Digital Banking Weekly | 2021 #41

BLOG

PODCAST

The Podcast recommendation of the week belongs to episode #79 of MoneyPot: Will Your Next Curry Come with a Side Credit Card?

Embedded finance is at the heart of payments innovation. Uberized payments, digital wallets, and contactless service have become the standard. Will the next wave be credit cards? Do the brands that you love know you better than your financial institution, and are they willing to extend you more credit because of it?

No Content. No Speakers. Just 30,000+ online meetings! Fintech Meetup focuses on what you really want from an event--meetings and connections with new partners and customers. Join 3,000+ other participants to meet fintechs, banks, investors, networks, tech cos, credit unions, and more! Online, March 8-10, startup rate available for qualifying cos.

REPORT

Can you feel it? Fintech has now reached mass adoption–with 88% of U.S. consumers now using digital apps and services to manage their finances. Similar leaps adoption leaps took the refrigerator twenty years, the computer ten, and the smartphone five.

As fintech adoption approaches parity with traditional banking, it's also become the primary way most people manage their money.

Changing the culture of money and showing up wherever people touch their money positions fintech to be the new center of the financial universe.

REPORT

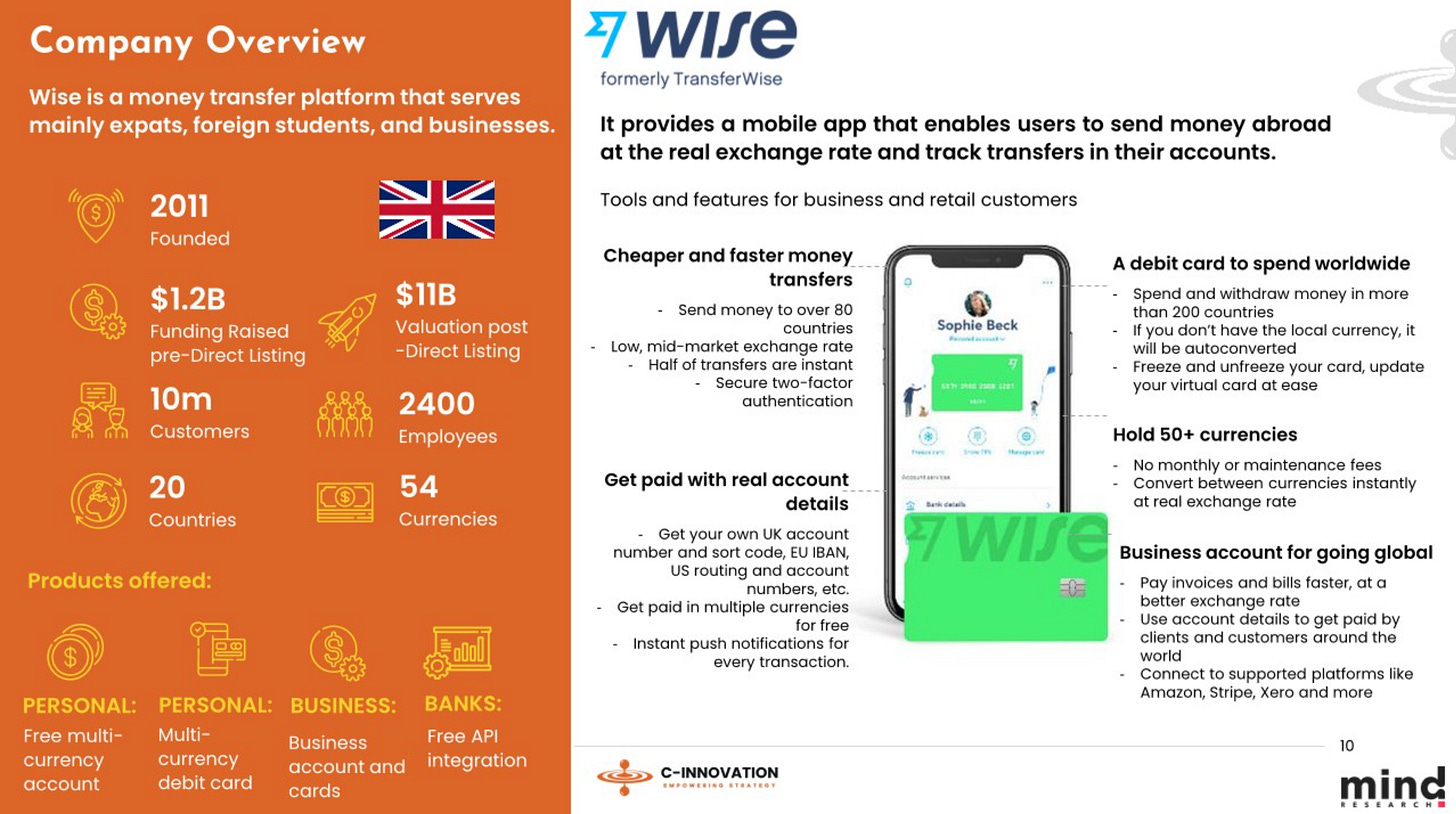

Earlier this year, TransferWise became Wise, after 10 years of operation and debuted at the LSE in a record-breaking London tech Direct Listing, increasing its valuation from $5 billion to $11 billion.

Read the full report on Wise by Javier Guevara Torres and Nevena Koleva Bostock

NOW, ON TO THE SUMMARY OF LAST WEEK'S DIGITAL BANKING SPACE

NEWS HIGHLIGHT

Fintech startup N26 has raised a $900 million Series E round at a $9 billion valuation. That represents a big jump from the company’s Series D valuation of $3.5 billion. The Berlin-based startup operates a digital bank with 7 million clients across 25 countries.

Third Point Ventures and Coatue Management are leading today’s round. Dragoneer Investment Group and some of N26’s existing investors are also participating.

