Digital Banking Weekly | 2021 #46

BLOG

Looking for funding? You’ll get funded at Fintech Meetup! Just ask Azimuth GRC--they met Mosaik Partners at Fintech Meetup 2021... 60 days later Mosaik led their Series A! Meet with investors including Addition, Bain Capital, Commerce Ventures, Flourish Ventures, General Atlantic, Information Venture Partners, Long Ridge Equity Partners, Middlemarch Partners, Mosaik Partners, Next Level Ventures, Point 72 Ventures, Riverwood Capital, Silver Smith Capital Partners, Tribeca Venture Partners, Vestigo Ventures and many more! Online, March 22-24, startup rate available for qualifying cos. Get Ticket

REPORT

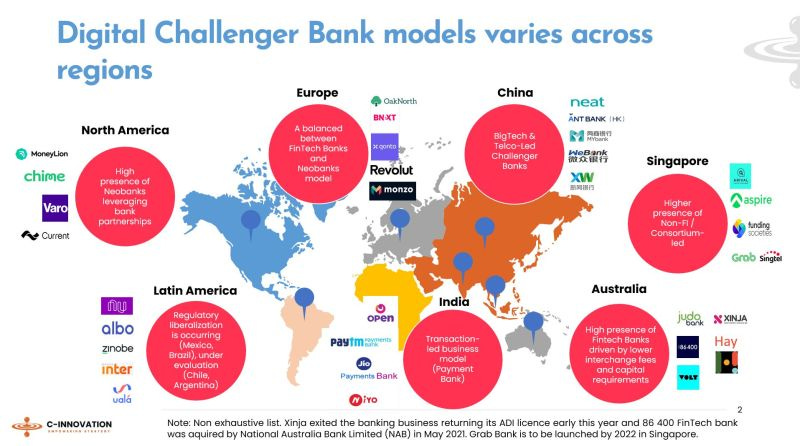

Digital banks have grown very fast globally and they tend to set up differently influenced by market regulation and competitive environment.

🇪🇺 Europe - Holds a balance between FinTech Banks and Neobanks models.

🇺🇸 USA - High presence of neobanks leveraging bank partnerships.

🇨🇳 China - BigTech & Telco-Led Challenger Banks.

🇸🇬 Singapore - Higher presence of Non-FI / Consortium-led.

🇮🇳 India - Transaction-led business model (Payment Bank).

🇦🇺 Australia - High presence of Fintech Banks driven by lower interchange fees and capital requirements. Few of them have already been acquired or exited the business.

Here, C-Innovation makes a differentiation between FinTech Banks and Neobanks in the following way:

FinTech Bank - Start-ups that have acquired a full banking license.

Neobanks - Firms without a full banking license. It could be partnering with a bank or have acquired other than a full banking license.

PODCAST

The Podcast recommendation of the week belongs to Wharton Fintech and their latest episode with Sherwin Gandhi, Co-Founder and President of Jeeves.

At Jeeves, Sherwin is looking to build international banking infrastructure from the ground up.

NOW, ON TO THE SUMMARY OF LAST WEEK'S DIGITAL BANKING SPACE

INDUSTRY HIGHLIGHTS

⭐️ Revolut Junior users aged between 6 and 17 will now be able to make payments using Apple Pay. Link here.

⭐️ Nubank will sponsor the World Cup 2022 regionally in South America. Link here.

⭐️ ComplyAdvantage, a global data technology company transforming financial crime detection, announced the availability of the firm’s new Anti-Money Laundering (AML) Guide For Digital Banks. Link here.

⭐️ N26 will discontinue its U.S. operations in the latest setback to the expansion plans for the German digital bank, which was recently valued at more than $9 billion. Link here.

⭐️ MoneyLion Inc. announced it has acquired MALKA Media Group LLC, a rapidly growing creator network and content platform. Link here.

⭐️ Klarna is gearing up to disrupt UK banking in a big way. Link here.

⭐️Anne Boden told the PA news agency that within five years Starling could overtake Barclays, for example, in the business banking market. In fact, it's a business goal. Link here.

⭐️ Three Fintech veterans from Finleap, Bafin and Figo are launching Brygge, a neobank for people over 55. Link here.

UNITED KINGDOM

Shares is about to be launched for consumers in the United Kingdom and, in early 2022, the investing app will be spread across the entire European market.Link here.

The first-of-its-kind savings account offers a GBP market-leading one-year 2% fixed-rate return. A new savings product, offering better returns and better protection for savers, is launched by bank challenger TallyMoney. Link here.

The cost of sanitary products continues to rise year on year, but now Revolut is helping some of its subscribers to cover the cost of their periods. Link here.

U.S. private equity firm Carlyle said about a possible takeover offer for Metro Bank have ended, sending shares in the British lender tumbling 16%. Neither company gave any reasons for the negotiations falling through. Link here.

PPS, an Edenred subsidiary and a one-stop-shop for prepaid and fintech programmes, announced its partnership with alternative e-money provider for the financially excluded Suits Me, following its migration from Banking as a Service Provider, Contis. Link here.

Starling Bank has reportedly bought a mortgage book worth around £1 billion as it steps up its challenge to the UK's largest banks. Link here.

EUROPE

Gránit Bank is one of the first banks to offer the Mastercard carbon calculator on November 15, 2021, which enables cardholders to check out the environmental impact of their purchases via their mobile bank. Link here.

The four Irish banks seeking to set up a money-transfer app to rival Revolut have raised an additional €5 million to fund the venture. Documents filed on Friday with the Companies Registration Office show that AIB, Bank of Ireland, Permanent TSB and KBC Bank Ireland committed more capital to the new entity, Synch Payments. Link here.

