👀 NEWS HIGHLIGHT

U.S. regulators have seized Republic First Bancorp, agreed to sell it to Fulton Bank, underscoring the challenges facing regional banks a year after the collapse of three peers.

Philadelphia-based Republic First, which had abandoned funding talks with a group of investors, was seized by the Pennsylvania Department of Banking and Securities.

📰 ARTICLE

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ Brazilian Banking as a Service company QI Tech is valued at over $1 billion.

⭐️ Visa joins AWS partner network.

⭐️ Stc pay can drive emerging Saudi digital banking market with new platform.

⭐️ Nu now allows customers to deposit and withdraw Bitcoin.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Zopa is in no rush to IPO, but the digital banks are coming for the incumbents. The likes of JPMorgan Chase and Goldman Sachs might have a stronger competitor than they realise.

Allica Bank reports first profitable year. The digital-only lending startup moved into profitability in June 2022 having reached £1 billion of lending and migration of 2000 new customers from AIB.

£2.9bn takeover of Virgin Money moves closer as shareholders are sent offer details. Over the first half of the year, the firm said: “Virgin Money delivered continued growth in relationship deposits and target lending segments, whilst maintaining a broadly stable margin, with ongoing cost efficiencies mitigating inflation.”

Revolut is exploring plans to monetize customer data through sharing it with advertising partners, as they seek new sources of revenue while its application for a UK 🇬🇧 Banking License remains in limbo.

Monzo offers customers free sausage rolls in premium subscription drive. The new subscription plans Extra, Perks and Max follows a study conducted among more than 45,000 customers to understand what works best for them, alongside research into their everyday spending habits.

Meet the Monzo millionaires. The fresh round from a new investor like Alphabet still felt like a big moment for the company, which hit profitability for the first two months of 2023.

Standard Chartered Offers Banking As A Service (BaaS) Through audax. The success of this approach has since led the bank to launch audax, which is a separate business line offering the technology stack to other financial institutions.

LHV Bank moves into profit. Over the past year, LHV has entered the personal savings market through a deal with deposit platforms Raisin and Flagstone and moved into SME loans after taking over the lending book of Manchester-based regional lender Bank North.

Frost Bank Improves Customer Experience with Atomic Direct Deposit Switch. Incorporating Atomic into its operations will help Frost achieve its goals of improving customer satisfaction and making banking more accessible for all.

EUROPE 🇪🇺

Danish challenger bank Lunar trials voice-enabled AI-powered chatbot- voiced by CEO. The idea is currently being road-tested by Danish neobank Lunar, which along with UK advertiser-subsidised BNPL firm Zilch recently spoke about AI and generative AI and how they were deploying it within their organisations.

Russia's Tinkoff plans share issue to fund Rosbank deal. Russian online bank Tinkoff plans to issue up to 130 million additional shares to help fund a deal to integrate fellow lender Rosbank into its holding structure, the company said on Tuesday.

Veritran partners with Swift. Throughout the partnership, Veritran will join the Swift Partner Programme in order to allow its collaborators to be able to provide their end users access to several Swift solutions that will increase transparency, security, and efficiency in cross-border transactions.

Standard Chartered has announced its partnership with Visa in order to optimise cross-border payments, as it joined the Visa B2B Connect network. The solution is expected to expand and optimise the financial institution’s existing suite of payment services, with a priority set on facilitating faster and more cost-effective business-to-business (B2B) transactions across borders and markets.

USA 🇺🇸

Goldman Sachs is considering applying for a local banking licence to extend a broader suite of lending products to its ultra-high net worth clients in Australia, the bank’s co-head of global private wealth management, John Mallory, says.

Capital One Financial and Discover Financial Services spent months talking and even walked away from negotiations at one point before the two companies reached a deal that, if it gets approved, will create the largest credit card lender in the United States.

Americans are losing millions of dollars every year to criminals who steal money from their bank accounts through fraudulent wire transfers. Some U.S. senators are now pressing major banks for answers about what they are doing to stop the scammers.

Grasshopper Debuts Digital Application for SBA Loans. Small business owners can now get pre-qualified for an SBA 7(a) loan in less than 10 minutes from any device using this online form.

Marqeta Partners with OakNorth to Offer Commercial Cards in the UK, Embracing Growing Small and Medium-Sized Business Demand for Better Banking Tools.

In response to the growing demand for climate-friendly financial services, FinTech and sustainability industry veteran Tim Newell has reached an agreement with climate finance company Aspiration Partners, Inc., to spin off Aspiration’s green consumer financial services brand into a new standalone company.

JPMorgan Chase is preparing a broad rollout of a biometric authentication system at U.S. retailers in 2025, following experiments it has run over the past year. JPMorgan Chase will offer biometric payments as part of its omnichannel payments platform, which also supports Tap to Pay.

LATAM

Nubank's NuInvest gets green light to operate in foreign exchange. NuInvest, Nubank's investment broker, has just received authorization from the Central Bank (BC) to operate in the foreign exchange market.

