Digital Banking | 2023 #9

Weekly news up to Monday, 27th of January 2023

REPORT

Judo Bank announced the 2023 half-year result in a webcast with Joseph Healy, CEO, and co-founder, and Andrew Leslie, CFO.

Key takeaways:

🚀 Strong 1H23 result with Dec-22 GLAs of $7.5b up 23%, revenue up 67% and profit before tax up >300% to $53m

👉 On track to achieve FY23 guidance and key business metrics at scale

💰 Significant organic capital generation contributing to robust CET1 ratio of 17.3%

REPORT

The Banking as a Service industry is worth billions. Even a conservative estimate, which leaves out non-traditional banking services like point-of-sale lending and customer-consented payment initiation services, projects a rise in total BaaS revenue from US$1.7 billion in 2021 to over US$17.3 billion in 2026.

REPORT

Check out this FinTech report by HSBC about Reinventing banking for young millennials 👇

👀 NEWS HIGHLIGHT

Revolut launches a savvier way to shop where customers earn cashback from their favorite retailers. The new service, ‘Shops’, lets users search and browse products from leading brands within the Revolut app.

These include local favorites ranging from John Lewis and MyProtein to Boots and Co-op; international retailers like Amazon, ASOS, and Wish; and big brands’ online stores, including Nike, Charlotte Tilbury and a range of luxury fashion retailers.

😎 SPONSORED CONTENT

It's not too late to get a Ticket. Get your late registration Ticket by March 3rd and you’ll still benefit from almost everything our meetings program - and our full event - delivers. March 19-22 at the Aria, Las Vegas.

📊 INFOGRAPHIC

In Asia, fintech companies are witnessing strong growth in the cross-border payment area, recording rates often three or four times those of incumbents.

📰 ARTICLE

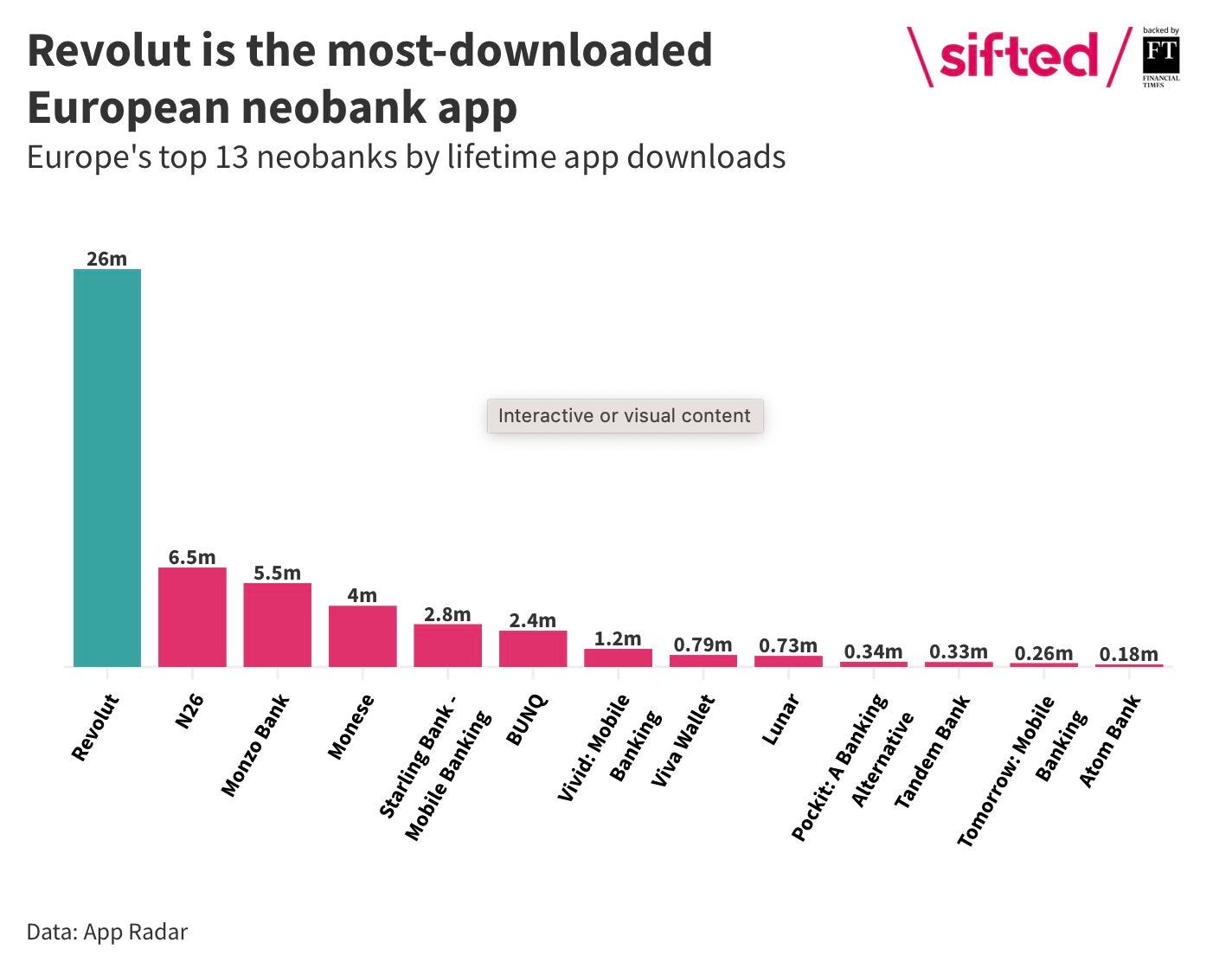

Customer acquisition has been the holy grail for European banking apps. But who’s coming out on top?

