Digital Banking Weekly | 2021 #47

MVO- THE CARD COLLECTION

Revolut announced the launch of its limited-edition 24-carat gold card, available for Europe, US, and the UK. 👉 Read more here.

INTERVIEW

Oliver Hughes, Co-CEO at Tinkoff Group, discusses the firm's latest results and the outlook for the Russian online bank on CNBC. 👉 Watch the video here.

ARTICLE

During the pandemic, challenger banks and fintech tripled their share of the credit card market and grew their personal loan books by 50% – according to new data from ClearScore, the UK’s leading free credit score and credit marketplace.

Andy Sleigh, ClearScore COO, commented: “The pandemic allowed newer entrants and more nimble, smaller operators to focus on growth at a time when the high street banks had to – understandably – protect and serve their current customer base.”

👉 Read more here.

REPORT

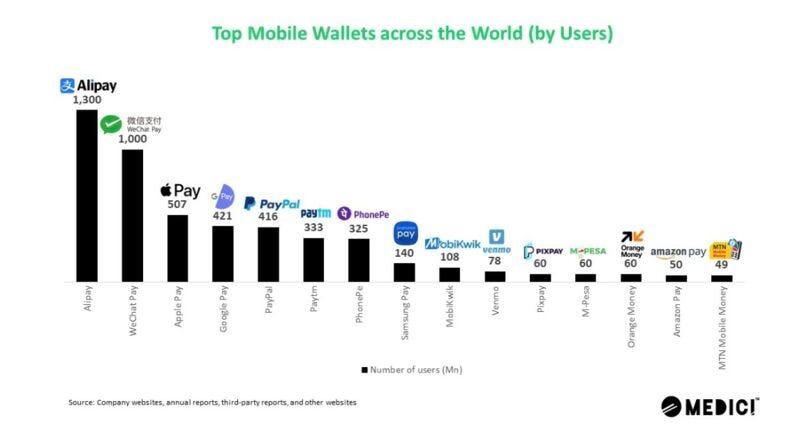

The report recommendation of the week belongs to MEDICI’s “A Perspective on Mobile Wallets across the World” Report.

We have evolved, and so have our smartphones. The tools that kept us connected beyond borders now fuel commerce by facilitating financial transactions and have also become the building blocks of various economies. Today, there are about 3.9 billion smartphone users worldwide (approximately 50% of the world’s population).

👉Read more here.

CEO SPOTLIGHT

The story of how Anne Boden built Starling Bank is a genuine blockbuster of entrepreneurship and perseverance. Another great “The Diary Of A CEO with Steven Bartlett” video I highly recommend you to watch!

👉Watch more here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S DIGITAL BANKING SPACE

NEWS HIGHLIGHTS

Online bank Revolut has been hit by major issues in the middle of Black Friday.

The company said that it was struggling to let customers sign in, make card payments, top-up their bank cards or make transfers.

“Hi, there are currently issues affecting our app functionalities,” Revolut said on Twitter. “We’re already working to have this resolved as soon as possible. We apologize for the inconvenience!”

It means that customers may be unable to make purchases during one of the busiest shopping days of the year.

👉Read more here.

INDUSTRY HIGHLIGHTS

⭐️ Monzo Bank's buy now, pay later product, Flex, will come with a virtual card that lets users make contactless Apple Pay or Google Pay payments in-store. Link here.

⭐️ A Harvard graduate and the son of a Malaysian auto-conglomerate owner, Tan started Grab as an alternative to Malaysia's infamous public taxis, which were once ranked the worst cab service in the world. Link here.

⭐️ Allica Bank has closed a £110m Series B new cash raise, it’s largest funding round to date. Link here.

⭐️ New Digital Bank launch: Kuwait’s first fully digital bank, Weyay Bank by National Bank of Kuwait. Link here.

⭐️ Dave Founder CEO Jason Wilk, discusses how neobanks can help to alleviate the massive need for alternative banking solutions that serve everyday Americans. Link here.

UNITED KINGDOM

Thought Machine, the cloud-native core banking technology firm, today announces the close of its series C funding round, bringing $200m into the business from new and existing investors. This new round sees Thought Machine achieve unicorn status. Link here.

Revolut has dramatically outperformed its European rivals so far this year as its valuation increased six-fold, new data shows. Link here. Also, Revolut is expanding its fintech offering for businesses in the hospitality sector, snapping up a company that provides point-of-sale software. Link here. Furthemore, Revolut has contracted with London-based RegTech Cube to help it keep track of evolving regulations as it rolls out new products and enters new markets globally. Link here.

Credova, a buy now, pay later (BNPL) solution emerging in the increasingly popular outdoor recreation, farm, home and ranch markets, announced today an exclusive agreement with Cornerstone Bank. Link here.

Rental deposit lending business Fronted has raised over £20m in a debt and equity deal led by Fasanara Capital. This comes after Monzo co-founders backed the fintech in a £1m fundraise in May 2021. Link here.

Tide, a London-based mobile-first bank for small and medium-sized businesses (SMB), uses Open Banking to enable companies to connect existing accounts to their financial services platform. Link here.

Bank North is looking to raise £1 million in growth capital on GrowthFunders. Link here.

B4B Payments (B4B), a leading global provider of card issuing solutions for businesses, is set to join the Banking Circle ecosystem to complement the Banking Circle Payments Bank, providing accounts, payments, and issuing to Payments businesses, Banks and Corporates. Link here.

