Digital Banking Weekly | 2021 #16

I have exciting news to share with you.

I recently announced a unique opportunity to invest in a Series A from a US-based neobank, through my Angel Investors Syndicate.

INTERVIEW

Find out how Novo, a Challenger Bank for SMBs, grew exponentially during COVID-19. Startup.info interviewed Michael Rangel, CEO, and co-founder of Novo, about problems with SMB banking:

COVID-19 had a K-shaped impact on startups, causing demand to decrease for some businesses (like restaurants) and an increase for others (like telehealth companies).

In the digital banking space, COVID-19 caused a significant increase in demand. In short, we’ve been drinking from the proverbial fire hose since lockdowns started about a year ago. At Novo, we grew our portfolio by 5x and processed more than $600M in transactions in 2020. We’ve also grown exponentially in the first quarter of 2021—when our competitor, Azlo, shutdown, many of their customers switched to Novo – positioning Novo as the leader in the space targeting Mainstream American Small Businesses. As we look toward the next year, our team shares a deep commitment to doing our part in helping these small businesses recover.

👉 Read more here.

REPORT

According to the following Whitesight piece: Green is the new Black in Fintech.

In recent times various banks have unveiled their trillion-dollar commitments towards the planet with a sustainable finance budget to be spent across multiple decades. The fintech industry is taking the mantle with a right-here-right-now approach to sustainability.

👉 Learn more here.

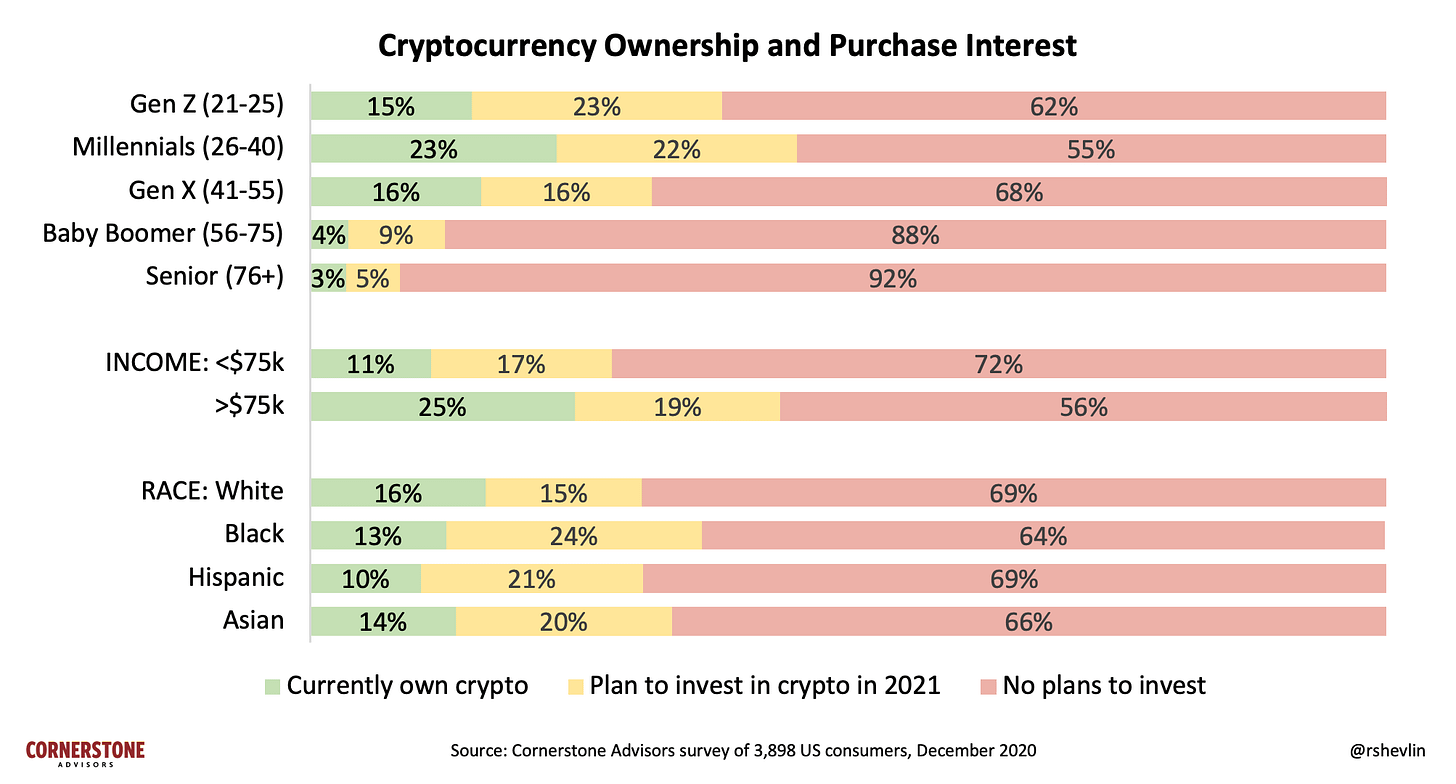

With Crypto leading headlines everywhere in the world, what are American banks doing to incorporate new crypto products and services for their customers?

A Cornerstone Advisors survey of senior bank and credit union executives found that eight in 10 financial institutions have no interest in offering cryptocurrency investing services to their customers—and just 2% said they were “very” interested.

This is highly unusual, given that almost every demographic shows a strong and growing interest in investing in cryptocurrencies.

👉 Learn more here.

ARTICLE

What will be the next fintech trend for neobanks?

Digital banks that were developed with millennials in mind have now turned their attention to the next generation, but their road to success is set to be bumpy.

“The best brand will eventually win in this digital banking era, so the ones that are really building a brand that clients believe in, not just another digital bank.”