Mars Growth, a Liquidity Group and MUFG joint venture fund, announced it has provided a $4.5 million credit facility for Kontist, a leading FinTech company providing banking and bookkeeping services to the self-employed and freelancers in Germany. Link here.

Hamburg-based FinTech pockid.money announced its €4 million seed funding round. Link here.

SumUp announced the launch of a new Business Account solution for SumUp merchants in the UK, and almost a dozen European markets. Link here.

US

Jiko announced its first banking-as-a-service (BaaS) client today. It will partner with Euphoria, a technology suite for the transgender community that helps alleviate the struggles associated with gender transition, to launch a banking app called Bliss. Link here.

nCino is to acquire SimpleNexus, a digital homeownership software company. The stock and cash transaction valued SimpleNexus at approximately $1.2 billion. Link here.

UNest, a fintech startup that provides financial planning tools for parents saving on behalf of their children, announced that it raised $26 million in Series B funding led by The Artemis Fund. Link here.

Connecticut-based Patriot National Bancorp is set to acquire digital banking start-up American Challenger Development Corp. It is intended that Patriot Bank will adopt American Challenger’s technology platform for its operations, driving efficiency improvements. Link here.

Credit Sesame launched the general availability of its new credit builder banking technology, an all-in-one bank account that allows consumers to build their credit with their money and debit card purchases. Link here.

Mastercard is working with the digital banking platform provider MoCaFi on a contactless multifunction card that will provide 125 New Orleans residents with a monthly universal basic income for 10 months. Link here.

Oportun has had its eye on expanding into offering banking services for some time. The fintech filed an application for a bank charter with the Office of the Comptroller of the Currency (OCC) last year, then withdrew it last month. Link here.

The payment pause on federally-backed student loans has been helpful to millions of borrowers across the country, but one company has been hit substantially by the moratorium. After the payment pause was first announced, "our student loan business got cut in more than half," SoFi CEO Anthony Noto told Yahoo Finance Live. Link here.

The fintech Upstart is planning to work with banks and credit unions to offer a product that has heretofore been rare: small-dollar consumer loans at annual percentage rates below 36%. Link here.

ASIA

Bengaluru-headquartered fintech startup Zolve is expecting to reach a $1 million revenue run rate by the end of this year. The brand is aiming to grow it to a $100 million revenue run rate by the end of FY23. Link here.

Corporate service platform Sleek has raised $14 million in a Series A funding round led by Jungle Ventures and White Star Capital. Link here.

Corporate service platform Sleek has raised $14 million in a Series A funding round led by Jungle Ventures and White Star Capital. The Singaporean firm intends to use the cash to invest in tech and product development, grow its workforce and expand its global footprint outside of Singapore, Hong Kong, Australia and the Philippines. Link here.

KoinWorks, an Indonesia-based FinTech firm, is set to launch a neobank feature that would allow business owners to handle several banking services directly in its app. Link here.

South Korea’s financial market watchdog has warned KakaoBank, the country’s leading neobank, that it must fix its money laundering shortcomings as pressure from regulators mounts on challenger banks around the world. Link here.

Fintech company Niyo, in association with SBM Bank India and Visa, on Friday said it now offers a digital savings account with Niyo Global. Along with zero forex mark-up, customers can now earn interest on the savings account. Link here.

Dairy industry-focused neobanking startup Digivriddhi Technologies Private Limited (DGV) has raised $3.1 Mn in a Pre Series A round from Info Edge Ventures and Omnivore. Link here.

LATAM

Nubank announced the purchase of Olivia, an artificial intelligence startup that seeks to help its users plan expenses and save more. Link here. Also, Nubank announced that it will provide loans against the car guarantee directly through its application, in partnership with Creditas. Link here.

Recently, Brazilian congressman Luizão Goulart proposed allowing crypto-payments for employees in the country. Link here.

CANADA

DNBC officially launches the new feature of Mobile Top-up to offer a convenient solution for global users who have strong preference for digital payment services. Link here.

AUSTRALIA

Fast-growing SME banking provider Airwallex has topped-up its already impressive Series E funding round announced two months ago, with an additional $100m at an even higher valuation. Link here.

Commonwealth Bank of Australia’s (CBA) venture-scaling entity, x15ventures, has launched its newest venture, Cheddar, a brand and deal discovery app that rewards Gen Z and millennial Australians for shopping with popular brands. Link here.

AFRICA

Nigerian money transfer startup Aboki Africa has raised a round of pre-seed funding to help it expand its team and scale its product. Link here.

Airtel Africa announced that its subsidiary Airtel Mobile Commerce Nigeria Ltd has been granted approval in principle by the Central Bank of Nigeria to operate as a super agent in Nigeria. Link here.

Equity Bank has announced that its already positioning its network of 190 branches into centres of providing advisory and consultation services for SMEs and large customers as retail clients shifted to digital channels. Link here.

MIDDLE EAST

Layer has announced the launch of its digital banking services with Al Baraka Islamic Bank in Bahrain, to help fuel digital transformation and provide greater access to a wider range of financial services for its customers. Link here.

Verity, a UAE-based fintech startup headquartered in the Dubai International Financial Centre (DIFC), has closed a $800,000 pre-Seed round, preparing for the launch of its fully-integrated family banking and financial literacy app built for the Middle East. Link here.

MOVERS AND SHAKERS:

Shares, Europe’s first social and investing app, announced the appointment of Harjas Singh as Co-Founder & Chief Product Officer. Link here.

The Western Union Company, a leader in cross-border, cross-currency money movement and payments, announces the appointment of Devin B. McGranahan as new Chief Executive Officer (CEO). Link here.

OPPORTUNITIES:

As it opens the doors to a 7000 square foot flagship branch in Manhattan, Citi says it is "doubling down" on its network, despite the rise of digital banking. Link here.