Digital Banking | 2023 #5

Weekly news up to Monday, 30rd of January 2023

REPORT

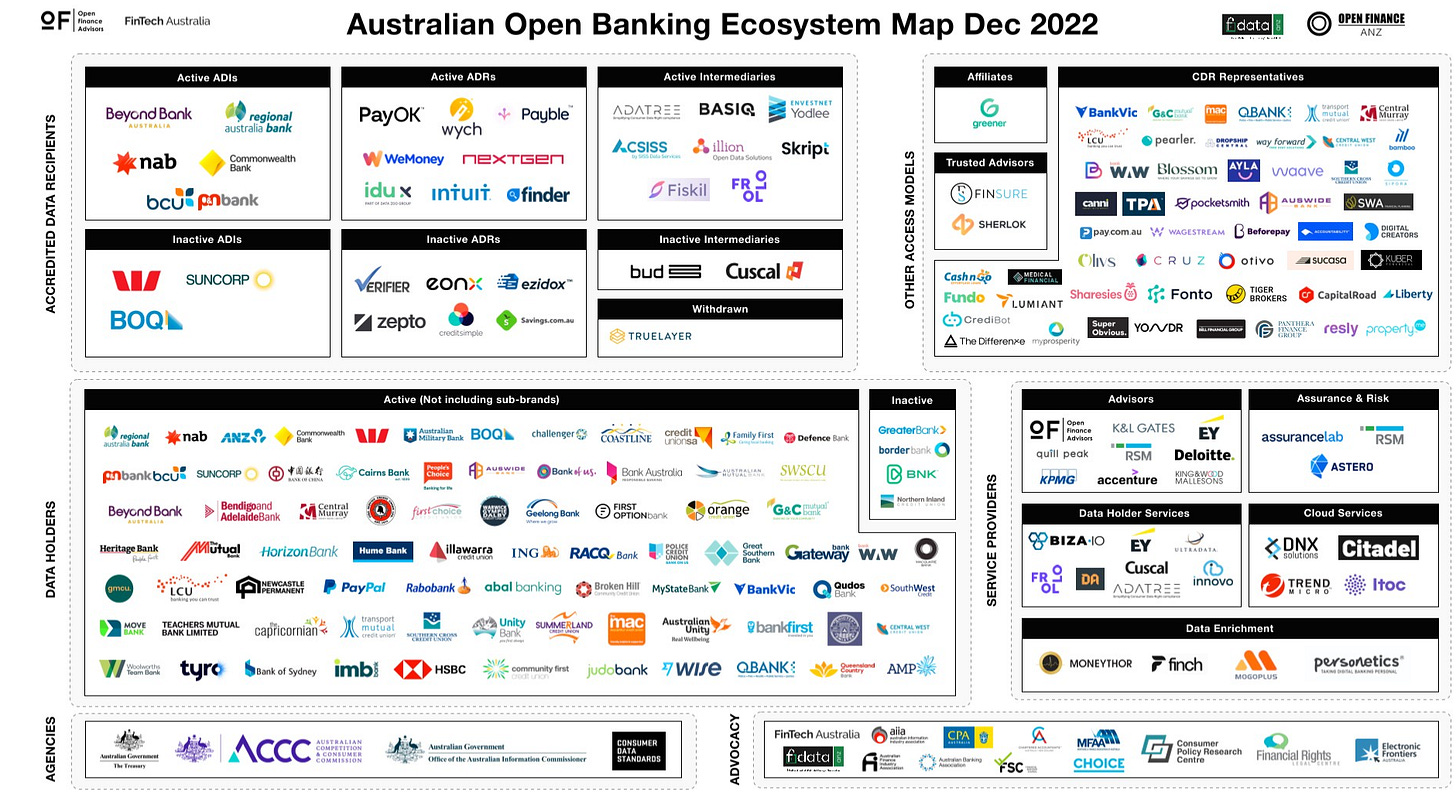

Here you have the latest 🇦🇺Australian Open Banking Ecosystem Map & Report👇

It's the first independent map of Australia’s Open Banking Ecosystem focussing on the Consumer Data Right.