Allica Bank, the fintech challenger bank, makes its first major acquisition with an agreement to acquire c.2,000 SME customers and c.£0.6 billion of associated lending from AIB Group (UK) Plc following AIB’s exit from the SME market in Great Britain. Link here.

Augmentum Fintech’s stake in peer-to-peer lender Zopa has been given a 60 per cent boost in the past six months, the investment trust’s half-year results show. Link here.

ClearBank’s phenomenal annual growth of over 21,000 per cent over the last four years helped propel the fintech into the number one spot on Deloitte’s annual ranking. Link here.

EUROPE

Tinkoff has procured a controlling stake (51%) in Just Look, the designer of Jump. Finance, a monetary technology service that robotizes interactions with consultants, including payments. Link here.

JPMorgan Chase & Co. is weighing a potential investment in Greek digital banking and payments firm Viva Wallet (vivawallet.com), as it seeks to bring more financial disruptors under its roof. Link here.

Temenos, the banking software company, announced Temenos Exchange, a new Fintech marketplace to bring open banking innovation to market faster, and at scale. Link here.

Contis, a leading Banking-as-a-service (BaaS) provider in Europe, has announced the expansion of its offering in Germany following its partnership with NAGA. Link here.

Auriga, a global software provider for the omnichannel banking and payments sector, announced that Banca Carige, an Italian retail bank with over 480 branches all over Italy, is launching its first four Carige Smart branches. Link here.

Lydia has struck a deal to offer crypto and stock trading to its 5.5 million users through a white label deal with Bitpanda. Link here.

Russian food retailer, that operates Pyaterochka, Perekrestok and Karusel brands, will uplift loyalty cards and add banking services such as payments, money transfers and rouble-denominated cashback. Link here.

US

Unit, the New York-based banking-as-a-service platform (BaaS), has partnered with Currencycloud, the experts simplifying business in a multi-currency world, to offer their customers an easy, seamless way to fulfill both domestic and international banking needs. Link here.

Greenlight® Financial Technology, Inc., the fintech company on a mission to help parents raise financially-smart kids, announced a collaboration with Amazon. Link here.

ASIA

Bengaluru-based neobanking startup Open has launched a do-it-yourself (DIY) fintech service platform Zwitch for fintechs and enterprises. Link here.

Paytm Payments Bank Limited (PPBL), which is India’s homegrown payments bank, has today announced the launch of the Paytm Transit Card, bringing together the power of One Nation, One Card. Link here.

A consortium of 74 Japanese firms - including the country's biggest banks - have set out plans to start testing a private sector digital yen in the coming months. Link here.

As part of its commitments to sustainability and a net-zero future, HSBC has launched India’s first credit card made from recycled PVC plastic (rPVC). Link here.

Viva Republica, the operator of South Korea’s pioneering fintech platform Toss, acquired a 1 percent stake in Republic, a multi-asset retail investment platform based in New York, for $5 million. Link here.

Mox Bank is launching ‘Payroll’, a new service allowing customers to use Mox as their default payroll account. Link here.

Speaking at Singapore’s FinTech Festival, Daniel Ong, Mbanq Labs Accelerator Manager, said, “Creating a challenger bank or innovative Credit Union has never been easier. Link here.

LATAM

Fintech startup Jefa has raised a $2 million seed round to build a fintech startup offering digital accounts with a product specifically designed for women living in Latin America and the Caribbean. Link here.

Bankingly, the Uruguayan digital banking services provider, announced its entry to Mexico in conjunction with CSN Cooperative Financiera. Bankingly currently serves over 80 clients in Latin America and Africa. Link here.

Omie, a Brazilian cloud-based SaaS ERP platform focused on mid-sized companies, has announced its acquisition of Linker, a digital bank. Link here.

Máximo, FinTech that develops financial services for young people, with the support of Mastercard, launches in the Peruvian market "Máximo League of Legends Esports", the first prepaid card in Latin America for gamers in partnership with Riot. Link here.

Finaktiva acquired Libera to build a challenger bank for SMEs in LatAm. With this move, Finaktiva aims to close the year with more than 100,000 financing operations and generating a volume of $500 million. Link here.

Z1, a Brazilian neobank focused on offering digital accounts and a linked prepaid card to teenagers and young adults, secured $10 million in Series A funding just six months after taking in $2.5 million. Link here.

AUSTRALIA

Bendigo and Adelaide Bank will consolidate multiple core banking systems and shift 50 percent of its applications to the cloud over the next three years. Link here.

Pepper Money CEO Mario Rehayem has paid tribute to the broker channel after the non-bank revised their profit expectations upwards for the 2021 calendar year. Link here.

The future of banking will not be created by throwing a digital facade on the tired and old incumbent model, writes Steve Weston, Volt Bank Founder and Chief Executive. Link here.

London-based financial API provider Codat is arriving in Australia and New Zealand (ANZ), with local SME challenger bank Judo as the firm’s first flagship client. Link here.

MIDDLE EAST

QuantoPay, the Mobile-Only Digital and Blockchain Banking Platform of the Future, is set to launch in the Middle Eastern market in 2022, after the successful launch of its second-generation fintech solution challenger bank in Europe and the UK in January 2022, and the US and Latin America throughout 2022. Link here.

MOVERS AND SHAKERS:

Bank North, the UK's first truly regional business bank of the modern era, has appointed Louise Halliwell as Head of Savings. Link here.

Paysend, the card-to-card pioneer and international payments platform, announces the appointment to its board of former President Mastercard Europe, Javier Perez, as a non-executive director. Link here.

TrueLayer announced the appointment of Jodi Ross to the position of Regulatory Lead in Australia. Link here.