Digital Banking: bunq is embroiled in a conflict with British shareholder | 2023 #30

Weekly news up to Monday, 24th of July 2023

REPORT

Banks today find themselves buffeted by a range of forces, many of which are accelerating. Long-term trends such as climate change and demographic ageing are picking up. Shock events like the covid-19 pandemic and the war in Ukraine have destabilised markets. The direct threat posed by both fintech and big tech companies is growing. Taken together, these forces of change are causing banks to evolve business models to meet new societal expectations and engage customers in highly dynamic digital environments.

👀 NEWS HIGHLIGHT

Bunq founder, Ali Niknam, has initiated a lawsuit following failed negotiations.

PSC, a London-based private equity investor, refuses to contribute further to the capital needs of the company and has asked Niknam to develop an alternative strategy for slower growth.

This includes selling off Bunq's subsidiary, Capitalflow, an Irish loan provider Bunq had only acquired a year and a half ago.

📊 INFOGRAPHIC

📰 ARTICLE

First of all, the German neobank confirmed the dismissal of 15% of its Brazilian workforce last week.

Furthermore, analysts estimate that N26 has only 200,000 Brazilian customers after 2 years of operations, though Brazil CEO Eduardo Del Guerra Prota claimed that N26 Brazil has a waitlist of 800,000 users onboarding about 3k evert week.

FedNow went live today. FedNow is a payments and transfers service provided by the US Federal Reserve. Approved financial institutions may use the service to enable immediate payments and transfers. Currently, there are 35 approved institutions out of around 9000 banks and credit unions in the US.

City minister Andrew Griffith has summoned bank chiefs for a meeting to discuss how customers can be protected from “being de-banked” after Coutts cut ties with Nigel Farage.

👨💻 BLOG

Interest in central bank digital currencies (CBDCs) is on the rise in Latin America and the Caribbean (LAC), with several countries making significant advancements in their adoption, according to IMF. While El Salvador gained attention for legalizing Bitcoin as a form of payment, other LAC nations are exploring CBDCs to enhance financial inclusion, lower cross-border remittance costs, and strengthen payment systems.,.

Read this full blog by Zach Anderson.

💡INSIGHTS

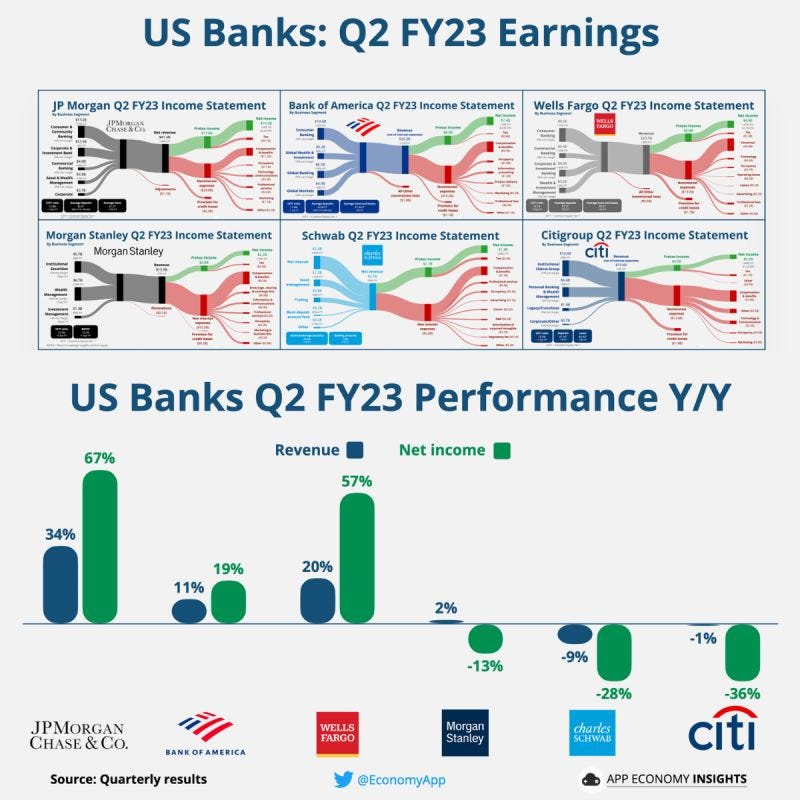

According to the most recent Federal Reserve stress test, the 23 largest US banks have showcased resilience despite recent banking failures.

