What digital banking trends will rock the industry in 2021? The landscape is as diverse as it is complex. 2020 has been a year of financial instability because of the global pandemic. Inevitably, the fintech sector will have to adapt to the new needs of consumers in 2021.

Here are the trends I believe will be the strongest in 2021:

Digital banks for underserved demographics

LGBTQIA+

Black Americans

Women

Brand alignment

Read my full guest blog post on Curve's blog here.

PODCAST

"Are Neobanks dead?" This week's Podcast recommendation belongs to episode #70 of the FinTech Australia Podcast. Dexter Cousins is joined by 86 400's founding CEO, Robert Bell. Listen in as they discuss the proposed acquisition by NAB. Link here.

REPORT

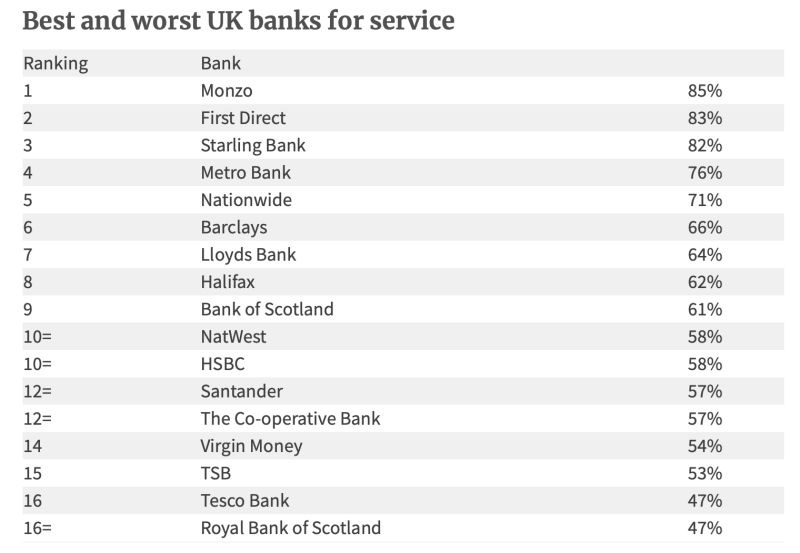

Ipsos MORI conducted a review of around 1,000 customers from each of the 19 biggest personal current account providers in the UK to rank the best and worst banks. The findings are designed to compare the quality of service between the UK’s leading providers, as well gathering customer opinions on overdrafts and branches.

According to the survey, Monzo and First Direct provide better service to customers than traditional banks. Read more here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S DIGITAL BANKING SPACE

NEWS HIGHLIGHTS

Europe has bred some of the world’s most successful and well-known fintechs, so why are so many of them hell-bent on cracking America?

The likes of Revolut, Monzo Bank and N26 have yet to make a lasting impact on the US market, coming head-to-head with the likes of homegrown challengers Chime and Varo Bank. Link here.

INDUSTRY HIGHLIGHTS

⭐️ Saudi Arabia’s government has approved the establishment of a new bank for small and medium-sized enterprises (SMEs). Link here.

⭐️ Russian billionaire Oleg Tinkov will dedicate himself to charity work including fighting leukemia. Link here.

⭐️ Want to co-invest alongside me in the most promising FinTechs? Join my Angel Investors Syndicate. Link here.

UNITED KINGDOM

Revolut rolls out QR codes, Cashplus is seeking new investment, and Starling Bank launches a new campaign.

Taking one step closer to becoming a ‘financial super app’, Revolut is rolling out QR codes for its business customers. From today, Revolut’s business customers across 25 countries will be able to take in-person, socially distanced payments via a QR code. Link here.

Newly minted UK bank Cashplus Bank is seeking a £50m investment to support growth in customers and lending. The digital bank, which launched in 2005 as an alternative lender as well as offering deposits, was granted a full UK bank license on 3rd February. Link here.

Starling Bank has launched its latest video campaign #BreakUpWithYourBank in an effort to encourage users and small businesses to switch to its online services. The campaign video outlines the struggles people encounter with traditional banking, through a series of mini videos and images put together in-house. Link here.

Monzo Bank is set to reach 5 million customers within days, as the business rebounds from a rocky year sparked by the COVID-19 pandemic. Monzo averages about 100,000 new customer sign-ups each month, putting the bank on track to cross the 5 million mark within days. Link here.

This week, Tandem Bank launched its new Green Instant Access Saver, knowing how most UK customers would opt for green options when it comes to their money. In a recent survey carried out by the bank, almost two-thirds of us said we would switch banks if they were more environmentally friendly – but over half of us admitted we simply don’t know where to start or go. Link here.

EUROPE

Tinkoff Bank is using a unique AI tool, Revolut to increase fees for Irish customers, and Lunar adds an in-app mental health tool.

Nordic challenger bank Lunar has expanded its business banking offering to include a mental health tool specifically tailored for entrepreneurs. The new feature will help business owners to tackle some of the biggest issues facing small business owners currently, such as burnout and stress. Link here.

Tinkoff Bank, one of Europe’s largest and most innovative digital banks, has begun using an AI-powered predictive analytics tool, based on combined data from multiple sources, including telecom operators, Russia’s largest credit bureau, and Tinkoff itself. Such software architecture and the way it employs big data analytics are unique, making this application the first of its kind in Russia and worldwide. Link here.

Revolut has on February 15 "operationalized" its European specialized banking license in Latvia, according to a release by Revolut. Those who choose to upgrade to Revolut Bank for additional services will now have their deposits protected under the deposit guarantee scheme, the company said. Link here.