REPORT

Here we go again🚀: This new chapter of the 900-day Built for Mars study is all about the hidden complexities of bank cards👇

You might have had a sense that all the experiences are starting to look fairly similar—well, Peter Ramsey shows you exactly what's happened over the last two and a half years and the underlying storyline of 'who's copied who'.

REPORT

As mobile wallets gain in popularity, a growing number of Americans still prefer the convenience of plastic.

👀 NEWS HIGHLIGHT

Wise delists Atlantic Money – breach of its commitment to transparency.

With its flat fee transfers for £/€ 3, Atlantic Money was often shown as the cheapest option available in a number of G10 currencies.

📰 ARTICLE

Open Banking’s strategic working group finds “limited agreement” on the future UK direction of open banking.

The draft report, seen by AltFi, details “very stark differences” in industry views on consumer protections, the levels of fraud caused by open banking payments, API reliability and much more.

💡INSIGHTS

Did you know that the UK and the Nordics are Europe’s #openbanking frontrunners? 🏃♀️

Read more on open banking developments in Europe below and swipe to check the adoption levels.

👨💻 BLOG

Here is dialling it up to 11 to include the latest in the world of BaaS from the latter half of 2022, giving you a speedy rundown of all the action that has surfaced in this rapidly evolving field.

📰 ARTICLE

Banking on consequences: an examination of penalties imposed on financial institutions.

As the backbone of national and global financial systems, banks are held to the highest standards of accountability, financial stability and fairness. However, the consequences can be harsh and far-reaching when these standards are not met.

🧐 ANALYSIS

Launching into new markets has long been a common strategy for money transfer and remittance players looking to increase the size of their business, and the last few months have seen a flurry of new intercontinental launches.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ Revolut added two more precious metals — platinum and palladium to the list of commodities that its customers in Singapore can trade through its app.

⭐️ Lloyds Banking Group invested £4 million in Caura, a motoring app that brings together all driving-related payments together in one place.

⭐️ HMRC’s open banking payments via Ecospend hits £10.5bn.

⭐️ Neo-banking is down but not out. 2022 brought big challenges for the Neobanking sector.

⭐️ Here is key takeaways of Accenture’s Top 10 Banking Trends for 2023.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Starling and Monzo lead the neobanks as current account switching booms.

LiveMore Capital secured a credit facility of up to £250m from Citi taking total funding raised by the lender since inception to nearly £600m.

Nine new shared banking hubs are to be opened across the UK as the country's high street lenders push ahead with further branch closure programs.

EUROPE 🇪🇺

Garanti BBVA customers can now view account activity from other banks on mobile app.

Commerzbank is suing EY for the recovery of €200 million in losses from the collapse of disgraced German payments firm Wirecard.

Worldline announced the extension of a partnership with ING Bank.

SaaScada partnered with Relio to support its business digital payments offering, set to launch later this year.

USA 🇺🇸

Metro Bank is moving into the auto finance market, beginning with real-time hire purchase loans for used cars currently available through motor brokers.

AFRICA

Reserve Bank testing new payment system in South Africa – launching this year. The new system forms part of the South African Reserve Bank’s (SARB) Vision 2025, simplifying and making real-time payments more affordable and efficient.

TymeBank roped in retail giant TFG (The Foschini Group) to exploit its footprint in expanding its financial products and services to its expanding customer base.

Adaverse backed by EMURGO Africa with a mission to scale Web3 projects on the Cardano blockchain, announced an investment in BoundlessPay.

MOVERS AND SHAKERS

The Banking as a Service Association announced the hire of William Briggs to serve as its first Chief Executive Officer.

N26, The Mobile Bank, announced the appointment of Arnd Schwierholz as its new Chief Financial Officer.