Digital Banking Weekly | 2021 #22

Hi, there! Welcome back to another Digital Banking Weekly Newsletter. In this newsletter, I cover all the major weekly news related to digital banking around the world. The newsletter begins with recommended articles, reports, podcasts, interviews, etc. I then cover the news highlights for that week before diving into a regional breakdown. Thank you for subscribing!

With the European Championships about to start, you can imagine I’m quite excited. Although I’m in Curacao at the moment, I’ll be back in Amsterdam right in time for the first game. No big parties or big screens in the city center this time, but we’ll manage with a small group of good friends 😉.

I don’t expect our Dutch National team will get far by the way, but I am looking forward to the international breakthrough of Ajax talents Ryan Gravenberch and Jurriën Timber (with Curacao roots 😉). Keep an eye on them!

I can talk for hours about football! But I won’t bother you with more of this, for now.

So, let’s get started!

INTERVIEW

Check out Efma’s interview with Eduardo Ozaita, the CEO of EVO Banco, the Spanish neobank. In this interview, he discusses how his company is expanding and innovating:

In terms of innovation, EVO is a leader in voice banking, one of the most cutting-edge systems in the financial market and with high penetration in all industries. In 2018, EVO became the world's first voicebanks thanks to an artificial intelligence-based voice assistant in Spanish. In 2021 it will launch the first voice biometrics system that will protect its customers in their banking access and operations.

👉 Read more here.

ARTICLE

Very interesting Sifted article by Rob Moffat on the need for enterprise software.

There has been an explosion of fintechs serving SMEs and freelancers in recent years: Qonto, Tide, Funding Circle UK, and Market Invoice to name but a few.

However, there has been much less innovation in fintechs serving enterprises (companies with over 250 employees), despite this market is the same size as the SME sector (roughly 50% of the economy in the UK).

That’s not because large companies are better served. Quite the reverse — enterprises managing their finances today will often have a custom SAP, Oracle, or Microsoft system which is hard to use, expensive to maintain, and cumbersome to update.

👉 Read more here.

REPORT

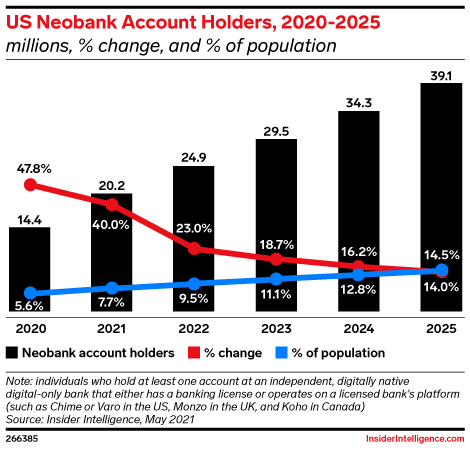

Neobanks, the digital disruptors of the fintech world, will see the number of US account holders reach 20.2 million by the end of 2021, more than double the number just two years ago, according to our inaugural Insider Intelligence forecast for digital-only banks.

Neobank Chime, which was founded in 2013, is well ahead of its competitors. It will hold steady as the industry leader, but there will be a shift this year for the No. 2 spots.

👉 Read more here.

MVO CARD COLLECTION

On the eve of World Environment Day, another eco-friendly FinTech is looking to make its mark. HELPFUL, a FinTech that promotes sustainable living, has joined forces with global payments giant Mastercard to launch its new debit card.

The new debit card will help create a healthier planet with each purchase, with Helpful hoping to plant a tree for every purchase made.

👉 Read more here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S DIGITAL BANKING SPACE

NEWS HIGHLIGHT

MoneyLion Inc. an award-winning data-driven, digital financial platform, announced their preliminary financial results for the first quarter ended March 31, 2021.

First Quarter 2021 Highlights:

⭐️ Net revenue increased 98%, reaching $33.2 million, compared to $16.8 million in Q1 2020, while adjusted revenue increased 125%, reaching $32.5 million, compared to $14.4 million in Q1 2020

⭐️ Contribution profit2 increased to $19.4 million, compared to $5.0 million in Q1 2020

⭐️ Total customers grew 80% to 1.8 million, compared to 1.0 million in Q1 2020

⭐️ Total originations grew 204% to $188.7 million, compared to $62.0 million in Q1 2020

⭐️ Total payment volume grew 213% to $306.4 million, compared to $97.9 million in Q1 2020

⭐️ Net loss was reduced to $2.2 million, excluding a non-cash $80.5 million change in fair value of warrants and convertible notes, compared to a $6.8 million loss in Q1 2020. Including this adjustment, net loss increased to $82.7 million

👉 Read more here.

INDUSTRY HIGHLIGHTS

⭐️ bunq is introducing Update 17. From now on, users in France will receive a French IBAN so they can use their bunq accounts to the fullest. Link here.

⭐️ SMEs make up 95% of businesses in many countries, and yet they are consistently underserved by banks around the world. Link here.

⭐️ Tinkoff is making its voice assistant, Oleg, available to non-customers, giving all Russians access to the bot's non-financial services features. Link here.

UNITED KINGDOM

3S Money, a bank challenger that enables corporates to accept and manage bank transfers in foreign markets, has announced that it is expanding its portfolio of banking partners to include Raiffeisen Bank International AG – an Austrian banking group. Link here.