Also, Revolut is set to deal a blow to its Irish customers are the company increases its fees. The fintech app which offers personal banking services is set to hike its fees which will affect over 1 million Irish customers. The main change introduced by the company will be to make it more expensive to use cash. Link here.

N26 announced their new product that makes saving up for a dream easier. EasyFlex Savings—a free and flexible way to make your money grow. With no minimum deposit periods and the ability to add money or withdraw funds from EasyFlex Savings as often as you like. Link here.

Also, N26 has just announced the launch of a 100% digital N26 Standard account equipped with a virtual card. From today in selected European markets N26’s customers will have the option to go fully digital when they sign up for a free Standard bank account. Link here.

Sopra Banking Software announced the launch of its Marketplace aiming at accelerating modernization and “platformization” of banking and financial systems. This new Marketplace consolidates all offers provided by its partner FinTech. Link here.

UNITED STATES

Brex applies for a bank charter, Marqeta adds credit cards, and Marcus gets an automated investing feature.

Brex is the latest fintech to apply for a bank charter. The fast-growing company, which sells a credit card tailored for startups with Emigrant Bank currently acting as the issuer, announced Friday that it has submitted an application with the Federal Deposit Insurance Corporation (FDIC) and the Utah Department of Financial Institutions (UDFI) to establish Brex Bank. Link here.

Varo Bank has bagged a $63 M investment, led by nine-time NBA All-Star Russell Westbrook. The funding round was led by Russell Westbrook Enterprises, with Westbrook joining the bank as an adviser to give guidance to Varo Bank about how best to make its services inclusive for communities of color and African American communities. Link here.

On the heels of filing for an IPO, Marqeta, Inc has added credit cards to its open API issuing and processing platform. Already a major player in the prepaid and debit card issuing market, Marqeta’s credit card platform completes its feature set. Link here.

Goldman Sachs has added an automated investing feature to Marcus by Goldman Sachs, its online retail banking service. Marcus Invest recommends a portfolio of stock and bond ETFs based on the customer's risk level and timeline. Users can open an account with as little as $1000. Link here.

As part of its work around helping people better understand their financial health and make better financial decisions, BBVA USA recently launched BBVA Insights in its online banking and mobile banking app. With this proactive information, customers can take action on items they may not have otherwise realized had changed and, in the process, start to improve their finances. Link here.

CANADA

Canada's oldest retailer is teaming up with one of the country's newest financial technology companies to offer a new credit card. The partnership between Hudson's Bay Company. and Neo Financial announced Tuesday comes three months after U.S.-based Capital One said it was ending its relationship with HBC and Costco Wholesale Canada in 2021. Link here.

AUSTRALIA

ANZ Bnk’s technology chief Gerard Florian has hosed down the immediate prospects of the lender buying a neobank to improve its digital offering, saying it will lean on partnerships instead of acquisitions to keep pace with its big four rivals. ANZ’s app has also been regarded as a laggard in recent years, however, Mr. Florian said it had now caught up with the market, in terms of the features people needed. Link here.

Xinja shareholders have banded together to put pressure on the board to retain its banking license and overhaul the leadership of the ailing startup ahead of a shareholder meeting this week. The fallen neobank has asked shareholders to vote on two options for the future of the company in a non-binding poll on Wednesday – wind up and expect nothing back or pay more and launch new products, for example, an American share trading platform. Investors who own more than 20 percent of Xinja’s shares are now calling for a third option that includes retaining the company’s banking license, raising more capital, and flushing out the board. Link here.

Small business-focused neobank Judo Bank has confirmed it has settled a massive $284 million capital raise, first announced late last year, which values the business at about $1.6 billion. The bank has also revealed further information about the investors themselves, highlighting positive news at a time of rife speculation about the future of this industry in Australia. Link here.

ASIA

Raghunandan G announced Zolve, a neobanking platform for individuals moving from India to the U.S. (or the other way around). The startup works with banks in the U.S. and India to provide consumers access to financial products seamlessly — without paying any premium or coughing up any security deposit. Link here.

Revolut introduced its financial app designed for kids called Junior. The average child in Singapore starts receiving pocket money at 7 years old, as mentioned by the company. This is the perfect age for parents to begin engaging their children in conversations about money. Junior is controlled by a parent or a legal guardian. Revolut Junior, already launched in more than 30 markets globally, is now available to Revolut customers and their children/wards in Singapore. Link here.

AFRICA

Kuda Technologies, the digital-led challenger bank for Africa, recently revealed that its Android app has been downloaded over 1 million times. The London-headquartered startup, which launched in Nigeria in 2019 and operates under a microfinance banking license from the Central Bank of Nigeria, has witnessed significant growth since the beginning of the COVID-19 pandemic. Link here.

MIDDLE EAST

Bahrain’s leading local bank National Bank of Bahrain (NBB) announced the launch of its new digital banking platform, built in partnership with banking technology provider Backbase. Link here.

MOVERS AND SHAKERS:

Lynn Cherry, a payments industry veteran and fintech industry leader, has joined Greenwood as Chief Compliance and Risk Officer. Lynn Cherry began her banking career at Wachovia (now Wells Fargo). In 1998, after completing the Bank Card Services Management Training Program, she moved into the debit and prepaid card verticals and has since designed, built and managed bank-centric regulatory compliance programs for several top card issuers in the United States and Europe. Link here.

This ends my weekly digital banking newsletter. Thank you for reading to the end! If you liked it, I invite you to like, share and/or leave a comment below. You may also subscribe here.

Let me know if there are any questions or news/insights worth mentioning in next week's newsletter. Until the next!

Regards,

Marcel van Oost