Digital Banking Weekly | 2021 #24

Hi, there! Welcome back to another Digital Banking Weekly Newsletter. In this newsletter, I cover all the major weekly news related to digital banking around the world. The newsletter begins with recommended articles, reports, podcasts, interviews, etc. I then cover the news highlights for that week before diving into a regional breakdown. Thank you for subscribing!

ARTICLE

Tata Digital is building a neobank for its upcoming super app.

“Tata Digital is likely to offer financial services – including credit, insurance, and mutual funds – on its soon-to-be-launched ‘super app,'”

Details:

The neobank offering will be in partnership with licensed financial institutions, according to the sources.

Tata Digital has already set up the neobank vertical and is reportedly roping in industry veterans to head it.

👉 Read more here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S DIGITAL BANKING SPACE

NEWS HIGHLIGHT

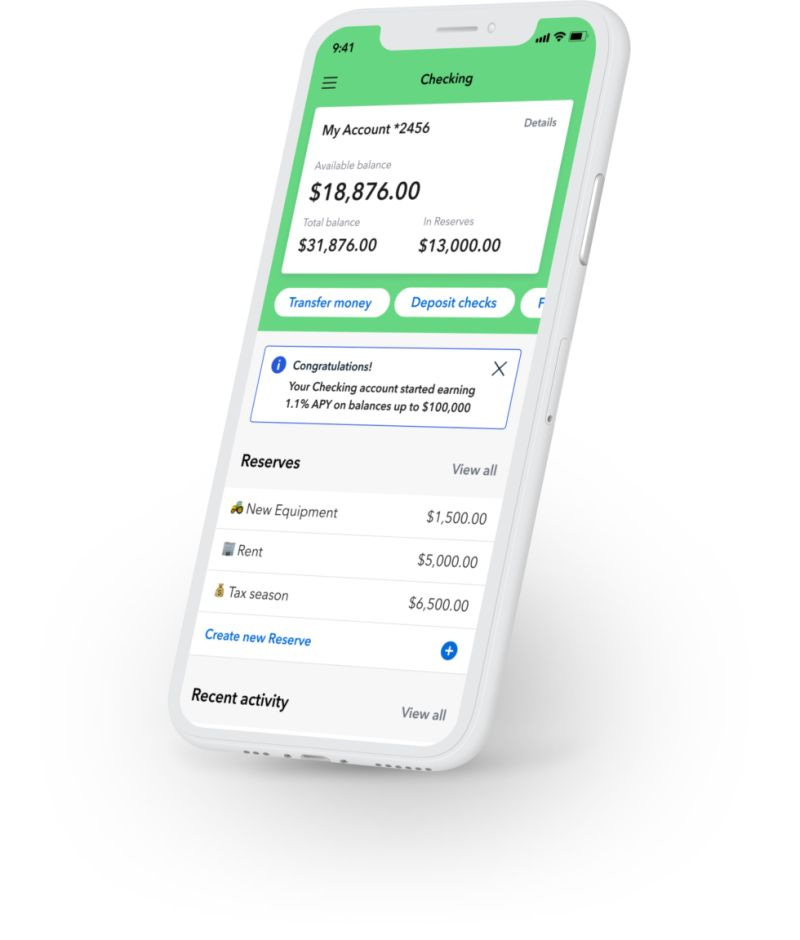

American Express is pushing deeper into traditional banking territory with the launch of its first checking account.

American Express acquired Kabbage in August last year as part of a strategy to roll out a range of cash flow services to businesses.

Kabbage Checking is a no-fee digital account that pays 1.1% interest on up to $100,000 in balances. It includes mobile check deposits, a debit card, bill pay, and targeted savings features as well as access to a network of ATMs and retail locations for cash transactions.

👉 Read more here.

INDUSTRY HIGHLIGHTS

⭐️ Verizon launched a new family money app and prepaid debit card designed for children aged eight to 17. Link here.

⭐️ bunq agreed on the terms of 160 million euros ($194 million) in investment by a British private equity firm, valuing the Dutch business at $2 billion. Link here.

⭐️ Wise confirms direct listing on London Stock Exchange at estimated £9bn value. Link here.

UNITED KINGDOM

The London-based European mobile money fintech, Monese, has announced its partnership with Veriff, a global identity verification provider. According to reports, the partnership was motivated by Monese recognizing the need for enhanced security for its digital banking services. The collaboration will provide an additional layer of safety and security for the mobile money app. Link here.

Standard Chartered Bank is a leading international banking group with a presence in 59 of the world’s most dynamic markets and serves clients in a further 85. With Temenos’ modern technology stack, Standard Chartered is now well-positioned to offer futuristic services to its clients, improve the overall client experience and continue going from strength to strength to take on this growing market opportunity as one of the leading alternatives administrators. Link here.

Credit Kudos has today launched a new open banking-powered credit decisioning product, Assembly. The new launch will see lenders save thousands of hours in manual underwriting, allowing them to automate policies, grow their loan books and implement real-time decisioning with little to no technical integration. Link here.