According to fintech research group WhiteSight, there were nearly 60 neo banks catering to kids and teens around the world in 2020.

👉 Read more here.

THE CARD COLLECTION

Osper, a parent-managed debit card for young people, and Viacom CBS Consumer Products UK, is bringing a range of Nickelodeon characters to prepaid debit cards for under-18s.

Card designs include SpongeBob SquarePants, Nickelodeon Slime, Teenage Mutant Ninja Turtles, and JoJo Siwa.

👉 Learn more here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S DIGITAL BANKING SPACE

NEWS HIGHLIGHTS

Russian consumers are to get their first taste of the buy now, pay later phenomenon sweeping neighbouring European markets, courtesy of a new product from digital bank Tinkoff.

The Dolyame.ru service allows customers to split the purchase price of goods sold online into four equal parts. In order to make a purchase, they need only cover 25% of its price.

👉 Read more here.

INDUSTRY HIGHLIGHTS

⭐️ Yimba and Railsbank are joining forces to provide customers with products and services that will enhance their digital wallet experience. Link here.

⭐️ Revolut is laying the groundwork for expansion into India. In total, Revolut has earmarked a £25 million spend on building the business over the next five years, with plans to launch in 2022. Link here.

UNITED KINGDOM

ekko, an innovative new app, debit card and ecosystem that turns the tide on climate change, has launched in the UK with a strategic partnership with Mastercard. Link here.

Starling Bank has extended its latest funding round with a £50m investment from Goldman Sachs. Link here.

Finadvant, a London based fintech, launched their business banking platform for SMEs that are involved in international trade. The company is on track to create a banking ecosystem for their niche customers by offering various services essential for global trade. Link here.

EUROPE

Mastercard and Aion Bank, supported by technology partner, Vodeno, have signed a strategic partnership, whereby the digital bank has become a welcomed, certified member of Mastercard’s Fintech Express programme. Link here.

Lendify, a veteran Swedish digital lender, is being bought by Lunar, a Danish digital bank. The acquisition comes after a difficult 2020 for alternative lenders like Lendify. In particular, the startup saw its application for a credit licence rejected — dunking hopes of a public listing and a more competitive lending model — as well as the departure of its founder. Link here.

As the world continues to become more cashless, two major fintech players have joined forces in a bid to make digital payments easier for freelancers and self-employed workers. N26 has teamed up with digital payments company SumUp to help customers access the tools they need to make cashless payments easier. Link here.

FintechOS has announced €51m in new financing as it looks to rapidly expand its operations — and take its low-code approach to transforming banks and insurers to global heights. Its main selling point is its ability to assist legacy banks and insurers in accelerating their digital transformation, enabling them to build end-to-end digital products in weeks rather than months. Link here.

Solarisbank, the German banking-as-a-service (BaaS) provider, is currently mulling the route of a special purpose acquisition company (Spac) merger to go public. Link here.

US

Greenwood, the digital banking platform for Black and Latino individuals and business owners, announced it has selected Mastercard as its network of choice for its first debit card. Link here.

American couples will soon be able to share an Apple Card, merging their credit lines and building credit together. Launching in the US next month, Apple Card Family comes two years after Apple first launched its credit card in partnership with Goldman Sachs. Link here.

Mantl, a digital account opening technology provider targeting community banks and credit unions, has raised $40 million in a Series B funding round led by Alphabet's independent growth fund, CapitalG. Link here.

Alkami Technology, Inc, a leading cloud-based digital banking solutions provider for U.S.-based financial institutions, announced the pricing of its initial public offering of 6,000,000 shares of its common stock at a public offering price of $30 per share. Link here.

CANADA

Clearbanc rebrands to “Clearco” as it announces $100m Series C. Alongside the $100m in equity, Clearco has also secured a $250m debt facility from Credigy, a subsidiary of the National Bank of Canada. Link here.

LATAM

Hash payment infrastructure fintech company has just received a US$15 million investment led by QED Investors, which invests in Brazilian unicorns Nubank and Creditas. The Canary and Kaszek funds, which have invested in the company, followed the round. Link here.

ASIA

Minna Bank, Japan's first app-only bank, is set to open for business in May after acquiring a banking licence from the country's Financial Services Agency. A wholly owned subsidiary of regional banking group Fukuoka Financial, Minna Bank’s services are designed to appeal to the needs of digital natives, providing account opening, deposits and funds transfer over consumer smartphones. Link here.

Co-creators of Google Pay, Sujith Narayanan, and Sumit Gwalani, are launching Fi, a neobank for salaried millennials in partnership with Federal Bank. Link here.

AUSTRALIA

New savings and transaction accounts are entering the market, with Virgin Money Australia launching its own digital bank. Having already offered credit cards and balance transfers, insurance, superannuation and home loans, Virgin Money - which is owned by Bank of Queensland - has launched its first ever transaction account along with two different savings accounts. Link here.

MOVERS AND SHAKERS:

Square is currently recruiting for five new roles in its banking-focused design team, led by Andy Montgomery. “We’re hiring a bunch of roles on my team for new banking products at Square,” Montgomery said in a Tweet on Monday. Andy Montgomery is Square’s design head for banking. Link here.

Revolut will hire 300 staff for its subsidiary in India and make a multi-million pound investment there as part of its global expansion, the British-based digital bank app said on Thursday. Link here.

Jessica Holzbach, Co-Founder of Penta, the leading digital bank for business clients, will leave the company's management team as of April 30th, 2021, after more than four years. Link here.

This ends my weekly digital banking newsletter. Thank you for reading to the end! If you liked it, I invite you to like, share and/or leave a comment below. You may also subscribe here.

Let me know if there are any questions or news/insights worth mentioning in next week's newsletter. Until the next!

Regards,

Marcel van Oost