Ziglu launched a new investment product offering an interest rate of 5% APY. Called Sterling Boost, the product accepts balances of between £1 and £10,000 and offers instant, penalty-free access to funds. Link here.

ikigai, the wealth management and banking app for affluent millennials has raised almost £2 million in a crowdfunding campaign via Crowdcube to accelerate its product roadmap and tech team. Link here.

Coconut, which provides a bookkeeping and tax app for UK sole traders, has launched a crowdfunding push using the Crowdcube platform. Link here.

Tred has selected global B2B payments company - Nium - to be its card-issuance partner for its new sustainable product – the Tred green debit card. Link here.

Accounting software provider ClearBooks Solutions is to be the first third-party application to join a new business marketplace built by Revolut to house apps embedded with its own financial services capabilities. Link here.

EUROPE

Swiss FinTech neon has raised seven million CHF (£5.5M) from pre-existing investors and kicked off a crowdfunding round for customers. With 70,000 customers already on board, neon is launching equity crowd-investing with tokenized non-voting shares which will be held in a personal wallet. Link here.

Bankable Aion Bank, a full service, European licensed digital bank, and credit institution regulated in Belgium, and Vodeno, a fully cloud-native ‘360’ platform for digital financial services today announced a 10-year strategic, multi-layered partnership for all European markets and the UK. Link here.

CrediNord, the online platform for business lending aimed at Small & Micro enterprises, is refining its strategy for the period 2021–2023. With the refined strategy, CrediNord aims for a customer base of 150 thousand SMEs and wide European coverage by the end of 2023. Link here.

Standard Chartered Bank has entered into an agreement with the Swedish impact tech company Doconomy to introduce a digital tool that helps clients track, measure, and manage the impact on carbon emissions and freshwater consumption, based on goods and services they have purchased, as identified through their credit and debit card transactions. Link here.

US

Synctera, which aims to serve as a matchmaker for community banks and fintechs, has raised $33 million in a Series A round of funding led by Fin VC. The raise comes just under six months after the fintech raised $12.4 million in a seed round of funding. Link here.

LATAM

Algorand and Bnext join forces to revolutionize the remittances market in Europe and Latam. In 2020, Latam received more than USD100bn and Spain sent more than USD18bn, being Latam by far, the preferred destination. Link here.

AUSTRALIA

Commonwealth Bank of Australia will become the first of Australia's Big Four banks to let customers see balances from other banks within its banking app under the country's new Open Banking rules. The move comes as the bank ups its digital game with a $50 million investment in disruptive business platforms Little Birdie and Amber. Link here.

Australian Finance Group has taken an 8 percent equity stake in Volt Bank and will use it to push a “white label” mortgage offering that will compete with other lenders offered by AFG’s mortgage brokers. Link here.

Furthermore, Volt received A$15 million (US$11.6 million) in its extended series E fundraise from AFG. This pushes the total capital raised to date in the neobank’s ongoing round to A$37.7 million (US$29.1 million), according to a statement. However, it has extended the round’s targeted amount to A$85 million (US$65.7 million). Link here.

ASIA

Switzerland's Temenos is looking to break into the Chinese market, having become the first core banking software provider certified with Huawei infrastructure and Huawei Public Cloud. Link here.

Money transfer firm Wise has touched down in India, opening an office in Mumbai and enabling users to send and receive payments to 44 countries worldwide. Transfers to Indian rupees were first made available in 2013, and the company most recently enabled Google Pay users in the US to send INR to Google Pay users in India. Link here.

Digital lending start-up, Finja, has secured extra investment in its Series A from Pakistan’s largest commercial bank, Habib Bank (HBL). HBL says its investment serves a two-pronged purpose. Link here.

PT Bank Jago Tbk (Bank Jago), an Indonesia-listed bank, has selected Mambu’s SaaS banking platform as its technology foundation as the bank begins its journey towards operating as a technology based-bank. Link here.

MIDDLE EAST

TAG has closed $5.5 million in a pre-seed round led by US VCs Quiet Capital and Liberty City Ventures. The Pakistani FinTech was also accepted to join Y Combinator’s Summer 2021 batch. According to MENAbytes data, it is the largest pre-seed ever in the Middle East, North Africa & Pakistan. Link here.

MOVERS AND SHAKERS:

After a tumultuous 2020 put many European fintechs’ plans for US expansion on ice, Revolut is preparing a huge marketing push that it hopes will help it reach 1m American customers by early next year. To drive the growth Revolut is hiring at least 300 staff in Dallas, Texas, which will see the city overtake New York and San Francisco as Revolut’s largest US hub. Link here.

YieldX, the FinTech reimagining fixed income, announced two key appointments. Stewart Russell has joined as Chief Investment Officer, and David Andonian has been added to the YieldX Board of Directors. Link here.

Sponsored Content: Fintech Meetup cuts straight to the most important part of an event: building connections. Sign up and meet with 1,000+ other knowledgeable & influential industry professionals.

This ends my weekly digital banking newsletter. Thank you for reading to the end! If you liked it, I invite you to like, share and/or leave a comment below. You may also subscribe here.

Let me know if there are any questions or news/insights worth mentioning in next week's newsletter. Until the next!

Regards,

Marcel van Oost

Follow me on Twitter, Linkedin, and Telegram.

Discover other newsletters by MVO.