Digital Banking Weekly | 2021 #27

Hi, there! Welcome back to another Digital Banking Weekly Newsletter. In this newsletter, I cover all the major weekly news related to digital banking around the world. The newsletter begins with recommended articles, reports, podcasts, interviews, etc. I then cover the news highlights for that week before diving into a regional breakdown. Thank you for subscribing!

REPORT

Flagship Advisory Partners examined the offerings of the top 20 neobanks in Europe and North America as measured by client base and funding.

As shown in Figure 1 below, the top 20 neobanks share several characteristics: most are based in the US or UK, and several of the largest did not originate as “pure” neobanks.

👉 Read more here.

ARTICLE

Nik Storonsky, founder and CEO of Revolut, built a $5.5bn fintech, which boasts 15m customers across 30+ countries, and is even slowly edging towards profitability.

But Storonsky hasn’t built Revolut alone over the past 6 years.

Amid his 2000 employees, there is a small team of trusted individuals who Storonsky has entrusted to help scale the business.

Sifted has identified the 15 most senior people at Revolut. These are the people who — according to multiple sources — have Storonsky’s ‘ear’ and have an exceptional level of influence over the business.

👉 Read more here.

BLOG

Downloads of the top 10 apps pictured below have increased 37.4% YoY. Chime is still the leader of this group for most mobile app performance metrics and it was the most downloaded banking app in the US in 2020.

👉 Read more here.

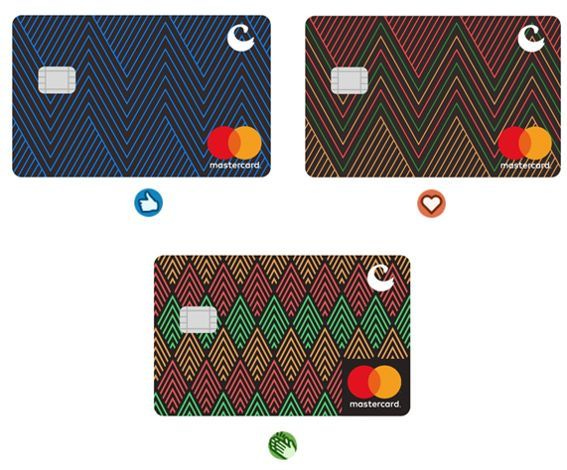

MVO’S CARD COLLECTION

Lamine Tall needs some help to pick a design for Cauri Money debit card. The first digital bank built to serve the 15 million African 🌍 ex-pats in Europe.

👉 Read more here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S DIGITAL BANKING SPACE

NEWS HIGHLIGHT

Sponsored Content: Registration is Now Live for the World’s Largest Fintech Meetings Event! Join 30,000+ Meetings with 4,000 Participants. Online, March 8-10, 2022.

INDUSTRY HIGHLIGHTS

⭐️ By February this year, nearly 80% of customer transactions at U.S. Bank were digital and nearly 60% of active customers did most of their banking that way. Link here.

⭐️ A close look at Monzo Bank’s new growth strategy. Link here.

⭐️ Wise had a solid stock market debut Wednesday, giving the company a market value of more than £8 billion ($11 billion). Link here.

UNITED KINGDOM

Revolut is in “detailed talks” with SoftBank about a fundraising round that could value the firm between $30 billion and $40 billion. Revolut and its advisers have asked investors at SoftBank’s Vision Fund 2 to submit proposals for an investment of between $750 million to $1 billion with a deal expected to be “some weeks” away. Link here.

fidomoney, an innovative fintech company offering bespoke business current accounts, has launched in the UK. Link here.

Atom bank, the UK’s first app-based bank, achieved two significant milestones this week when it exceeded £3bn of residential mortgage completions and on the same day hit £1bn in deposits into its Instant Saver accounts. Link here.

Tide launched Credit Builder for Small Businesses, which includes a micro ‘reverse loan’ of £240. The SMEs make regular ‘repayments’ of £23/month to Tide, and then after 12 months receive the full £240 back, costing them nothing. Link here.

Monzo has teamed up with Wise in order to provide clients with a simple and affordable way to send funds overseas. Monzo says they’ll always be using the “real exchange rate, with no hidden fees.” Link here.

Novus, the fintech app that generates positive social and environmental impact from everyday actions, has successfully secured regulatory approval to operate as an Electronic Money Directive (EMD) Agent of PayrNet Limited (Railsbank), ahead of its planned launch to the wider public later this summer. Link here.

EUROPE

Sweden's financial watchdog said it was investigating Klarna over a potential breach of banking secrecy laws in connection with an IT incident at the firm in May. Link here.

Solarisbank AG, the tech company with a banking license, announced that it has launched in France, Italy, and Spain to offer local IBANs. Link here.

Juni, a neobank that is built specifically for companies selling online, has closed a Series A of $21.5 million, only 12 weeks after officially opening for business. Link here.

