Digital Banking Weekly | 2021 #35

Hi, there! Welcome back to another Digital Banking Weekly Newsletter. In this newsletter, I cover all the major weekly news related to digital banking around the world. The newsletter begins with recommended articles, reports, podcasts, interviews, etc. I then cover the news highlights for that week before diving into a regional breakdown. Thank you for subscribing!

Sponsored Content: Meet fintechs and uncover opportunities that will transform your business! Fintech Meetup (Online, March 8-10) does the hard work so you don’t have to--with 30,000+ meetings for 4,000 participants you’ll get 3 months worth of meetings in just 3 half days! Qualifying banks & credit unions are eligible for FREE tickets. Get your ticket now--prices go up on Friday!

INTERVIEW

This week’s interview recommendation belongs to Time’s cover of Mos, a startup that sees a new business opportunity in teaching Gen Z about money.

In the face of rising college costs, soaring consumer debt and less confidence in banks since the 2008 financial crisis, Mos is one of several fintech startups that see a need to reimagine banking for a younger generation.

ARTICLE

Sid Singh’s post on Buy Now Pay Later is the talk of the town. The goal of his post is to bring together his learnings and highlight the core elements of the industry.

As seen above in the complete market mapping of BNPL players, the whole industry has become a force majeure especially as Covid-19 wrecked havoc on the global economy beginning March, 2020 and consumers primarily shifted to online shopping.

NEWSLETTER

As a regulated and licensed bank, is it your job to compete with Neobanks? Lobby against them? Or enable them?

Below is the map Simon Taylor likes to use to frame strategy conversations (regular readers of his newsletter will be familiar with it by now); you can think of financial services in 5 layers at the most abstract level.

REPORT

Dive right in to Entrepeneur’s report on Open Finance. Open Finance presents major opportunities, but the collaborative process isn't very straightforward. The proper implementation of Open Finance has many challenges that need to be addressed for a better, interconnected financial ecosystem.

INFOGRAPHIC

Did you know 65% of customers believe their bank enables them to bank however they like?

As digital banking continues to increase, RFi Group is taking a deep dive into the latest consumer insights in their latest infographic.

NOW, ON TO THE SUMMARY OF LAST WEEK'S DIGITAL BANKING SPACE

NEWS HIGHLIGHT

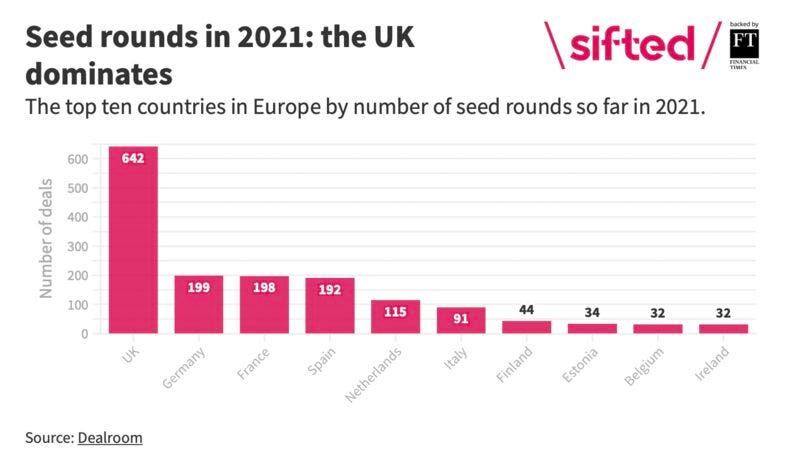

Despite being a month of sun and vacation, August was another active month for Europe’s seed investors. But which were the most exciting?

According to Dealroom.co data, 169 startups in Europe raised a seed round in August. That’s slightly behind the 200 deals recorded in July and the 229 recorded in June, though August’s figure is likely higher given the reporting lag.

👉 Read more here.

INDUSTRY HIGHLIGHTS

⭐️ A deep-dive into Europe’s fast-growing BNPL market. Link here.

⭐️ Revolut needs to achieve billions of dollars in annual sales before it can go public, CEO Nik Storonsky said. Link here.

⭐️ João Vitor Menin, CEO at Brazilian neobank Inter, discusses how their marketplace and its associated partnerships are at the heart of their offering. Link here.

⭐️ To Waupsh, a 15-year veteran in the music and fintech space, community in 2021 means something beyond geographic location. They built Nerve to bring mobile payments, digital credit, and audience tracking all in one place, Waupsh said, for the musician community. Link here.

⭐️ Russian Digital bank Tinkoff Bank has been recognized as the Most Innovative Digital Bank in Central and Eastern Europe at Global Finance magazine’s 2021 World’s Best Digital Banks awards, according to a note from the Fintech. Link here.

⭐️ When American Banker made predictions more than a year ago about what banking would look like in 2025, one of them was that it will be “invisible” — in other words, embedded in other things people do and places they go, with banks unseen in the background. Link here.

UNITED KINGDOM

A banking technology provider backed by Britain's biggest high street lender will add its name to the list of UK tech "unicorns" in the coming weeks when it completes a £150m fundraising. Thought Machine, which was set up in 2014, is close to concluding a deal that will more than double the amount of capital injected into the business since its formation. Link here.

BankiFi, a fintech business specialising in payment processing and financial administration services for SMEs, has secured a £2.2m investment in a funding round led by Praetura Ventures, with participation from the Greater Manchester Combined Authority (GMCA). Link here.