To find out, App Radar analyzed how many downloads Europe’s top neo banks and legacy bank apps attracted between 2021 and the end of 2022 using data from the Google Play Store.

💡INSIGHTS

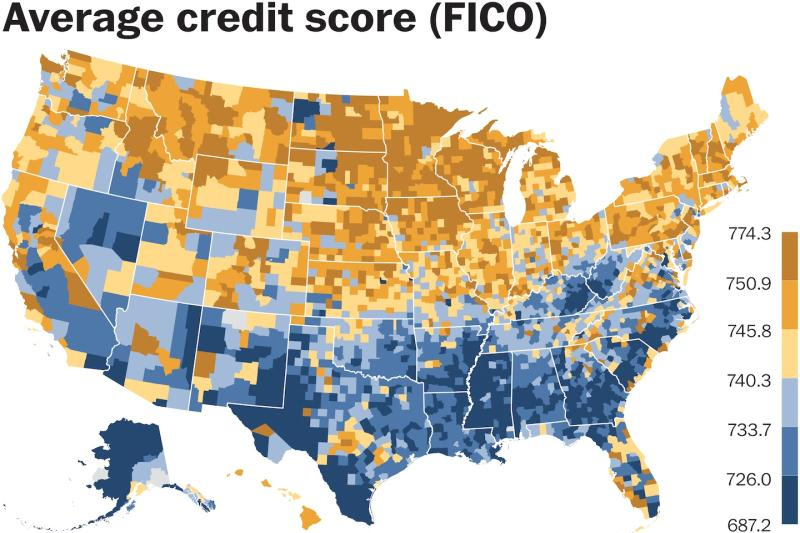

Almost every corner of America’s most populous region every race, and every income bracket appears to have low credit scores. But why? 👇

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ Bunq reached a pre-tax profit of €2.3m for the last quarter of 2022 and says it expects to continue to turn a profit throughout 2023.

⭐️ TWINT starts the new year by achieving the 5 million active users milestone.

⭐️ A joint whitepaper from NatWest and National Australia Bank called on both countries to learn from each other’s open banking implementations.

⭐️ The Bank of Japan announced that it will launch its Central Bank Digital Currency pilot program in April this year to test the use of a digital yen.

FinTech Meetup in Vegas is just around the corner and I will start and close it with a bang. Join me and let's do this together!

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

The number of consumers and SMEs actively using open banking-powered services in the UK has reached seven million for the first time.

Finastra announced a partnership with Integro Technologies a subsidiary of Aurionpro to offer Integro’s SmartLender Trade Limits solution alongside its own Trade Innovation solution.

tell.money contracted to integrate its Gateway solution into the Solaris platform.

Revolut is partnering with grassroots UK-based charity British-Ukranian Aid.

Revolut claims it is set to become a branch in Portugal in the coming months, a change in banking license.

Investment banks approach Monzo Bank over potential IPO as $4.5 billion FinTech plots investing push.

Barclays Eagle intends to allocate a “big chunk” of the £12 million Digital Growth Grant toward the UK’s tech industry.

Mastercard and Visa are set to face another multibillion-pound UK lawsuit over Multilateral Interchange Fees.

EUROPE 🇪🇺

Intesa Sanpaolo told staff they can sign up to test from March 1 the app for the new digital lender it is set up with Thought Machine.

The State Treasury of Finland, Kela, and Enfuce partnered to deliver a prepaid disbursement card service that allows the State Treasury and Kela together with Enfuce to provide a secure, reliable, and easy-to-use prepaid payment solution in situations where account payments are not an option.

Radicant Bank sacked its CEO and co-founder after an internal email blasting critics and local politicians were leaked online.

USA 🇺🇸

A trio of regulators including the Federal Reserve warned banks to be mindful of liquidity risks related to cryptocurrencies, the latest move by U.S. officials to limit the economy’s vulnerability to the tumultuous market.

Wells Fargo laid off hundreds of mortgage bankers in a new round of job cuts.

ASIA

The Siam Commercial Bank unveiled its plans to become a fully digital bank in wealth management through its “Digital Bank with Human Touch” vision.

Ascenda announced a strategic partnership with HDFC Bank to drive growth for its payments business.

Freedom Finance Bank Kazakhstan JSC and Visa partnered to facilitate cross-border payments from the central Asian country.

AFRICA

KCB Bank Kenya partnered with fintech Sopra Banking Software to drive its digital banking transformation.

MOVERS AND SHAKERS

RTGS.global appointed chief commercial officer Jarrad Hubble as its new interim CEO.

Varo Bank announced the appointment of Wook Chung as Chief Product Officer.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.