However, indications from the Fed suggest that future stress tests might see an increase in their stringency, stemming from lessons learned from this year's banking crisis.

Digital banking and digital banks are on the rise globally. Can the challenger banks overcome their challenges to provide a superior customer experience at very low cost, especially in Singapore, with strong competition from the incumbents and a limited pool of the unbanked and underserved?

International fund transfers made to Romania using Revolut increased by 5% YoY in the first half (H1) of 2023, according to a recent report released by the company.

The rise of digital banking, such as contactless payments and digital wallets, has helped bring more African consumers online, as digital penetration grows across the region, and nations formulate and implement progressive banking regulations to help administer the degree of digital banking adoption.

2Q23 provision for credit losses was $615 million, reflecting net provisions related to the credit card and point-of-sale loan portfolios, driven by net charge-offs and growth, and individual impairments on wholesale loans, partially offset by a reserve reduction related to the repayment of a term deposit with First Republic Bank

🧐 ANALYSIS

A Comparative Analysis:

The UK’s leading neo-banks have now submitted their annual accounts for 2022, except for Revolut.

This year was truly transformative as many neo-banks achieved a significant milestone, which was led by Starling and Revolut last year who created history in the neo-bank industry by announcing their first-ever annual profits in 2021.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 DIGITAL BANKING HIGHLIGHTS

⭐️ Dimon confirms JPMorgan’s plan to launch digital bank in Germany.

⭐️ Swedbank partnered with competitors to create a new payment method.

⭐️ Temenos achieves certification for Fed Now.

⭐️ Virgin Money to close 39 branches in shift to online.

⭐️ Bunq hits 9 million users in Europe, doubles deposits in four months.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Revolut is being massively criticized after an allegation made by Tristan Tate that his account was locked with a staggering $700,000 inside.

Wise reported a strong start to its new financial year this morning, with a huge 66 per cent jump in its income for the first quarter of 2024 to £311m.

The UK government has stepped into a row over bank inclosures vowing to clamp down on firms refusing to serve customers over apparent political links.

Wise is now attracting “a couple of thousand" new Irish customers every month.

Revolut has announced the launch of its new Joint Accounts product in the UK, after hitting 100,000 joint users across the EEA.

Atom bank turns in first annual profit. Set against a £2 million loss in 2022, Atom has doubled customer numbers to 224,000 over the year, luring new customers with a range of attractive interest-bearing savings accounts.

EUROPE 🇪🇺

ING and the European Investment Bank (EIB), has unveiled a new sustainable finance programme designed to bolster SMEs.

Nordea bolsters Nordic presence with Danske Bank’s Norwegian personal customer business acquisition.

The US Federal Reserve Board has fined Deutsche Bank $186 million citing “unsafe and unsound banking practices”.

USA 🇺🇸

Regional banks battle for deposits with tougher US rules looming. The biggest US banks are facing tougher competition for deposits and shelling out more to keep them. That doesn’t bode well for their smaller peers.

bunq has added cash-back and savings bonuses to its offerings designed for digital nomads. bunq now offers 1% cash back on food and drinks to Easy Money and Easy Green users, and 2% back on public transportation to Easy Green users.

The U.S Federal Reserve launches long-awaited instant payments service, modernizing system.

Fed banking regulator warns A.I. could lead to illegal lending practices like excluding minorities.

Bankjoy integrates with Plaid to enable seamless account management for businesses.

The Financial Conduct Authority (FCA) has warned banks that they must inform savers if better deals are available once the new Consumer Duty comes into force at the end of the month.

CANADA

EQ Bank launches Canada's first fully digital, no-fee FHSA Savings Account. Through EQ Bank's FHSA, prospective first-time homebuyers can also purchase GICs with current returns of up to 5.50%2 and a wide range of term options.

LATAM

Revolut ends the wait. It took 2 months for the UK-based neobank to onboard all customers from its Brazilian waitlist, but Revolut is now fully open for business in Brazil.

Ualá joined forces with Western Union in Mexico to let users receive remittances via mobile phone.

ASIA

China's central bank digital currency has passed $250 billion in transactions within one-and-a-half years of its launch.

AFRICA

Kuda has passed the six-million customer milestone in Nigeria, extending its corporate mandate of making financial services more accessible, affordable and rewarding to all Africans.

MOVERS AND SHAKERS

Starling Bank appoints, Ariane Vickman, as head of public affairs.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.