a “large upfront investment” when purchasing a new payments system.

CANADA

Bank of America is bringing its Global Digital Disbursements technology to Canada via the country's popular Interac e-Transfer system.

LATAM

Neon has reached a significant milestone by serving 26 million customers and accumulating a credit portfolio worth R$ 4 billion.

Openbank signed an alliance with fintech GOcuotas to provide debit card financing in Argentina. Through this partnership, customers can purchase clothing, footwear, electronics, and cosmetics from multiple brands with interest-free installments.

ASIA

Pathao is awaiting a central bank license to set up a digital bank. By securing a digital banking licence, Pathao would have the necessary regulatory framework to unleash its cutting-edge technology.

Nagad has equipped itself to grow into a digital bank, which will make available all financial services on a single platform.

Bank Indonesia, Bank Negara Malaysia, Bank of Thailand to support the use of local currencies.

Indian Bank has announced its partnership with OneCard, aimed at introducing state-of-the-art, mobile-first, contactless, metal co-branded credit cards.

AUSTRALIA 🇦🇺

HSBC will sell its New Zealand mortgage portfolio to an NZ subsidiary of the Australian securities exchange-listed Pepper Money.

Douugh turned its attention to the rollout of its product in Australia. It hasn’t fared any better in the local market.

MIDDLE EAST

Commercial Bank of Dubai (CBD) and PwC Middle East have signed a Memorandum of Understanding (MOU) to accelerate the adoption of AI technologies across CBD’s operations.

Colendi is launching Turkey’s first digital deposit bank after approval from the Banking Regulation and Supervision Agency (BRSA).

AFRICA

TymeBank introduces PayShap, the country's first free real-time interbank digital payment service for its 7.6-million customers, enhancing affordability for all.

Anchor has raised $2.4 million in seed funding from a number of prominent investors, including Goat Capital, FoundersX and Rebel Fund.

MOVERS AND SHAKERS

Alexander Zwart to join Rabobank managing board as chief innovation and technology officer. He will be responsible as Managing Board member for Technology, Data and Analytics, Digital Transformation and Innovation at Rabobank.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.