“It gives us a lot of time over the next three to four years to line up for an IPO,” co-founder and CEO Valentin Stalf.

INDUSTRY HIGHLIGHTS

⭐️ Aspiration launched their very first credit card on Thursday, the Aspiration Zero Credit Card. Link here.

⭐️ Bradesco, Brazil’s third-largest bank, announced its purchase of a 49.99% stake in digital bank Digio for $113.2 million. Link here.

⭐️ After the completion of MoneyLion’s public listing on the NYSE, the company’s co-founder Foong Chee Mun becomes the first Malaysia fintech founder to be on the New York Stock Exchange. Link here.

⭐️ According to Bank of America, downloads of banking and digital wallet apps in the country dropped in September for the first time since 2015. Link here.

⭐️ Top 10 neobanks LATAM by customer count. Link here.

UNITED KINGDOM

Wealthtech apps may have taken the world by storm, but they have one serious shortcoming — a shortage of female users. Women are still far less likely to invest and about 70% of the users on apps like Robinhood are men. That’s why sisters Alexia and Margot de Broglie started Juno, a gamified financial-education app for women. It was officially launched yesterday, hot off a £250k pre-seed round. Link here.

Core banking provider Yobota has moved into the world of Banking-as-a-Service (BaaS) thanks to a partnership with Chetwood Financial Limited. Link here.

Monzo’s c.100,000 business customers will now be able to get paid faster and easier, being able to request a payment link or an invoice in just a few taps. Integrated into the Monzo Business platform, the new tool will see small businesses cut out unnecessary admin pain points and offer greater flexibility to SMEs. Link here.

EUROPE

FIBR, the connected digital bank, has launched with the sole focus of servicing European SMEs, through combining the stability of a bank with the agility and technology of a fintech. Link here.

The 4.8 million retail customers of Deutsche Kreditbank AG (DKB) can now access interest-bearing overnight and term deposit offers from other banks in Germany and across Europe. The new range of products is the result of DKB’s cooperation with Raisin DS, whose German savings platform WeltSparen is now available directly from the DKB platform. Link here.