The digital bank Lunar launched savings accounts in June, with Sweden’s highest savings rate of 1 percent and fee-free stock trading. Deposits have now grown by 100 percent in one month’s time and four times as many share purchases have been made compared to when the service was first rolled out in Denmark. Link here.

bunq has been self-funded by its founder and CEO Ali Niknam for several years. But the company has decided to raise some external capital, leading to the largest Series A round for a European FinTech company. The startup is raising $228 million (€193 million) in a round led by Pollen Street Capital. Link here.

US

Blue Ridge Bank, the national bank subsidiary of Blue Ridge Bankshares, Inc., has a partnership with Aeldra Financial, Inc., a Silicon Valley-based financial technology company, to launch a mobile neobank called Aeldra. Link here.

Nymbus, a leading provider of banking technology solutions, announced that VyStar Credit Union has chosen Nymbus as its new online and mobile banking solution partner. Link here.

Cross River Bank is “in early discussions with prospective suitors about raising roughly $200 million,” an effort that could put the Fort Lee, N.J.-based lender’s valuation at $2.5 billion or more. Link here.

CANADA

Mogo Inc. a digital payments and financial technology company, announced a new minority investment in Tetra Trust Company, which launched as Canada’s first qualified custodian for cryptocurrency assets. Link here.

LATAM

Amid increasing rivalry in the payments vertical in Latin America, delivery company Rappi is rolling out credit cards for Brazilian users. Link here.

Nubank, Brazil's largest fintech, announced the launch of a new card in premium mode, the 'Ultraviolet'. Made of metal, "three times heavier and stronger than plastic cards," the product allows 1% cashback that automatically grows by 200% of the CDI rate and never expires. Link here.

Z1, a Sao Paulo-based digital bank aimed at Latin American GenZers, has raised $2.5 million in a round led by U.S.-based Homebrew Labs. Put simply, Z1 is a digital bank app built for teenagers and young adults. The company was founded on the notion that by using its app and linked prepaid card, Brazilian and Latin American teenagers can become more financially independent. Link here.

AUSTRALIA

Bluestone Home Loans went live with its new digital lending platform. This launch includes a significant number of new features and improvements including a suite of new loan origination and servicing capabilities. Link here.

86 400 announced its partnership with one of Australia’s largest mortgage aggregators, PLAN Australia, as it continues to grow its broker network and offer even more Australians access to its digital home loans. Link here.

Appearing before the House of Representatives standing committee of economics last week, the chiefs of Bank of Queensland, Volt Bank, and Judo Bank alongside industry body Australian Banking Association (ABA) shared their thoughts on how to boost competition in the sector. Link here.

The Australian Prudential Regulation Authority (APRA) has granted Alex Bank Pty Ltd a license to operate as a restricted authorized deposit-taking institution (Restricted ADI) and Alex Corporation Limited as a non-operating holding company. Link here.

ASIA

South Korea's 카카오페이 (kakaopay) is looking to raise around $1.4 billion in an initial public offering in August. Link here.

Also, 카카오뱅크 Kakaobank and 카카오페이 (kakaopay), which are set to go public only seven days apart, each compared themselves to a Brazilian financial technology firm for their valuations, their initial public offering applications showed Tuesday. Link here.

Indonesia digital bank PT Bank Jago Tbk is set to launch its services on the Gojek platform. “We are ready to launch ... we are only looking to set the date,” said Kharim Indra Gupta Siregra, president director at Bank Jago. Link here.

Furthermore, PT Bank Jago Tbk (ARTO.JK) aims to crunch transaction data supplied by local technology giants to create customer profiles and market financial products, as the digital lender targets profitability this year. Link here.

India’s homegrown Paytm Payments Bank Ltd (PPBL) has emerged as one of the most successful digital banks operating in the Asia Pacific (APAC) region. Link here.

The Central Bank of Mongolia, also known as the Bank of Mongolia, has successfully completed a national project to migrate its entire payments infrastructure to Compass Plus solutions. Link here.

MoneyMatch announced the successful closing of its Series A fundraising round totaling MYR 18.5 million over two tranches, initially led by Cradle Seed Ventures in 2019 and now has been closed with KAF Investment Bank leading the second tranche earlier this year, subject to final regulatory approval. Link here.

AFRICA

Bank of Kigali Plc launched a new and upgraded Internet Banking platform that provides additional features and advantages to its clients. Link here.

MOVERS AND SHAKERS:

We have seen Paul Rippon and his alpaca farm, now we have an interesting career switch story from Canada: Dan Dickinson, Chief Information Officer at Equitable Bank, is leaving the lender for a career in the winemaking industry. Dickinson spent almost eight years at the Canadian bank, joining as vice president for digital banking in 2013. Link here.

Revolut’s chief operating officer, Steve Harman, has left the fintech after 10 months in the role as rumors swirl about a SoftBank Group Corp.-backed fundraising round. Link here.

This ends my weekly digital banking newsletter. Thank you for reading to the end! If you liked it, I invite you to like, share and/or leave a comment below. You may also subscribe here.

Let me know if there are any questions or news/insights worth mentioning in next week's newsletter. Until the next!

Regards,

Marcel van Oost

Follow me on Twitter, Linkedin, and Telegram.

Discover other newsletters by MVO.