10x Future technologies, the banking technology firm set up by former Barclays chief Antony Jenkins, has sealed an oversubscribed $187 million Series C financing round, co-led by funds managed by BlackRock and Canada Pension Plan Investment Board (CPP Investments) and supported by existing investors JPMorgan Chase, Nationwide, Ping An and Westpac. Link here.

EUROPE

ABN AMRO Bank N.V. has developed a tool that allows flexible workers to have their earnings paid out themselves, quickly and easily. As the gig economy grows, there are an increasing number of flexible workers using digital platforms to find jobs on an hourly basis. Link here.

Paysend announced the global rollout of its new Paysend 4.0 app, combining the firm’s international transfers, multicurrency accounts, and cross-border payments in a simple, top-performing, all-in-one digital APP. Link here.

Solarisbank has migrated its entire customer base from an externally sourced core banking system to an in-house alternative. Solarisbank initially contracted an outside supplier for its core system. Link here.

US

The US Office of the Comptroller of the Currency (OCC) has approved Adyen’s application to establish a Federal Foreign Branch in San Francisco, California. The OCC’s approval and its granting of the branch charter in combination with the Federal Reserve’s approval of the application on May 24, 2021 permits Adyen to commence operations as a Federal Foreign Branch. Link here.

Nymbus CUSO, founded three months ago to help credit unions manage FinTech solutions, has landed a $5 million second round investment from the Curql Fund, a venture capital fund founded last year and managed by credit unions Link here.

JPMorgan Chase & Co. has entered into an agreement to acquire digital wealth manager Nutmeg for an undisclosed amount ahead of the launch of its new digital bank. Link here.

Novo, a neobank that has built a service targeting small businesses, has closed a round of $40.7 million, a Series A that it will be using to continue growing its business, and its platform. Link here.

Better Financial, which launched this month, is the latest digital platform aiming to solve the needs of a highly specific demographic — gig workers that don’t have employer-provided health insurance coverage and face daily income volatility. Link here.

Raisin has gone live in the US with its first partner bank. MapleMark Bank has become the first US bank to embed Raisin's Savings-as-a-Service software in its online platform. Raisin first announced its intention to cross the Atlantic in the summer of 2019, hiring US CEO Paul Knodel from American fintech Wealthfront’s senior management team. Link here.

Splash Financial, a digital lending platform that helps borrowers shop and compare financial products from a network of lenders, has secured $44.3 million in a new Series B funding round. Link here.

Novus, an "impact-driven" startup has teamed up with Visa and Railsbank on a mobile application that rewards users for sustainable purchasing choices. Set to launch this summer with a 15,000 waitlist, Novus rewards its community with real-time impact points that can be spent, saved, and tracked via the app. Link here.

Unit has launched a product it says will allow companies to create live bank accounts and issue cards in minutes. Better Tomorrow Ventures, Aleph, Flourish Ventures, and TLV Partners joined the round for Unit, which was founded in 2019 but came out of stealth late last year. Link here.

LATAM

Credijusto.com, the leading technology-enabled lending platform in Mexico, announced today the acquisition of Banco Finterra, a Mexico City-based bank that specializes in financing solutions for small businesses and the agriculture sector. Credijusto is the first Mexican fintech to acquire a regulated bank, becoming the only neobank in Latin America focused on serving small and medium-sized enterprises (SMEs). Link here.

AUSTRALIA

86 400 cut fixed home loans rates by up to 31 basis points, at a time when many other lenders are raising theirs. 86 400's cuts were seen across both investor and owner-occupier home loans. All owner-occupier home loan cuts were for borrowers paying principal and interest (P&I), while for investors, there were some cuts for interest-only (IO) home loans. Link here.

ASIA

The Philippine central bank has awarded two more digital banking licenses, as Southeast Asia steps up its foray into fintech. Sequoia India-backed tonik Digital Bank and Singapore-based UNObank have secured licenses. They join the state-backed Overseas Filipino Bank, which got a license in March. Link here.

Bangalore-based FamPay has raised $38 million in its Series A round led by Elevation Capital. General Catalyst, rocketship.vc, Greenoaks Capital, and existing investors Sequoia Capital India, Y Combinator, Global Founders Capital, and Venture Highway LLP also participated in the new round, which brings FamPay’s to-date raise to $42.7 million. Link here.

MOVERS AND SHAKERS:

In a year where international expansion plans have been halted across the board, Dutch cloud banking fintech Ohpen has bolstered its UK presence. The fintech has appointed Jerry Mulle as its new UK managing director, doubling down on its UK presence. Mulle brings with him over 30 years of experience in the financial sector, including having held senior roles at NatWest, cloud-native technology company IE Digital and financial services company Sopra Banking Software. Link here.

This ends my weekly digital banking newsletter. Thank you for reading to the end! If you liked it, I invite you to like, share and/or leave a comment below. You may also subscribe here.

Let me know if there are any questions or news/insights worth mentioning in next week's newsletter. Until the next!

Regards,

Marcel van Oost

Follow me on Twitter, Linkedin, and Telegram.

Discover other newsletters by MVO.