Sweden is something of a FinTech Mecca, having spawned the likes of Klarna, Tink and iZettle, and the country is now lining up a new generation of FinTech stars. Among them is Juni, the neobank built for ecommerce merchants, which announced a $52m Series A extension from EQT Ventures. Link here.

Airbank, a financial management solution for European startups and SMBs, has selected open banking infrastructure provider Yapily to help its users manage their finances with ease. Link here.

Fintech scale-up Pleo, which offers a simplified company spending solution, smart company cards, and bill payment processing, announces its new business model incorporating a no-fee service for customers in the UK, Ireland, Sweden, and Denmark. Link here.

US

Fintech start-up Tala has raised $145 million in a Series E funding round that the company intends to use to expand borrow, save and money management options across Kenya, the Philippines, Mexico, India and the United States, including crypto offerings. Link here.

Arival Bank, which won Best of Show in its FinovateAsia debut in 2018, is now a fully licensed and regulated bank. The company was granted its U.S.-based banking license in Puerto Rico and will leverage its “U.S.-based but internationally friendly” license to work with customers around the world. Link here.

Plum has made the first close of its Series A with a $14m fundraise along with what it says is a tripling of its valuation. The company is also planning a crowdfunding round in October to top up the round. The company says it is in high growth mode and planning further product development including a crypto offering in 2022. Link here.

Temenos, the banking software company, announced that Green Dot Corporation has enlisted The Temenos Banking Cloud as its platform of choice to power its direct digital bank and banking platform services (or “BaaS”) partners, enabling more feature-rich, secure, and streamlined banking and payment experiences for customers, as well as scalable growth. Link here.

JPMorgan Chase signed a pledge to join the United Nations' Net-Zero Banking Alliance climate initiative. The Net-Zero Banking Alliance is composed of 61 banks across the globe that have committed to realigning their lending and investment portfolios to reduce attributable greenhouse-gas emissions, including a promise to reach net-zero carbon dioxide emissions by 2050. Link here.

ASIA

HSBC Malaysia has recently enhanced its mobile app with a new feature, a “Wealth on Mobile” dashboard so customers can invest and track their portfolios at the tap of a button. Link here.

Standard Chartered and Atome Financial have announced a 10-year multi-product strategic partnership, combining their strengths in finance and technology to deliver a wide range of financial services to consumers and merchants across key markets in Asia. Link here.

Google has invested in Bangalore-based Open Financial Technologies, becoming the latest high-profile investor to back a neobanking platform. Link here.

LATAM

Brazilian digital bank Nubank will have good results to presents to its investors ahead of its initial public offering (IPO) in New York. The fintech recorded its first profit in history in the first half of this year, BRL 76 million (USD 13.79 million). In the same period of 2020, the company had a negative balance sheet of BRL 95 million. Link here.

Dock, an innovator in financial technology infrastructure across Latin America, announced the acquisition of BPP, a payment institution regulated by the Central Bank of Brazil that specializes in Banking-as-a-Service (BaaS). Link here.

AUSTRALIA

The formation of Parpera, a money-management app for microbusinesses that will also hold deposits, shows you can operate just like a bank in Australia without actually becoming a bank. Link here.

AFRICA

Nigeria’s lifestyle and financial ecosystem app Sparkle Nigeria has raised a $3.1 million seed round from a group of all-Nigerian investors. The investment will be channeled towards scaling the platform’s talent teams across the sectors of engineering, financial risk, marketing, and investment department used while investing in automated back-end processes and digital infrastructure. Link here.

MOVERS AND SHAKERS:

The neobank Northmill Bank, which has the vision of improving people's financial life, appoints Tord Topsholm as the new CEO. Tord has extensive experience of leading positions in the banking and technology sector, in Sweden as well as internationally. Link here.

OPPORTUNITIES:

Railsbank announced the opening of its new Global Headquarters in Broadgate, London’s largest pedestrianized neighborhood in the heart of the financial district. Over the past 12 months, Railsbank has seen rapid growth, bringing on new clients globally. Link here.