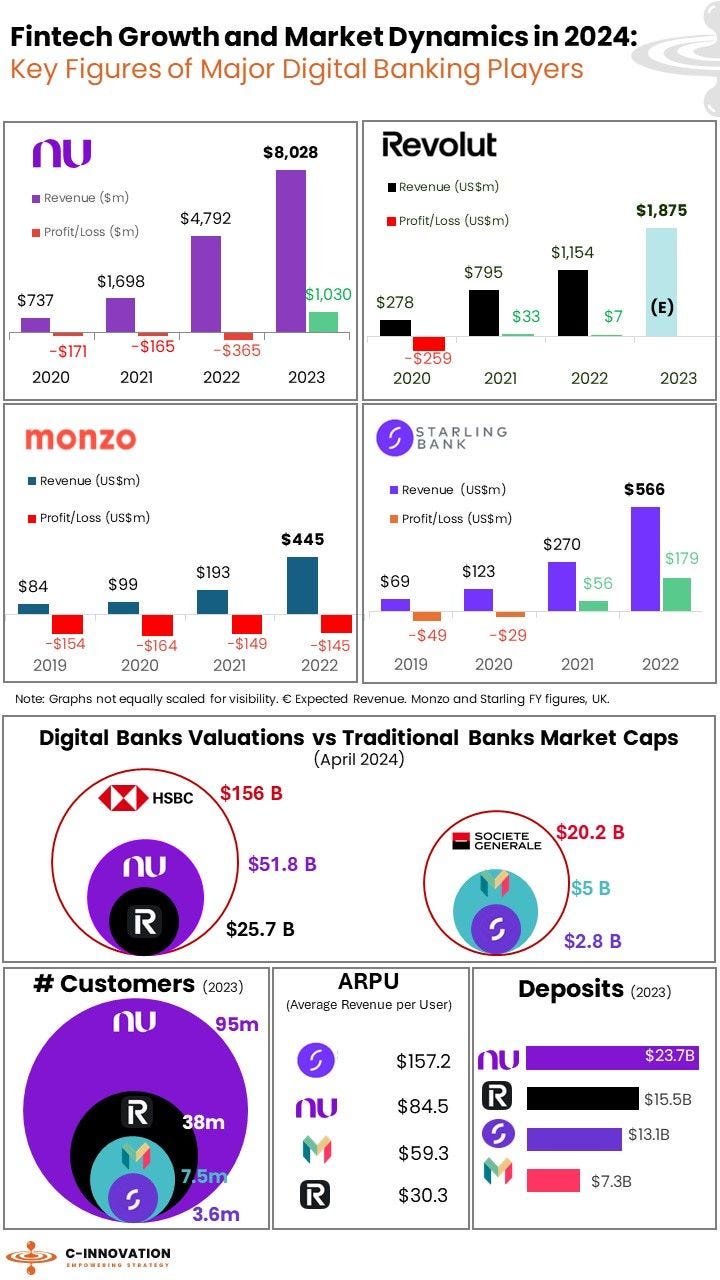

Nubank’s finance chief on the Brazilian bank’s three-pillar approach to growth. Guilherme Lago became CFO at São Paulo, Brazil-headquartered Nubank in February 2021, 10 months before the FinTech giant went public with a valuation of more than $40 bn.

Nubank announces the launch of Nubank+ and a groundbreaking partnership with Max in Brazil. The partnership with Max in Brazil, also announced today, is part of the Nubank+ benefits, offering access to the streaming platform at no extra cost for the first 12 months.

FinTech Prex becomes the first unbanked digital wallet to be interoperable in Peru. The FinTech company reaffirmed its commitment to the vision of open and barrier-free payments through the alliance with GMoney, an electronic money issuer.

Revolut is authorized as a bank in Mexico. The firm headed in Mexico by Juan Miguel Guerra Dávila will have to pass an operational audit before the bank can start operations with its flagship product.

ASIA

Aeon Bank to start its Islamic digital operations in Q2 2024. Aeon Bank, one of the five digital banking license holders in Malaysia, is set to start operations and launch its banking application by the end of the second quarter this year (Q2 2024).

United Arab Emirates (UAE)’s digital asset infrastructure provider Fasset has inked deal with Malaysian lender Malaysia Building Society Berhad (MBSB) to explore blockchain-powered Shariah-compliant banking solutions in Malaysia.

After turning profitable in its home market South Africa and establishing a presence in the Philippines, global digital bank TymeBank is set to strengthen its foothold in Southeast Asia’s emerging markets by launching in Vietnam and Indonesia this year.

National Bank of Iraq goes live with Temenos core banking and payments. With this implementation, NBI moved from its legacy systems onto the same core banking platform as other entities in the Capital Bank Group.

MOVERS AND SHAKERS

10x Banking Appoints Will Dale as Regional Vice President as It Expands in APAC. The appointment, which sees Dale join from Mambu where he held the role of Regional VP for nearly five years, sees 10x cement its presence in APAC as part of its mission to bring core banking transformation to financial institutions across the region.

Temenos appoints CEO; says sales hit by Hindenburg report. The company says that some clients delayed deals while an independent review into Hindenburg's claims was carried out.

Revolut to boost staff by 40 per cent this year amid rapid expansion. The London-based startup reached 10,000 employees worldwide earlier this month, adding some 2,000 staff since the start of 2024. It plans to boost this number to 11,500 by the end of the year.