Lending by British challenger banks surged to a record high last year driven by businesses rushing to capitalise on emergency Covid loan schemes. Research by accountancy firm BDO shows challenger bank lending climbed 11 per cent over the last year to £143bn, a record high, up from £128bn in the previous year. Link here.

SurePay a Rabobank spin off providing Confirmation of Payee (CoP) in the UK and Benelux, has raised a €12.2 million round led by Connected Capital with Iris Capital, joining Rabo Frontier Ventures to boost the company’s international expansion Link here.

EUROPE

Spotify has become Tinkoff’s partner in Russia. Now Tinkoff ecosystem customers can subscribe to and set up automatic payments for the music service via the Tinkoff super app or at Tinkoff.ru. Tinkoff will be offering up to 25% cashback on each payment for a Spotify subscription. Link here.

OneSpan, the global leader in digital banking security and e-signatures, announced that Belgian challenger bank NewB has deployed OneSpan Cloud Authentication and Mobile Security Suite to seamlessly secure its digital channels. Link here.

After moving into new European markets over the last year, bunq has just touched down in another. The Dutch challenger bank has hopped over to its Iberian neighbours and touched down in Spain, giving Spanish customers full access to its host of products. As of yesterday, all new and existing users in Spain can now receive a Spanish IBAN, giving them access to all of Bunq’s digital banking services. Link here.

US

Walgreens and InComm Payments, a leading global payments technology company, announced the launch of Scarlet, a bank account and debit card powered by Mastercard and issued by MetaBank, available exclusively at Walgreens. Link here.

Upstart, a leading artificial intelligence (AI) lending platform, announced that its platform for personal loans is now available in Spanish, becoming the first online lending platform for personal loans with full support for Spanish speakers across the U.S. Link here.

Point Card has raised a $46.5 million Series B funding round. The company offers an account associated with a debit card. And the startup positions itself as a premium debit card company and tries to offer credit card rewards with debit cards. Link here.

Albert, a money management platform with investing and budgeting tools, has been gaining momentum in the market through its promise to provide real-life human expertise through texting, as part of its subscription offering Genius. Now, it’s released a checking account called Albert Cash. Link here.

Banking technology and Banking-as-a-Service (BaaS) provider Mbanq, has formed a new Credit Union Services Organization (CUSO) to implement digital transformations for Credit Unions. Link here.

Monzo Bank USA recently revealed that you can move money to and from your other accounts – a feature that’s currently in Beta testing. Link here.

Revolut is planning US rollouts of an unsecured line of credit this fall and credit card offerings at the end of 2021 or in Q1 2022. A US credit card offer would mark the first launch of a Revolut credit card outside of select European markets where it can passport its Lithuanian banking license. Link here.

ASIA

Cake Digital Bank has selected the market leading SaaS cloud banking platform Mambu as it looks to scale its business towards offering a full suite of digital banking services. Link here.

Airwallex, a cross border payments company, announced that it has secured a money services business (MSB) license issued by Bank Negara Malaysia. They said, the new license will allow Airwallex to offer modern, streamlined, and integrated international payment solutions for Malaysian businesses of all sizes, from SMEs to larger enterprises, to efficiently manage their operations in Malaysia from early next year. Link here.

Neobanking Fintech Razorpay has teamed up with Shiprocket in order to provide end-to-end digital commerce solutions in India. As noted in the update from Razorpay, e-commerce has changed the “way we live, shop, and do business.” Link here.

American tech giant Google has recently partnered with fintech startup Setu to let users open fixed deposits (FDs) through the digital wallet platform Google Pay. Link here.

AUSTRALIA

Neobank Volt Bank has partnered with cryptocurrency exchange BTC Markets to offer its banking services to crypto investors, as the wider crypto industry grapples with neglect from traditional institutions and a lagging regulatory system. Link here.

AFRICA

Discovery Bank reported an operating loss for the year ended June 2021 of R1 094 million, 7% lower than the prior period. The bank continued to gain traction with 362,000 clients and 649,000 accounts, versus 274,000 clients and 505,000 accounts in July 2020. Link here.

MIDDLE EAST

Israel’s Bank Leumi announced that it signed an agreement with Google to roll out Google Pay, the tech giant’s digital payments app for Android users, in Israel. Link here.

Arab Bank has recently launched its FinTech-focused corporate accelerator program “AB Accelerator” in Egypt, following its successful launch in Jordan back in 2018. Link here.

Bahrain based leading FinTech firm, Aion Digital, and industry leading digital experience platform creator Kasisto, Inc., have just announced a strategic partnership to redefine the way consumers engage with banks in the Middle East. Link here.

MOVERS AND SHAKERS:

Nubank announced the third edition of “Yes, She Codes,” a program for hiring women working in the field of software engineering. Link here.

But which European fintech is the best to work for? Link here.

Step, the new modern-day financial services company built for teens and families, today announced the additions of two key executive hires. The company has welcomed Horacio Diaz Adda as its Chief Financial Officer and Kirupa Pushparaj as its General Counsel. Link here.

Provenir, a global leader in data analytics software and risk decisioning, has appointed Jose Luis Vargas Favero as its new executive vice president and general manager for Latin America. Link here.

This ends my weekly digital banking newsletter. Thank you for reading to the end! If you liked it, I invite you to like, share and/or leave a comment below. You may also subscribe here.

Let me know if there are any questions or news/insights worth mentioning in next week's newsletter. Until the next!

Regards,

Marcel van Oost

Follow me on Twitter, Linkedin, and Telegram.

Discover other newsletters by MVO.